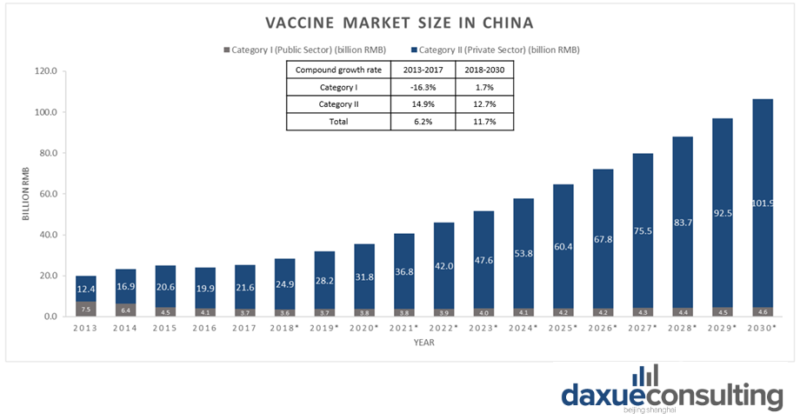

Size of the vaccine market in China

The vaccine market in China has been expanding rapidly and is predicted to continue growing. The market size has grown to 25.7 billion RMB in 2017 and is expected to reach 100 billion RMB by 2030.

In part thanks to the loosening of the one child policy in China, there were 16.7 million new-borns in 2018 and the number is expected to increase. Between 2007 and 2015, the annual supply of vaccines in China went from 666 million to 1,190 million doses, most of which are produced domestically. China is one of the world’s largest producers of vaccines, approximately 700 million vaccine doses are produced annually in China. The estimated growth rate for overall vaccination market in China is 11.7%, and the growth rate for category II vaccines in China is 12.7%.

[Source: Statista ‘Size of vaccine market in China by category I and II]

One Chinese vaccine market, two types of vaccines

China is a well-regulated producer of vaccines, but some vaccines that are important globally are not included in China’s Expanded Program on Immunization (EPI) system. Sustained and coordinated effort will be required to bring the vaccines industry in China and the EPI system into an era of global leadership.

The huge vaccine market in China appears to be easy to enter and stay. However, the Chinese vaccination system creates an uneven playground for different types of vaccines.

Category I vaccines in China

Category I vaccines in China belongs to the public sector, which means they are compulsory and free of charge. Two examples include measles and hepatitis. Six major domestic institute dominates the market of category I vaccines in China, and only very few foreign-made vaccines in China are available.

Category II vaccines in China

Category II vaccines in China such as Rabies, varicella, pneumonia, and human papillomavirus (HPV) vaccines, are a part of the private sector. They are voluntary vaccines that Chinese citizens pay at their own expense, and hence are made-for-profit. Most category II vaccines in China are foreign-made.

[Source: The Japan Times, Category I vaccines in China are free of charge for all children under 14 years ]

The Chinese government manages category I vaccines in China and provides them free of charge to all children under 14 years of age. The Provincial Center for Disease Control and Prevention (CDCs) purchases vaccine from the manufacturers and report the demand and supply data to the central government. The suppliers, which are vaccine manufacturers, have to strictly follow procurement contracts to provide category I vaccines to provincial or other CDCs.

Vaccine manufacturers could sell category II vaccines to multiple parties such as Wholesalers County or district CDCs, vaccination clinics and other healthcare providers prior to April 2016. The Chinese government later revised regulation in 2016, stating that category II vaccines in China must be procured using government procurement platforms. By integrating the two types of vaccines into one management system, the Chinese government can exercise greater control over the quality of category II vaccines in China as other channels such as the internet and wholesalers are banned. In 2017, the Chinese State Council updated the Vaccine Circulation and Immunization regulation, which requested establishment of a national advisory committee of experts to review category II vaccines in China based on safety, cost-efficiency, effectiveness and production capacity, and make recommendations for inclusion of vaccines into the current EPI system. This means more category II vaccines in China will be included in the free-of-charge category I vaccines in China, leaving less market share for foreign companies and making it more difficult for foreign-made vaccines to stay in the Chinese vaccine market.

Pricing of the vaccine market in China

In China, the contract prices for EPI program vaccines ranged from $0.1 to $5.7 US dollars per dose – similar to UNICEF prices. Contract prices for private-market vaccines ranged from $2.4 to $102.9 US dollars per dose – often higher than prices of comparable US, European, and UNICEF vaccines.

The prices for Category I vaccines in China are similar to UNICEF prices, but lower than the US and European countries. The low vaccine prices may give less incentive for manufacturers to invest in production improvement and development. Therefore, therefore, results in a lack of domestic production of large combination vaccines

The prices of Category II vaccines in China were high enough to attract more competition and thus more investment in research and development. However, the demand volumes are not large enough to achieve an economic of scale. Therefore, finding a balance between manufacturers’ profit needs and the general public’s health needs is challenging.

Leading Competitors in the Chinese vaccine market: international and domestic institutes

Although the number of Category I vaccines in China accounted for 65% of the total number of all vaccines in China, it was mainly occupied by the six major research institutes of China Biotechnology Co., Ltd. (Changchun, Beijing, Shanghai, Wuhan, Lanzhou, Chengdu). As Category I vaccines in China are dominated by the local competitors, foreign competitors can only enter the Chinese vaccine market with category II vaccines.

There are more than 30 companies in the vaccination market in China. Apart from major foreign players like GSK, MSD, Novartis, Sanofi Pasteur and Pfizer, local players such as Chang Sheng, Zhi Fei, Kang Tai, and Wo Sen are strong competitors..

Foreign vaccine companies in China’s vaccine market in China: GSK, MSD, Pfizer, Sanofi Pasteur, Novartis

GSK in China: Shingrix leading the way to expand in the Chinese vaccine market

[Source: GSK-China official website, ‘GSK-China has innovated 24 products between 2011 to 2016]

GSK has invested more than 500 million USD in China and its revenue reached almost 40 million USD in 2018. GSK products cover 250 cities in China. It has five business hubs: Beijing, Shanghai, Guangzhou, Chengdu and Hangzhou; five manufacturing hubs: Shanghai, Suzhou, Hangzhou and Tianjin; one global research and development center in Shanghai.

The growth rate of GSK vaccines in China was 12% in 2017. “I’m very confident in a long-term thriving vaccine industry in China, we want GSK to be part of it and to be a partner to bring new vaccines into the market.” said Walmsley, CEO of GSK since April 2017. She believes in prevention philosophically, in which vaccines have been the most powerful protector for human life aprart form clearn water.

Since Cervarix has entered the Chinese vaccine market, its growth rate has increased from 8% in 2016 to 65%. Meanwhile, GSK has developed Shingrix, a newly approved herpes vaccine in October 2017. This vaccine has achieved sales of £22 million in 2017, which suggests a huge market potential. Shingrix’s approval of Zostavax, which has been a monopoly in the Merck market for many years, has ushered in new competitors. It is worth mentioning that the Centers for Disease Control and Prevention (CDC) Advisory Committee on Immunization Practices (ACIP) issued a recommendation recommending Shinglix to replace herpes zoster, the vaccine Zostavax used for immunization of the elderly population aged 50 years and over. According to EvaluatePharma, by 2022, GSK will be the world’s vaccine market leader with more than $8 billion in sales with its new herpes zoster vaccine Shingrix (Sanofi second, Pfizer third, MSD fourth).

