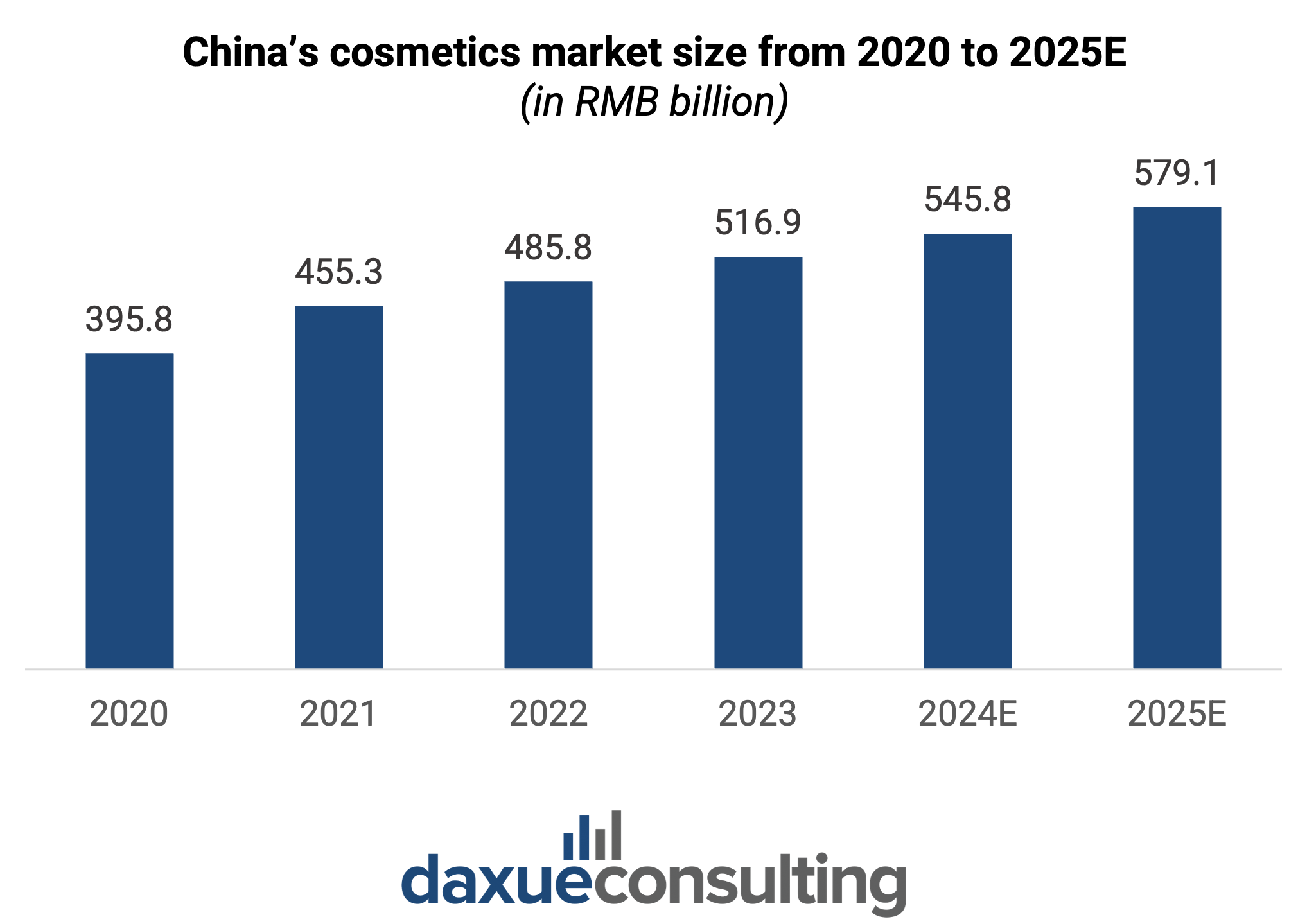

In 2023, the cosmetics market in China surpassed RMB 517 billion. This is a healthy growth of 6.4% compared to that in 2022. With continued interest in looking attractive and keeping their skin, the cosmetics market is projected to reach RMB 579 billion by 2025.

China’s cosmetics market, which comprises of skincare, makeup, and other products used to enhance or alter one’s appearance, is experiencing a fascinating shift in consumer preferences. There is strong focus on natural ingredients, premium products, and a growing support for Guochao. Moreover, there are emerging consumers like men and university students, prompting brands to innovate and meet diverse needs.

Download our report on Chinese beauty consumer pain points

Main consumers in China’s cosmetics market: young women from high tier cities

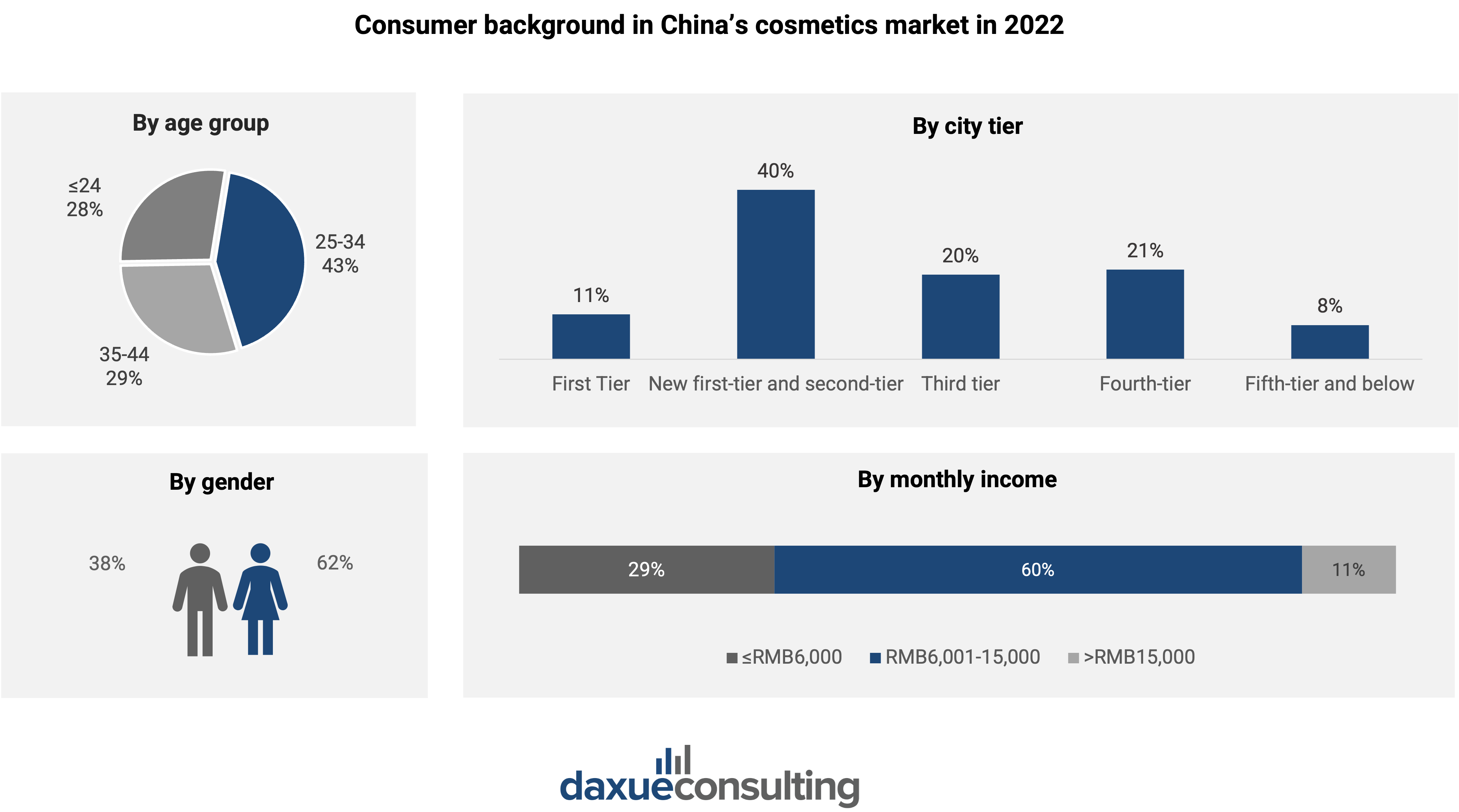

China’s beauty market is thriving, driven largely by female young Chinese adults who are in their mid-20s to early 30s. 43% of cosmetics consumers are 25 to 34 years old, which is moderately higher than 28% aged 24 or below and 29% aged 25 to 44. Women are the dominant consumers at 61.9%, but male consumers are more and more interested in skincare routines and premium cosmetics products. Many of these consumers reside in high tier cities. Over half of them were from first-tier, new first-tier, and second-tier cities, with three-fourth having a monthly income ranging from RMB 6,001 to 15,000.

University women: many beginners who suddenly makeup with little guidance

University women in China are a key demographic group that brands can appeal to as they have high interest in cosmetics and are willing to buy them. However, they struggle with issues that would typically be experienced at an earlier age in the West.

In China, many people start learning makeup at a later age compared to those in the West. Parents and schools are not very supportive of young people wearing makeup. This is because there are other priorities to focus on, like school, and makeup isn’t considered appropriate for young people. As a result, many Chinese people start learning how to wear makeup when they leave home for university.

Even though there are many products in the market, there is a need for those that suit makeup beginners. According to our social listening on pain points in China’s beauty market, young people in China find learning makeup too time consuming and difficult to learn, with other priorities like schoolwork and exercising.

Money is also an issue. Since beginners don’t know which product matches them well, they buy various products. However, they find the costs unjustifiable compared to the benefits.

Chinese workers: quick morning routines, short time for full makeup

When joining the workforce, people often wear makeup. Chinese workers desire to look good throughout the day but lead demanding lives and prefer not to spend too much time or energy on their morning routines.

Young men: small yet promising consumers in beauty

Even though the male beauty market in China is just 2% of women’s, it is experiencing robust growth. It is particularly driven by young people born in the post-95s, live in top-tier cities, and have a high per capita beauty consumption.

In response, global cosmetic giants like Unilever and Shiseido and homegrown players Make Essense and DearBoyFriend are appealing to them. They are also looking to attract those who have not yet engaged with skincare routines, focusing on educating them about the benefits of skincare.

Key factors influencing Chinese consumers when buying makeup and skincare products

Chinese consumers are making more rational consumption choices. According to iResearch Inc, 67% of Chinese consumers make more planned and needs-based purchases and 64% make more rational choices. Consumers focus on discounts too, with 62% more attuned to such information.

When purchasing makeup and skincare, consumers care most about usage experience – how they feel when using the product and how their skin reacts during and after use. However, the second most important factor is active ingredients for skincare and product reputation and reviews for makeup.

Foreign vs local brands in skincare and makeup

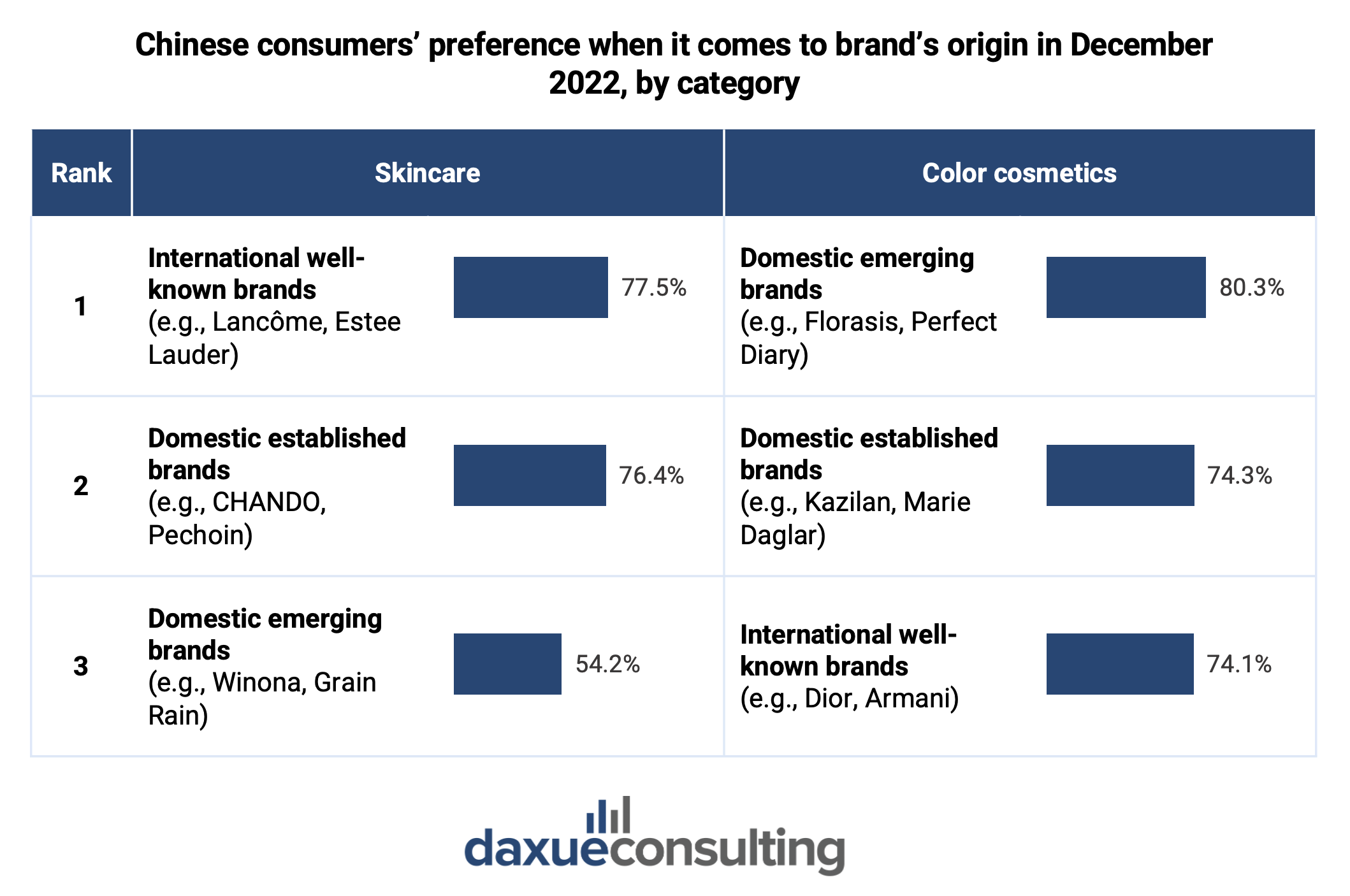

When purchasing skincare products, Chinese consumers primarily favor well-known international brands, attracted by the perceived superior quality of ingredients and the benefits of medical beauty repair. These international brands are thought to offer advanced formulations that promise better skin health outcomes.

In contrast, when it comes to makeup, Chinese consumers prefer to start with domestic emerging brands. This is followed by established domestic brands and international brands. The preference shift is largely influenced by the value placed on innovative design, attractive packaging, and Guochao (国潮), areas where local brands excel.

Download our China luxury market report

Growing focus on natural and organic ingredients

Post-COVID-19, there been an increased emphasis on health-consciousness, with 80% of consumers favoring clean beauty. Cosmetics with clean or healthy attributes are in high demand, with 90% of Chinese consumers prioritizing such products—the highest rate globally.

Social media conversations, as evidenced by the popularity of the hashtag #口罩脸抗敏接力 on Weibo, focus significantly on beauty tips for dealing with face mask-related skin sensitivity, attracting millions of views and discussions. Searches for natural and organic ingredients free from harmful substances are rising on Baidu. There’s a notable interest in niche natural ingredients, like Manuka honey and Edelweiss, indicating a market opportunity for global clean beauty brands in China.

Millennials and Generation Z are the primary consumers of clean beauty products, with over half of the latter preferring plant-based skincare. These demographics are acutely aware of counterfeit risks and prioritize product safety, often showing a greater trust in foreign clean beauty brands over local options due to concerns about product authenticity and safety.

Increased preference for premium products

In China, the trend toward premium skincare has been rising. A whopping 28% of consumers in China in 2022, significantly higher than other major countries, prioritize premium cosmetics. This preference is fueled by rising disposable income, particularly among the middle and upper classes.

There’s a clear perception of higher quality and effectiveness associated with luxury brands, both domestic and international. Interestingly, even younger demographics, like Gen Z, are showing a willingness to splurge on these items, with some surveys indicating that 21% of Gen Z dedicate over 16% of their income to luxury goods. This trend suggests a growing emphasis on self-care and a desire for unique, niche brands within the luxury cosmetic market.

Millennials leading the growth in China’s anti-aging market

China’s anti-aging market surged to RMB 82 billion in 2021 and is estimated to reach RMB 153.2 billion by 2026, growing at a rate of 13.3% annually, as per Euromonitor data.

China’s anti-aging market is surging thanks to a younger generation prioritizing preventative skincare. Millennials, with their rising disposable income and focus on beauty, are driving demand for high-end anti-aging products, particularly those with ingredients like retinol and hyaluronic acid. Moisturizing creams, anti-wrinkle formulas, and eye care products are especially popular, with both foreign brands like L’Oreal and domestic companies like KANS and WEI Beauty capitalizing on this trend through innovative formulas and TCM-based ingredients.

Influence of social media and marketing trends

Social media has become a driving force in shaping China’s beauty landscape. Platforms like Xiaohongshu, Weibo, and WeChat are key battlegrounds for influencing beauty trends and promoting products. Brands leverage these platforms to reach consumers directly, often collaborating with popular influencers to amplify their message.

Social media’s significance is exemplified through individuals like Austin Li Jiaqi, known as the “Lipstick King” in China. He gained prominence through its livestreams showcasing beauty products. With a massive following of 7 million on Weibo and 35 million on TikTok in 2021, his evaluations hold considerable sway over product success. A standout achievement was when he sold 15,000 lipsticks in only 5 minutes during a Taobao live stream. This even outperformed Alibaba’s founder, Jack Ma, in a direct selling contest.

E-commerce platforms have also revolutionized the way Chinese consumers purchase cosmetics. A staggering 46.3% of cosmetics sales in China happen online, with Alibaba holding the crown as the largest retail sales channel in 2023. This shift towards online shopping highlights the convenience and vast product selection offered by e-commerce platforms.

Cosmetics market in China: From social influence to the rise of men’s cosmetics

- China’s cosmetic market is growing, with a 6.4% increase in 2023. It is expected to reach RMB 579 billion by 2025.

- The main cosmetics consumers are young adults aged 25 to 35 years old and women, including university women and Chinese workers. More and more young men are interested in cosmetics.

- We conducted social listening on pain points in China’s beauty market. Our findings show that university women want to learn makeup but find it too difficult. Also, Chinese workers want to wear full makeup but have too little time in the morning.

- Chinese consumers prefer foreign brands over domestic ones in skincare and domestic brands over foreign ones in color cosmetics.

- Premium, anti-aging, and clean beauty products are growing in demand.

- Social media is crucial in engaging consumers and driving sales in China.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.