Little Red Book, also known as RedNote and Xiaohongshu (小红书), was founded in Shanghai in 2013 by Charlwin Mao and Miranda Qu. Although the English name is used to refer to the collection of quotations from Chairman Mao, they are unrelated. RedNote is a lifestyle-focused social media and e-commerce platform that is widely popular among young consumers in China. Users frequently visit the platform for travel recommendations, medical advice, and tutorials, among others. In January 2025, many American users started joining the platform. Even though Little Red Book in China is not the same as TikTok and primarily operates in Chinese, foreign users are joining in protest against the potential U.S. government ban on TikTok, and Chinese users are welcoming them.

Download the report on the She economy in China

First of all, what is Little Red Book, or RedNote?

Little Red Book is a lifestyle-focused social media and e-commerce platform. It is not like TikTok or Douyin (抖音), the Chinese version of TikTok. In fact, it is more like a combination of Instagram and Pinterest.

It is a community-driven platform, relying on user-generated content, with peer reviews playing a key role in consumers’ pre-purchase decisions. Users search for recommendations, product reviews, and tips on various topics, including travel, medicine, food, and secondhand items shared by other users.

The content, however, is not limited to China. In fact, when people go abroad for travel or study, they use it to search for trendy areas or medications, especially in countries like the U.S. where healthcare is expensive.

Who are Little Red Book’s users?

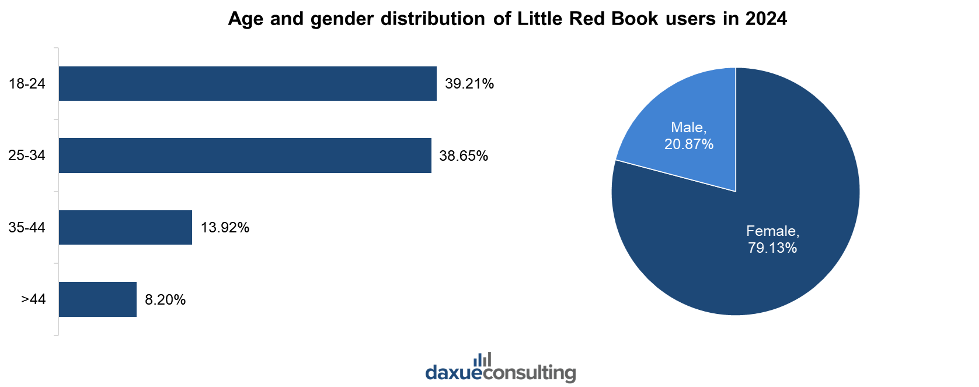

According to Qiangua and RedNote, the number of monthly active users of Little Red Book reached 300 million in 2024, with 38.65% of users being born in the 1990s and 39.21% being born in the 2000s. Users from first- and second-tier cities accounted for 85.31% of the total, which is a drop from 90% in 2022.

Among the active users, female and male users account for 79.13% and 20.87%, respectively. In order to expand the proportion of male users, Little Red Book has made continuous efforts, launching the “Men’s Content Incentive Plan” in 2021, which provides support for content preferred by male users, including digital, fashion, sports and automobiles. Compared with the approximately 60 million male users who accounted for 30% in 2021, the number of male users increased to approximately 63 million in 2024.

“TikTok refugees” flock to RedNote

As TikTok faces a potential ban in the U.S., an increasing number of people are turning to RedNote, dubbing themselves “TikTok refugees”. Posts under “#tiktokrefugee” amassed a staggering 800 million views and generated 14.77 million discussions.

From January 8th to January 14th, 2025, mobile downloads of RedNote in the U.S. surged more than twentyfold compared to the previous week. In January 2025, over 22% of the app’s total downloads originated from the United States, a stark contrast to just 2% during the same period in 2024.

Moreover, people from other countries are downloading RedNote, with the app topping the App Store download charts in 87 countries, including the United Kingdom, Italy, and Australia, on January 15th.

Overcoming language barriers on RedNote

For TikTok refugees, a primary barrier to using RedNote is language. Some friendly and eager-to-learn Chinese netizens are attempting to communicate with foreign users in English, while also posting bilingual content in Chinese and English. Foreign users, on the other hand, are copying the text that needs to be read and translated into ChatGPT or Google Translate, and they are utilizing various floating window and screenshot translation tools, such as iTranscreen or built-in system applications. Additionally, some foreign users on RedNote are creating videos to instruct new users on how to activate Chinese and English subtitles and how to effectively use translation software.

To address users’ communication challenges, an internal employee of RedNote revealed that one of the teams within the community technology department has started to develop real-time translation features since January 14th, with an anticipated launch in the near future. At the same time, RedNote’s human resources are urgently seeking English content reviewers.

The evolution of RedNote in China

From a shopping guide to a community to e-commerce

It all started in Hong Kong, one of the favorite overseas travel destinations for mainland Chinese people. Despite the Western ambiance and exquisite Cantonese cuisine, one of the main purposes of travel was shopping. Qu, the co-founder, explained that RedNote’s original goal was to introduce foreign brands to Chinese consumers and vice versa. By January 2023, the platform featured over 140,000 brands, with 56% being domestic.

Due to language barriers and limited knowledge about foreign brands, Chinese travelers often wondered about luxury handbags, skincare, or tax refunds. Mao, co-founder of RedNote, noticed this gap and launched the Little Red Book Hong Kong Shopping Guide to share shopping insights from travelers.

As users began sharing experiences from places like Thailand, South Korea, and Japan, the platform expanded its focus and renamed itself Little Red Book Shopping Notes. By late 2014, the platform evolved into a social-commerce hybrid, where users can purchase items they discover and research on the platform.

How brands are leveraging Little Red Book to target Chinese audience

Similar to famous platforms like WeChat and Weibo, foreign companies can set up an official brand account on Little Red Book in China as well. Brands need to submit various documents such as business registration for verification and depending on the product category, required documents can be different.

In recent years, the Little Red Book platform seemed to be a compulsory social media platform to target young Chinese consumers. Both international and local brands are integrating Little Red Book as part of their marketing strategy to engage consumers, especially during brand or new product activation. These brands leveraged a strong sense of community by inviting KOLs and KOCs to post on the marketing event and engage with targeted audiences through giveaways held on the social media platform.

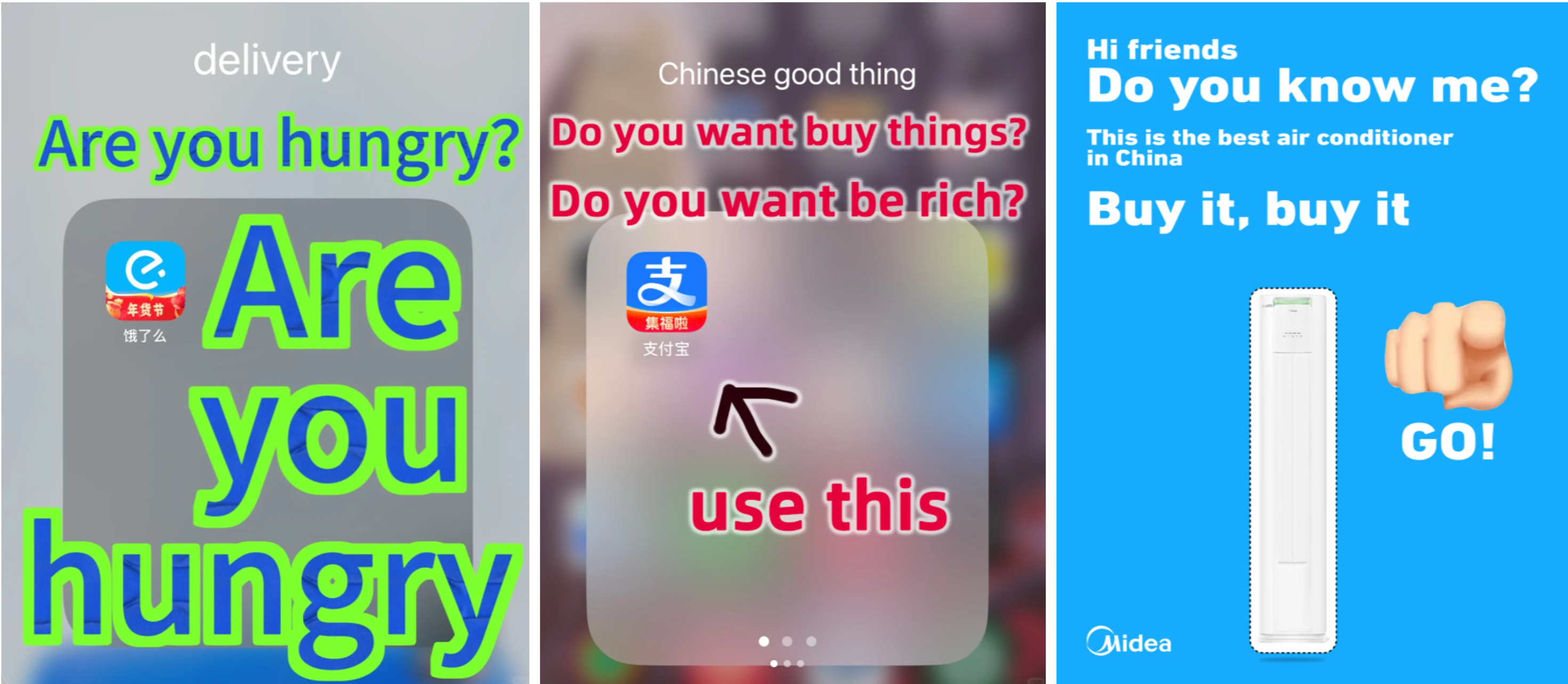

Local brands embrace TikTok refugees through cross-cultural engagement

As TikTok refugees flooded to Little Red Book, local brands began creating content to connect with Western audiences. This cross-cultural exchange allows them to tap into the platform’s global growth and expand their reach. These companies started introducing themselves to English-speaking users, fostering greater cultural connection and understanding.

