Beauty & Skincare

The beauty market in China includes many sectors, including cosmetics, skincare, hair care, beauty devices, and more. All of these segments are going through dynamic changes such as the increased preference for domestic brands, and more attention paid to the quality and ingredients of products. Millennials are the driving force of the beauty market, with 21 to 30 year olds contributing 31% of the beauty market sales in China. KOLs and social media play a large role in influencing consumption, with 63% of Chinese millennials say they trust bloggers and user reviews when buying beauty products.

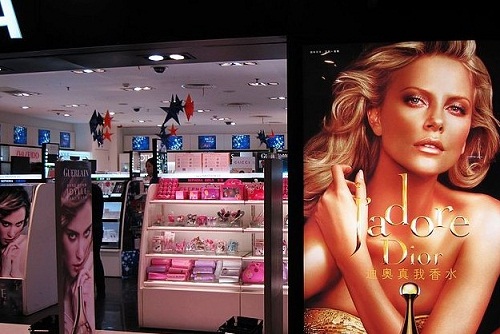

We have robust experience in beauty market research and consulting for global beauty brands, which include the cosmetics, hair care, and skincare departments. Our beauty industry projects have included product-testing through sensory analysis and focus groups, distributor analysis to find the best way to reach consumers, and social media listening.

Download our China beauty industry white paper

At the moment, Chinese consumers pay more attention to the ingredients than brand image of beauty products. For example, sales of skincare products containing whitening ingredient niacinamide are growing rapidly. Skincare products with “fullerene” ingredients have become the second most popular. Similarly, products with ceramides, astaxanthin, and salicylic acid grew quickly in recent years.

Cosmetics occupy a significant position in the beauty market in China. From 2012 to 2019, China’s cosmetic market grew from 248 billion yuan to 425 billion yuan, with a compound annual growth rate of 7.9%. However, in 2020 the market size dropped to 396 billion yuan due to the COVID-19 outbreak.

At present, the Chinese cosmetics market has shown three major trends: natural ingredients, environmentally friendly products, and functional skincare.

White-collar women in first- and second-tier cities are the main consumers of luxury beauty products. Basic makeup can no longer meet their daily needs. This segment is dominated by foreign brands: L’Oréal with 17.3%, Estée Lauder with 13.1% and LVMH Moët Hennessy Louis Vuitton with 8.7%.

Although the luxury goods market was hit during the peak of COVID-19 in China, however, the recovery is now accelerating thanks to the increased in digitisation and usage of online commerce platforms. In June 2020, luxury beauty brands in China saw an increase in online sales by an average of 244% compared to January 2020. About 60% of online luxury beauty buyers in China are millennials.

COVID-19 had an impact on the beauty sector: Mask wearing brought more attention to skin sensitivity problems, while extended indoor time without make-up gave consumers the time to experiment with their skincare routines. Jean-Philippe Benoist, the founder and CEO at GED said during the pandemic: “Lip balms are doing fantastically these days”.

Mintel data shows that around 60% of Chinese consumers purchase high-end skin care products with the anti-aging effects, namely “firming skin” (63%) and “anti-oxidation” (60%). 54% of respondents use high-end skin care products to moisturize their skin, which is the fourth most effective effect consumers seek.

In general, with the improvement of income and living standards, the consumption concept and daily cleaning habits of Chinese people gradually move closer to consumers in developed countries in Europe and America. Current trend shows that Chinese consumers use not two-in-one shampoos, but more functional products such as conditioners, hair masks, hair dyes. They choose silicone oil-free products, and hair loss consumers choose hair growth shampoos.

China’s beauty service industry (excluding the beauty products) in 2020 reached about 637.3 billion yuan, and the forecast predicts it to reach 837.5 billion yuan in 2025.

Beauty services includes spa massage, skin care services, weight loss services, nail salons, tattoos, intimate care, tanning, facial correction, etc. It also covers medical beauty services in China aimed at improving the appearance of people with using various procedures. According to Frost & Sullivan, in terms of revenue, China became the second largest beauty services, accounting for approximately 13.5% of the global beauty services market.