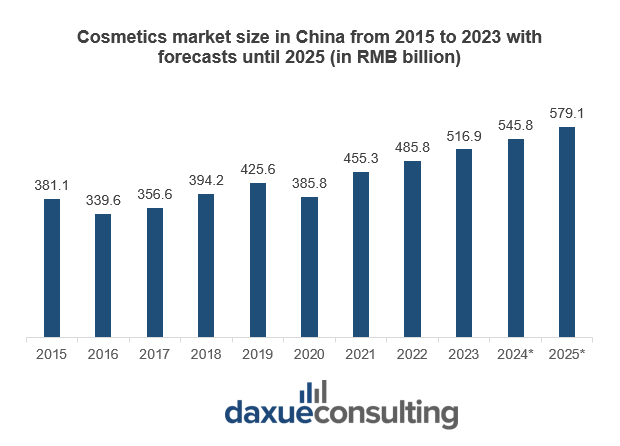

Cosmetic distribution in China is on an upward trajectory. According to the iiMedia Research, China’s cosmetics industry is projected to reach RMB 579.1 billion by 2025, with an expected CAGR of 4.93% from 2020 to 2025. However, the market’s complexity requires brands to adopt innovative distribution strategies tailored to Chinese consumers’ unique behaviors and expectations.

Download our report on Chinese beauty consumer pain points

Consumer behavior trends shape the industry, with digital platforms like Douyin and Xiaohongshu playing a pivotal role in product discovery and purchase. To succeed, brands are increasingly embracing an omnichannel approach that seamlessly merges e-commerce platforms like Tmall and JD.com with dynamic offline retail experiences. This strategy aligns with China’s “new retail” model, which integrates online and offline shopping to create a more personalized, efficient, and engaging consumer journey. By tapping into this hybrid retail ecosystem, brands are not only enhancing their reach but also staying ahead in an evolving market landscape. Moreover, China’s cosmetics market operates under stringent regulatory guidelines. This includes ingredient restrictions and mandatory compliance with the National Medical Products Administration (NMPA). NMPA governs areas such as safety standards and animal testing for imported products unless exempt under recent reforms.

Download our China’s samples economy report

Key channels for cosmetic distribution in China

1. Online retail (E-commerce platforms)

E-commerce dominates cosmetic distribution in China, with platforms like Tmall, JD.com, and Douyin (TikTok’s Chinese counterpart) at the forefront. These platforms not only serve as sales channels but also provide marketing opportunities. For instance, live streaming on platforms like Douyin enables real-time interaction with consumers, fostering trust and driving sales. Additionally, social commerce, which leverages social media platforms to integrate shopping experiences, has emerged as a powerful tool.

During festivals like the Double 11 shopping spree, e-commerce platforms host promotions that significantly boost cosmetics sales. For foreign brands, these platforms often act as an entry point into cosmetic distribution in China, allowing them to bypass extensive brick-and-mortar investments.

2. Offline retail (Brick-and-Mortar stores)

Despite the rise of e-commerce, physical retail remains important in China, particularly for premium and luxury cosmetics brands. For instance, Sephora and luxury brands like Chanel have invested in high-end, immersive retail spaces in major Chinese cities, providing personalized consultations and exclusive in-store experiences.

In lower-tier cities, offline stores help brands reach less digitally connected audiences. The blending of AI technology with in-store shopping—such as AR try-on tools and AI-enabled skin analysis—has made these spaces even more relevant in a digitally dominant era.

There is an emerging importance of experience-driven retail among cosmetics-distributed cities in China. Chinese consumers value stores that integrate traditional Chinese art, festivals, and craftsmanship into the retail environment, offering a sense of cultural pride and connection. Virtual reality (VR) try-ons, augmented reality (AR) product displays, and smart mirrors are increasingly popular, aligning with China’s tech-savvy consumer base. Many stores offer multifunctional spaces, combining shopping with cafés, workshops, or fitness areas to create a holistic lifestyle experience. Through immersive cultural experiences, tech-enhanced interactivity, and community and lifestyle hubs, the offline retail stores are welcoming its cosmetics business booming era.

3. Cross-border E-commerce (CBEC)

Cross-border e-commerce has been instrumental for foreign brands entering China, especially for niche and premium products. CBEC platforms, such as Kaola and Tmall Global, allow brands to sell directly to Chinese consumers without the need for local licensing or physical stores. However, strict government regulations on cosmetics imports and growing consumer demand for transparency require companies to adhere to safety and quality standards rigorously.

Challenges in cosmetic distribution

1. Regulatory hurdles

China’s regulatory environment can present significant challenges, especially for foreign brands. Import tariffs, mandatory product registration, and compliance with local safety standards often act as barriers to entry. For instance, non-special-use cosmetics must go through a filing system, while special-use products, like sunscreen, face a more stringent approval process.

