China’s online education market has seen expansion since 2014, especially during the COVID-19 crisis, driven by distance learning’s increasing demands. The Chinese government’s policies to encourage the development of the online education market and the massive jump of the capital inflows propel the expansion.

In recent years, information technology has improved, including in lower-tier cities. With infrastructure in place, the challenge remained raising the effectiveness of online teaching. Players, including internet giants and short-video platforms, have entered the competition in the past decades. At the same time, the capital market increasingly concentrates the investment into already established players.

More intense competition for the market share is expected, and players need to maintain their reputation in the industry while coming up with innovative technologies and strategies to improve the online learning experience to gain the market share. Daxue consulting examined some most innovative EdTech start-ups in China in details in another analysis.

China’s online education market took off in 2015

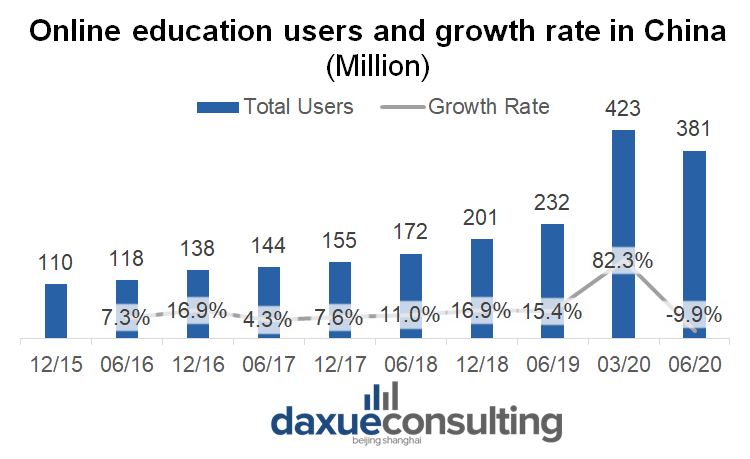

According to reports by CNNIC, China’s online education market experienced sustained growth in between 2015 and 2019. After this initial expansion phase, the sanitary measures imposed by the Chinese authority during the Covid-19 outbreak further pushed the demand in the market; the number of users after the first quarter of 2020 reached 423 million, marking an 81.9% increase from 2.32 million in June 2019. After the relaxation of the sanitary measures that allow schools and other education-related venues to resume in-person classes, the consumer base remains large, with 381 million users in June 2020.

Multiple online education platforms, such as Zuoyebang and Yuanfudao, have tens of millions of daily active users. Witnessing the drop of users after the outbreak, it will be essential for the companies to maintain the customer base in the future, keeping the users who first experienced online education out of necessity. The experience and effectiveness will be critical to make those users stay when in-person methods have become available.

Source: CNNIC, designed by Daxue Consulting, Online Education Users and Growth Rate in China

Trends of capitals in education industry in China

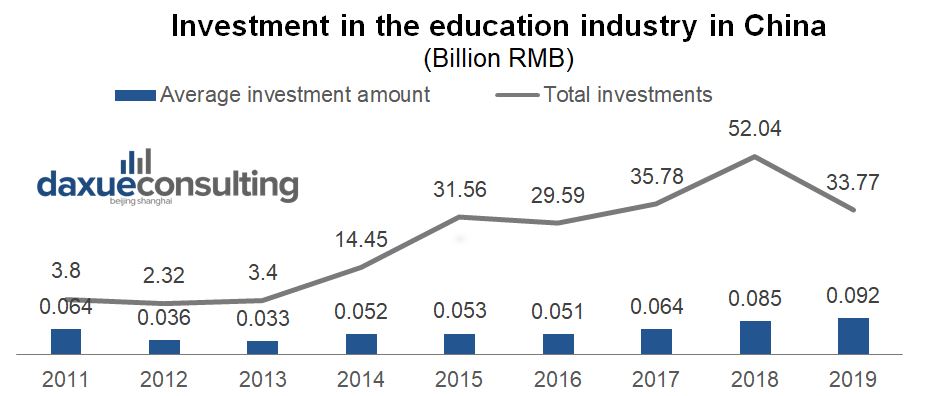

The potential of China’s online education market has caught the attention of the capital market. According to data from IT Juzi, the investment into the overall education industry in China took off between 2013 and 2015, experiencing a nine-fold increase from 3.4 billion RMB to 31.56 billion RMB. The online channel has been the main focus of the capital.

The investment into the sector has hovered around 30 billion RMB or above since 2014. However, it has become more challenging to receive investment for newcomers; the number of investment events has declined since 2018, while the average investment per event shows an increasing trend.

Source: IT Juzi, designed by Daxue Consulting, Investment Received by Education Industry in China

Growth driven by favourable policies and distance learning transition during COVID-19

Along with China’s rapid economic development since the 1990s, families in China have become increasingly focused on education; many families are willing to invest in education due to the one-child policy, from preschool in elite kindergartens to foreign postgraduate institutions.

Throughout the expansion of China’s online education market in the past two decades, the authority started to play an enlarged role in directing and regulating the industry since the 2010s to enhance the industrial standard. Under the framework established in “Guideline for Education Digitalization (2011-2020)”, China is currently in the phase of transition from Digitalization 1.0 to Digitalization 2.0, aiming to achieve the goal of covering all schools, students and teaching faculties and establishing integrated online education platform before 2022.

Since 2019 and especially during the school closure amid the COVID-19 outbreak, the authorities introduced a series of policies to roll out the distance learning system, showing positive signals to online education industry in China. Under the Ministry of Education’s proposal of “Continuing Education outside Physical Classroom”, 22 large online education platforms offered more than 24 thousand free online classes during the outbreak.

In the next few years, the authority will direct more resources into the sector and regulate the industry and the market more strictly. According to the data from Qixin, a total of 25 thousand online education companies had registered during the first seven months of 2020. Averagely, 120 companies were registered every day.

Big Tech in China’s online education market

Battle between China’s internet giants BAT

Chinese internet giants BAT (Baidu, Alibaba and Tencent) all entered the market as offering an extension to their primary business; they further tapped into the market to provide wide ranges of services through development, incubation, M&A, and investments.

Source: IT Social, Baidu, Ailibaba and Tencent, also known as BAT

The online search giant Baidu first entered the education business by launching the Baidu Library in 2009 as an online digital document sharing platform; it has consolidated and enlarged its business in education by gradually introducing education-related products.

Similar to Baidu, the other two also have cemented their positions in the field in recent years. In 2013, Alibaba launched Taobao Tongxue to integrate sales of online educational content and education-related physical goods like the event entrance. In the same year, Tencent established Tencent Education to provide functions such as PowerPoint Sharing on QQ to allow online teaching on the existing platform and gradually transformed it into an online education platform.

The internet giants are active recently to grab their market share in the market driven by COVID-19 in the first half of 2020. For example, the principal subsidiary of Alibaba, Taobao, established the Education Department in March 2020, aiming to integrate the platform’s existing education resources better. According to the company’s data, searches for education-related products on Taobao doubled during the first half of 2020. As of June 2020, Taobao hosted over 10 thousand education agencies and provided more than 3 million courses with a wide range of target audiences. The group stated: “it will allocate resources to help over 1,000 education service companies each secure 100,000 students over the course of three years.”

Emergence of video-sharing and short-video platforms in education industry

The internet giants are not the only tech companies competing in the market; other online entertainment platforms entered China’s online education market. Interestingly, many video-sharing and short-video platforms have added educational elements into their existing services.

How Bilibili became an online study destination

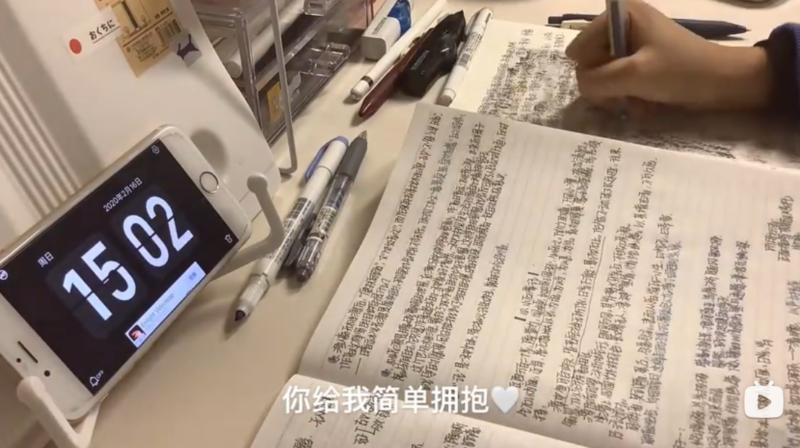

Bilibili, one of the most popular video-sharing platforms, initially focused on the ACG (animation, comics and games) content, but has transitioned to more general content, from cooking tutorials to vlogs. In the past few years, streaming and recording of studying have become popular on the platform.

Even though many of those videos provide no content other than the uploaders sitting in front of their desks studying for exams, many users find comfort and a sense of company in playing these kinds of videos on the side while studying. According to data from Bilibili, in 2018, #study with me# was the most popular category within its streaming service, and the users have streamed their study experience for a total of 1 million hours.

Additionally, many users voluntarily upload tutorials or tips for exams, while some education companies use the platform for marketing. The education-related videos from TOEFL class to Python tutorials to basketball training are provided as recorded tutorials or live streaming on the platform; the large user base of the platform has attracted many elite Chinese elite universities and research institutes like Beijing University to offer class content on Bilibili.

According to Bilibili, more than 18 million people watched education-related content on Bilibili in 2018, twice as many as the number of students who took the high school graduation exam (Gaokao) in that year. Because of the success, it launched Bilibili Class to offer paid class content to compete against more traditional MOOC platforms at the end of 2019, in an attempt to generate more paying users.

Source: Bilibili user “Bu Xiu”, #study with me# on Bibilibili

Kuaishou has one million educational content creators

Like Bilibili, Kuaishou, the popular short-video sharing platform, especially among rural users, also started directing its resources into education-related content. The platform gives content producers incentives to provide education-related content and partners with research institutes, such as the Chinese Academy of Sciences and the Chinese Research Institute for Science Popularization, to deliver popular science content in the past two years.

A wide range of content can be found on the platform, such as farming courses and electrician training, to match the user groups. Kuaishou also widened its footing in the market through investment. Two “AI” education companies, k-12 Intellegent Leaning and k6 Huahuasiwei received investments of 50 million and 40 million US Dollars from Kuaishou in the past two years. According to its report, there were almost a million education-related content creators as of 2019; the average daily play volume reached 2.2 billion; an average of 1 thousand million users watched education-related content daily.

Source: Chozan, class streaming on Kuaishou

Douyin plans to focus on developing educational content

ByteDance, the parent company of arguably the most popular short-video sharing platform Tik Tok (Douyin in China), announced to set education as one of its most important strategic development categories in March 2020 and expected to hire more than ten thousand staff for the education service in 2020. In the same month, Boxuhulian registered as a subsidiary for the education market. Prior to that, ByteDance has already incubated and bought companies like k-12 English education platforms AI KID and gogokid, as well as k-12 one-to-one tutoring company Xuebajun.

Matthew effect of online education industry in China: Large players benefit from investment

The Matthew effect of the online education industry has become evident alongside capitals’ increasing attention to the market. The number of investment events remained at a similar level between 2015 and 2018 and reduced by 40% in 2019, while the average investment amount in a single event gradually increased from 53 million RMB to 92 million RMB in 2019.

Although benefited from a series of policies aiming to facilitate the digitalization of classrooms during COVID-19, the primary beneficiaries of this new wave of digitalization are the large well-established players in the industry. The platforms and communication software owned by big techs such as Dingding by Alibaba, were designated as the education tools of the national school system by the government. A lot of growth in online education during COVID-19 can be attributed to large education companies such as XDF’s temporary transformation from in-person class to distance learning. In contrast, less-known companies still struggle with attracting new students.

The companies heavily rely on experience in the industry and reputation in the market to attract customers. Many of those in the k-12 segment need past results of the students to demonstrate their credibility to the parents. They are also susceptible to incidents that damage their reputation, especially when the information and reviews are easily accessible. The nature of the education industry determines that the companies must gradually accumulate expertise and reputation and gain their customer base through time, making it much more challenging to scale.

The traditional “Internet games” with rapid expansion led by huge investments cannot apply to many market situations. The industry fundamentally contradicts demands for rapid expansion and return commonly seen in the Internet capital market. To limit the uncertainties and risks, more and more investments are funneled to the leading companies. The competition in the market is expected to continue to rise after the rapid increase of the companies entering the market during the Covid-19 crisis. More and more small newcomers without the experience and reputation in the market will be phased out.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast