The Chinese consumer electronics market maintained its position as the largest in the world with an estimated market size of USD 212.9 billion in 2025. Furthermore, its growth potential will continue to be unleashed by the recent round of subsidies and developments in AI technology. The expected compound annual growth rate (CAGR) of 3.84% from 2025 to 2029. Smartphones remain the most significant segment, with an estimated market size of USD 115.8 billion in 2025, accounting for more than half of the market share.

With the rapid adoption of GenAI technology, the accelerated development of IoT devices, and government subsidies, China’s consumer electronics market is poised for continued growth in 2025.

China’s smartphone market in 2025

Government subsidies stimulate consumer demand

Government subsidies for electronics have been a key driver of growth in China’s smartphone market. The most recent subsidy program was launched on January 8, 2025, offering discounts of up to 15% for specific tech products. The maximum discount per item is RMB 500 (approximately USD 68). The program covers smartphones, tablets, smartwatches, and smart bands priced under RMB 6,000 (USD 820). However, high-end models such as foldable and flagship phones are excluded.

As a result, Xiaomi, which has a large number of low-end models, became the biggest beneficiary of the subsidy program. In contrast, Apple was not able to benefit from this initiative, as most of its phones (including the best-selling Pro models) are priced above the subsidy threshold. A small number of mobile phones that meet the subsidy restrictions, such as some models of iPhone 15/16. However, these subsidies are only available through certain channels, further limiting the effectiveness of the subsidy policy on Apple products.

China’s smartphone market performance in 2025

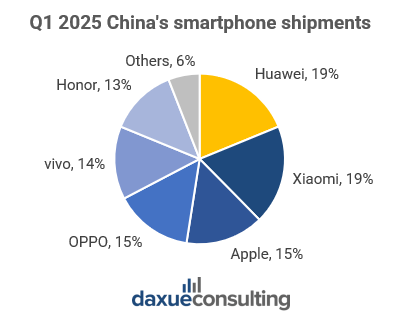

In the first quarter of 2025, the Chinese smartphone market continued the growth momentum seen since 2024. The segment achieved a total shipment volume of 70.9 million units, marking a year-on-year increase of 5%. Overall, the market showed a fragmented landscape, with no single brand holding more than 20% market share.

Among these, Xiaomi and Huawei were the biggest winners, with their shipments increasing by 18% and 40% year-on-year, respectively. On the other hand, Apple’s smartphone shipments in China declined by 9% compared to the previous year, making it the only major smartphone manufacturer to experience a drop in shipments.

GenAI and foldable smartphones: Long-term growth drivers

However, while the national subsidy program for consumer electronics introduced by the Chinese government has led to some demand for device upgrades in the short term, its effect is more of a temporary boost rather than a structural driver of growth. For the Chinese smartphone market, the long-term growth drivers remain technological advancements, particularly the application of GenAI in smartphones and the development of foldable phones.

With the rapid development of large-scale AI models, smartphones equipped with GenAI have gradually become a new growth point in the Chinese smartphone market. According to IDC’s research, by 2024, shipments of AI smartphones with on-device GenAI under the USD 1,000 price range will reach 35 million units, marking a year-on-year increase of 250%. GenAI will drive the transformation of smartphones into AI-powered devices, enhancing experiences across multiple scenarios such as entertainment and mobile office. By 2027, AI smartphones will account for over 50% of the Chinese market.

In fact, starting from 2024, many smartphone manufacturers have already begun exploring related technologies. On October 29, 2024, the “AI reshaping system applications” were announced by Xiaomi 15, including AI writing, speech recognition, and subtitle features. The following day, Honor launched the Magic7 series, which features the Honor AI assistant YOYO, capable of learning and recognizing user behaviors, analyzing and understanding user intentions, and automatically executing relevant tasks. OPPO, on the other hand, has partnered with Microsoft and Google, and its Reno12 series and the next-generation Find X series will integrate the Gemini AI large model, offering an AI toolbox with features such as copywriting generation and recording summaries.

Huawei dominates China’s foldable smartphone market

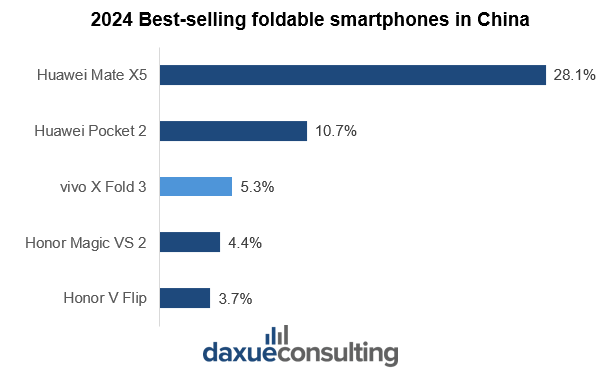

Foldable smartphones are another growth hotspot. In 2024, the revenue of China’s foldable smartphone market is expected to reach RMB 39.181 billion (USD 5.4 billion), with projections indicating it will reach RMB 83.557 billion (USD 11.5 billion) by 2030, with a compound annual growth rate (CAGR) of over 12% during this period. Huawei has already gained a leading position in this field. In 2024, Huawei’s two products, the Mate X5 and Pocket 2, received widespread acclaim in the market. In the first quarter of 2025, Huawei continued its strong momentum, capturing 76.6% of the Chinese foldable smartphone market, the highest market share in the sector.

