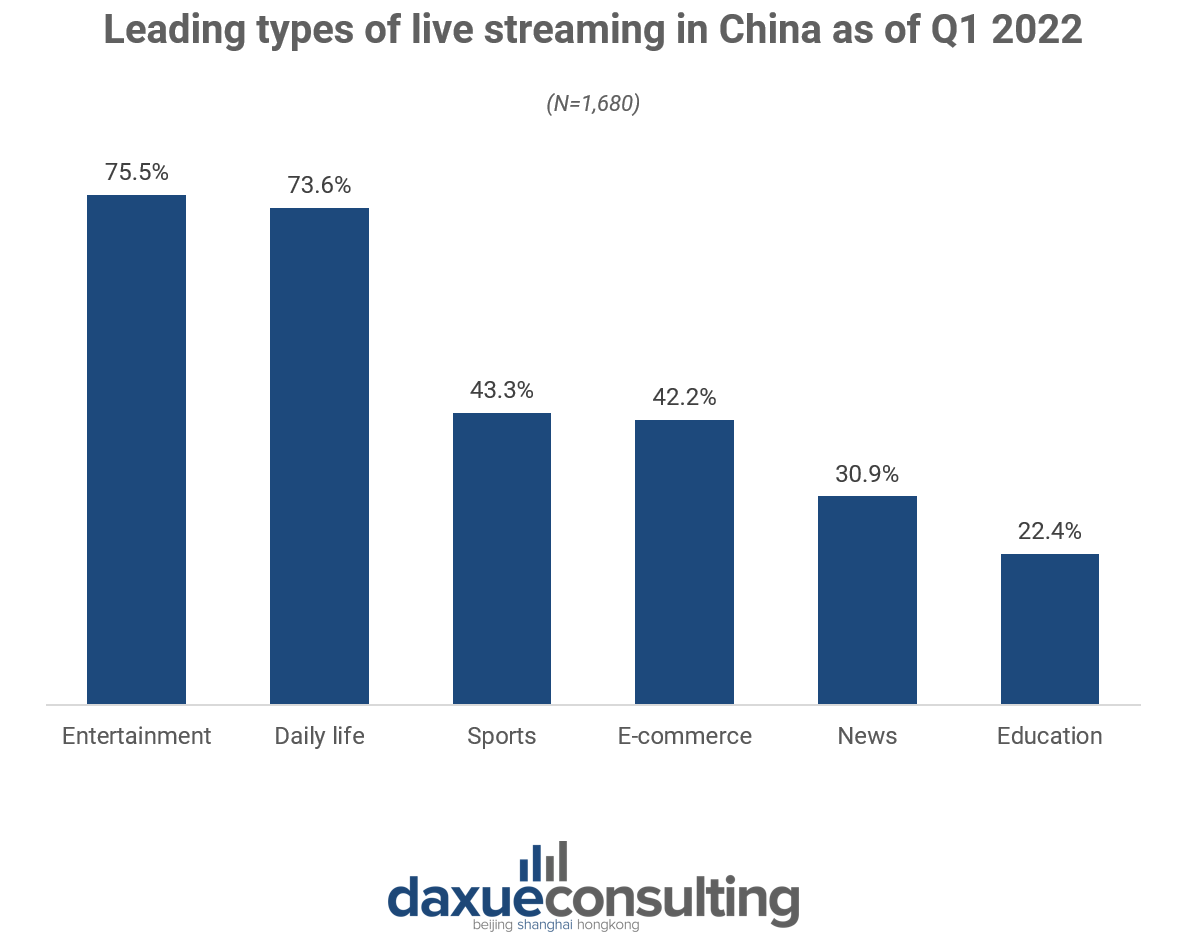

The live streaming market in China is experiencing remarkable growth and innovation, offering a unique platform for businesses to engage with their audience and drive sales. As of February 2022, over 703 million live streaming users resided in China, constituting about 68.2% of the country’s total internet users. The live streaming market in China continues to grow, but the pace of market expansion is gradually slowing down.

This vast audience engages with various content types, including sports, e-commerce, gaming, reality shows, news, education, and concerts. Notably, around 27.5% of Chinese internet users have live streamed sports events, with a significant number opting to pay for sports streaming services. The potential for live commerce is particularly evident, as nearly 60% of livestream viewers make purchases during or after live events. Companies can also gain higher conversion rates, reaching up to 30% – around 10 times higher than through conventional e-commerce.

Download our guide to Chinese gifting habits

Innovation remains a driving force within China’s live streaming landscape, largely attributed to the high levels of interaction and engagement this medium offers. Viewers can actively participate by using features such as 彈幕 (danmu), which are interactive commentary subtitles that pop up when watching live streams. This enhances real-time conversations and fosters a strong sense of community. However, to tap into this lucrative market, it’s crucial to consider content regulations and sensitivities unique to China. As the appeal of live streaming grows, it is important for brands to provide a seamless and tailored live streaming experience to Chinese viewers.

Regulations about China’s live streaming industry

For those outside of China who want to live stream, there’s a step that needs to be tackled: passing an ICP (Internet Content Provider) examination. ICP license fees are very expensive. Arguably only mid-size businesses and large corporations looking to stream into China can afford it. If online activities include payment processing or planning to stream, there’s an alternative – opting for an ICP registration. This path is relatively more budget-friendly, though costs are still involved.

Apart from ICP licensing, there is a guideline about the 31 banned behaviors during live-streaming sessions, which was published in 2022. It includes but is not limited to publishing content that distorts the leadership of the Chinese Communist Party, using deepfake technologies to tamper with the images of the party or “hyping up” sensitive issues, and over displaying extravagant lifestyles including showing off luxury products and cash.

Some content is not recommended including fortune-telling, consuming non-edible food such as paper, hip shaking, taking shots at nightclubs, insulting Chinese heroes and martyrs,wearing fake police uniforms, tombstones, and coffins.

Top five live streaming platforms in China to be aware of

Based on brand value and word-of-mouth reviews, Taobao Live (淘宝直播), Jingdong (京东), Xiaohongshu (小红书), Douyin (抖音), and Kuaishou (快手) are the top five live streaming platforms in China as of August 1st 2023. Other well-known live streaming platforms include Douyu, Inke, Bilibili, Yizhibo, YY Live, Huajiao Live, and Huya Live.

Taobao Live

Taobao has recently undergone its biggest change in the last three years–the full launch of the “Night Taobao” entrance, introducing new entertaining features by switching to a 24-hour “lifestyle and entertainment” version of Taobao by clicking on the entrance located in the upper right corner of the Taobao homepage.

“Night Taobao” offers more interactive games, entertainment content, and event features. For instance, there are activities like disco dance live streams, intense card games, and exclusive summer limited-time flash sales. Additionally, there are live stream hosts taking users on a culinary journey through popular night markets in various cities such as Beijing, Hangzhou, Chongqing, and Wuhan. They also promote nighttime dining and summer-related economic trends in a content-driven manner. Furthermore, it’s reported that exciting live streams including movie premieres, classic TV series, village-level esports finals, and live house performances are on the horizon.

Duoyin Live

One of the most popular social media platforms, Douyin, is also developing its e-commerce platform. ByteDance, the owner of Douyin, has established an e-commerce department as the first level business unit since June 2020. The platform has attracted an astonishing 680 million Daily Active Users (DAUs) as of August 2022.

An effective Duoyin live streaming involves a structured approach, starting with the selection of compelling themes such as makeup tutorials, product recommendations, new product previews, and event collaborations. Timing and duration must also be carefully considered, with live broadcasts lasting 3-4 hours or more, strategically timed during peak hours. The product explanations should pinpoint user pain points and focus on 3-4 key features per item, each explained within a concise 10-minute timeframe.

The biggest difference between Taobao Live and Douyin Live is that when users go on Taobao Live, they already have shopping intentions. Therefore, they want to be more specific and targeted to understand a certain product, have product introductions and interact with the streamer to learn more about the item. However, compared to Douyin Live, Taobao Live’s content and entertainment properties are weaker.

