Vaping has become a trend worldwide in recent years. The e-cigarettes which were previously introduced to help smokers quit have become a symbol of the Gen Z. The size of the vape market in China is still smaller than that in the U.S., despite a much larger smoking population.

Many users, including middle schoolers and high schoolers, have become addicted to nicotine after vaping. Its popularity and user abuse have inevitably caused many controversies, especially in the U.S., where the trend started. Despite all the controversies, the industry continues its rapid growth worldwide. Although the recent trend took off in the U.S., the first e-cigarette was, in fact, invented in China more than a decade ago. The country, specifically Shenzhen, as the manufacturing hub for most e-cigarettes and auxiliary products for the worldwide market, is also the home for many companies renowned in foreign markets. With many smokers and relatively less social stigma linked to nicotine products, China was not an exception to this global trend.

The potential of China’s own vape market, however, hasn’t been fully explored. The population’s mindset regarding vaping and smoking, the cultures, and government regulations regarding e-cigarettes make it a unique market.

Will the biggest tobacco market also become the biggest vape market?

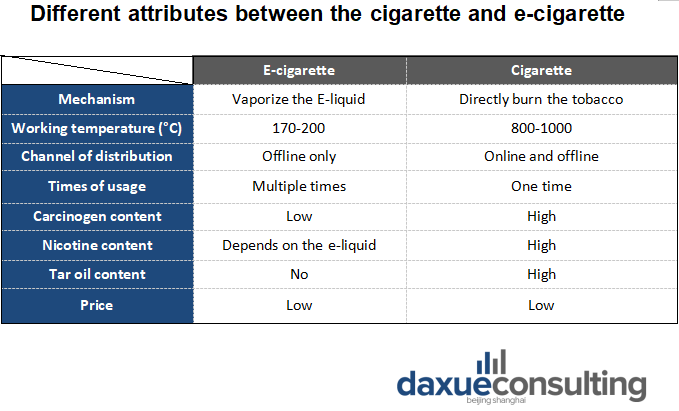

The connection between the electronic cigarette market and the tobacco market is self-explanatory. Tobacco companies have entered the market, as many smokers have become more aware of tobacco products’ health risks. The acquisition of Juul Labs by Altria (previously known as Philip Morris) reflects the interconnectedness of two industries and markets; it also indicates the possible future direction of tobacco companies’ development.

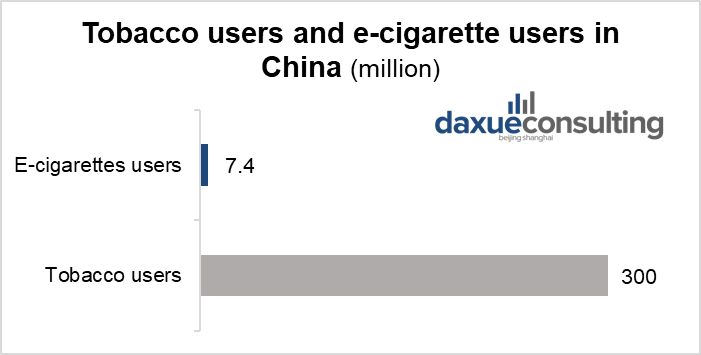

According to the World Health Organization study in 2018, China is the biggest tobacco market globally, with more than 300 million cigarette smokers. 60% of the smokers are male, and a smoker spends an average of 160 US Dollars per year on tobacco products. The market generates the most revenue globally, and the market is still growing. An annual growth rate of 1.4% is predicted, and the revenue is expected to reach 240 billion U.S. Dollars in 2021. The e-cigarette and vape market in China is still insignificant compared to the tobacco market. As of the end of 2019, an estimated 7.4 million people in China are regular e-cigarette users. That means the electronic cigarette industry in China can still potentially convert a large number of smokers.

Sources: WHO, Tsinghua University, designed by Daxue Consulting, Tobacco users and e-cigarette users in China

Just as the trend observed elsewhere, the electronic cigarette industry in China now targets both existing smokers and non-smokers. As more than 82 million adolescents will be entering adulthood in the next five years, many might probably get their first nicotine hit from vaping rather than smoking. Thus, with such a large potential target customer base who might want to seek a less harmful nicotine intake method, the vape market in China will continue to grow.

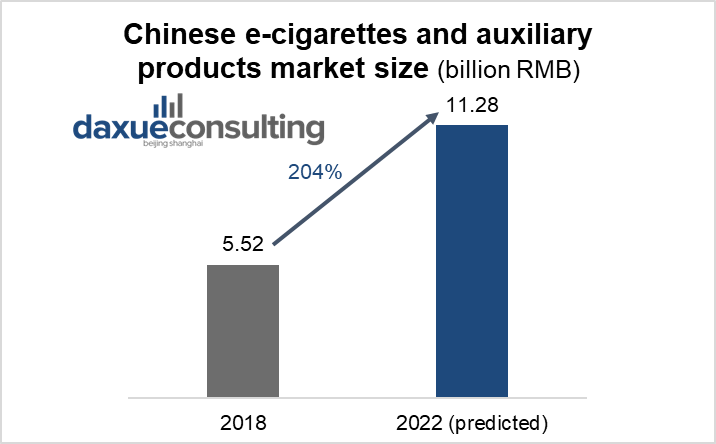

Globally, the e-cigarette market in 2019 generated 11.73 billion U.S. Dollars in revenue. It has an expected CAGR of 17% in the next few years, predicted to reach 21.4 billion by 2023. Among all the countries, the U.S. is still the largest market, but the Chinese market has also proliferated. