Anti-aging products in the market have become more and more prevalent. Despite the ageing population, the consumer base of the anti-aging market in China is becoming younger and younger. With millennials becoming the main consumer group, the anti-aging market demand is showing a burst of momentum.

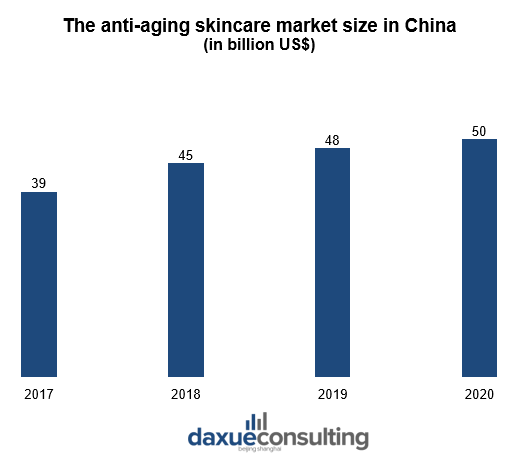

The scale of the anti-aging market in China reached 48 billion US$ in 2019, a year-on-year increase of 6%. It also accounts for 18% of the Chinese skincare market. Forecast shows that in 2022 the CAGR of anti-aging cosmetics in China will reach 12%.

Data Source: Zhiyan Consulting, China’s anti-aging skincare market

What drives the growth of the anti-aging market in China

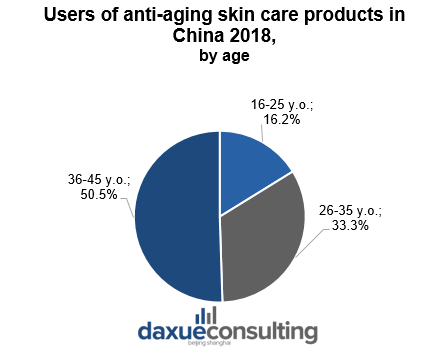

As the first batch of post-90s are turning 30 years old, more people in this age group have entered the phase of “anti-aging panic”. They demand less whitening and brightening cosmetic, but heavy moisturizers and anti-aging products. As millennials in China consider beauty very important, they have higher spending on beauty products. Compared to 70s and 80s generation, the skincare awareness of the younger generations has gradually increased. Panic about skin aging makes young generation use anti-aging cosmetics earlier. Among the users of anti-aging skincare products, the post-90s generation accounts for more than 15%.

Data Source: JDND Research Institute, Users of anti-aging skin care products in China

In the skin care consumption index, the anti-wrinkle category has the highest consumption and is showing a rapid growth. According to Chinese e-commerce platform JD.com, during 618 shopping festival in 2019, 28% of sales of cosmetic were anti-aging products. There was an increase in spending from women in their 20’s. Moreover, buying anti-ageing beauty products is becoming a higher priority for this group than luxury goods such as designer handbags.

Anti-aging cosmetics in China is becoming a marketing tool

With the improvement of consumer awareness of skin care and the rise of the importance of ingredients, products’ technology is the focus of consumers’ attention. Compared with moisturizing, whitening, the effect of anti-aging products is difficult to see in a short period of time. The research and promotion of “high-tech” ingredients has become the key point for the brand to gain consumer trust.

Most of the hot anti-aging ingredients such as carnosine, fermented yeast extract, superoxide dismutase, carry the banner of “black technology” ingredients. They are the core of brand promotion. The so-called “black technology ingredients” are also called biotechnology ingredients. Compared with traditional plant anti-aging ingredients, these ingredients act directly on the bottom layer of the skin. They use biological principles and provide skin self-repair and accelerate skin metabolism. These “black technology” ingredients are more suitable for consumers’ increasing anti-aging needs in terms of efficacy. Also, technologically-made and professional ingredients and technical names have become a “weapon” to impress consumers in marketing.

Anti-aging skincare trends: moisturizing, preventing premature aging and anti-wrinkles routine

Anti-aging creams are leading in the elderly skincare market in China

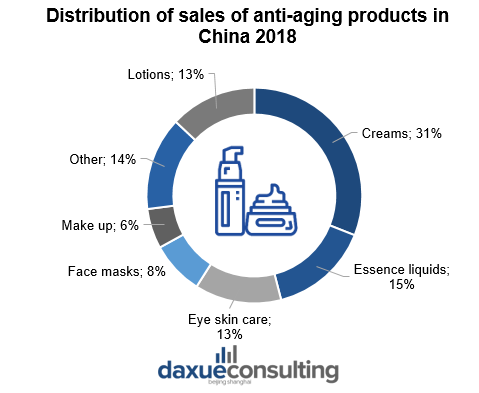

Data Source: Direct Sales Data Research Center, Distribution of sales of anti-aging products in China

China is becoming the largest consumer base of anti-aging creams, especially among the young. Young Chinese women are more focusing on preventing damage to their skin rather than treatment. The common mentality of ‘starting early’ shared among young Chinese women has certainly rejuvenated many high-end beauty brands’ business. Increasing skin concerns among the consumers and growing beauty care industry are driving the market of moisturizing creams.

Survey shows that the female respondents aged 20-30 show a strongest willingness to invest more in anti-wrinkles cosmetics (82%), which is higher than those aged 31-40 (78%) and 41-50 (63%).