A major regulatory shift occurred in 2021 when China lifted the mandatory animal testing requirement for imported non-special-use cosmetics. Previously, this regulation posed a significant hurdle for cruelty-free foreign brands, which avoid animal testing to align with ethical practices and consumer preferences in their home markets. This policy change has paved the way for global cruelty-free brands like The Body Shop and Lush to expand into China.

However, despite this progress, special-use products still face strict approval procedures. As a result, foreign companies must remain vigilant and adaptable, keeping up-to-date with the evolving regulatory landscape to successfully navigate China’s complex market.

2. Intense market competition

Cosmetic distribution in China is highly competitive, with domestic players like Perfect Diary and Florasis gaining traction through aggressive pricing, innovative marketing, and deep localization. Perfect Diary, a flagship brand of Yatsen Holdings, has faced challenges in maintaining its competitiveness in China’s highly dynamic cosmetics market. Initially a leading force in the color cosmetics sector, it gained prominence through innovative marketing strategies such as Key Opinion Leader (KOL) partnership and product co-branding. However, in recent years, Perfect Diary has experienced declines in revenue from color cosmetics, which remain a critical segment of its business. Additionally, the imported international brands must differentiate themselves through unique value propositions, such as high-quality ingredients or advanced formulations.

3. Logistics and supply chain management

China’s vast geography creates logistical challenges, particularly in ensuring timely delivery to rural areas. Urban consumers, accustomed to same-day or next-day delivery, expect seamless fulfillment. Brands must invest in robust supply chain networks and collaborate with logistics providers like Cainiao to meet these demands.

Strategies for success in the Chinese cosmetics distribution

1. Omnichannel strategy

A seamless integration of online and offline channels is key to capturing diverse consumer preferences. Brands like L’Oréal and Estée Lauder excel by offering consistent experiences across e-commerce, social media, and physical stores. In practice, this might involve combining online promotions with offline events, such as product launches at flagship stores supported by live-streaming campaigns, which is known as the omnichannel strategy.

2. Leveraging technology of AI and data

Big data and AI are reshaping cosmetics distribution in China. AI-powered tools help brands analyze consumer preferences, enabling targeted marketing and personalized product recommendations. For example, Perfect Diary uses AI to recommend makeup products based on users’ skin tones and preferences, driving consumer engagement and loyalty.

3. Key Opinion Leaders (KOLs) partnership

KOL partnership is essential for market penetration. These influencers, who range from celebrities to niche micro-influencers, wield significant influence over consumer purchasing decisions. For instance, brands that partner with beauty influencers on Douyin or Xiaohongshu (Little Red Book) have seen tremendous success in engaging young consumers. Douyin, with over 746.5 million monthly active users as of 2023 according to Digital Crew, excels in driving consumer engagement through short videos and live-streaming events. Influencers on this platform often showcase products interactively, answering real-time questions, which fosters trust and encourages immediate purchases. Livestreaming e-commerce is projected to grow continuously, underscoring the massive scale of this trend

Future trends in China’s cosmetics market

1. Growth of niche and premium markets

Chinese consumers are increasingly seeking niche and premium products, particularly luxury and organic brands. According to Fortune Business Insights, the Chinese skincare market, a key segment of premium cosmetics, was valued at USD 59.08 billion in 2024 and is projected to grow at a CAGR of 11.75%, reaching USD 128.61 billion by 2032. Younger generations value uniqueness and quality over mass-market offerings.

International brands like La Mer and niche organic brands have seen significant demand growth in this segment. Rising awareness of health and environmental sustainability fuels demand for organic and clean beauty products. This has led to the growth of specialty stores, eco-friendly boutiques, and dedicated sections in mainstream retail outlets focused on sustainable cosmetics. The popularity of clean beauty is more prominent in Tier 1 and Tier 2 cities, where consumers are more informed about the benefits of natural and organic products and are willing to pay premium prices.

2. Innovations in product development and distribution

Personalized beauty is becoming a key trend, with brands offering customized skincare and makeup solutions. China has relaxed regulations for personalized beauty, enabling significant advancements in this area. Additionally, smart retail, such as unmanned stores and AI-driven product vending machines, is transforming the way cosmetics are distributed in China.

3. Sustainability as a differentiator

Eco-friendly packaging and ethically sourced ingredients are gaining traction among environmentally conscious consumers. Brands like Innisfree and Lush are capitalizing on this trend, offering sustainable alternatives that appeal to younger audiences.

What to know about China’s cosmetic distribution

Navigating the complexities of China’s cosmetics market requires a deep understanding of local consumer behavior, a robust omnichannel strategy, and a willingness to embrace innovation. Brands that can effectively integrate the technology of AI, partnerships, and sustainability into their distribution strategies have a higher chance to succeed and thrive in this competitive landscape.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.