China is the largest e-commerce market in the world. In 2021, it was estimated to have a revenue of more than 1.5 trillion USD, while the US ranks second, with 875 billion USD. The biggest platforms for e-shopping in terms of users and transactions are in China and almost one billion people visit them every day. This frequency helps to create an ever-flourishing market where western brands are using more and more strategies to make their names known to Chinese consumers.

Young Chinese Digital Consumers Are Taking Over the Market

During H1 2022, there were more than 922 million active users, 17 million more than in 2021. In the period, more than 80% of all internet users have shopped online at least once, and the gap between generations is clear too. Gen Z and millennials accounted for roughly 78% of the total e-commerce users in 2021. This new wave of young people is favoring the market they are willing to experience new services and follow new trends.

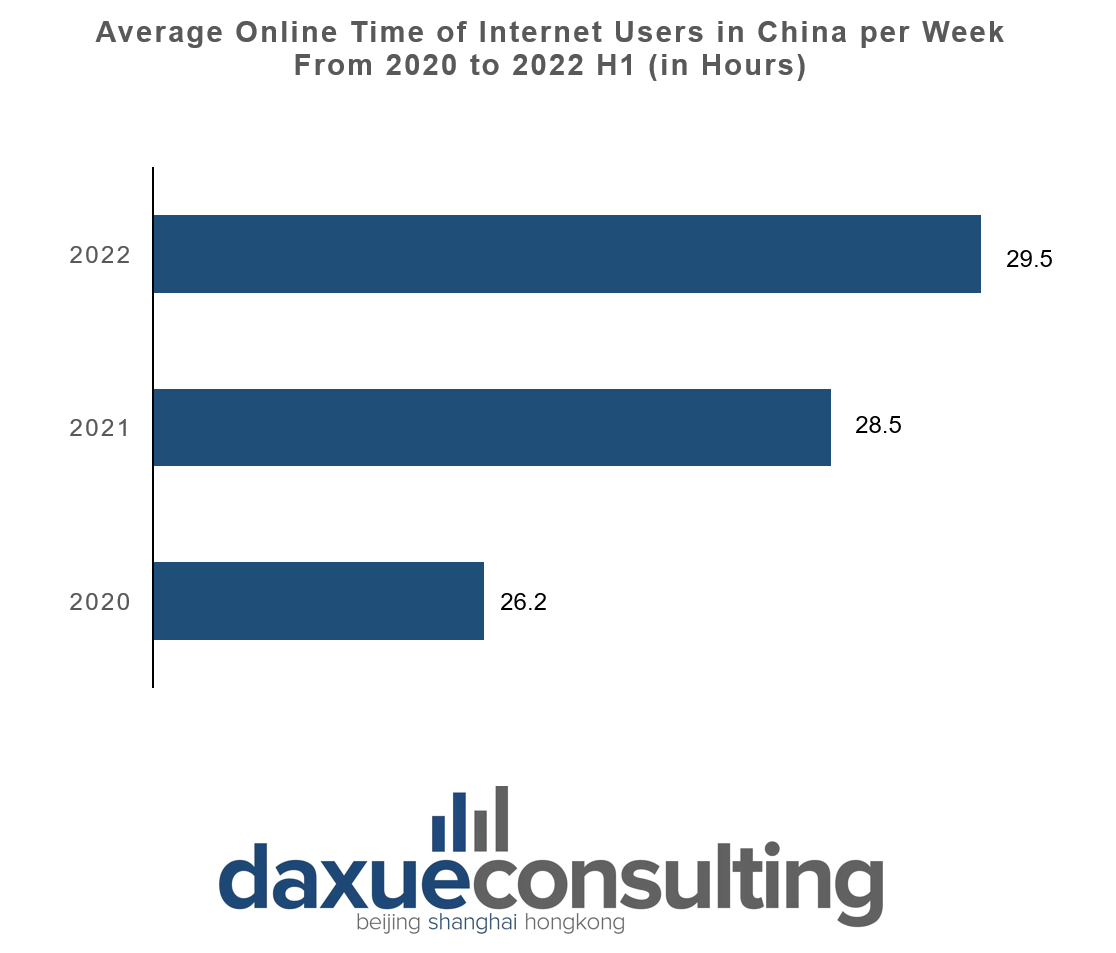

As a result, the time spent navigating online has grown to an average of 29.5 hours per week in 2021. While in 2022, users spend almost 4 hours and 50 minutes per day online, overtaking by 20 minutes the average of the previous year due to the lockdown.

WeChat and Taobao are undisputed leaders in terms of number of users

When it comes to instant messaging apps, WeChat is surely the best in its sub-segment. The Chinese multi-purpose app, released in 2011, can count on a base of 1.27 billion Monthly Active Users (MAUs) in Q4 of 2021, of which 780 million are on its social network part. The main reason of the popularity of such platform is its versatility. Indeed, it can be used for a wide range of actions for example paying bills, ordering food, online shopping, or just as a social media platform. Chinese people spend one third of their online time on WeChat, making it the 5th most checked app in the world.

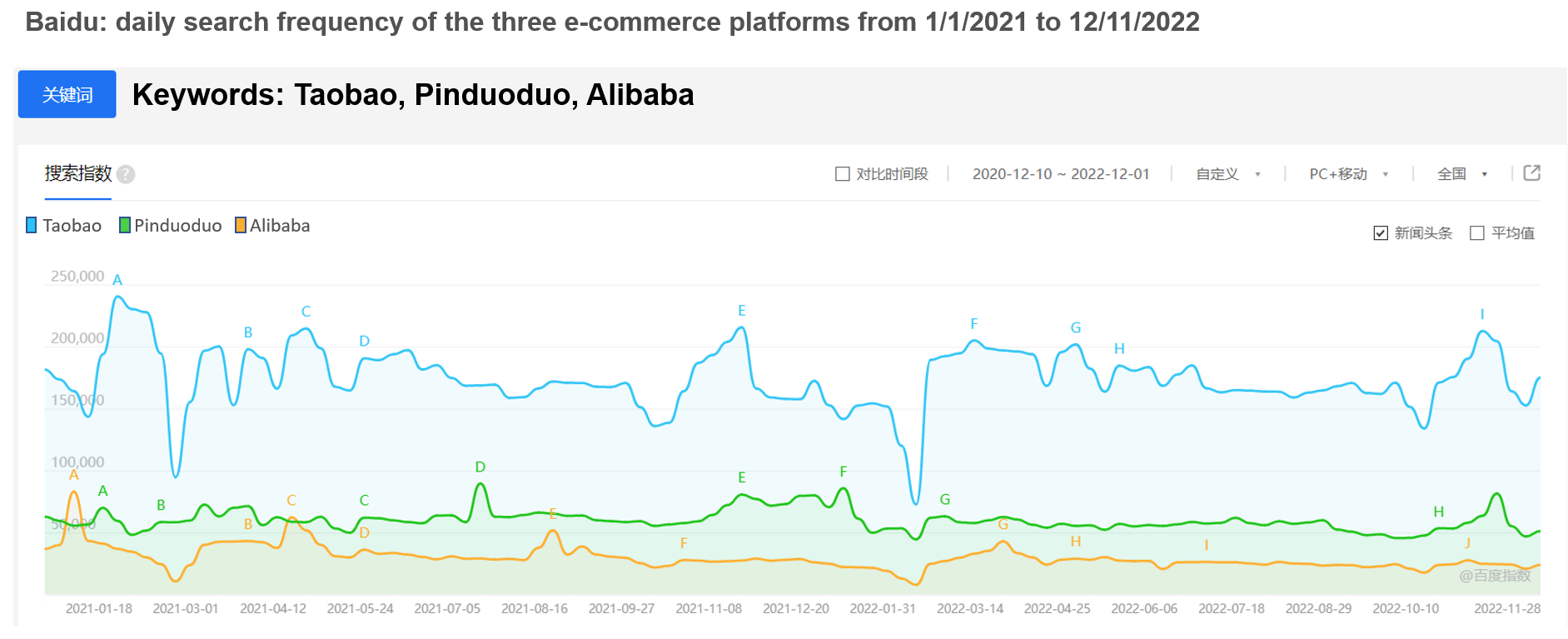

Talking about e-commerce platforms, Taobao is one of the most frequently used in China. The app attracted 875 million MAUs in June 2022, becoming one of the most visited platforms in China and even in the entire world. The silver medal goes to the group-buying app Pinduoduo, which recorded more than 751 million MAUs during the same period.

Capturing Users’ Attention is a real challenge for brands

There are many ways in which apps and platforms can engage with their digital consumers. For example, WeChat strategy is focused on simplicity. The app is organized in mini programs, services which a consumer gets the access to. These can go from payments to education, news, travel, and online shopping. Thanks to its multifunctionality and the main concept of “all-in-one”, WeChat has created an actual ecosystem where the user can navigate smoothly.

Another important feature of WeChat is social media, where users can stay updated on the latest trends and creators can upload their contents. However, nowadays, people are constantly overwhelmed by advertisements. As a result, major companies developed their own marketing strategy based on using Key Opinion Leaders (KOLs) to promote their products and enhance brand awareness through Chinese social media.

KOLs vs KOCs

Key Opinion Leaders or KOLs are one of the most important helpers for online advertising. They are usually experts, brand ambassadors or simply influencers hired by brands to promote products. They have the power to influence users’ purchases through their public credibility.

It is estimated that 48% of online purchases made by Gen Z in 2020 were influenced by KOLs. An example of this can be the case of “Mr. Bags”, a KOL specialized in commercializing handbags which vaunted more than 6.7 million followers on Weibo in 2022. In 2019, he helped the Italian luxury brand Tod’s selling their bags through a Mini program on WeChat, generating more than 460,000 USD (3.2 million RMB) worth of sales in just 6 minutes.

A problem that a lot of Chinese digital consumers have with KOLs is the lack of authenticity. Brands usually pay KOLs to promote their products so their opinion may be often misleading or overhyped. The solution to this problem is given by Key Opinion Consumers or KOCs. The main difference between KOCs and KOLs is that KOLs are contacted by brands to promote their products, while KOCs generally ask companies to test the products they are interested in. In this way, KOCs can provide a more genuine review of the products they are advertising. In addition, they usually have a smaller number of followers than KOLs, thereby allowing them to create a stronger bond with their audience.

Young consumers are becoming less impulsive buyers

In recent years, Chinese digital consumers’ behavior during online shopping festivals and promotional events has changed. According to Nandu Polls, the number of respondents who declared they planned to shop during Double 11 decreased by 20% in 2022 compared to 2020 while those who did not plan to make purchases increased from 12.09% in 2020 to 23.83% in 2022.

The reason of such decline in Chinese consumers’ willingness to consume on such online shopping festivals was mainly due to a change of the way they conceive consumption. People are gradually getting less attracted to shopping spree events and rather prefer spreading their consumption throughout the year. As shown by the 2021 New Youth Fashion Consumption Trend Development Report, younger consumers tend to be less impulsive when it comes to doing shopping, with 58.6% of consumers claiming to “only buy what they need” and to adopt less showy consumption patterns. As a result, young Chinese digital consumers boast less seasonal purchasing behaviors and focus a bit more on their real needs when shopping.

Younger Generations are Reshaping China’s e-Commerce Ecosystem

Green Consumption is one of the rising trends among young people. Even though it is a widespread phenomenon yet, Chinese young consumers tend to be increasingly more motivated to purchase eco-friendly products for protecting the environment: 90% of the surveyed Gen Z and millennials have altered their purchase decisions due to environmental concerns between October 2021 and March 2022.

Moreover, in 2021, online second-hand e-commerce users reached 223 million in China, and they are expected to increase by 40 million by the end of 2022. Due to increasing awareness about environmental issues and the strict zero-Covid strategy that blocked them up at home during the last 2 years, younger people are now craving for getting closer to nature. Hence the growing success of outdoor activities such as glamping, ecotourism, and ultimate frisbee.

Young Chinese consumers love new trends

Gen Z users are the new driving force for e-commerce shopping, thus it is not surprising that brands are eager to please them and meet their needs. Young consumers are open to new trends and new retail channels.

It is not surprising then that the metaverse is currently achieving a discrete popularity among Chinese digital consumers. Indeed, the idea of purchasing products in virtual reality, for example on the Alibaba’s metaverse “Taobao Life”, is gaining so much importance that in 2021, the Chinese government set Metaverse technology development as an objective for the country’s economic growth. Beyond Alibaba, other Big Techs are also investing in Metaverse technology, such as the Chinese mobile devices giant Huawei, which in 2019 released its first VR glasses and in 2021 its VR glass game suite.

Chinese Digital Consumers: A World of Infinite Possibilities

- Chinese market is in continuous expansion, it is expected to reach a revenue of 3.3 trillion USD by 2025.

- Chinese digital consumers are spending more daily time on the internet.

- Young people are driving the digital market. Their presence on online platforms is huge and they are settling the newest trends.

- KOLs and KOCs are powerful tools for brands to make their product popular online.

- KOCs tend to be perceived as more authentic and vaunt stronger ties with Chinese digital consumers.

- Young Chinese consumers are less attracted to shopping spree events and rather prefer purchasing when they need something.

- The Metaverse is gaining popularity among the new generations of Chinese digital consumers, along with the rising interest in sustainability.