Working with KOLs and KOCs: Online influencers in China

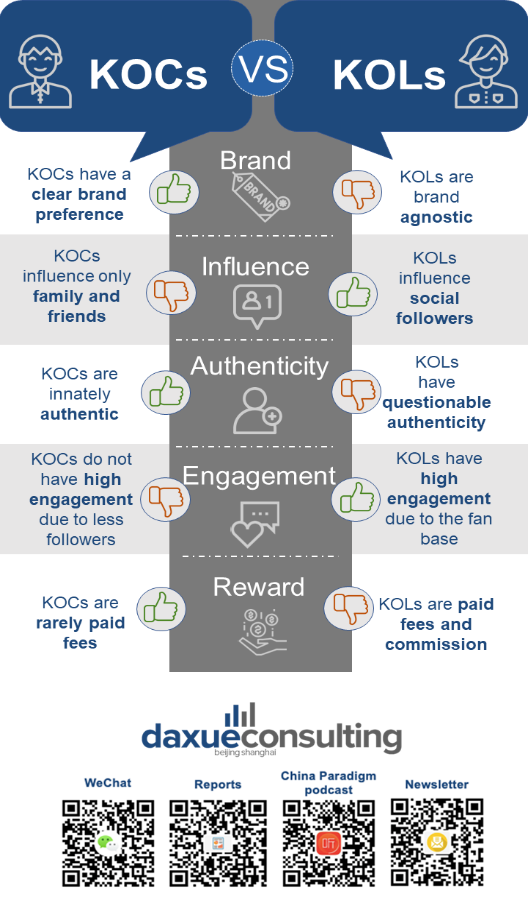

Working with KOLs and KOCs is crucial in China since Chinese consumers assume that online influencers are more trustworthy than “official” ads.

In China, KOL marketing is one of the main ways that brands use to reach their target audience. KOL stands for Key Opinion Leader, who can settle new trends, widen a brand’s audience, increase brand awareness, and motivate customers to purchase from online and offline channels. When collaborating with a KOL, it is of major importance to find the right person, whose image is compatible with your brand and whose followers are your target groups. The simplest way to reach out to a KOL is by sending them free samples of your product.

Meanwhile, as Chinese consumers are increasingly sensitive to authenticity, KOC marketing is also a great way worth considering. KOCs, also known as Key Opinion Consumers, are the micro-influencers of China. Little Red Book has a mature ecosystem in KOC management, allowing users to not only consume content but also create a side income and build community on the platform. The main benefit of collaborating with KOCs on Little Red Book in China is that they are perceived as more authentic, are more loyal to a brand and are much less expensive. However, a KOC’s influence is minimal compared to a KOL. The infographic below weighs the pros and cons of both KOLs and KOCs.

Case study: Duolingo rides the wave of Americans joining RedNote

As foreigners flock to the RedNote, many Chinese and foreigners, including Americans and Koreans, are engaging in language exchanges and homework support. Duoling, in response, is engaging with RedNote’s users through its humorous content, including screenshots of a folder named “new fav apps” and RedNote and Xiaohongshu.

How trustworthy is Little Red Book in China among consumers?

- RedNote, a Chinese app founded in 2013, is a lifestyle-focused social media and e-commerce platform. It is not the Chinese TikTok but rather Instagram and Pinterest combined.

- It is primarily used by young affluent women living in the urban areas. However, more men and people from lower-tier cities are using it. In January 2025, many Americans started flocking to the platform in response to the potential ban of TikTok in the U.S.

- Even though language barrier is a problem, foreigners and Chinese people are overcoming it by using separate translation tools. RedNote started to develop real-time translation features since January 14th, 2025.

- Little Red Book is a trustworthy app for many Chinese consumers. As a platform that relies heavily on user-generated content, word of mouth plays a crucial role. People seek to understand the personal experiences and opinions of other users with similar concerns or interests.

- Whether it’s learning about smaller or lesser-known brands, finding reliable medicine while traveling abroad, or getting fashion tips, many people turn to it for guidance.

- KOLs and KOCs are considered more trustworthy than “official” ads in China. Consumers with similar interests seek their expertise and experience for products and services.