Eye creams are the most dynamic segment in the anti-aging market in China

Within anti-aging, one of the most dynamic areas is the skin around the eyes. Data estimates China’s spending on anti-aging eye creams, serums and masks reached around RMB 3.2 billion in 2019. It had increase of 43% from the year prior, growing from 1.7 billion yuan in 2018, to 3.2 billion yuan in 2019

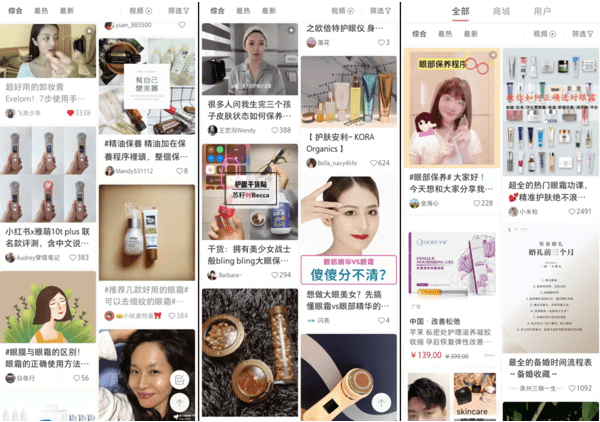

Interest in eye skin care routines are also booming, with over 570,000 relevant routines and product reviews featured on Xiaohongshu.

Particularly, the focus of costumers aged 20-25 clusters around hydration, brightening and de-puffing. This shifts as consumers approach their thirties, where consumers tend to favor anti-aging products, collagen boosters and retinol formats that deliver rapid results, for example, serums and ampoules.

Image Source: China Agency, Xiaohongshu, eye care routines in China

Anti-aging cosmetics in China: brand competition in the mass market and premium segments

L’Oréal meets the demand for anti-aging cosmetics in China

The Chinese population is ultra-digitalized, with more becoming highly educated travelers, with strong purchasing power, who are seeking new things to try. Beauty is very important for them: they want to age gracefully, and they use skin care products from a very early age.

Skincare, and especially the anti-ageing category, is rapidly growing thanks to this evolution. Skincare has always been a core need for Chinese women because in China they say that “true beauty comes from a good quality skin care”. A partnership between Tmall and L’Oréal China led to the co-creation with consumers of the anti-aging Midnight cream under the L’Oréal Paris brand. It was very successful during Singles’ Day, the world’s largest 24h retail and e-commerce festival.

Back in 2018 L’Oreal Paris launched their Revitalift Filler Ampoules in China. They sold 2,000 units in the first minute and over a million units in the first three months. The Revitalift skin care line of creams, treatments, moisturizers, pads and serums help fight the key signs of aging.

Data Source: L’Oreal, Revitalift products

KANS: a domestic brand focusing on the anti-aging market in China

Founded in 2002, KANS proved to be a serious contender in the beauty game. It also has climbed up the ranks of being one of the top 10 China beauty brands. Aside from delivering high-quality beauty products, the brand promotes environmentally sustainability by using solar and wind energy to produce products.

KANS Moisturizing Facial Foam is one of the top anti-aging cosmetics in China. This antioxidant-packed facial foam boasts deep cleansing properties without stripping away the skin’s natural moisture. Infused with sodium hyaluronate and purslane, this cleanser also boosts collagen production and delivers intense hydration, leaving skin feeling more refreshed than ever. It does not dry out the skin, reveals smoother complexion and minimizes the appearance of fine lines and wrinkles.

Data Source: KANS, Moisturizing Facial Foam

KANS, a domestic Chinese brand also has a lot of products that contain gold ingredients. According to experiments, high-concentration gold has strong antioxidant capacity and can inhibit free radicals, the “culprit of aging”. In addition, gold is a natural introduction carrier that can carry ingredients to penetrate the bottom of the muscle and increase the absorption by 50%.

WEI Beauty: Chinese herbs to fight aging

WEI Beauty, which uses TCM elements in cosmetics marketing, found an audience in China thanks to a partnership with global chain Sephora in 2013. Consisting of everything from eye creams to cleansers, Wei uses a unique blend of Chinese herbs (sometimes more than 20) to help address a wide variety of concerns, including aging and dull skin. For example, one of its most popular products is China Herbal Anti-Aging Set, which includes cream and serum. China Herbal Ultimate Renewal Cream is a high-performance anti-wrinkle cream. Led by Ginkgo, ten herbs help fight the appearance of fine lines and wrinkles. Natural flavonoids in Gingko help protect skin against free radical damages and palm leaf raspberry extract provides anti-aging benefits. China Herbal Youth Recaptured Serum is an oil, acid, and fragrance-free serum quickly absorbs into skin, becoming a force of nature to recapture skin’s youthful appearance.

Data Source: WEI, China Herbal Anti-Aging Set

Prospects of the anti—aging skincare market in China

From the perspective of anti-aging market in China, the country joined the ranks of anti-aging product innovation research and development. In addition, the global anti-aging product market has been growing rapidly in the past two years. The top three countries in the Asia-Pacific region where the anti-aging cosmetics market is active are South Korea, Japan, and China.

At present, anti-aging cosmetics in China has become one of the most popular domestic cosmetics products. Its consumption also has increased significantly. Essences and facial masks are the most popular anti-aging product categories for consumers. In addition, today’s anti-aging consumers tend to be younger, mainly in their 20s to 45s.

From the perspective of the anti-aging market in China, about one-third of companies have anti-aging products. Foreign companies account for a larger proportion. Domestic and foreign brands are increasing the research and development of anti-aging products and speeding up the pace of entering the anti-aging cosmetics market. Furthermore, the category of anti-aging cosmetics in China will include mainly cream, followed by liquid serums and eye cream.

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast