The musical market in China is one of the fastest-growing markets worldwide and represents the backbone of the music market. Some key factors driving this growth are technological advancements, consumer demand and the rise of the middle class in China, contributing to market expansion. As such, the revenue of the music streaming market in China is projected to reach RMB 27.46 billion (USD 3.82 billion) by 2025.

The trend of consuming online music is projected to reach 178.6 million users by 2029. The constant rise of digital consumers and the increasing usage of artificial intelligence among creators are only a few of the reasons why music streaming platforms in China are gaining so much popularity among consumers. Thanks to these factors, creating music has gotten way easier and more accessible.

Gen Z sees music as a way to express their feelings

The digital music market in China shows a huge user base among netizens. As of 2024, around 748 million people listened to online music from a music streaming platform, which is equivalent to 67.5% of internet users in the country. Furthermore, Gen Z represents the biggest chunk of online music consumers. As of 2023, more than 65% of digital music listeners in China were born after 2000. Younger people treat listening to music as part of taking a break from everyday life. They consider it a special moment to avoid the dynamism of society. It is also a way to express their feelings with the infinite possibilities that only music can give.

IP protection laws in the age of AI

Ongoing changes in the music industry are continuing to challenge artists, and like many other countries, China also faces problems with digitalization and artificial intelligence. The National Copyright Administration of the People’s Republic of China (NCAC) plans to release its next five-year copyright plan in 2026. The shift toward licensed digital music’s power is still mostly in the hands of streaming platforms and music companies. AI is mostly not supported by the government in China, and the effort to regulate exclusive copyright licensing for music has reinforced the dominance of music-related platforms. Musicians transferred their rights to recording companies, which then would negotiate licensing deals with streaming services like Tencent Music Entertainment (TME).

Tencent Music has the monopoly on the biggest music streaming platforms in China

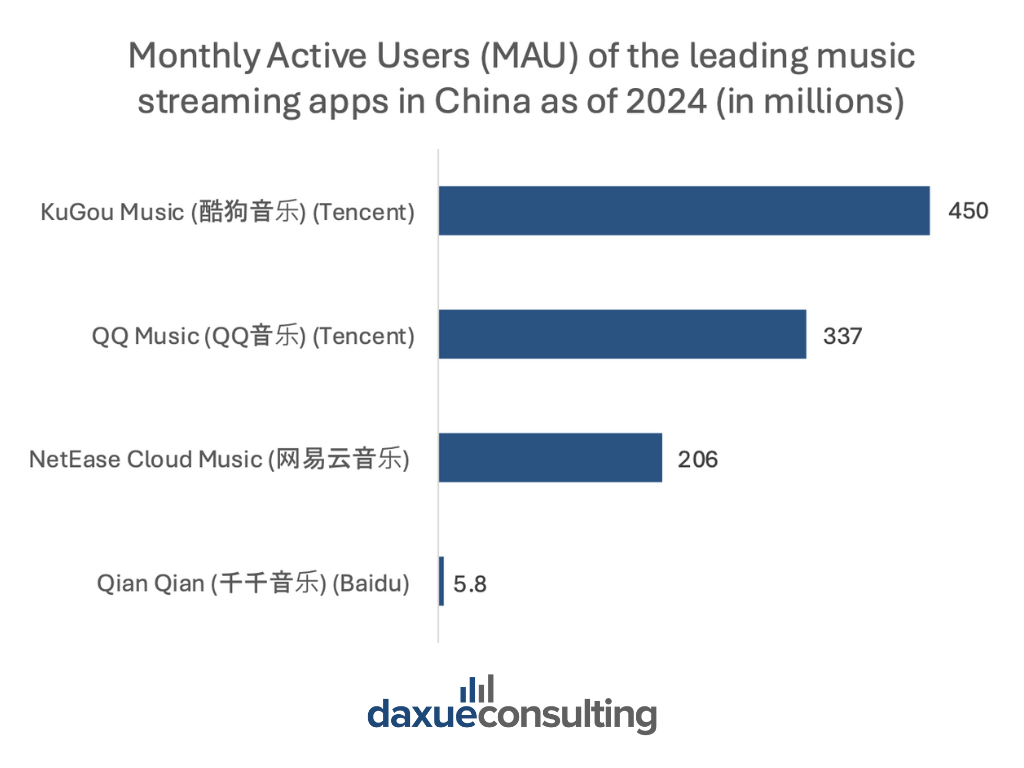

Domestic companies represent the main players in the country’s digital music market. Tencent is not only one of the biggest tech giants in China. This performance was due to the consistent expansion of its paying user base, partly boosted by it’s “Super VIP” tier.

