Estee Lauder entered China in 1993. After two decades, Estee Lauder is a well-known high-end cosmetic brand in Chinese customers’ eyes. During the 2018-2019 fiscal year, the sales of the Estee Lauder around the globe broke the record. Notably, Estee Lauder in China, and retail travel channels contributed the most to the brand’s double-digit worldwide growth. Especially thanks to China’s robust skincare market.

Meanwhile, Estee Lauder Group launched twelve brands into the Chinese cosmetic market, enabling China to be its No.2 international market. In 2019, Estee Lauder Group’s net sales in the Asian-Pacific region reached 3.6 billion USD. In contrast to the American region’s negative change, the Asian-Pacific area earned a 21 percent increase year-over-year.

Data Source: JUMEILI.CN, Regional Net Sales of Estee Lauder Group

History of Estee Lauder

Mrs. Estee Lauder created Estee Lauder in New York. Now, it is the world’s biggest company for skincare products, cosmetics, and perfume. Its products are available in over 13,000 outlets in over 130 countries around the globe. One of Estee Lauder’s strengths is R&D and product development. Also, it keeps a harmonious relationship with its customers, making it possible for the company to acquire more growth in the future. Mrs. Estee Lauder had always insisted that a woman can always be beautiful and fashionable. Thus she injected her lifestyle and sensitivity to fashion into the brand.

The layout of the Estee Lauder Group in China

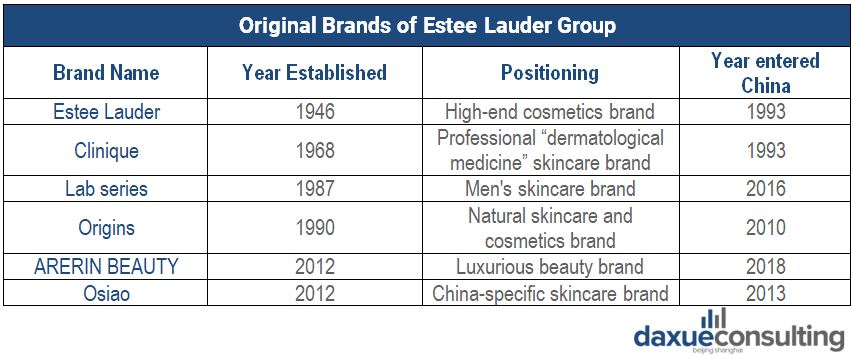

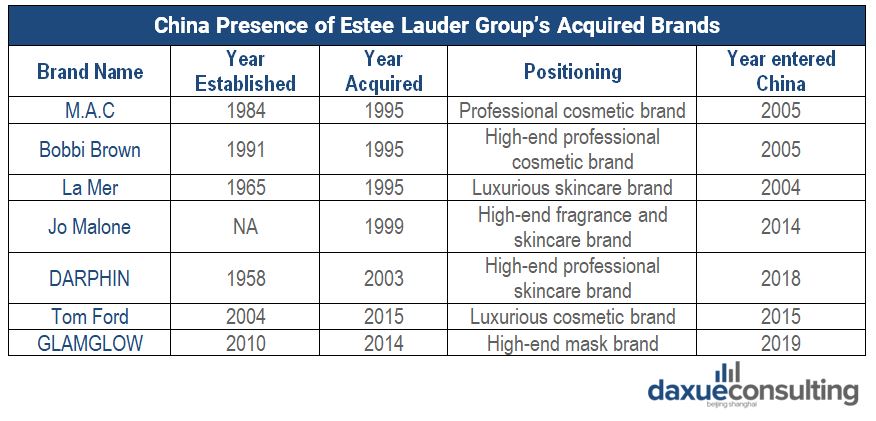

Estee Lauder Group launched many well-known brands, promoting its whole layout in the Chinese cosmetics market.

