Millennials, also known as Generation Y, are those born between 1981 and 1996. This makes the oldest millennial 42 years old and the youngest 27 years old in 2023. There are more than 350 million millennials in China, amounted to about 25 percent of the whole population. They are more educated than the previous generations, with 25 percent of them holding a bachelor’s degree or higher. The Shanghai Youth Employment Status Report which was published in 2019 showed that young adults aged between 16 and 35 are earning an average monthly wage of 7,342 Chinese yuan (USD 1,018).

Chinese millennials were born in a period of exponential economic growth and witnessed the unprecedented advancement of technology. They are also living in a time of endless opportunities and optimism in China. They are the main drivers of the country’s surge in consumption, which has global implications. For example, a report released by Boston Consulting Group and Tencent observed that Chinese customers would account for 40 percent of the global luxury goods sold worldwide by 2024. Furthermore, in 2019, 48 percent of Chinese luxury consumers were aged below 30.

Chinese Millennials enjoy being single

Although their interest in the luxury sector is rising, millennials have to deal with the rising cost of living in China. This makes it more expensive to build families and raise children. Their decisions were reflected by the number of new marriages which has decreased significantly in China, from 12.2 million couples in 2015 to 7.6 million couples in 2021.

According to a Zhiyan report, 20 percent of the single population is above the age of 20 in China. Half of this single population is aged between 20 to 29. Thus, millennials are a significant part of the “singles economy”. The same report characterizes these consumers as convenience and leisure seekers, interested in raising the quality of life, and spending more on higher-quality food or home products.

Moreover, it is not only the costs of living that is stopping people from forming families. Many Chinese women do not strive for marriage because they are afraid of losing financial freedom. Being single allows them to spend on luxury, travel, and entertainment. Besides, it allows them to have full control of their life, thus keeping a higher quality of life.

Singles are boosting the pet food market

Chinese millennials’ unwillingness to get married and raise children has widespread effects. Although the government has abolished the one-child policy and encouraged people to have more kids, citizens show the opposite tendency. Millennials are more and more reluctant to raise children and prefer to adopt pets. As a result, the number of pets in China grew from 130 million in 2016 to a stunning 200 million pets in 2020.

A report by PwC showed that a significant number of pet owners in China are single women. According to the report, 88% of pet owners in China are female, among which 50% of them are millennials. The report describes the image of a typical pet owner— a single and well-educated professional living in a big city who keeps a pet to accompany them at home. They usually have a parent-child-like relationship with their pet and are willing to spend on specialized pet products and healthcare.

This naturally led to growth in the pet food market, unlike in the baby food market. For example, in 2021, Nestle reported Purina PetCare saw double-digit growth, led by science-based and premium brands Purina Pro Plan, Fancy Feast, and Purina ONE, as well as other veterinary products. At the same time, sales in the Infant Nutrition category in China decreased.

Chinese millennials’ perception of money is shifting

Having gone through a very competitive educational process to enter university and secure a job, millennials have become tired and lost motivation. Working long hours with low paychecks has caused massive burnout, and millennials are part of the “lying flat” movement. Less focus on work means millennials have more time for hobbies and personal lives.

An increasing number of millennials prefer self-fulfillment over chasing traditional social goals, such as buying an apartment and a car, creating a family, and raising kids. As a result, more millennials have a growing interest in luxury products and services. Not only do luxury products substitute larger investments such as property, but they also serve as social symbols that prove the owners’ social status and are seen as a reward for “overworking”.

Meanwhile, millennials who decided to form families show interest in buying higher quality and safer products for their children. The millennial mothers, so-called “spicy moms”, have the image of being trendy and cool, as well as being updated on the latest changes in the market. Like other millennials, they value self-care and premium brands. Hence, luxury brands are focusing on the Chinese market and children’s clothes. For instance, China has the largest number of Burberry kids’ stores in the world.

Millennials and Gen Z account for most of the luxury goods consumption

According to a survey by McKinsey, China delivered more than half the global growth in luxury spending between 2012–2018, however, its growth slowed after the pandemic. Still, the Chinese market is expected to exhibit an annual growth rate of 5.5% during 2022-2027 in spending on luxury. The post-’90s consumers spend 25,000 RMB a year on luxury goods, already as much as their parents’ generations. This observation reflects young people’s increasing disposable income, optimism about the future, and the pursuit of a more premium lifestyle.

Although young Chinese consumers often view high-end brands as representations of higher social status, the brand becomes less of a decisive factor to the younger generations compared to the older population. This is because the social nature of luxury consumption accelerates sophistication: younger consumers have started to put more emphasis on design, fabric, and the production process.

The same report by McKinsey showed that young consumers prefer foreign luxury brands, particularly those from France and Italy. However, compared to older generations that have few interests in Chinese luxury brands, one in ten post-’90s consumers said they would opt for a high-end Chinese brand. Chinese brands are starting to gain more reputation and popularity.

Meanwhile, according to Accenture, the age of 30 marks a tipping point for consumers’ tastes. Millennials aged 30 to 40 have rising purchasing power. They typically spend more time at work and have the least leisure time as compared to the other age groups. Thus, they are more willing to spend money to save time, more reliant on well-known brands and businesses, and more likely to flaunt their status through conspicuous consumption.

Millennials in China are increasingly relying on mobile e-commerce

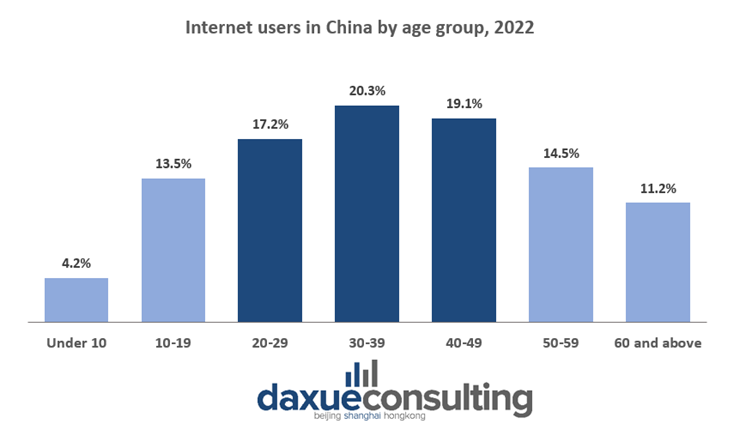

Chinese millennials are social media and e-commerce savvy as well as more willing to seek advice from peers rather than older generations. In January 2022, there were 1.02 billion internet users in China, and just between 2021 and 2022, there has been an increase of 35.9 million internet users, which is a 3.6 percent growth. Millennials, with the age group of 30-39, make up the largest part of internet users at 20.3 percent.

Accessibility to the internet made the stay-at-home economy both a lifestyle and a trend for developing business in China during the pandemic, a big part of which was contributed by millennials. The strong demand for shopping without leaving one’s home has made the mobile shopping industry one of the most competitive industries during COVID-19. In 2021, online shopping was used by 79.1% of internet users, and the top three shopping apps with the largest user size in 2022 were still Taobao, Pinduoduo (拼多多), and JD (京东).

Among the categories of e-commerce, fresh food e-commerce has emerged as a popular category with high demand and a bright prospect. In 2021, the fresh food e-commerce market reached 564 billion yuan and is expected to reach 818.7 billion yuan in 2023, according to Mob Research Institute.

The same report also showed that the online food delivery market in China is expanding but at a slower growth rate. Back in 2021, people aged 35 to 44 occupied 45.4% of the entire food delivery consumer group. However, there was a change in consumption patterns where more married men are starting to buy groceries online and become “family cooks”. On the other hand, the same report pointed out that despite the growth of the sector slowing down, efficiency is rising. For instance, the delivery speed is increasing.

Chinese millennials pursue a healthy lifestyle

The pandemic naturally affected millennials that have demonstrated an increasing willingness to adopt a healthier lifestyle: apart from the virus causing people to be more aware about immunity, millennials are aging and encountering health issues themselves. According to McKinsey, in 2021, health and family safety issues accounted for half of Chinese consumers’ top 10 concerns. As a result, consumers are focusing on improving their immune systems and making purchases related to health and hygiene.

Consumers focused on improving immune systems and prioritizing product safety, 2021

% of survey respondents, sample size N = 2,947

31% are focusing on improving their immune systems through exercise and healthy eating

29% reported spending more on fresh food during the crisis than before; 26% are spending more on fresh food after the crisis than during the crisis

42% consider hygiene as a critical factor in choosing a store to make their purchase

65% claim to care more about product safety after COVID-19

Source: McKinsey, Shift of consumers’ focus on health, 2021

A tough problem Chinese Millennials have to face is the aging of the population. Being born under the one-child policy means that they are the sole caretaker of their aging parents. This is because they do not have siblings to share the burden of taking care of the elderly of the family which puts a lot of pressure on millennials. For instance, they have to find ways to pay for their own expenses and their parents rising medical spending as they age. Besides, cities are struggling to provide enough nursing home beds for the increasing aging population.

Millennials’ consumption in lower-tier cities

As online shopping has become accessible in China, brands are actively reaching out to millennials from lower-tier cities. According to the National Bureau of Statistics of China, tier-three cities have more young people aged 25 to 30 than first and second-tier cities.

McKinsey Digital’s research also showed that young consumers in China’s lower-tier cities are as likely to shop online as their top-tier city dwelling counterparts. Moreover, in 2021, lower-tier cities were faster to recover from the pandemic outbreak than tier-1 cities such as Beijing and Shanghai. This is due to the lower-tier cities’ larger pools of consumers with significant levels of disposable income and a keen appetite for online deals.

Besides, lower-tier city millennials’ interest in showing their status through premium products opens bigger possibilities for luxury brands. The growth of online shopping and the possibility of acquiring premium products online provides future business opportunities in lower-tier cities for luxury brands.

Low-tier cities led China’s consumption surge in 2021

70% of health services consumption happened in third- and fourth-tier cities in the first half of 2021

90% of health services consumption happened in third- and fourth-tier cities in the second half of 2021

40% of the total consumption in 2021 happened in third- and fourth-tier cities in 2021

19 out of 20 top cities that expanded consumption in 2021 were third- and fourth-tier cities

Source: Tencent, Minsheng Bank. Low-tier cities share in China’s consumption, 2021

In terms of online shopping behaviors of these consumers, during huge online promotion events like Double 11, they are less price-sensitive than those in tier-1 and 2 cities. Instead, they value social engagement, which could come in the form of referral programs or endorsement by KOLs/KOCs, and special editions. In fact, they value these things more than their counterparts in tier-1 and 2 cities.

Understanding Chinese Millennials spending behavior

- More than just a response to the COVID-19 outbreak, Chinese Millennials’ spending habits increasingly adapt to the stay-at-home economy due to its convenience.

- Millennials face pressure such as long hours at work and sole responsibility to take care of their aging parents. Thus, they seek convenience and efficiency in purchases and started to make conscious purchases to boost a healthy lifestyle.

- Many Chinese women prefer to remain single to maintain financial freedom and a higher quality of life. This led to a growth in the pet food market as they opt to adopt pets instead of having children.

- Millennials’ perception of money is shifting, with a focus on self-fulfillment over traditional social goals.

- Millennial consumers in lower-tier cities are less price-sensitive than those in higher-tier cities. They also value social engagement of referral programs or KOLs/KOCs’ recommendation and special editions more.

Author: Sofia Tishchenko