The pet economy in China has become a vital and fast-growing sector, reaching an estimated RMB 300.2 billion in revenue in 2024, with a steady 7.5% year-over-year growth. At the heart of this expansion lies the pet food market, which accounted for over half of the total pet market spending, making it the industry’s largest and most dynamic segment. Once considered a niche, China’s pet food market has rapidly evolved into a multi-billion-dollar industry fueled by urbanization, rising disposable incomes, and shifting lifestyle preferences. Today, pets are seen not just as companions but as integral parts of modern living, driving demand for premium nutrition, innovation, and tailored experiences in the pet food market.

Download our report on China’s Pet Economy

Treating pets like family is transforming China’s pet food market

Once seen primarily as utilitarian, pets are now embraced as family members, companions, and even child substitutes. This shift has led pet owners to invest more in their care, with pet food receiving the same level of attention as their own meals.

Pet food is the dominant segment in the pet market, occupying approximately 52.8% of total pet-related spending. The pet food market alone reached RMB 159.5 billion in 2024, showing a 9.2% year-over-year increase. From 2013 to 2024, China’s pet food market demonstrated a compound annual growth rate of 22.4%. As families get smaller and people seek emotional connection, pets increasingly take on central roles in households. With that, the demand for high-quality, nutritious pet food continues to rise, reflecting a deeper cultural investment in animal well-being.

Cats take the lead: Shifting pet food demand

With dogs and cats representing the two largest consumer groups in 2023, the combined market size for dog and cat food reached RMB 144 billion. While dog food once dominated the segment, recent years have seen a notable shift: cat food consumption has now surpassed dog food.

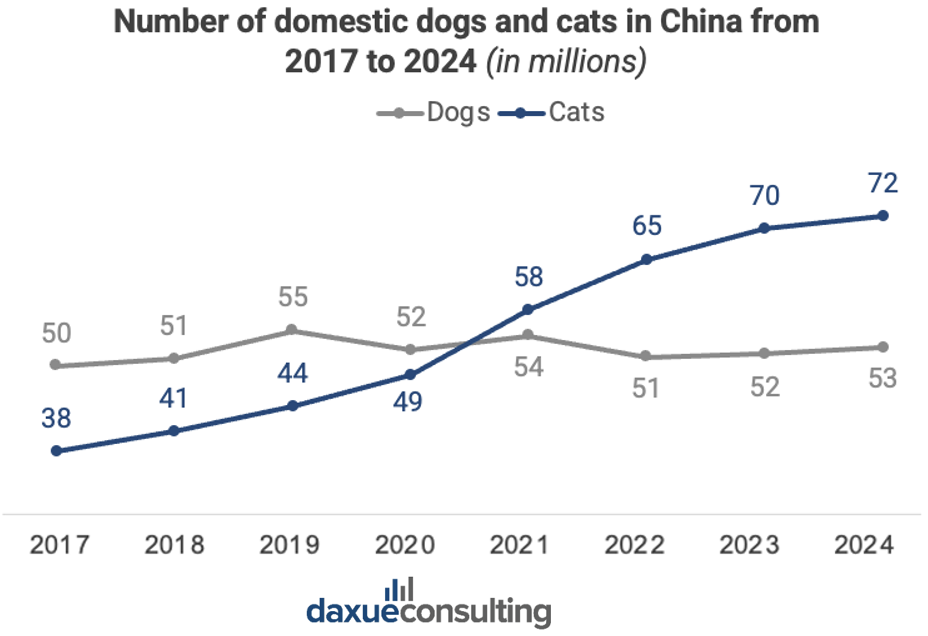

This change mirrors broader pet ownership trends. In 2021, the number of domestic cats in China exceeded that of dogs for the first time, a turning point driven by urban lifestyles that favor lower-maintenance pets suited to smaller living spaces. By 2023, the cat food market reached RMB 74.8 billion with a year-over-year growth rate of 7.6%, outpacing dog food at RMB 71 billion and a 3.9% growth rate.

Notably, the annual spending per cat growth also exceeded that per dog for the first time: 2,020 RMB per cat, a 4.9% increase from 2023, compared to 2,961 RMB per dog, a 3% increase. This higher per-animal spending reflects greater attention to premium products, personalized nutrition, and functional foods that enhance feline health.

Foreign brands standing out for their high-quality pet food

China boasts a significant pet food manufacturing base, with 200 certified producers across 23 provinces capable of generating 1.12 million tons annually. Hebei Province leads production at over 429,000 tons, followed closely by Shandong at 268,000 tons, providing a robust and competitive supply chain for both domestic and international brands.

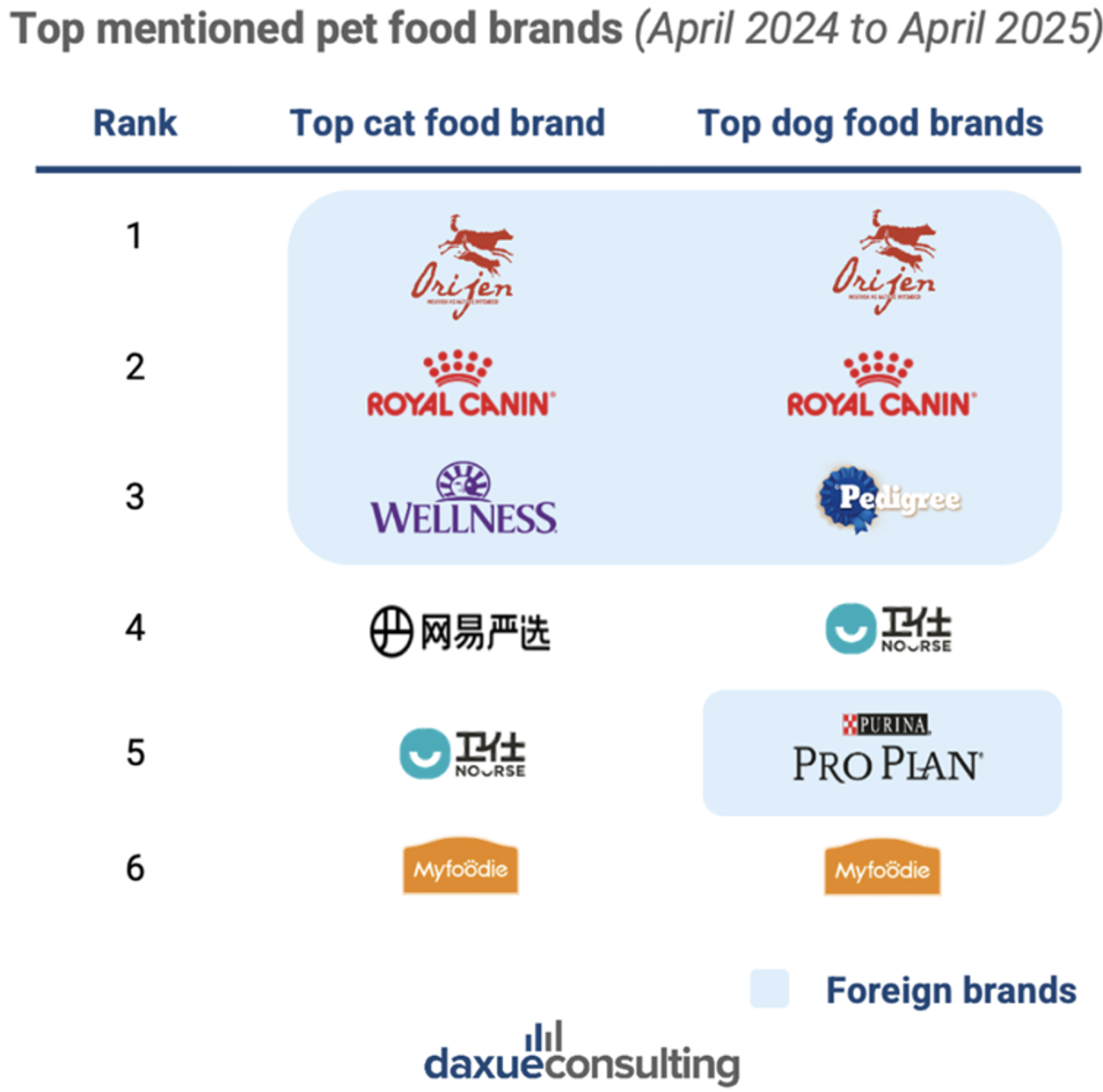

Despite this scale, China’s pet food market remains relatively infant compared to developed nations. The industry emerged in the 1990s with the entry of multinational players like Mars Inc., Nestlé, and Purina. These foreign brands have long dominated the premium segment, building consumer trust through transparency, consistent quality, and stringent production standards. Established names such as Orijen, Royal Canin, Wellness, and Pedigree continue to enjoy strong reputations.