Kuaishou

Kuaishou has transformed from a pure utility application into a short video community, serving as a platform for users to record and share moments from both their creative and daily lives.

Kuaishou’s evolving strategy focuses on striking a balance between profitability and user engagement, signaling a shift from its previous aggressive growth tactics as the challenge of retaining user interest grows harder. In Q1 2023, the platform’s average daily active users increased by 8.3% to reach 374.3 million, and average monthly active users grew by 9.4% to 654.4 million. However, these growth rates were slower than the previous year, indicating a challenge in maintaining user acquisition momentum.

Gaming livestream in China focus more on content

Game livestreams primarily utilize game streaming platforms to showcase content to users. Major companies in the field of game content authorization include Tencent Games(腾讯游戏), NetEase Games(网易游戏), Perfect World(完美世界), and Giant Network(巨人网络). Huya Live Stream(虎牙直播), Douyu Livestream(斗鱼直播), Kuaishou Livestream(快手直播), and Penguin Esports(企鹅电竞) are the representative platforms for game live streaming.

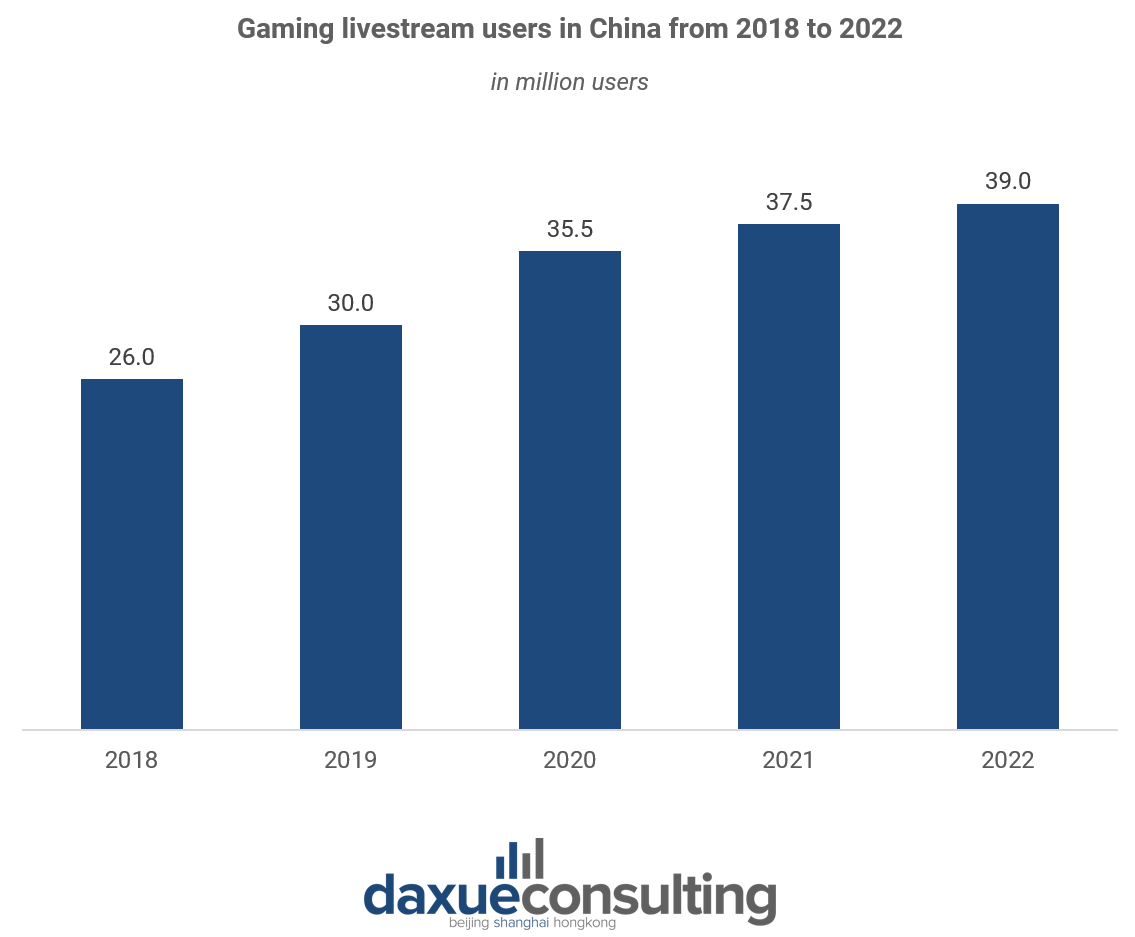

In 2021, the majority of Chinese game live streaming users spent 1-2 hours watching live streams, accounting for 43.7%, followed by 30 minutes to 1 hour, at 31.4%. The main source of the views is from the “platform internal search.” Moreover, the user growth rate spurred by the pandemic is beginning to decline.

Looking ahead, game live streaming will place greater emphasis on content. As much as 82.7% of game live streaming users follow streamers because of their content, and 64.1% watch live streams due to homepage recommendations. In summary, content is the primary driver for attracting viewers to game livestreams, indicating that the industry will increasingly prioritize livestream content in the future.

Opportunities of AI technology and informational transformation in live streaming in China

Driven by technological and informational advancements and innovative approaches, China’s live streaming is undergoing a profound transformation. AI-powered virtual hosts, VR, AR, MR , or XR-integrated interfaces blur the lines between the virtual and real worlds, promising an immersive environment to interact with the audiences.

In terms of content and support, platforms are collaborating with ecosystem partners to refine algorithms for more precise content discovery, setting new industry standards, and extending support to rural areas to boost inclusivity and economic growth. Initiatives to engage influencers and merchants through short video content creation are also becoming pivotal in expanding the live stream ecosystem.

In addition, China’s live streaming market extends its impact to rural regions, fostering a more dynamic and inclusive industry. For instance, Taobao empowers “Village Streamers” to bring the farm products to life, along with projects like “Gathering in China” and the “Caring for Farmers Project”.

Challenges of live streaming services in China: balancing content regulation, user trust, and host sustainability

Livestreaming in China requires qualifications for certain topics, which could impact the content and operations. Striking a balance between creative freedom and regulatory compliance is crucial to avoid penalties and maintain a positive user experience.

Attracting and retaining users on the platforms is a persistent challenge. While livestreaming offers enticing opportunities, issues such as counterfeit goods and misleading advertising can erode user trust. Ensuring product quality and protecting consumer rights are paramount to building a loyal user base.

Nearly 60% of livestream hosts are forced to leave the industry after less than a year. The allure of high profits from livestreaming has led to intense competition among hosts. Live Streaming platforms must find ways to support and sustain their hosts, fostering an environment conducive to long-term success.

As the livestreaming landscape evolves, companies are transitioning from being mere technology providers to offering comprehensive live streaming services. This shift requires platforms to understand user needs, provide end-to-end live streaming solutions, and differentiate their operational services.

Technology innovations and regulatory balancing of live streaming in China

- With over 703 million users engaged in live streaming as of February 2022, accounting for 68.2% of the country’s internet users, the potential for growth and innovation remains substantial.

- This diverse content attracts a substantial audience, with sports and e-commerce live streaming drawing significant user engagement. Nearly 60% of live stream viewers make purchases during or after live events, showcasing the potential of live commerce.

- The integration of cutting-edge technology such as AI-powered virtual hosts, VR, AR, and MR enriches user experiences, blurring the lines between virtual and real worlds.

- Intense competition among hosts, particularly those with strong commercial endorsements, poses a challenge. To sustain success, live streaming platforms must support hosts and create an environment conducive to long-term growth.

- Regulations governing live streaming topics require platforms to balance creative freedom with compliance. Striking this balance is crucial to avoid penalties and maintain a positive user experience.