Tencent Music announced an 8.7% year-on-year increase in revenue for the first quarter of 2025, totaling RMB 7.36 billion (USD 1.03 billion). Tencent also represents the vast majority of the music market. In particular, three of the most successful music apps are all owned by the company’s branch Tencent Music: QQ Music, Kugou Music, and Kuwo Music. With more than 600 million MAUs as of November 2024, KuGou Music was the biggest Chinese music streaming service, followed by QQ Music with 337 million MAUs.

With KuGou Music, everyone can be an artist

Apart from being the biggest Chinese musical streaming service, KuGou music (酷狗音乐) is also one of the biggest platforms in terms of artists and singers, and its popularity is increasing year-on-year. The platform was launched in 2006. Thus, it is one of the oldest musical streaming platforms in China, together with QQ Music. Many users choose this musical service for its numerous and varied choice of songs. In 2023, the platform added almost 26 million new songs to its archives. It saw an increase of 26% compared to 2022.

Furthermore, KuGou Music is more open to young producers and artists than other Chinese platforms. One of the most innovative programs launched by the Tencent-owned app is the “KuGou Musician open platform” (酷狗音乐人开放平台), a service where people can choose to enter the platform as a singer, a producer, or a record label. As of 2023, more than 480,000 musicians have joined this program, and around 50% of them were born between the 1990s and 2000s.

The rise of NetEase Cloud Music and its partnership with Soundcharts

NetEase Cloud Music (网易云音乐) is one of China’s leading music platforms, second behind Tencent. With over 206 million Monthly Active Users (MAUs) as of 2025, they are making China’s streaming charts more accessible to the global music industry through a partnership with Soundcharts. Through this collaboration, artists, managers, and labels can monitor music trends in China globally. They can also identify any opportunities for growth and engagement. This is also helping artists all over the world build presence in China’s music industry.

By integrating NetEase Cloud Music’s chart updates into Soundcharts, it enables global music professionals to track song performance in China through real-time data. They can also understand how music trends are built among China’s listeners and make better decisions about marketing efforts in China.

Despite the limitations, Apple Music in China is raising consumers’ interest

Apple Music is one of the few foreign musical streaming platforms that are allowed in China. After entering the Chinese market in 2015, the app stood out among its competitors because of a collaboration launched with Douyin in 2018, when the Chinese social media platform joined the “Apple Music partner program”. After which, all Douyin users could have access to the Apple Music catalog while using social media. Despite its competitive prices for a monthly subscription, which is RMB 11 (USD 1.5) per month, Apple Music is not very popular among Chinese consumers because its collection of songs is quite limited.

Furthermore, there are other options that are not available for mainland China users, such as podcasts and radio. Apple is trying to close this gap with the other Chinese musical streaming services. As an example, in January 2024, Apple Music added an app allowing users to download classical music globally. This is to match Chinese consumers’ rising interest in this music genre. Initially launched in Hong Kong, it is also finding its space in mainland China. The initiative became immediately popular: as of April 2024, the hashtag “#苹果在中国推出AppleMusic古典乐#” (“Apple launches Apple Music classical in China”) has more than 36.9 million views on Weibo.

Douyin for music exposure and discovery

Douyin, the Chinese version of TikTok and both owned by ByteDance, is a short-form video sharing app used within China. There are over 3,000 new songs officially released on a daily basis across different music platforms, and over 100,000 music uploads appear on Douyin in a single day alone in 2025. It has revolutionized the way people consume, discover, and share music, resulting in a content economy where music experiences an extremely fast growth rate.

There are also new opportunities here, especially for China’s Gen Z, as they are interested in multi-cultural and experimental music. What makes Douyin different is the way fans behave and how music gets discovered. Discovery is shaped by algorithms and curated videos, as well as fandoms and communities. Listeners are not just passively listening; they are promoting and funding the artists they love.

How China’s music streaming platforms are redefining digital music

- Gen Z represents the biggest pool of consumers of the music streaming platforms in China. As of 2022, almost 60% of the total digital music listeners were born after 2000.

- The Chinese government has strict control over the digital music market, especially concerning the protection of intellectual property rights. As technology develops, the government has put out policies regarding the use of AI in creating music. Tencent Music holds the monopoly of the Chinese musical streaming industry. The three biggest streaming platforms are all owned by the Chinese colossus.

- KuGou Music is the biggest Chinese music streaming service. As of November 2023, it had more than 350 million MAUs. The app became very popular because it allows everyone to become a creator. This was thanks to the “KuGou Musician open platform” program.

- NetEase Cloud Music and its partnership with Soundchart to making China’s music market more accessible.

- Apple Music is the biggest foreign musical platform which is not banned in China. Despite many features not working in the country, the company launched many initiatives to keep up with Chinese players. For instance, the classical music streaming app gained a lot of popularity on Weibo.

- Douyin and social media as a way for Gen Zs and artists to discover, market, and share music.