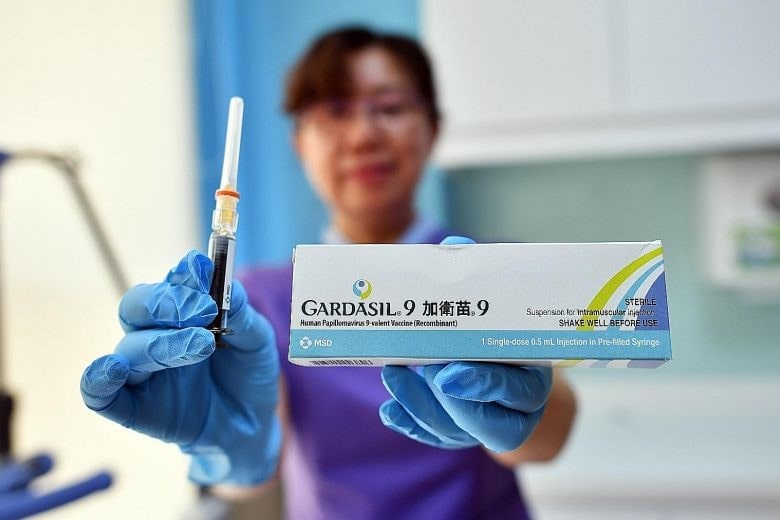

MSD in China: Explosive demand for Gardasil 9 in China

[Source: Xinhua, Merck Sharp and Dohme (MSD) introduces Gardasil 9 in China]

Merck Sharp and Dohme (MSD) is a global research-driven pharmaceutical company dedicated to putting patients first. MSD China formed in 1994 in partnership with Hangzhou Hua-dong Medicine Group Co. Ltd. From the beginning, MSD China has been a socially responsible, innovative company contributing to improved health and economic growth. With more than 5000 highly skilled, motivated employees throughout the country, MSD China is committed to bringing its high quality medicines and vaccines to the Chinese people. MSD has 10 operation areas, manufacturing plants and R&D centers. It has invested 1.5 billion USD in Beijing to establish a research center in 2011. In April 2013, it invested 120 million for MSD new plant in Hangzhou. The plant is the biggest and with most advanced technology pharmaceutical production packaging plant in APAC area.

One of the highlight products from MSD is its 9-valence cervical cancer vaccine: Gardasil 9. It has become so popular in China that there is not enough supply of vaccines to meet the demand. In 2018, MSD Gardasil 9 cervical cancer vaccine sales reached 3.15 billion USD in China. However, Gardasil 9 in China grew only by 37% due to the production capacity constraints. It is clear that in the future, China is one of the most important consumer markets for MSD cervical cancer vaccine.

Local Giants of the Chinese vaccine market: Changsheng, Zhifei, Kangtai, Walvax

Changsheng

[Source: Changsheng biotechnology Changsheng biotechnology’s vaccine products maintained good market sales]

According to the company’s annual report data, 2017 Changsheng Biological’s vaccine products maintained good market sales, achieving sales revenue growth of 51.67%. The growth is mainly attributed to the company’s significant increase in the sales revenue of category II vaccines, which totaled an operating income of ¥115 million yuan representing an increase of 59.57% from 2016. The sales of category I vaccines however decreased by 5.89%.

Zhifei

[Source: Chongqing Zhifei Biological Products Zhifei Biotech derived its sales mainly from Category II vaccines in China]

Zhifei Biotech’s revenue is mainly derived from the sales and promotion of Category II vaccines in China, including self-developed vaccines and agent-imported vaccines. According to the company’s annual report data, in 2017, Zhifei Biotech generated a sales of ¥1.263 billion yuan from vaccine products, an increase of 205.36% from 2016. Among all vaccines sold, the sales revenue of its self-developed category II vaccines has increased by 140.84%. The total sales of the Category II vaccines in China as a proxy was 274 million yuan, a year-on-year increase of 9231.67%.

From the company’s own analysis, its full-invested subsidiary Zhifei Green Bamboo’s self-produced global exclusive product: AC-Hib triple vaccine, is the most important contributor to the profit growth. At the same time, Zhifei Airport, another full-invested subsidiary of the company, successfully renewed the agency distribution contract for the 23-valence pneumonia with vaccine and inactivated hepatitis A vaccine last year, and the agent’s 4-valence HPV vaccine also successfully passed the drug registration approval, driving the company’s revenue growth.

