Nowadays, as increasingly more male consumers care about their look, the male beauty market in China has gradually become a new driver of growth for the beauty industry. The size of the male beauty market in China reached 17.8 billion RMB in 2021, and according to Euromonitor International, retail sales in China’s male beauty market grew by an average annual rate of 13.5 percent from 2016 to 2019, much higher than the global average (5.8 percent).

Who are male beauty consumers

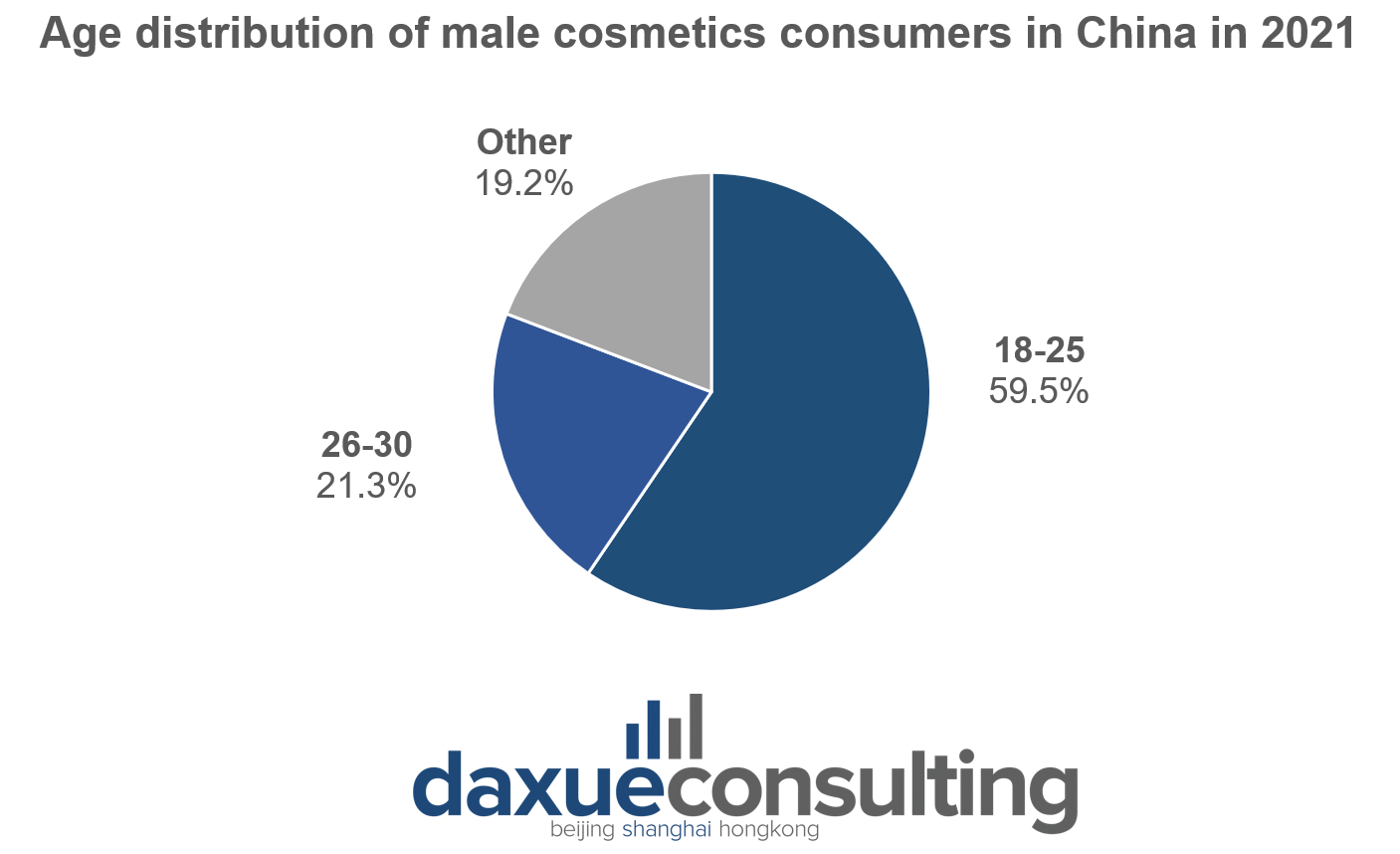

Gen Z has become a dominant force in the male beauty industry. According to the Korea International Trade Association, young Chinese men aged between 18 and 25 account for 59.50% of the total, while those aged 26-30 account for 21.30%.

What platforms do male beauty consumers use

Similar to female consumers, male beauty consumers also utilize platforms such as Xiaohongshu and Douyin for knowing more about beauty products. The search volume of male beauty-related keywords in Xiaohongshu increased significantly in the last few years, with the keyword ” Men Facial Cleanser ” increasing by 732% month-on-month in 2022.

Hupu is the largest online sports community in China. Men account for 89.80 percent of Hupu users, while women account for only 10.20 percent. Hupu’s e-commerce platform began to sell cosmetics in 2020. They offer both female cosmetics, mainly targeting men who are looking for gifts for their girlfriends, and male cosmetics. Moreover, Hupu also invested into the male beauty brand MAKE ESSENSE, helping it complete an A+ round of financing.

In addition, Taobao and Tmall are the leading marketplaces for beauty industry, including male beauty. The number of men’s skincare brands on Taobao and Tmall increased by more than 10% YoY from 2019 to 2021 and during the 618 shopping festival in 2022, the overall sales of men’s care products on Tmall platform achieved a 20-fold growth.

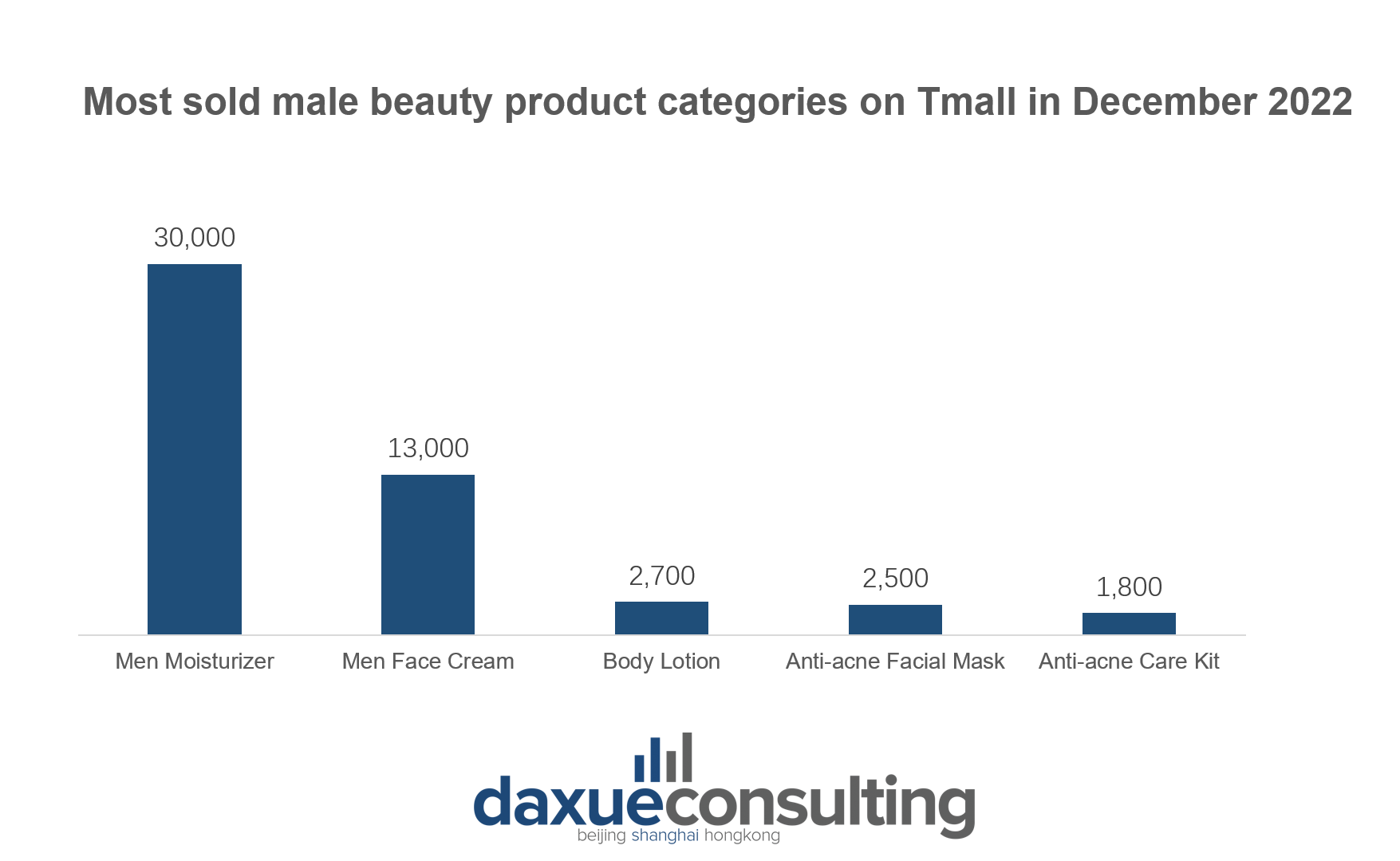

Daily moisturizing creams and facial cleansers play a key role in the male beauty market in China

Among male beauty categories, facial cleansers are the most sold male beauty items in terms of sales revenue. At present, daily facial cleanser and moisturizing cream still account for a big chunk of Chinese male consumers’ demand for cosmetics.

Unlike in the past, contemporary men are more independent and highly engaged in consumption. They are more open to try new things, enjoy social interactions and are willing to choose fashion platforms as new “social places”. They are not afraid of buying cosmetics for themselves. Although these Chinese male consumers are still a minority group, they are gradually breaking out of the traditional gender limits.

According to the Beauty Industry Research Institute, male beauty bloggers account for more than 20 percent on the three major video platforms in China (Douyin, Kuaishou and Bilibili).