Estee Lauder Group in China desires to provide a wide range of cosmetic products to Chinese customers

When Estee Lauder initially entered China, it focused on high-end product sales. In 2005, however, it launched six new brands into the Chinese market. Estee Lauder assigns its brands to different target customers. It hopes every customer can find suitable products from Estee Lauder Group. M.A.C highlights the personal style, looking more fashionable, while Estee Lauder is a typical high-end brand. Now, all-around brands’ matrix almost covers all categories of cosmetic products and price zone, reducing the risk that customers change their preferences. Notably, Estee Lauder Group launched a brand called Osiao in Hong Kong in mid-October, 2012. This brand is specially designed for the skin of Asian people.

Brand matrix of Estee Lauder Group in China

Now, Estee Lauder Group has many famous brands. Its top brand is LA MER. Then Estee Lauder follows as the first tier brand, and Clinique and Origins follow as the second-tier brands. Smaller brands also include Aramis, Prescriptive, Tommy Hilfiger Toiletrie, Kiton, Darphin, Michael Kors Fragrance, and Bobbi Brown. Currently, only parts of its brands are in the Chinese market. However, Estee Lauder Group never stops its expansion in the Chinese market. On June 16th, 2020, two luxurious fragrance brands from Estee Lauder Group, BY Killian and Editions de Parfums Frederic Malle, initiated in Shanghai International Finance Center.

Source: JUMEILI.CN Original Brands of Estee Lauder Group in China

Source: JUMEILI.CN Acquired Brands of Estee Lauder Group in China

Strategies of Estee Lauder in China

Through decades of development, Estee Lauder has a big market share in the Chinese cosmetic market. Fan Jiayu, the general manager of Estee Lauder China, shared that Estee Lauder paid attention to what they do now and looked forward to the future’s business environment. Estee Lauder China always keeps its awareness of possible crisis to evaluate its position and prepare for potential risks. That allows the brand to strengthen its brand awareness in China and customer stickiness.

Estee Lauder established an R&D center in China to better satisfy Chinese customers’ needs

According to the CEO of Estee Lauder in Asian and Pacific Districts, Fabrice Weber, Estee Lauder contended a keen interest in the Chinese market. He hoped that Estee Lauder could merge into China market instead of being a ‘foreign’ company. In 2005, Estee Lauder set up a team to research Asian skincare needs. In 2010, Nutritious Super Pomegranate series appeared that were designed for Asians to improve dehydrated skin. On June 2nd, 2011, Estee Lauder announced the establishment of its Asian R&D Center in Shanghai.

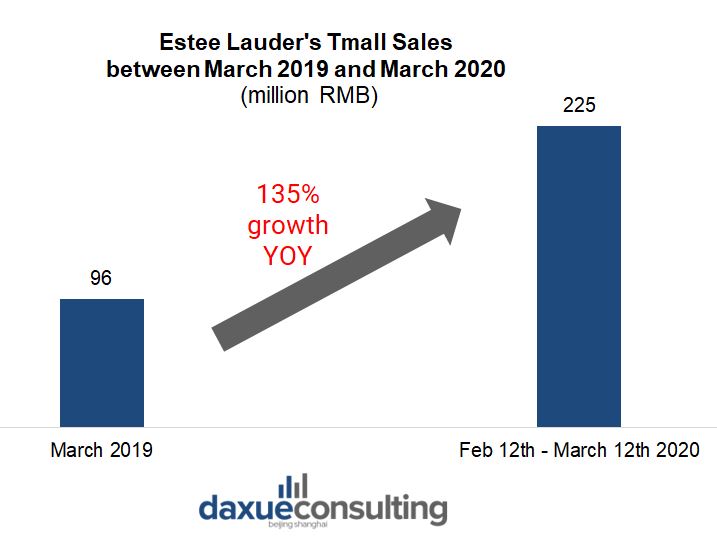

Estee Lauder China’s e-commerce sales boomed in 2020

Ecommerce in China has developed rapidly and is quickly becoming the main purchasing method among Chinese. Thus, Estee Lauder took a specialized online strategy to adapt to the Chinese market. E-commerce represents approximately 30% of Estée Lauder’s business in its top markets. In 2014, Estee Lauder became one of the first high-end cosmetic brands that entered on Tmall. Estee Lauder built a professional team with 50 people to focus on Estee Lauder’s Tmall store and independent e-commerce shop. In 2017, the sales revenue of Estee Lauder in China got 40 percent growth. Notably, e-commerce accounted for 50 percent of that increase. Also, Estee Lauder Group opened online stores for its sub-brands, bringing more consumption for the group.

After the COVID-19 outbreak spread through China, Estee Lauder’s March e-commerce sales spiked, with a 135% YoY increase. During this same period, Lancôme’s Tmall sales increased by 110%, and those of Perfect Diary’s by 29%, according to data from WalkTheChat.

Data Source: WalkTheChat Analysis, Evolution of Tmall flagship sales between March 2019 and March 2020

Estee Lauder builds close relationships with celebrities and KOLs

Celebrity endorsement marketing is also behind Estee Lauder’s success in China. Fabrizio Freda, Estee Lauder’s CEO, contended that 75 percent of investments were spent on digital marketing, social media, and KOLs, earning a high efficiency. For example, Yang Mi, a famous Chinese actress, is Estee Lauder’s brand ambassador. Her first cooperation with Estee Lauder in February 2017 earned over one million shares on Weibo and brought over a 500 percent increase in sales. Meanwhile, the cosmetics brand also engaged in KOL marketing in China. In the 2019 double 11 presales, Chinese actress Li Jiaqi sold over 0.4 million Estee Lauder’s Advanced Night Repair in a short time.

Source: Weibo Estee Lauder, Estee Lauder announced Yang Mi to be its Asian-Pacific region brand ambassador, gaining over one million shares.

The cosmetic market is competitive, so Estee Lauder needs to prepare for potential risks

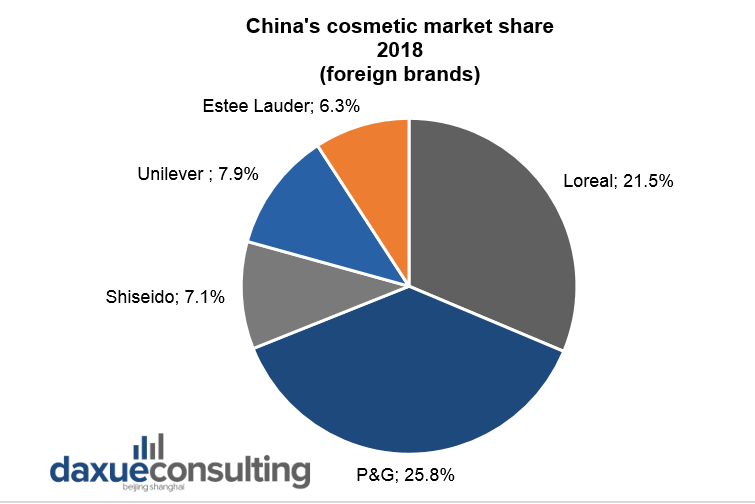

Estee Lauder received great results in the Chinese market due to its excellent strategies. However, Estee Lauder in China also meets tremendous challenges from both thriving domestic brands and well-known international brands. Particularly, L’Oréal Group, has an identical layout in the brand matrix that involves different levels of brands. Especially, one of its cosmetic brands, Lancôme, is the main competitor of Estee Lauder. One of their eye creams uses similar technology and has similar functions, triggering aggressive competition between them. Yet, although Estee Lauder won significant market shares in China, it still faces crucial competition. Therefore, Estee Lauder needs to maintain vigilance in case of potential risks.

Data Source: qianzhan, China’s cosmetic market share 2018 (foreign brands only)

COVID-19 impact on Estee Lauder Group in China

COVID-19 had a great impact on the cosmetic market. Travel retail channels could not function well due to decline in China’s inbound and outbound tourism.

In March 2020 Estée Lauder reported a 11% decrease in net sales from the same period last year. As a result, the company has implemented a host of measures to reduce spending in advertising, administration, and human resources, as well as furloughing part of its vast retail staff and cutting salaries of top management.

The short-term impact on Estee Lauder online business in China is roughly the same as that of physical channels, but e-commerce can play a leading role in business recovery in the future.

Authors: April Peng & Valeriia Mikhailova

Learn more about China’s cosmetics and personal care market

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast