Retail is now at a crossroad. Driven by digitalization, the development of the omnichannel and new customer requirements, trade, and retail have undergone profound changes in recent years. In China, Alibaba has taken the leadership of this revolution by unveiling its new retail project in a 2017 letter to shareholders: New Retail. In this article, Daxue Consulting looks back at the origins, challenges, and consequences of this change in the Chinese retail market.

New retail in China, a consumer-centric approach

What is New Retail in China? A Merge of Offline and Online strategy

The retail world is evolving at a dizzying pace, and this transformation goes far beyond online shopping. The Chinese e-commerce giant Alibaba (39.9 billion USD revenue in 2018 and more than 600 million active buyers) has understood this well.

Two years ago, Jack Ma, Alibaba’s executive chairman, announced its new project: the ‘Five New’ strategy, composed of New Retail, New Finance, New Manufacturing, New Technology, and New Energy. New Retail was, therefore, going to be the new trend that would transform not only China but also the rest of the world. But what does New Retail even mean?

For Jack Ma, the future of retail is not a question of channels, but experience. Thus, New retail consists of offering a new shopping experience without boundaries: merging online and offline commerce.

This strategy aims to combine the best of both online and offline shopping experiences. In China, the traditional marketing strategy called O2O (Online to Offline) is now becoming OMO (Online merge Offline).

This means the one-dimensional purchasing tunnel as it existed a few years ago is no longer relevant. The entire customer journey is redesigned. Chinese consumers will no longer think in terms of separate purchasing channels, but use them at the same time for various purposes: product research, comparison, Click and Collect, Store To Home, delivery or customer service.

However, for years, the physical sales network and digital networks were managed separately by companies when it came to a database, customer relationship, loyalty program and KPI’s. Alibaba has made this differentiated management obsolete. The Chinese giant, therefore, understood that the real challenge was to succeed in following their customers through the multiplication of contact points and devices, and the adoption of mobile phones as the primary device in China is a significant factor in New Retail.

Indeed, experts estimate that mobile commerce in China will reach about $1.5 trillion in sales in 2019, representing a quarter of the country’s overall retail market. So this is a unified approach to trade that is a direct response to consumer behavior.

With this Online Merge Offline strategy, Alibaba hopes to achieve its growth objectives: to reach 2 billion consumers by the end of 2036 (currently 742 million).

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

Rethinking the retail experience is an international trend

As rethinking the customer experience is a real lever for business development in China, this has been both a daily challenge and a competitive issue for brands for years.

For example, home delivery has become an essential service, and Amazon has taken a giant step forward in this regard. The brand makes its competitors tremble with its deliveries in one day, or even one hour in Paris, or with its distribution of fresh products (Amazon Fresh), launched in London, Tokyo, and Berlin. This requires distributors to set up warehouses in new strategic locations in order to be able to deliver as quickly as possible. It is changing the whole traditional process of mass distribution throughout the world.

As a result, the retail industry and brands around the world did not wait for Alibaba to rethink their retail experience. New Retail is, therefore, not a revolutionary project, rather its speed of execution, structure, and implementation make it an innovative strategy that is remodeling the retail landscape in China.

The Chinese dream store, immediate, and hyper-connected

Extreme digitalization and data reign

New Retail relies heavily on digitalization. In China, consumers are already used to it: they use their phones for everything and scan dozens of QR Codes every week. For instance, New Retail stores will allow users to try on clothes virtually, fill a virtual cart that will then be delivered to their home or pay via facial recognition without going to the checkout.

But such a strategy is essentially based on personal data collection. New Retail makes stores omniscient: phone numbers, purchase history, payment activities, financial transactions, addresses, they will know everything.

“Data is the most important element in redefining retail,” said Wu Weijia, an equity analyst who focuses on Internet-based businesses at ICBC International Holdings Ltd. “With big data, multi-dimensional digital marketing can help increase the monetization rate of advertisements as well as the conversion rate of the online and offline merchants with the platforms.”

New Retail is, therefore, more than ever celebrating the advent of the intrusive data era. But in China, consumers are much less suspicious than in Europe. According to Remi Blanchard, project leader at Daxue Consulting, Chinese consumers are less regarding on data collection than Western buyers to the use of personal data, which allows more technological freedom: “That’s also for this reason that the Chinese and Americans are ahead of many in terms of technological innovations or artificial intelligence, they have more freedom.”

Immediate shopping

See Now Buy Now (SNBN) is an innovative practice in the fashion industry that allows consumers to immediately buy the clothes they see during a fashion show. Alibaba used this strategic technique during the annual Singles Day (11.11) in 2016, but it is now implementing Immediate Shopping in its stores.

You see a product, you scan it, you leave, and it arrives at your home. Or even more agile, while watching a showcase of products, you can directly choose to have one on your plate or shopping cart.

And if New Retail succeeds in meeting this need for immediacy, it is because it changes the supply chain and transforms it real time. This new value chain is based on “test, measure and optimize” data analysis.

As a result, the production cycle is faster, reducing the risk of excess inventory, therefore, optimizing margins. This is a fundamental change for the current retail model, but it meets the immediate needs of Chinese consumers and would, therefore, lead to better customer satisfaction.

A major issue: Address a new Chinese target in search of quality

Traceable quality products

Globalization has allowed Chinese consumers to obtain better products, which has intensified competition for storage resources. Meeting consumer demand for quality products while improving the product range and optimizing space design is the top priority in the new era of retail trade.

Indeed, today the youngest Chinese consumers are becoming more selective in the choice of their products, and are willing to pay more for quality. Healthier products, higher food safety, and more precise tracking are now part of consumer demand. Direct purchase in short product circuits is also trendy.

Thus New Retail is the advent of product tracking. For example, at Hema supermarket, you can now watch short reports on the origins of items (by scanning the QR code of a product, the customer will be able to access all this information). This report will show you the product’s circuit, its origins, and transformations. The information includes audits such as pictures of the distributor’s operating permits and food safety certificates.

Alibaba is also part of a group of companies that have introduced a food traceability system based on blockchain technology. The initiative is called The Food Trust Framework. Its goal is to ensure traceability and transparency throughout the supply chain. And because seafood is one of Hema’s signature products, Alibaba had to be part of this initiative and to integrate various standards and controls to manage the supply chain process.

In-store display strategy: generate a strong desire to buy

In a supermarket, with a myriad of products and labels, cognitive stimulation is very high. A display can make information processing easier. New Retail is consumer-centric, meaning that the products will be set up to please consumers helping them make purchasing decisions quickly.

In-store technology is part of this strategy. New Retail in China means the end of static stores, stores are now lively: crustaceans wiggle in their tank, images on screens scroll, and staff assertively maneuver between customers.

Thus New Retail is also based on a solid merchandising strategy that arranges the products to generate a strong desire to buy.

Beyond the Chinese consumer experience: A retailtainment strategy

Not a store anymore but an authentic living space

Consumers are increasingly frustrated by today’s shopping experience. According to a recent Capgemini study conducted in several countries including China, four in ten consumers (40%) say shopping in stores is a chore. This is why New Retail is based on the concept of Retailtainment.

The store is no longer just a place to buy products. We’re going out for an experience. That’s why many stores are now turning into showcases. This is a strategy employed by Apple inApple Stores around the world. Consumers often decide to go to an Apple Store just for leisure, knowing full well that they are not going to buy. According to our experts at Daxue Consulting, “consumers need a reason to leave their homes and go shopping”,and New Retail can provide a reason.

In Hema supermarket and Carrefour Le Marché in Shanghai, in addition to the grocery section, cooks work every day to prepare freshly purchased products for those who wish to consume on site.

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

Buying in China has become a game

Gamification is a marketing technique that uses games to make consumers do actions that at first may appear uninteresting. This marketing strategy generates in-store traffic and collects customer data. Through a playful and entertaining approach, we are led to purchase.

For example, Alibaba has released a mobile AR application to make the shopping experience more fun. In 2017, on 11.11, consumers could then play a game similar to Pokemon Go. The Tmall “Catch The Cat ” game allowed consumers to earn special promotion and prizes every time they catch the cat, which is Tmall mascot via Alibaba’s Taobao and Tmall apps.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

New retail stores in China: Alibaba, JD.com and Wechat, the giants’ race

Alibaba and Hema Xiansheng (盒马鲜生)

Hema Xiansheng is Alibaba’s New Retail supermarket. Launched in January 2016 in Shanghai, the brand so far has owned over 100 stores across China.

JD.COM & 7 Fresh

JD.com, the second largest e-commerce platform in China (305.3 million actives users and net revenues of 67.2 billion USD in 2018) follows a retail strategy similar to Alibaba’s New Retail: it is called Unbounded Retail. It is based on three main pillars:

- “Unlimited consumers”: consumers can access more and more purchase options through different channels;

- “Unlimited scenarios”: Connect online and offline channels to new scenarios incorporating innovative technologies;

- “Unlimited marketing”: All media, brands, and platforms are collaborating to generate intelligent content and facilitate sales conversion.

To implement its Unbounded Retail strategy and to compete with Hema supermarkets, JD.com has opened stores in Beijing, called 7 Fresh. 7 Fresh only sells food products, 75% of which is fresh. There are also many imported products such as fruit from New Zealand, beef from Australia, Iberico ham or French oysters.

Tencent and Carrefour Le Marché

Last year, Carrefour China and Tencent launched their first smart store in Shanghai. This is Carrefour’s first global initiative in intelligent distribution. Carrefour is trying to reposition itself on the Chinese market from the classic hypermarket model to more flexible retail models. Indeed, last year, Carrefour saw its turnover fall by 6.6%.

Thus Carrefour Le Marché closely looks like the other smart supermarkets that came with the New Retail wave. Technology, fluidity, ‘omni-channelity’ and quality are all there with a touch of import.

Grocery retail in China disrupted by the announcement of Alibaba

Grocery retail landscape in China

The grocery retail landscape in China is traditionally composed of three different types of stores: the huge hypermarkets often located on the outskirts of cities, the more traditional supermarkets within towns and finally the convenience stores that can be found on every street corner.

Hypermarkets (mega stores) in China

Hypermarkets have been dominating the retail market in China for a long time. These huge supermarkets have all types of products, including many imported products.

The major hypermarkets in China are China Resources Vanguard, RT-Mart (大润发), Walmart, Carrefour, Yonghui (永辉), Bubugao (步步高), Wumart (物美), Metro and AEON China. The success of these chains is due to the availability of products. The Chinese could then buy everything at the same place, at fair prices and close to home.

But, the issue is that today these hypermarkets no longer meet the expectations of Chinese consumers. Their clientele is mainly composed of seniors or families who want to do big weekly shopping in the same place and agree to take part in their day for shopping. Even if hypermarkets in China are trying to modernize and adapt to new lifestyles, according to a 2018 study from Fung Business Intelligence, store closures remain significant for hypermarkets.

Middle-sized stores in China

The smallest traditional supermarkets are often located in the heart of cities. Unlike convenience stores, they offer basic grocery including vegetables, fruits, and meat. The main supermarkets in China are, for example, Lianhua (联华), Hualian(华联), NGS (农工商), Jiadeli(家得利). Despite a sharp drop in income in recent years in China (for instance, Lianhua Supermarket closed 492 stores in 2017, and opened only 295 stores), these supermarkets still meet the needs of a particular target group of Chinese: adults who live and work in the city and who shop every 2-3 days.

Convenience stores in China

Small format shops are becoming more and more popular in China. Consumers are demanding a simpler, faster and daily shopping experience. These are called ‘mom-and-pop convenience stores’.

Convenience stores in China are often located near subway stations or around every area with high pedestrian traffic. These stores are not very large, from 20 to 80 square meters for the vast majority. They target young urban consumers who have a busy lifestyle and do not take the time to do real weekly shopping or cooking.

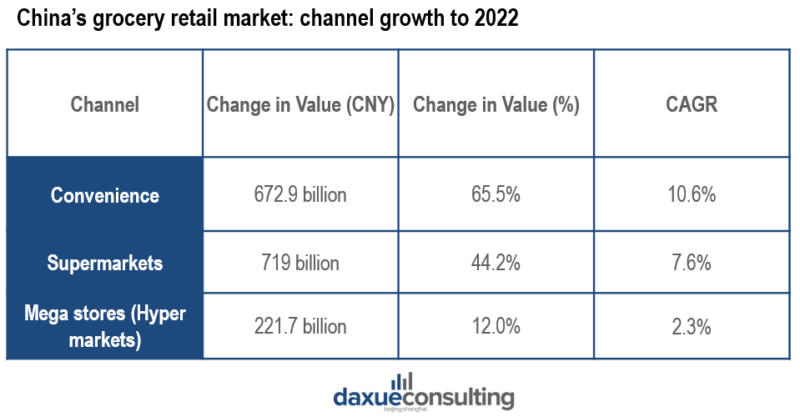

According to the IGD research association’s estimates and as can be seen in the graph below, convenience stores have better development prospects in China compared to supermarkets and mega stores.

Also in 2018, the China Chain Store & Franchise Association published its China Urban Convenience Store Index 2018, which surveyed a sample of 36 cities. The survey revealed that there are more than 100,000 mom-and-pop convenience stores in China, with a combined annual income of 190 billion yuan ($29.7 billion).

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

But then how does the New Retail modify this current landscape?

Alibaba wants to reach physical omnipresence in China: recently, the company announced that it wants to connect with the 6 million local stores in China.

The strategic idea is to bring its new retail management technology, called LST system (Ling Shou Tong system) to these physical stores to strengthen its bricks-and-mortar presence in the daily lives of Chinese people.

LST is an app developed by Alibaba that helps stores optimize product supply and increase sales. This ‘one-stop solution for digital transformation’ provides recommendations to stores, helps them analyze their sales and expenses, manage promotions and improve the presentation of their products in stores.

Alibaba then began to deploy this solution free of charge in strategic stores and exchange, stores must let Alibaba use their storefronts and provide all their customer’s data.

So, according to Alibaba, New Retail will allow convenience stores to remain competitive on the market: “We share a common goal with millions of small shop owners, which is to turn every one of them into a smart store that blurs the boundaries of online and offline retail to bring together the power of both retail spaces.”, said Daniel Zhang, Alibaba’s CEO.

At the end of 2018, at the Alibaba LST Retail Conference, Lin Xiaohai, general manager of the LST Retail business, announced that the number of retail outlets covered by Ling Shou Tong had exceeded 1 million.

New Retail in China is, therefore, not only a question of creating new innovative stores, it is a marketing strategy to reshape the Chinese grocery retail landscape. With this strategy, Alibaba hits hard on hypermarkets and supermarkets that are likely to suffer to the benefit of convenience stores.

New Retail is thus profoundly reshaping the entire grocery retail eco-system in China.

So, who will be the next to enter the smart retail race in China?

Author: Steffi Noël

Daxue Consulting can help you improve your in-store strategy in China. Thanks to research methods such as mystery shopping or consumer’s behavior analysis, our teams achieve concrete results that will serve as indicators in optimizing your sales channels on the Chinese market. For any further information, contact our team directly.