Emerging brands in the male beauty market in China

Here are some examples of brands that have successfully tapped into the male beauty market in China. By analyzing the brand strategies they’ve used, we can learn some valuable lessons.

JACB (嘉仕酷) Targets Generation Z male consumers

Founded in April 2020, JUST A COOL BRAND (JACB) is a grooming and skincare brand for Generation Z men. In October 2020, the Shanghai-based brand received funding of 10 million RMB from BAI Capital (Bertelsmann Asia Investment Fund) and CCV (Genesis Partners Capital). JACB aims at providing men with products easy to use that can meet their daily beauty needs, while showing its male consumers that men can look masculine even when using makeup.

MAKE ESSENSE (理然) makes a wise use of co-branding strategies

MAKE ESSENSE is a cutting-edge domestic male beauty brand. “SINCERITY, PIONEER, GOOD TASTE” is the motto of such brand specialized in men’s significantly increased face care needs, MAKE ESSENSE provides a comprehensive range of skin care products and cosmetics for men. As of January 21, 2021, MAKE ESSENSE has completed nearly 150 million RMB of financing.

MAKE ESSENSE is good at enhancing its brand awareness through cooperating with well-established brands in different sectors. In 2020, MAKE ESSENSE launched a partnership with VITA Lemon Tea, releasing a limited-edition gift box containing 1 bottle of MAKE ESSENSE shower gel and 2 bottles of VITA Iced Lemon Tea. This product soon became the top 1 by sales in its category on Tmall.

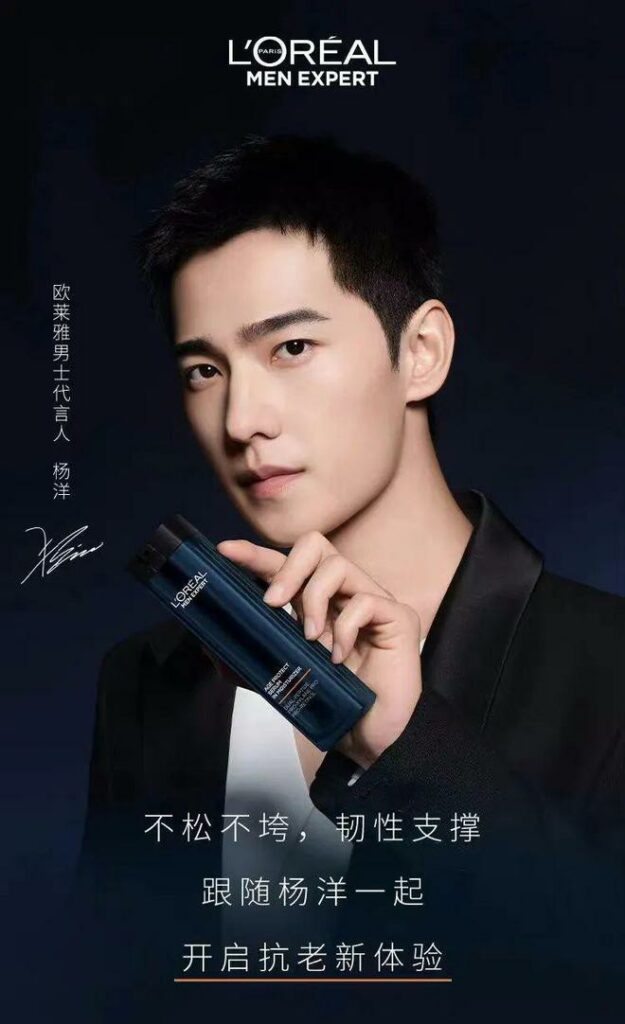

L’Oréal Paris Men Expert (欧莱雅男士) relies on KOL Marketing to reach a wider audience in China

L’Oréal Paris Men Expert’s advantages are its popularity and diversified product line. With a good understanding of young Chinese lifestyles, the brand has won the trust of many Chinese consumers. Moreover, L’Oréal has constantly been working with Chinese millennial and Gen-Z celebrities to create their brand image among Chinese male beauty consumers since 2009.

On September 8, 2022, L’Oréal Paris Men Expert officially announced Chinese actor Yang Yang as its spokesperson. As of December 8, 2022, the promotional video depicting Yang Yang advertising L’Oréal Paris Men Expert’s products received 8.48 million views and more than 1 million retweets.

KOL marketing campaigns like this have a great influence on male beauty consumers in China: QuestMobile’s 2021 Male Consumption Insight Report estimated about 185 million male users following main beauty KOLs on Chinese social networks, mainly aged between 25 and 30 years old.

What we can learn about the male beauty market in China

- The male beauty market in China is thriving.

- Most beauty consumers belong to Gen Z and they prefer using platforms such as Tmall and Taobao to buy beauty products for themselves.

- Facial cleansers and moisturizing creams are the most purchased male beauty products in China.

- Emerging male skincare and cosmetics brands adopted a wide range of strategies to capture Chinese consumers, such as omnichannel advertising, co-branding initiatives, and influencer marketing.