In the huge, complex, and highly competitive market, the role of branding in China in building a successful business has become increasingly crucial. Not only is there more pressure from other brands, but people’s needs and desires are also becoming more diverse and many are preferring local brands as reflected in the Guochao marketing trends. Moreover, building a powerful brand can help a business stand out and earn the trust and loyalty of consumers. As China goes through the post-pandemic reopening phase, foreign brands need to take heed and keep tabs on evolving consumer needs, tastes, and purchasing power.

Cracking the Chinese market: strategies for global brands to compete with local firms

Developing a good brand strategy is vital in standing out and generating sales. Based on the data from the National Bureau of Statistics, from October 2021 to October 2022, China’s consumer confidence index decreased by 28%. This downward trend in consumer confidence has led to a reduction in consumer spending, intensifying competition in the domestic market.

As in the fashion industry in China, it has become increasingly difficult and competitive for foreign brands, underscoring the importance of enhancing their branding strategies. A McKinsey report shows that in 2021, the top 20 Chinese local brands accounted for 60% of the total sales of the apparel market, while the sales of foreign brands dropped from 46% to 40%.

However, the apparel, fashion, and luxury goods market in China remains one of the largest and most dynamic in the world, meaning it could return to double-digit growth, driven in part by a rising middle class. This growth potential attracts a steady stream of brands wanting to enter the Chinese market. As a result, to compete with local firms, it’s necessary for foreign companies to prioritize their branding efforts.

How consistent branding builds solid brand awareness and reputation

Building brand awareness and reputation is important. Despite rising concerns about the economy, consumers in China prefer premium brands when they spend to treat themselves. They focus on the quality and reliability of the products and brands, which is why well-known brands can still be attractive. Through consistent and intriguing branding and advertising campaigns, businesses can increase their visibility and build a solid brand reputation.

Enhancing brand reputation can strengthen Chinese customers trust. To achieve this, companies can do co-branding with well-known brands, and cooperate with popular idols and celebrities, among many strategies. Popular foreign brands like Apple and Starbucks have achieved great brand success in China by leveraging their premium positioning and reputation for excellence.

Harnessing the power of omnichannel direct-to-consumer (D2C) channels in China’s market

To successfully grow a brand in China, it is not enough to just look at the short term and sell products and services broadly. Some brands sell directly to Chinese consumers through more focused direct-to-consumer (D2C) channels when branding in China, bypassing any third-party retailers or any other intermediaries. By establishing a direct connection with Chinese consumers, brands can gain greater control over branding, and customer data, and gain higher profits through DTC channels.

China’s D2C market has grown significantly in the past few years, exceeding 63 billion yuan in 2019. With the rise of social commerce, the Chinese market is expected to maintain strong growth and reach 122 billion yuan by 2024. Many international brands have successfully incorporated “direct-to-consumer” into their branding strategies in China, establishing a direct relationship with consumers and create an independent brand image by establishing a direct relationship with consumers in the distribution and communication of the brand’s own channels.

Maximizing brand impact through Chinese e-commerce platforms and social media integration

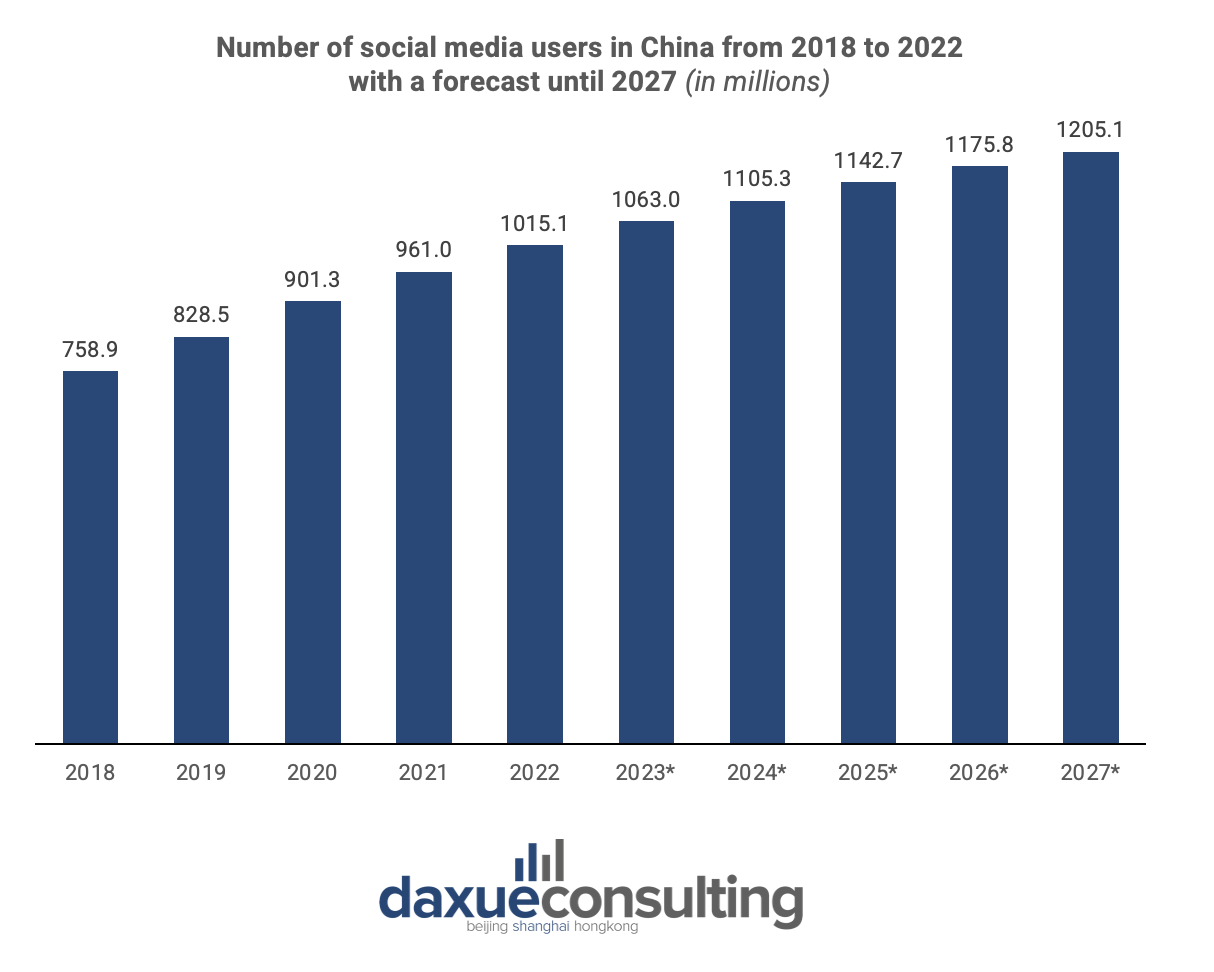

Effective marketing channels and strategies are what keeps the brand alive in the eyes of Chinese consumers. China has a huge social media user base, so marketing on social media is indispensable. Data from Statista shows that there would be nearly 1.015 billion social media users in China by 2022, which ultimately makes China the world’s largest social media market.

Moreover, the number of active users is expected to steadily increase and reach 1.205 billion by 2027. Therefore, understanding China’s major social media platforms, such as WeChat, RED (Xiaohongshu) and Weibo, as well as other niche but influential platforms, can help companies communicate their brand messages to their target audience. In addition to social media, brands can further engage with their consumers through e-commerce channels leveraging KOLs with large fan bases and innovative tools such as live-streaming.

Unleashing the power of key opinion leaders (KOLs): captivating Chinese consumers through influencer engagement

Businesses can also connect directly with consumers through KOL marketing in China and key opinion consumers (KOC), who can help them gain the trust of Chinese consumers. A KOL in China can be a blogger, celebrity, authority, or a professional in a certain industry with many followers and/or subscribers. KOLs don’t only attract a large and loyal audience through their social media posts, but they also have a significant impact on the purchasing decisions of their fans who turn to them for advice and validation.

Understanding the power of live-streaming: a gateway for foreign brands to connect with Chinese consumers

During the pandemic, livestreaming in China has developed rapidly, emphasizing the need for brands to find ways to connect with their consumers through various e-commerce and social media platforms.

The success of live-streaming sales in China shouldn’t be overlooked. The gross merchandise value of China’s e-commerce livestreaming surged from less than 20 billion yuan in 2017 to 3.5 trillion yuan in 2022. Taobao, Douyin/TikTok, and Kuaishou are the three leading livestreaming e-commerce platforms among Chinese online shoppers. Consumers are using them for their instant, interactive, and seamless shopping experience, with e-commerce features such as one-click purchases and special promotions like discounts and flash sales. Brands can use them to provide comprehensive, interactive, and personalized experiences, enabling them to engage with their target customers authentically and effectively.

ECCO case study: reinventing branding strategies for success in the Chinese footwear market

A successful branding case involves ECCO, a renowned premium Danish footwear brand whose successful branding strategy allowed it to showcase its ability to evolve and captivate Chinese consumers. ECCO went through a successful transformation from targeting a niche demographic to embracing brand rejuvenation and celebrity endorsements.

In the 1990s, ECCO made its entry into the nascent Chinese market by targeting the affluent class. It catered to the image-conscious “successful businessmen” who desired both style and comfort. However, since 2010, China’s fashion consumer market witnessed significant change and the rise of leisure sports determines the market’s direction. Additionally, social media and e-commerce platforms accelerated the spread of fashion-related content and made purchasing more accessible. Considering that ECCO’s main consumer group is mainly composed of older individuals, ECCO needed to change its branding strategy.

Integration of celebrity endorsement with brand promotions

Recognizing the need for change, ECCO embarked on a comprehensive brand rejuvenation strategy. The focus extended beyond improving product aesthetics to integrating celebrity endorsements with brand promotion. In 2012, ECCO partnered with Dong Jie, a popular Chinese actress. This collaboration involved an array of promotional activities, including image shoots, microfilms, and tours, effectively enhancing ECCO’s visibility and appeal. ECCO has continued to secure influential ambassadors like Ni Ni and Huang Jingyu, since 2020.

In the process of branding, brands also need to understand how culture impacts the behavior of Chinese consumers. “Face culture” (面子), for example, shows the importance of respect, honor, and social position and can explain purchasing behaviors. Based on the 2023 KPMG China and DLG report, Chinese people buy luxury brands not only for their function but also for their brand culture and values. They may use luxury brands to reflect their own personality and wouldn’t if brands happen to conflict with their own values and beliefs.

Nike’s direct-to-consumer triumph: revolutionizing retail in China

Nike, a beloved sports brand in China, has successfully built a comprehensive direct-to-consumer (D2C) retail framework, transforming the way it connects with customers. Since 2012, Nike has prioritized the development of its D2C channels in China. This strategy encompasses a diverse range of platforms, such as brand-owned apps, the Nike WeChat store, and its own retail stores. By investing in a robust D2C framework, Nike aims to strengthen its direct relationship with customers and enhance the overall shopping experience.

Moreover, Nike China tried to reduce its dependence on department stores and turn to selling through its own channels, which played a very good role during the pandemic. Based on the 2022 fiscal year report of Nike China, Nike’s implementation of DTC transformation has achieved considerable results. The annual NIKE Direct revenue reached roughly 133.33 billion yuan, a year-on-year increase of 14%. This result suggests that not only is Nike looking to put more emphasis on its D2C business, but it is also aiming to “create a consistent, connected, and modern shopping experience.”

Nike’s triumph in the Chinese market through its D2C transformation showcases its commitment to innovation and customer-centric strategies. With a strategic focus on online and offline channels, digital supply chain optimization, and reduced reliance on department stores, Nike has achieved remarkable results and created a seamless and modern shopping experience for its Chinese consumers.

Driving growth and innovation through the D2C model

Moreover, the D2C model allows the consumers to build truth with the business before purchasing their products. Cross-border marketplaces in China are often criticized for offering fake goods. Chinese consumers tend to purchase products through brand-owned channels where they can ensure that the brands have full control over the whole retail process. The D2C model can also strengthen personal relationships after purchase. As brands connect directly to Chinese consumers, they achieve stronger growth and become more innovative. Successful brands enjoy benefits impacting their entire value chain: higher value chain margins, satisfied consumers, first-hand consumer insights, and higher entry barriers for competitors.

Source: McKinsey, Social direct-to-consumer (DTC) channel adoption for branding in China

Branding to create connections and drive sales

- Branding in China plays an important role in building a successful business as diverse consumer preferences and the rise of local brands make it essential to stand out and earn consumer trust and loyalty.

- Branding requires consistent communication with consumers. Brands don’t only need to raise brand awareness but also engage with their consumers. Many have largely used D2C channels, e-commerce channels, and social media platforms to do so.

- Leveraging KOLs and livestreaming has become important and even necessary for brands to capture growth opportunities in the Chinese market and even generate sales.

Read about Chinese Gen Z consumer preferences

Contact us for professional branding services in China

In the competitive Chinese market, branding extends far beyond just a name; it encapsulates your company’s identity, ideals, and the social value perceived by consumers. Recognizing this, Daxue Consulting offers specialized branding services that can significantly enhance your market presence. Our international team of project managers is adept at aligning your company’s culture and identity with the expectations of Chinese consumers, helping to foster a brand that is synonymous with quality, reliability, and prestige—especially important in the luxury goods sector.

Partner with us to develop and implement a robust branding strategy in China that not only resonates with your target audience but also gives you a competitive edge. Reach out today to set the foundation for your brand’s success in this dynamic market.