L’Oréal, the world’s largest cosmetic company, entered China’s market in 1997. Since then, L’Oréal in China has expanded and become one of the nation’s most loved and purchased luxury cosmetic brands, with China its second largest market in the world.

“I believe that one day China will become the No.1 country in the world in terms of economy and also for L’Oréal, I have this vision!”

Jean-Paul AGON, Present Chairman and CEO of L’Oréal Croup

L’Oréal has devoted itself to beauty for over 100 years and has developed its international portfolio of 36 brands, covering makeup, cosmetics, haircare, perfume and skincare. Currently, 23 brands have presence in China’s personal care and beauty market.

L’Oréal’s China sales grew by 35 percent in 2019, hitting a 15-year high. In 2020, L’Oréal will see the sales revenue of Khiels’ – a skincare brand within the group – exceed 3 billion yuan ($432 million) in China. The two cosmetics brands, Urban Decay and NYX – made their debut in the Chinese market at last year’s (2019) China International Import Expo. The brands will be available to Chinese consumers via cross-border channels sometime during 2020.

Six key strategies can explain L’Oréal China’s success

Consumer-centricity

Launch powerful brands and products

Since 2017, China’s cosmetics market is exploding and China has already been the world’s second-largest cosmetics consumer market only behind the United States, with the retail sales rising to RMB297.36 billion in 2019. At the same time, different consumers are expecting different products, which requests cosmetic companies to take consumers segmentation into account and offer multiple products that appeal to different market segments.

So, in order to satisfy Chinese customers’ increasingly demanding lifestyles, L’Oréal not only performs cluster analysis in China, focusing on all customers’ needs to optimize products and brands, but also adopts social listening to keep track of brands’ performance and discover new opportunities. L’Oréal China is riding on the waves of consumption diversification: launching complementary brands and products in various categories, including Skincare, Men’s Skincare, Makeup, Hair Care, Hair Coloring, Perfume, Cosmeceuticals, Body Care, Beauty Equipment, etc..

Targeting young consumers

The Chinese cosmetics market is changing quickly and the young consumers, whose choices are quite different from those of the previous generation, are driving the growth of this market. Young Chinese women wear make-up and eagerly track the latest trends. In recent years, L’Oréal China started targeting a younger audience by implementing a series of marketing campaigns.

[Source: L’Oréal official site, “L’Oréal Paris’s brand ambassador-Yuan Wang”]

L’Oréal Paris announced Yuan Wang, an 18-year-old Chinese idol from boy band TFBoys, who has nearly 40 million followers on Weibo, as its newest Chinese brand ambassador in 2018. Wang’s fans bought L’Oreal products worth more than 13.93 million yuan in March and April 2018 after the teen idol became the endorser for L’Oreal’s beauty. In addition, L’Oréal connect with Chinese customers with the launch of many campaigns in collaboration with some popular brands like HeyTea and Disney. With the Hey Tea and Disney target audience being a young customer base, L’Oréal successfully attracts the younger generation in Chinese market.

Build R&D team for China

In 2005, L’Oréal opened the Shanghai L’Oréal Research Centre, whose main mission is to conduct and support science research to better understand the structure and behavior of Chinese hair and skin. Due to the efforts of Shanghai lab, L’Oréal is able to create more region specific products such as anti-aging serums, whitening creams and pollution-fighting cleansers for Chinese customers. The technology such as skin reconstructions created in the Shanghai-lab, will help L’Oréal create customized make-up and skincare for Chinese consumers, and is thought to be a way for the company to hold on to its position as the top-selling beauty brand within China.

Digitalization

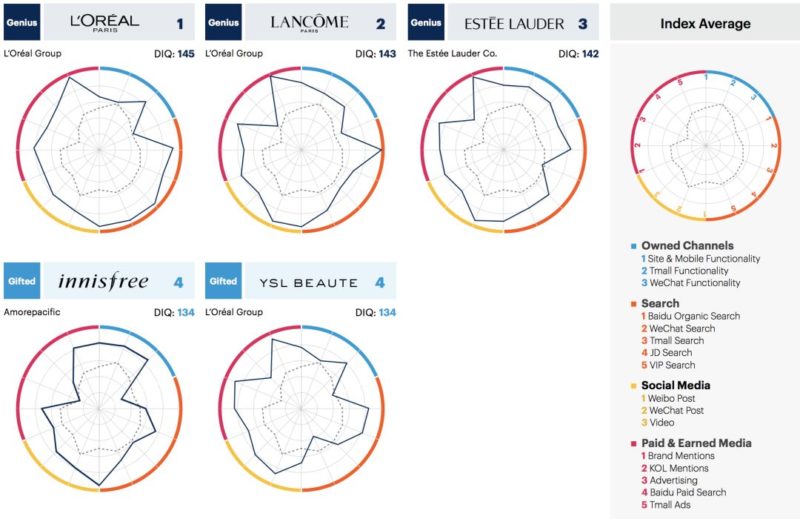

[Source: Gartner L2, “Digital IQ Index-Beauty China in 2019”]

In Gartner L2’s released Digital IQ Index ‘Beauty China in 2019’, L’Oréal-owned brands had the top ranks, with L’Oréal Paris and Lancôme ranking first and second, and with YSL beauty, Kiehl’s, Maybelline in forth, sixth and seventh respectively. From this ranking we know that L’Oréal excelled at the China digital strategies across four dimensions: paid and earned media, owned channels, search, and social media.

Thanks to its strategy of new marketing and new retail, L’Oréal China wins the digital transformation in beauty industry.

New marketing

Use of social media and KOL’s

L’Oréal leverages social media, like Weibo, WeChat, to reach Chinese customers. Most of L’Oréal’s brands have their own official accounts on Weibo with a large number of followers.

Recently, L’Oréal created a social media campaign with #我的选择 我值得拥有(#I deserve it) to advertise their Women’s Day promotions through Weibo. In this campaign, women fans were encouraged to share their feelings and stories by uploading images to social media platforms Weibo using hashtags #我的选择 我值得拥有. Also, many celebrities like Li Gong, Zhilei Xin (Chinese famous actresses) are joining the campaign to share their own words with Weibo users, which attracts more fans to participate and express their comments. There are around 24.8 million reads and 470 thousands discussions on Weibo #我的选择 我值得拥有 topic.

Women empowerment marketing

L’Oréal reaches its target market and to position itself with a brand message which leads to further conversations of women empowerment. In this case, L’Oréal successfully builds brand image among billions of Weibo users and promotes the sales of its Women’s Day shopping festival at the same time.

In addition, L’Oréal markets its products by collaborating with KOLs (Key Opinion Leader) or influencers on different social media platforms. Instead of famous KOLs with millions of fans, L’Oréal prefers KOLs who have fewer followers but frequently interact with fans and focus on specified areas like skincare, haircare, makeup, and matching. Such strategy of choosing KOL makes the endorsement of products more reliable and professional.

L’Oréal also launches its new marketing strategy on WeChat. For instance, YSL created a Mini Program that emulates the features of Xiaohongshu, allowing the creation of user-generated content and product tagging. Specifically, through sharing the pictures and comments about YSL’s products they purchased, customers could obtain member points as reward. Such WeChat mini-program not only provides YSL with precious customers’ information, but also guides a large number of users to share high-quality reviews and thus attracts huge traffic to brand.

IP marketing

[Source: L’Oréal official site, “L’Oréal×National Museum of China lipsticks”]

L’Oréal China actively launches “IP marketing”, or co-branding, a term that means pairing up products with other intellectual property By crossing over their products with other brands from totally unrelated industries, brands are able to bring about a sense of novelty and uniqueness. For example, in 2018 L’Oréal teamed up with the National Museum of China to release joinly-produced lipsticks in five colors representing the Five Beauties that appear in a Qing dynasty painting kept at the museum. With the packaging adorned with traditional Chinese paintings, the Chinese style lipstick became one of the best-sellers on L’Oreal’s Tmall flagship store.

New retail

Omni-channel retail strategy

According to the chief digital officer at L’Oréal in China, the digital revolution in China is a consumer revolution. “The consumer is neither a purely online nor purely offline consumer,” he noted, “She is the digital consumer who’s constantly on the mobile phone”. For this reason, sub-brands of L’Oréal in China are finding new ways to connect with Chinese consumers by creating O+O (online and offline) consumer experiences that are breaking physical and digital boundaries. For example, through a WeChat mini-program, Maybelline has developed a sophisticated loyalty program, allowing store reservations and points integrated with those earned through Tmall, its DTC store, and offline purchases.

Also, L’Oréal China launches the omni-channel retail together with partners like Alibaba, a Chinese Internet giant. The partnership between L’Oréal and Alibaba led to the co-creation of the first AI-based acne diagnosis mobile application and the 1st 3D makeup try-on service on Tmall’s mini app. And in line with L’Oréal’s sustainability program Sharing Beauty With All, L’Oréal and Alibaba have created the Green Parcel Project for ecommerce delivery, using sustainable materials for around 10 million parcels delivered to Chinese consumers.

Personalization strategy

As the digital noise gets louder by the day, the beauty industry especially need to differentiate their products and services to offer personalized experiences for their shoppers. To create a more customized digital experience, L’Oréal China rolled out a 3D augmented reality (AR) makeup try-on application on Giorgio Armani WeChat mini program, teaming up with Tencent. The AR application allows shoppers to try on virtual makeup and after testing the products, WeChat users can order them from Giorgio Armani Beauty’s mini-program shopping site. Users also can screenshot, save and share images as well as view before and after images to elevate the consumer shopping experience.

[Source: Jessica Rapp, “Kiehl’s store and cafe in Beijing”]

As for offline stores, L’Oréal also adopts new retail strategy to provide customers with personalized shopping experience. For example, Kiehl’s set up the coffee house in Beijing’s Taikoo Li Mall in 2017, offering a menu of Instagram-friendly lattes and cakes whose flavors take cues from the natural ingredients in its skincare products. So far, reviews seem to be generally positive, generating plenty of social media photos of its exquisite decoration, decorated desserts and lattes.

L’Oréal in China: Coronavirus crisis management

During the spread of coronavirus in China, L’Oréal continues developing and upgrading its online shopping channels in order to manage the coronavirus crisis. According to L’Oréal in China, the spread of the coronavirus has had a short-term impact on sales, but it has also brought new opportunities for online business due to the increase in online traffic. As a leader in digital innovation and e-commerce business in the Chinese cosmetics market, L’Oréal is able to seize the opportunity to develop its online channels by promoting digital marketing and providing better online shopping experiences.

“Consumption will bounce back up after coronavirus.” L’Oréal China’s CEO said. He also mentioned that since consumers are spending more time understanding beauty knowledge through various live broadcasts and streaming media, it is also an opportunity for the development of more beauty products. So, in the future, L’Oréal will fully promote in the area of beauty technology to ensure its leading position in Chinese cosmetics market. L’Oréal China owes its success to the “5-power model”: powerful brands/products, superior innovation, new marketing, new retail and social value.

Consumer-centric and digital, two ingredients in a recipe for success

All in all, the fundamental factors behind the phenomenal success of L’Oréal are their consumer- centric and digital strategies in China. With above strategies, L’Oréal is able to have a closer relationship with Chinese customers and grasp the future of digital society to redefine the future Chinese cosmetics market.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes