In China, pets have transcended their traditional roles as guard dogs or pest catchers and become full-fledged family members, emotional confidants, and even status symbols. Once constrained to the outdoors, they now dine in restaurants, star in social media vlogs, and enjoy spa treatments complete with ocean-themed sound therapy. This transformation is not merely sentimental; it’s a commercial revolution, reshaping industries from food and fashion to tourism and tech.

Download our report on China’s Pet Economy

Pet owners in China value emotional connections with their pets

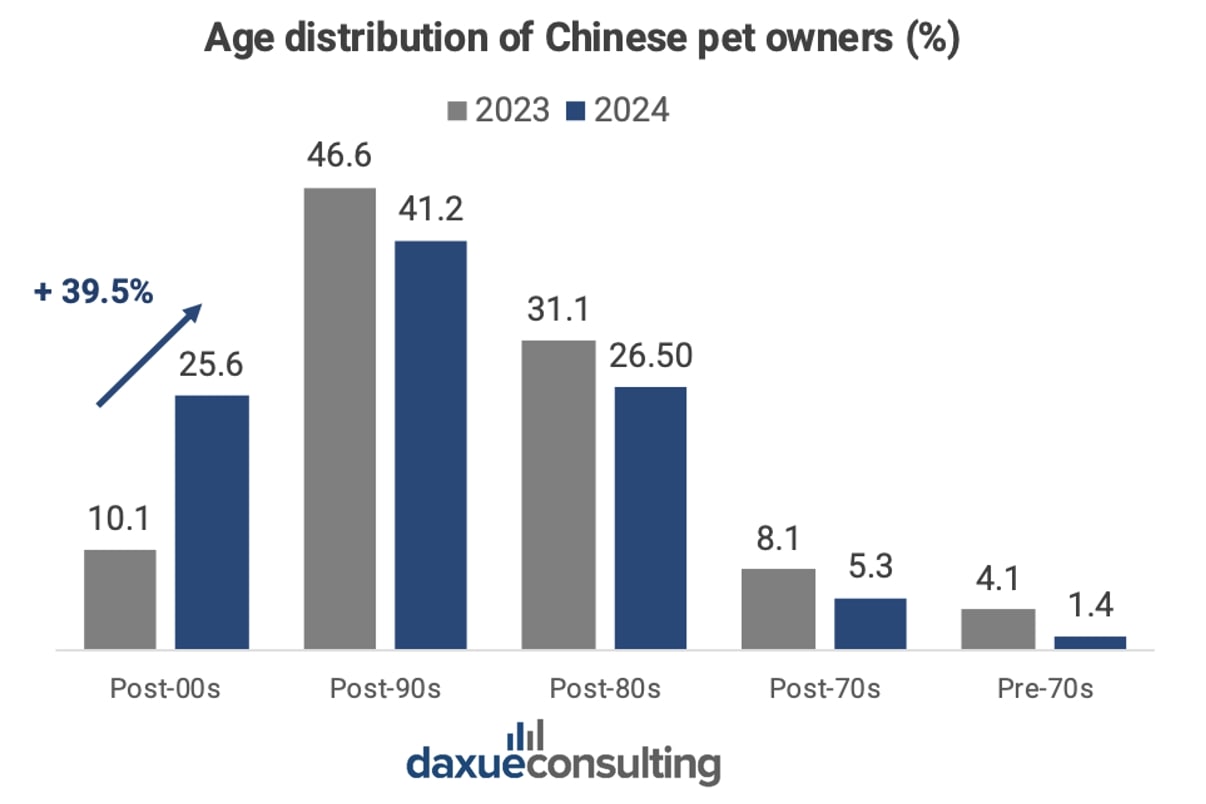

The surge in pet economy in China is largely driven by the post-1990s and post-2000s generations, who account for over two-thirds of China’s pet owners in 2024. These younger consumers often view pets as emotional partners or even child substitutes in a society increasingly marked by delayed marriages and shrinking birth rates. Ownership among those born after 2000 alone jumped 39.5% in 2024. This generational shift reflects a growing desire for companionship amid rising urban loneliness, career pressures, and unaffordable housing, all of which make traditional family-building less accessible or appealing.

Chinese pet owners not only keep their pets indoors but also involves them into every aspect of their daily routines, whether it’s cooking together, sharing TV time, or celebrating birthdays with cakes, gifts, and parties. The bond between pet and owner is no longer functional; it’s familial and deeply emotional.

Cats surpass dogs as the most popular pet in China

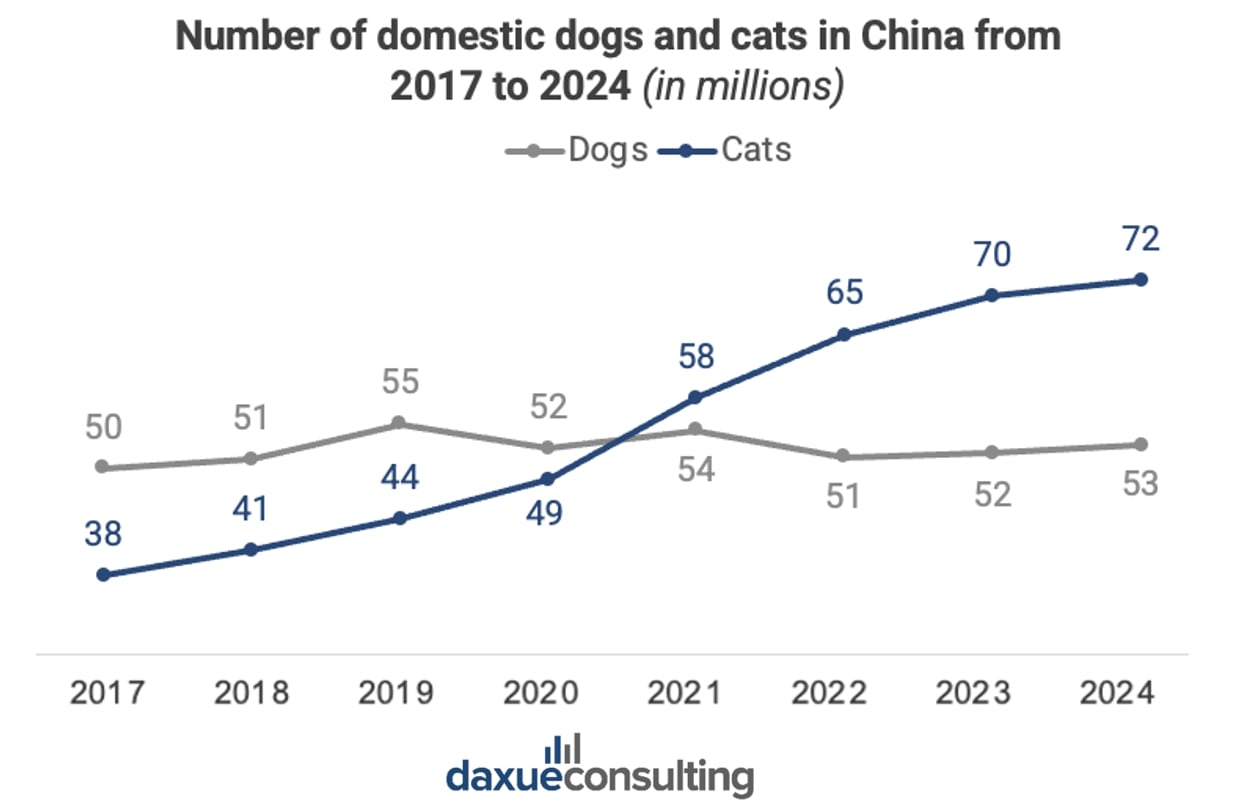

Cats have overtaken dogs in popularity, a significant cultural shift. In 2017, dogs still led in numbers, but by 2024, China was home to 72 million cats compared to 52 million dogs. Urban living conditions have played a crucial role in this change. Cats are quieter, cleaner, more independent, and require less space, making them ideal companions for apartment dwellers. The post-pandemic shift to remote work also accelerated this trend, with many people turning to cats for low-maintenance comfort and emotional companionship during lockdowns.

While dogs remain popular for their social and active natures, engaging in hiking, swimming, and even watching television, cats are increasingly taking part in such routines too. The number of mentions on cat training on social media (RedNote, Weibo and Douyin) surged by nearly 50% year-over-year in April 2025, reaching 8.4 million, suggesting a subtle yet notable transformation in the way people engage with their feline friends.

Exotic pets in China reflect a desire for identity, self-expression, and the unconventional

A growing number of Chinese consumers are gravitating toward exotic pets to express personal identity and stand out from the crowd. According to our social listening analysis on China’s pet economy, in April 2025, mentions of pet snakes on social media exploded by 482% year-over-year, partly influenced by the Year of the Snake in the Chinese zodiac, as they represent symbolic luck. The growing interest in snakes in recent years points to a lasting shift rather than a passing fad as reptiles and exotic pets have become a popular way to express a unique and unconventional personal image in China.

Similarly, birds like parrots and pigeons are becoming urban fashion statements, favored not only for their aesthetics but also their intelligence and expressive behaviors. Online videos of colorful, talkative birds have further cemented their role as stylish, unconventional companions. Even rodents and fish are joining the trend: angelfish saw a 441% growth in popularity thanks to their diverse appearances and collectors’ interest, while hamsters are now often featured in elaborately staged photo shoots with miniature props and accessories. These are becoming lifestyle hobbies for collectors and creators.

Digital platforms are refining how people adopt pets in China

Pet ownership in China has historically been informal. Many people adopted strays from the streets or fed animals casually without treating them as full-time companions. However, online channels have been facilitating pet adoption and introduced a wider variety of pets. Marketplaces like MaiZhiChongWu (买只宠物) and JD.com allow consumers to browse, compare, and purchase pets easily, enjoying discounts and delivery the same way they would with consumer goods.

Social media positively impact the number of adoptions as well as increase the spending per pet

Social media like Douyin and Xiaohongshu introduce potential owners to cute, viral pet content. Pets visibility on Chinese social media increases the interest in pet adoption. One striking example is the rise of huskies. In 2025, huskies became the most mentioned dog breed on Chinese social media, accounting for 37.9% of all breed-related mentions. Their viral appeal, due to videos highlighting their expressive, mischievous personalities, drove a wave of purchases despite their large size and demanding care needs.

Their online presence not only encourages more people to adopt pets but also increases how much they’re willing to spend on them. The pet market is growing faster than the number of pets in China, meaning the spending per pet is increasing. From 2023 to 2024, the number of cats owned went up by 1.6% and dogs by 2.5%, while the overall market grew by 7.5%.

Digital platforms now shape every stage of the pet owner’s journey

Driven by a growing interest in pets’ physical and mental health, Petkit’s smart devices monitor hydration, sleep, and diet, syncing seamlessly with health-tracking apps. Owners can now book vet appointments through WeChat mini-programs, manage vaccinations, and even receive grooming reminders. This level of integration reflects the modernization of pet care and the convenience expected by China’s urban, tech-savvy consumers.

Pets are disrupting many other industries beyond their scope

As relationships with pets evolve in China, the ripple effects are reshaping multiple sectors in the pet economy, highlighting the need to understand shifting consumer behaviors and engage them more effectively.

Traveling with tails

The travel industry in China is one of the most dynamic beneficiaries, with hotels, transportation and activities becoming more pet-friendly. Airlines like Hainan now offer in-cabin pet transport, and even high-speed trains between Beijing and Shanghai provide pet consignment services for small animals. By November 2024, Hainan Airlines transported over 10,000 pets in-cabin across 27 major cities. Meanwhile, Shenzhen Bao’an International Airport opened China’s first dedicated pet lounge in 2024, a spacious facility equipped with air quality monitors, species-specific zones and play areas.

Beauty brands offer special products for pets

In the fragrance and perfume market in China, the rise of pet-centric products has blurred the line between animal care and human luxury. Big names like Kiehl’s have launched pet grooming lines, while Dolce & Gabbana has ventured into pet fragrances. Seasonal outfits, ranging from rain boots and cooling vests to traditional Hanfu costumes, are now common on Chinese social media feeds. Celebrating holidays with themed pet outfits is increasingly popular, and matching human-pet fashion sets have become both a style choice and a bonding ritual.

Pet wellness experiences grow more diverse and sophisticated

China’s first pet gym, GOGOGYM, located in Shanghai, offers treadmill workouts and hydrotherapy for dogs, signaling that pet wellness is no longer limited to traditional grooming. Pet spas now offer services such as stress-relieving massage therapy, cryo-recovery, and even holistic treatments like sound baths.

Food and beverage companies also offer food for pets

Businesses from China’s food and beverage industry are also evolving to accommodate this trend. In Chengdu, restaurants entice patrons with free treats for their pets or offer discounts to those who show pet photos. Malls in cities like Shanghai now feature pet-friendly cafes and burger joints with dedicated pet menus, allowing pets to dine alongside their owners. Meanwhile, the popularity of dog and cat birthday celebrations has created new opportunities for pet bakeries, event planners, and specialty retailers focused on gifts, accessories, and decorations.

How the pet economy in China is disrupting many industries

- China’s booming pet economy is more than a trend, it’s a lifestyle transformation.

- Younger generations are embracing pets as family, fueled by emotional connection, social media influence, and rising disposable income.

- Viral breeds like huskies and shareable content are driving both adoption rates and premium spending.

- Digital platforms now guide every step of the pet journey, from discovery to daily care.

- As pets reshape how Chinese consumers live, shop, and express themselves, they’re also redefining entire industries.