Kangtai

[Source: Bio Kangtai Changsheng, The sales revenue of Kangtai Bio continue to grow]

Taking close to the market opportunity of the recovery of the vaccine industry in China, Kangtai Bio intensified its sales and promotion of vaccine products in 2017. According to the company’s annual report data, the sales revenue of Kangtai Bio’s vaccine products increased by 113.07% in 2017, among which, the second-class vaccine products. In 2017, the sales revenue was approximately ¥1.034 billion yuan, a year-on-year increase of 148.26%, attributing to the sales growth of its hepatitis B vaccine, Hib vaccine and quadruple vaccine. However, the sales revenue of one class of vaccine products has decreased slightly by 2.00% year-on-year.

Walvax

[Source: Walvax Biotechnology, Walvax Bio’s self-produced vaccines resumed growth]

In 2017, Walvax Bio’s original self-produced vaccine product sales resumed growth, and the sales revenue of various vaccine products increased significantly in 2017, especially the Haemophilus influenza type b conjugate vaccine and the freeze-dried AC vaccine group meningitis. The cocci-polysaccharide conjugate vaccine increased by 169.73% and 108.92% compared with 2016. At the same time, Walvax Bio’s 23-valent pneumococcal polysaccharide vaccine annual sales was ¥102 million yuan in 2017, accounting for 15.30% of operating income.

Scandals of the Chinese vaccine market and lessons learned

Faulty Vaccines: scandals of local giants making Chinese consumers lose confidence in the domestic vaccine companies

[Source: Changchun Chang Sheng filed bankruptcy after been find making faulty vaccines]

In July 2018, Changchun Chang Sheng Biotechnology, one of China’s largest vaccine makers, was exposed for selling and distributing hundreds of thousands of faulty vaccines to the Chinese vaccines market. The number of rabies vaccines involved is about 113,000 batches. The government’s investigation showed in August 2018 that the company also produced nearly 500,000 non-compliant diphtheria, tetanus and pertussis vaccines.

As this news spreads through the country, the public is outraged as the affected vaccines are intended for babies, not to mention many Chinese families only have one child. Therefore, infant parents began to look for safer sources of vaccines by travelling to Hong Kong and Macao to take foreign-made vaccinations.

Chinese authority stepped into investigation immediately, removed dozens of senior officials and fined ¥9.1 billion yuan on Changchun Chang sheng, placing the company in a difficult situation. Changchun Changsheng announced its bankruptcy in Nov 2019 has sent a strong signal to the vaccine industry in China, indicating that it is likely to face a much stricter legal environment in the near future.

Chinese perceptions of vaccines

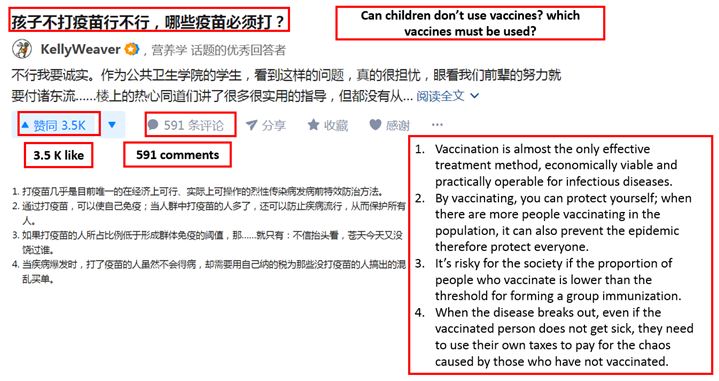

Are there ant-vaxxers in China?

Research in 2015 by Hangzhou’s Center of Disease Control and Prevention suggests that the media has swayed Chinese netizen perception of vaccines. Social media activity on Weibo and Zhihu do show that some Chinese netizens are hesitant to use vaccines. Although during the time of the research, some provinces showed a 30% decline in hepatitis B vaccinations, government officials quickly dispelled anti-vax sentiment. Compared to the west, anti-vaccination sentiment in China is more due to fear of contamination rather than distrust of the science of vaccines. Additionally, anti-vaccination sentiment in China tends to arise only after vaccines scandals, and more contained then in the west.

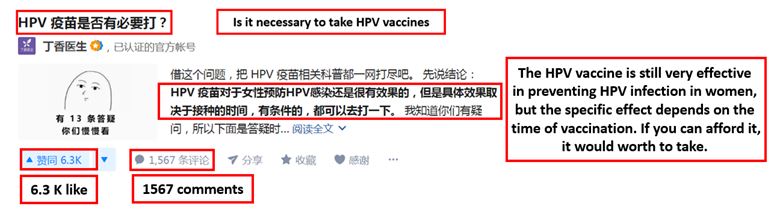

Chinese perceptions of vaccines in 2020

[Source: Zhihu, Consumer on Zhihu asking if the HPV vaccine is worthy and effective]

Although the market for the HPV vaccine in China is booming, many consumers still doubt the necessity of taking the expensive category II vaccine. There are many similar questions posted on Zhihu, a Chinese question-answer forum, asking for detailed information on HPV vaccines. This indicates that the Chinese consumers are aware of the HPV vaccine, but the amount of information available on such vaccines is fairly low. Many are still judging between the needs and the costs.

[Source: Zhihu Chinese consumers asking the necessity of taking vaccines and the types of vaccines required]

As anti-vaccination theories become increasingly prevalent, many consumers are seeking to gain more knowledge on the importance and the necessity for taking vaccines. Moreover, the above question is posted after Changchun Chang Sheng’s faulty vaccines scandal, which indicates Chinese consumers’ concern over the Chinese vaccine market.

Opportunities in the vaccine market in China

Increasing number of newborns as China’s ‘one-child policy’ loosens

In 2015, the “Population and Family Planning Law of China” was amended in which China’s one-child policy became two-child policy. This change will lead to an increase in the birth cohort size and hence an aggregate increase in vaccine demand.

Growing demand for quality vaccinations

Many common vaccines that are currently used in China has been outdated compared to international markets. To fulfil the growing demand, there are more quality vaccines developed and will replace the first generation vaccines. For example, Prevnar 13 and Gardasil 9 approved in 2016 and 2017 by CFDA. Furthermore, the concern over domestic manufacturers made many parents fly all the way to Hong Kong to get foreign-made vaccinations for their children. However, this may also serve an opportunity for foreign-made vaccines to enter the Chinese vaccine market directly.

Growth potential of the adult vaccine market in China

The adult vaccine market in China is also developing along with the aging population. Vaccine for common diseases is proven to be the one of the most effective ways to prevent elderly from getting the diseases. In China, the population of those aged 65 and older is expected to raise to 16.6% by 2030 and thus increase demand for such types of vaccines in China.

Increased purchasing power leading to higher demand of foreign-made vaccinations

With greater purchasing power, more Chinese consumers are willing to buy foreign-made vaccines in China. Disposable income is expected to increase to ¥50,900 yuan for households in the cities and to ¥22,200 yuan for households in countryside, with compound growth rates of 7.1% and 9.5%.

Loosened requirement for clinical trials allowing more room for future development

Historically, China has required clinical trials to be conducted in China before a drug can be approved for use. Reforms in the Chinese Food and Drug Administration (CFDA) in 2017 have removed this requirement and in which makes it easier for companies to receive approval.

Pfizer faced this issue when its Prevenar 7 (pneumococcal 7-valent conjugate), the only pneumococcal vaccine available in China at that time, was up for license renewal in 2015. The government did not approve the renewal, resulting in Pfizer abruptly ceasing their vaccine sales in China and prompting significant changes in the company’s operations, as well as leading to a shortage of the vaccine for Chinese children. Pfizer did not comment on why its license was not renewed, but the Beijing-based finance magazine CaiJin reported on an anonymous source who suggested that the license was not renewed in order to allow domestic pneumococcal vaccine development more time free from competition.

Companies are subject to less regulations. Therefore, the long research and development time they have go through will more likely be realized than ever before.

The vaccine market in China has a long future of growth

Overall, there is still a huge potential for the Chinese vaccine market to further expand in the foreseeable future. The increasing amount of awareness and demand for category II vaccines in China will bring more opportunities and open doors to more foreign companies to provide vaccines in China. Although competition with domestic brands is tight, there is still a displayed interest among Chinese consumers for foreign made products. Additionally, the awareness of diseases is increasing, and as the middle class grows, so will the demand for vaccinations.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes