The China Mergers & Acquisition (M&A) market has undergone significant changes in recent years, particularly in outbound deals. Despite a slump in China’s outbound M&A transactions in 2022, Asia remains a popular destination. However, continued tensions between the U.S. and China in combination with the hurdles presented by national security reviews continue to pose challenges to Chinese issuers, affecting deal activity and valuations in foreign markets.

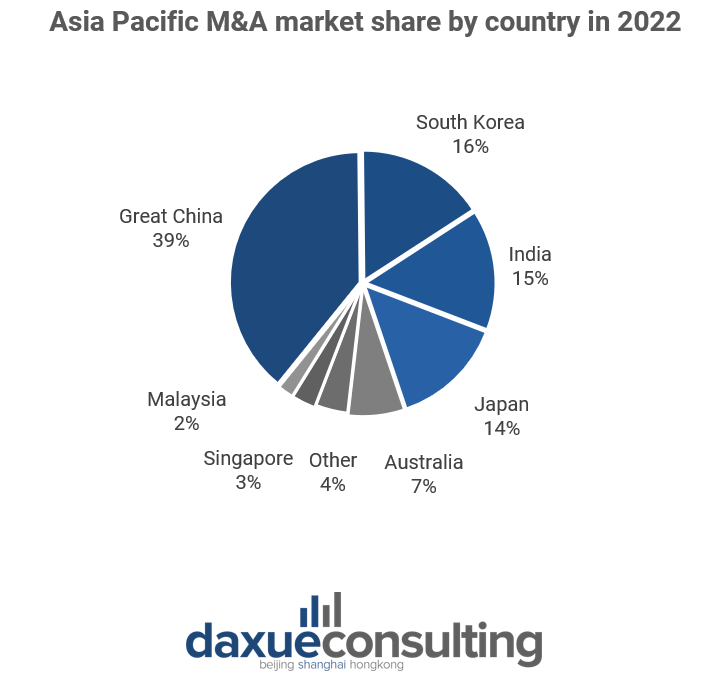

China remains an appealing region in the Asia Pacific M&A market

In 2022, Greater China, South Korea, and India had the most active M&A markets, accounting for 39%, 15.6%, and 14.9%, respectively, of the total M&A transaction value of the Asia Pacific region.

China’s M&A landscape: navigating fluctuations and resilience around COVID-19

In 2016, China experienced a thriving M&A landscape with over 7,860 deals with a total value of over 740 billion USD took place. However, after 2016, both the volume and the value of China M&A slumped. In 2019, the value and volume of M&A in China dropped by 14% and 13% respectively from 2018. In 2020, the value and number of China M&A increased by 31.3% and 11.3% respectively compared to 2019, the average value of M&A deals increased by about 16%. The total deal volume kept relatively consistent as small-sized transactions remained active every month while the world was still recovering from COVID-19.

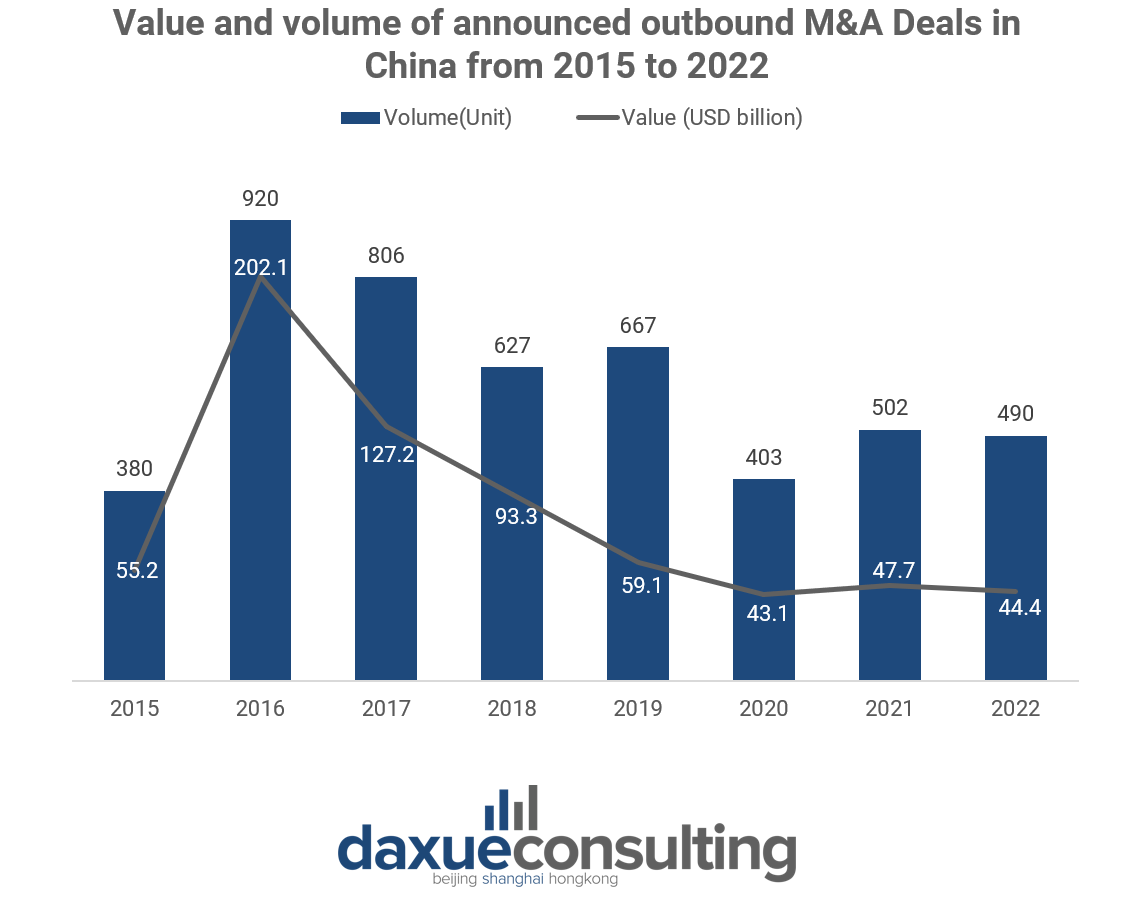

China’s outbound M&A transactions slumped in 2022

In 2022, Chinese companies announced takeovers of 490 foreign companies, with a worth of 44.4 billion USD. This was a slight decrease from the previous year, but considerably less than in 2016.

The overall China M&A market size in 2021 was estimated to be around 600 billion USD. However, in 2022, China M&A experienced a significant decline, reaching an eight-year low of 486 billion USD, marking a 20% decrease compared to the previous year. In 2022, China overseas M&A reached 44.4 billion USD, down 7% Year-Over-Year (YOY). Private Equity (PE) investments, which had been the largest category of M&A by value in 2021, also faced challenges in 2022 due to strong macroeconomic headwinds, resulting in an eight-year low.

China became more cautious about making investments abroad due to the impact of global economic trends and China’s pandemic policies. Additionally, there were more deals where the exact value was not disclosed, which influenced the statistical outcomes. In terms of the announced deals, there were 490 deals, down 3% YOY.

In terms of the regional distribution, in 2022, almost every region had a decrease in the value of the announced outbound M&A deals compared to 2021, except for the takeovers of Middle East companies. The announced transaction volume in 2022 amounted to around 15.6 billion USD in the Middle East and 8.1 billion in Asia.

Asia and Europe were the main destinations for China’s outbound M&A deals

China’s outbound M&A in Asia remains a popular destination for Chinese companies’ outbound investments

In Asia, the value of deals decreased by 61% YOY in 2022, reaching 10.8 billion USD. However, the volume of deals remained high, with 171 deals, representing a 4% increase compared to the previous year. This indicates that Asia remains a popular destination for Chinese companies’ outbound investments. Among China’s overseas M&A destinations, four out of the top 10 were located in Asia: Singapore, Japan, South Korea, and Indonesia. These four countries collectively accounted for nearly 80% of the total value of investments in Asia.

The sectors attracting the most investment from Chinese enterprises in Asia were TMT (Technology, Media, and Telecommunications), RHC (real estate, hospitality & construction), and CP (consumer products). Combined, these sectors accounted for 66% of the total value of investments in the continent.

Looking ahead to 2023, the M&A market in Asia is expected to continue growing due to several factors. These include the anticipated release of pent-up demand as COVID-19 restrictions are lifted, measures implemented by China’s leadership to address the real estate crisis, the relaxation of restrictions on the internet economy, and a renewed focus on overall economic growth.

Chinese investments in Europe: The Netherlands emerge as top destination, TMT sector leads the way

In 2022, in Europe, the value of deals decreased by 52% year-on-year, amounting to US 7.6 billion USD. However, the volume of deals saw a 6% increase with a total of 170 deals compared to the previous year. In terms of Chinese investments in Europe, the Netherlands emerged as the top destination following a mega-scale deal in 2022. The United Kingdom and Germany were also popular investment choices based on deal volume, collectively accounting for 42% of the total value in the continent.

The TMT sector (Technology, Media, and Telecommunications) dominated investment activity in Europe as well, representing 45% of the total value in 2022. It is worth noting that inflation in Europe reached an all-time high during the same period, although rising prices in some countries slowed down by year-end. Despite this, high inflation has not deterred investment activities in the region, and Chinese enterprises continue to find opportunities in various sectors across Europe.

China’s outbound M&A in North America: Historic lows in deals, yet opportunities in HCLS and AMM Sectors

In North America, both the value and volume of deals reached historic lows. The total value of deals decreased by 33% year-on-year, amounting to 6.3 billion USD, while the number of deals experienced a significant decline of 42%, with only 82 deals compared to the previous year. Despite these challenges, there were notable highlights in specific sectors. The HCLS (Healthcare, Life Sciences, and Services) and AMM (Advanced Manufacturing and Materials) sectors recorded new highs in terms of value, with increases of 42% and 178% YOY, respectively. These two sectors collectively accounted for 76% of the total value of investments in the continent. HCLS also maintained its position as the top sector in terms of deal volume, representing 33% of the total volume in North America.

Despite the looming threat of an economic recession and geopolitical issues in the US, the advantages of technological advancements and the market size of the country can still be attractive to Chinese overseas investors, particularly in less sensitive sectors. While the overall investment landscape in North America faces challenges, there are still opportunities to be found in sectors that capitalize on technology and benefit from the United States’ large market size.

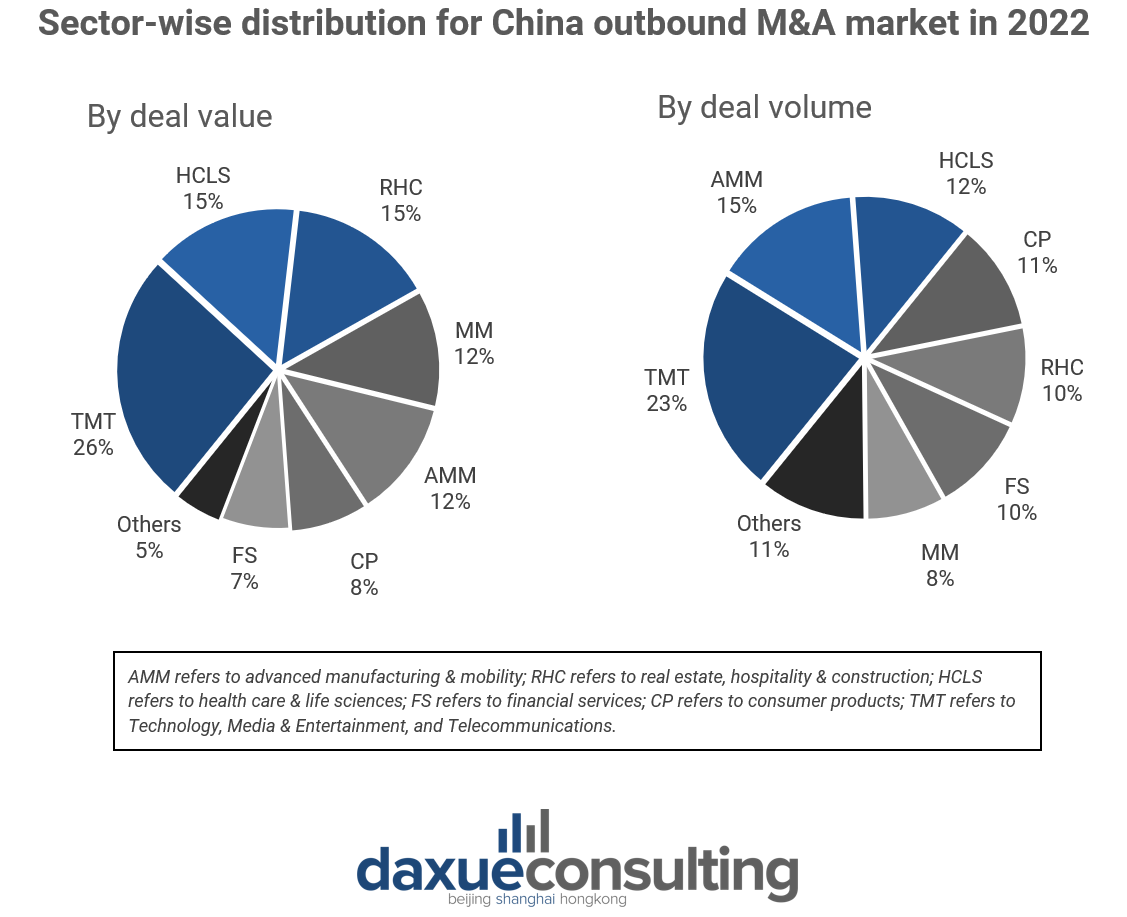

Sector-wise analysis for China’s outbound M&A market in 2022

In 2022, the China’s outbound M&A market saw interesting trends in different sectors. The healthcare and life sciences sector (HCLS) had most of its deals in North America, accounting for 75% of the total value. Furthermore, the advanced manufacturing and mobility (AMM) sector had a drop in overall investment, but there was more investment in North America and Europe, especially in transport infrastructure, automobiles, and chemicals. In addition, Chinese enterprises focused on power and utilities deals in Asia, with a strong emphasis on renewable energy like solar and wind. What’s more, the consumer products (CP) sector had deals mostly in Asia and Oceania. The technology, media & entertainment (TMT) sector stood out as the highlight of the year, with growth in both deal volume and value.

The impact of the pandemic and geopolitical issues

Considering that the COVID-driven boost to deal-making has mostly disappeared, this decline compared to the previous year might be seen as a return to “pre-pandemic” levels. Moreover, rising geopolitical tensions in the aftermath of the Russia-Ukraine conflict, a worsening macroeconomic outlook, higher interest rates, and supply chain disruptions have all contributed to a slowdown in investment activity, particularly in Asia-Pacific M&A hubs, including China. In other words, the M&A market is entering a more muted phase as corporations become more cautious about transactions.

For large state-owned enterprises (SOEs), the desire for outbound M&A has decreased due to geopolitical tensions and regulatory restrictions from countries such as the US. For instance, there is such a “Common Prosperity” campaign in 2021, and it was predicted that there would be stricter supervision and scrutiny on technology companies in the near future. Such heightened scrutiny could redirect the focus of these SOEs towards their core businesses within the domestic market, leading to a decreased interest in pursuing M&A abroad.

In 2022, of the 1,220 deals, the largest deal announced in Q4 2022 was Hong Kong public investment firm Link Real Estate Investment Trust (SEHK:823) agreeing to acquire Singaporean asset Jurong Point and Swing By @ Thomson Plaza from Mercatus Co-operative Limited, a Singaporean private company, for 1.6 billion USD announced on December 28, 2022. Cumulatively, the top five deals amounted to 12.5 billion USD and accounted for nearly 11.61% of the total deals (by value) announced during the last twelve months.

Record-breaking surge in China M&A deals observed in New Energy Industry in 2022

China’s ambitious goals of achieving “carbon peaking and carbon neutralization” have had a profound impact on the burgeoning new energy sector. In fact, China’s energy sector witnessed a record-breaking annual M&A transaction value of 59.6 billion USD in 2021, with over 803 deals executed, marking a notable 50% increase in mergers and an impressive 80 % increase in acquisitions compared to the previous year.

Renewable energy segments such as wind and solar power, alongside the emerging domains of new energy vehicles and energy storage, have experienced remarkable growth and piqued the interest of investors. The cutting-edge technology provided by hydrogen energy has also captured attention, with China’s hydrogen demand projected to reach 35 million tons by 2030, constituting at least 5 % of the country’s energy supply. This demand is expected to escalate further, reaching 60 million tons by 2050 and a staggering 100 million tons by 2060, according to the estimations of the China Hydrogen Alliance. In line with these promising prospects, the industry’s output value is anticipated to reach a remarkable RMB 1 trillion (157.44 billion USD) by 2025. These positive developments create an attractive landscape for M&A activities, fostering greater enthusiasm among investors to participate in the thriving new energy sector.

PE Market has decreased compared to the previous years

According to the report by Bain & Company, despite the fact that the deal value in Greater China’s PE market fell 53% to 62 billion USD in 2022 compared to the previous year, PE investment was the largest single category overall for the second year – representing nearly half of all deal activity. PE/VCs took advantage of frothy M&A market conditions and relatively healthy public- and private-market valuations in the first half of 2022 to initiate exits from their growing portfolios.

In 2022, US investments in China significantly declined due to geopolitical tensions and strict lockdown measures. The total value of these investments dropped by 76% to 7.02 billion USD from 28.92 billion USD, and the number of deals decreased by 40% to 208 from 346. Mergers, acquisitions, and fresh funding rounds involving US private equity firms hit a two-year low, with only 530 million USD across 36 deals in the final quarter of 2022, compared to7.17 billion USD across 94 deals in the same period of 2021.

Regulatory issues affecting Chinese issuers continued to take US equity markets largely out of play, while Hong Kong was also soft with lower valuations. Deal value in Greater China’s PE market fell by 53% to 62 billion USD in 2022 compared to the previous year. Average deal size was at 82 million USD, the lowest since 2013, while deal count shrunk 38% year-on-year.

Knowing the past and looking forward to 2023

- China’s outbound M&A transactions experienced a significant slump in 2022, reaching an eight-year low in deal value. The volume of China’s overseas M&A deals has been decreasing since 2016, with 2022 being a particularly challenging year.

- Asia remains a popular destination for China’s outbound investments, with sectors like TMT, real estate, hospitality & construction, and consumer products attracting the most investment.

- Europe and North America also saw a decline in China’s outbound M&A activities in 2022, although specific sectors like healthcare & life sciences and advanced manufacturing & mobility experienced growth.

- The renewable energy sector, including wind, solar power, new energy vehicles, and energy storage, has seen significant growth and presents attractive opportunities for M&A activities.

- PE investment in China experienced a decrease in 2022, but it remained the largest category overall, indicating ongoing interest in M&A despite market challenges.

- Regulatory issues and geopolitical tensions have affected Chinese issuers’ access to foreign markets, impacting deal activity and valuations.

Author: Howard Lai

Learn about young Chinese consumer trends