Closing the gap: how Chinese pet food brands are catching up

However, domestic brands are rapidly closing the gap. Bolstered by advancements in manufacturing and growing consumer confidence, Chinese companies like Navarch, Legend Sandy, and Myfoodie are gaining significant traction. Local brands secured four spots among 2024’s top-growing pet food brands. Moreover, in our social listening analysis on Weibo, Douyin, and RedNote (known as Xiahongshu in China) from April 2024 to April 2025, local brands held three positions in the top six most-mentioned brands.

Notably, domestic brands like Navarch and Honestbite have experienced impressive growth: Navarch with a 150% year-over-year increase and Honestbite with 140%. Navarch’s success is largely credited to its “55° Core Stuffing Technology,” a low-temperature injection process that helps preserve flavor and freshness. This innovation has won over even the pickiest pets, with netizens remarking that “even picky cats love this brand.” Honestbite’s rise, on the other hand, stems from its low-temperature baking technique and inclusion of gut-friendly nutrients like prebiotics, which support digestive health. By adding fresh meat directly into their formulas, the brand retains more nutrients and flavor, reinforcing its appeal among health-conscious pet owners. Together, these examples underscore the growing strength and rising reputation of Chinese pet food manufacturers.

A taste for change among China’s pet owners

Chinese brands are making notable gains in pet food. Brand loyalty is increasingly fluid: in 2024, nearly half of Chinese pet owners (47% dog owners, 48% cat owners) report no strong brand preference. Crucially, a growing segment now exclusively chooses domestic brands (27% dog owners, 28% cat owners), surpassing those who exclusively buy foreign products (18% and 19%, respectively). Domestic brands are catching up with the quality of foreign brands and even more, they’re more affordable. Not only are domestic brands matching foreign quality—they also offer more competitive prices.

Consumer product preferences reflect a growing appetite for premium quality and specialization. Among cat owners in 2024, freeze-dried food was the most popular staple choice (49.7%), followed by baked dry food (43.7%) and extruded food (40.5%). Dog owners showed similar trends, with 43.8% preferring extruded food and 42.3% choosing freeze-dried options. These preferences underscore rising demand for high-quality, premium, and functional pet foods.

Beyond premium quality, consumers are also in search of innovative products that enhance their pets’ quality of life. For brands, this presents an opportunity to stand out in a saturated market. In 2023, several major players introduced cutting-edge offerings, Clearlake Capital Group launched a new line of supplements aimed at supporting dogs’ daily health, while ADM opened a new probiotics facility to boost the nutritional value of pet food.

The digital shift with e-commerce dominates sales channels

The way Chinese consumers shop for pet food is also shifting rapidly. E-commerce has emerged as the dominant channel. A 2022 survey by iiMedia found that more than 60% of 1,390 respondents preferred buying pet products through e-commerce platforms, a number that has only grown in the years since, boosted by COVID-19’s influence and the growth of e-commerce in China. Pet owners now increasingly favor online shopping for its speed, convenience, and reduced physical effort.

Major platforms like JD.com and Tmall lead in online sales, while social commerce giants like Douyin are reshaping consumer engagement. The shift was especially evident during Tmall’s 618 shopping festival in 2023, when transaction volumes in pet food livestream rooms surged over 50% year-on-year. More than 50 livestreams recorded sales exceeding one million yuan, and over 200 saw year-on-year growth rates above 100%. A prime example of the “rush” to e-commerce is the leader of the chart above: Mars Inc. Indeed, in 2016 Mars announced a business partnership with Alibaba. For the first time in the pet food economy, customers could finally experience a “one stop shopping center”: people could purchase everything they needed through a single e-commerce app, including pet food, and the products would have been delivered to their houses as quickly as possible, even if the consumers were situated in rural China, by using “Rural Taobao”.

Insights that define China’s pet food momentum

- China’s pet food market is the largest and fastest-growing segment, accounting for over half of total pet-related spending in 2024. It’s no longer just about feeding pets, it’s about wellness, functionality, and lifestyle alignment.

- For the first time, cat food has overtaken dog food in both sales and growth. Urban living, smaller homes, and lifestyle preferences are pushing more consumers toward cat ownership and with that, feline-focused nutrition.

- Owners are seeking premium, functional, and health-enhancing pet food, especially freeze-dried, probiotic-rich, grain-free, and customized formulas. Innovation is key to capturing consumer attention.

- Nearly half of pet owners show no strong brand loyalty, signaling a more experimental market where product quality, ingredients, and innovation drive decisions more than legacy branding.

- Despite its growth, China’s pet food industry is still young compared to developed countries. This leaves room for rapid development, brand building, and long-term transformation.