Although the foldable smartphone market is still considered a niche market, accounting for only about 3% of China’s smartphone market, significant improvements in technology are enhancing foldable smartphones in terms of thickness, hinges, weight, battery life, and camera quality. Notably, the weight and thickness of book-style foldable phones are now approaching those of traditional bar phones. This makes them more convenient for most consumers to use. With the improvement in software and hardware integration and the expansion of use cases, the foldable smartphone market is expected to achieve sustainable growth. Thus, the competition among related manufacturers will become more intense.

Smart home appliances: Policy and tech drive growth

Another industry benefiting from the Chinese government’s subsidies for consumer electronics is the smart home appliance sector. In recent years, China has implemented a series of policies to promote the development of the smart home appliance industry, such as the “Rural Revitalization Plan (2024-2027)”, the “Action Plan to Promote the Trade-in of Consumer Goods”, the “County-Level Commercial Three-Year Action Plan (2023-2025)”, and the “Several Measures to Promote the Consumption of Electronic Products”. The implementation of these policies has greatly stimulated the prosperity and consumption upgrade of the smart home appliance market.

In China, smart home appliances refer to household appliances that are equipped with technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data, enabling smart control, autonomous learning, and interconnectivity. Currently, with the arrival of the home appliance replacement cycle and the growing focus of Chinese home appliance manufacturers on the ecological chain, smart home appliances are evolving from “single-product intelligence” to “whole-house intelligence.”

The common smart home appliance types and functions

| Type | Core function |

| Smart air conditioners | Automatically adjust temperature and humidity, pre-start with weather data |

| Smart door locks and cameras | Face recognition unlocking, motion detection warning, and remote video monitoring |

| Smart kitchen facilities | Ingredient expiration reminder, remote control cooking mode |

| Robot vacuum cleaners and smart washing machines | Route planning, clothing material recognition, and matching a washing program |

| Smart audio and video equipment, home theaters | Voice-on-demand audio and video content, cross-device screen projection |

Source: AskCI Consulting Co., Ltd., designed by Daxue Consulting, Common smart home appliance types and functions

Subsidies have proven to be effective in fueling growth in China’s consumer electronics market

Subsidy policies for consumer electronics have long been considered one of the effective measures to promote China’s economic development. In fact, as early as the end of 2007, following the global financial crisis, the Chinese government used fiscal measures to subsidize the purchase of home appliances for rural residents in order to expand domestic demand. This policy continued until January 2013 and yielded good results for China’s consumer electronics market.

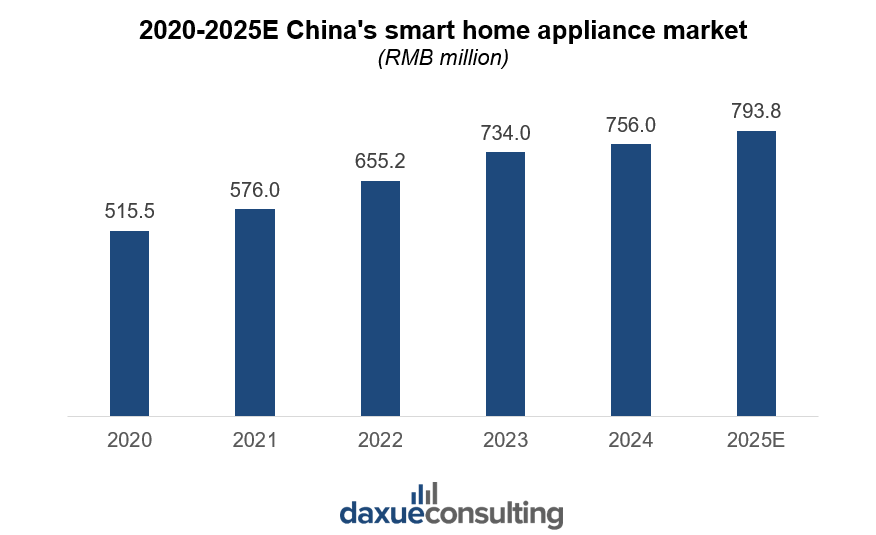

The new round of subsidy policies, which began in the second half of 2024, has similarly had a significant growth effect on the home appliance market. Data from the China National Research Institute of Industry shows that in 2024, the shipment of smart robotic vacuum cleaners in China reached 5.4 million units, a year-on-year increase of 6.7%. In the fourth quarter, stimulated by the “national subsidy” policy, shipments reached 1.75 million units, marking a year-on-year growth of 28.2%. Analysts from the same source forecast that in 2025, the shipment of smart robotic vacuum cleaners in China will reach 5.658 million units, and China’s smart home appliance market will reach a scale of RMB 790 billion (USD 110.7 billion) by 2025.

From single products to whole-home smart appliances: Intensifying competition among domestic appliance brands in China

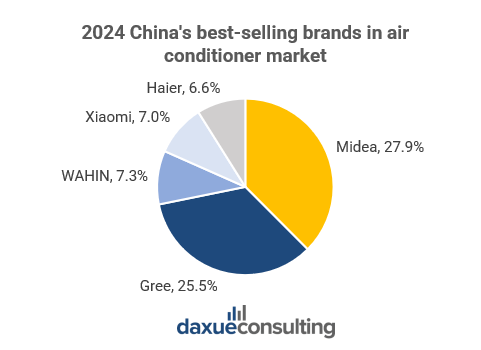

Domestic brands are the preferred choice in China’s home appliance market. Taking the highly competitive air conditioning market as an example, in 2024, China’s air conditioner shipments are expected to reach approximately 102 million units, a year-on-year increase of 5.86%. The total shipment value for the year is estimated to be around RMB 271.5 billion (USD 37.55 billion), with the top five brands in the market all being domestic brands.

With the development of smart home appliance technologies, competition among Chinese home appliance companies is shifting from individual products to competition within the product ecosystem. For instance, Gree Electric plans to open a new chain of stores named “Dong Mingzhu Health Home” nationwide starting from March 2025, with plans to eventually open 10,000 such stores across the country. As pointed out by Gree Electric, these “Dong Mingzhu Health Home” stores aim to showcase the company’s “healthy living” concept and represent a strategic shift from product manufacturing to comprehensive health services.

In contrast to Gree, China’s other two major appliance giants, Midea and Haier, have chosen to leverage AI technology to build an ecosystem of their home appliance products. In 2023, Midea launched its human-centered intelligent system, which integrates a central intelligent hub, three major super terminals, four appliance systems, and numerous intelligent scenarios to achieve synergy between home appliances through human-centered AI cloud computing. Haier, on the other hand, introduced HomeGPT, a self-developed domain-specific model, enabling deep interaction between the brand’s home appliances and consumers. Moreover, during Haier’s 2025 ecosystem conference, the company announced its initiative to develop household service robots to replace approximately 80% of domestic chores.

Emerging brands exploring the smart home appliance market: Xiaomi’s ambitious goals

In addition to the well-established major brands that have already secured a foothold in China’s consumer electronics market, younger, emerging brands are also actively exploring this market. A representative of this trend is Xiaomi, a Chinese tech company. In November 2024, Xiaomi began construction of its smart home appliance factory in the Wuhan East Lake High-Tech Development Zone, completing the structural topping within just 80 days. Xiaomi claims that the first phase of this factory, which includes six sub-factories and over 100 laboratories, will begin mass production of the company’s self-developed air conditioners by the end of 2025.

Xiaomi has ambitious plans for the smart home appliance market. In March 2025, Xiaomi co-founder Lu Weibing stated on the Chinese social platform Weibo that Xiaomi’s air conditioner sales target for this year is to rank third in the domestic market, with plans to become a leading air conditioner brand within the next five years.

Foreign competitors turn to cooperation to stay competitive in China’s consumer electronics market

To counter the competition from Chinese home appliance companies, Samsung and LG, two Korean companies that have long been competing with each other, have started cooperation in the field of smart home appliances. The two companies plan to allow each other’s products to be added to their respective home appliance remote control applications to improve consumer convenience. Samsung and LG respectively operate smart home remote control applications “SmartThings” and “ThinQ”, which originally only allowed the addition of their own products, but will be able to add each other’s products in the future.

KBS analysis pointed out that through cooperation, both parties will be able to achieve a win-win situation. Samsung Electronics can transform its advantages in the field of smartphones into a driving force for the increase in home appliance sales. At the same time, LG, which has withdrawn from the smartphone market, will be able to win over Samsung smartphone users and expand the user base of home appliance products.

Subsidies and AI trends that are driving China’s consumer electronics market:

- Affected by policy subsidies, China’s smartphone market continues to prosper. Local brands like Xiaomi and Huawei have become the biggest beneficiaries of the subsidies.

- Smartphones and foldable phones equipped with GenAI have become the growth hotspots in China’s mobile phone market.

- China’s home appliance market is continuing to expand, and competition is gradually becoming systematized.

- Chinese traditional home appliance giants such as Gree, Midea, and Haier are competing in health products and smart home appliances.

- Xiaomi is showing great ambition in the smart home appliance market.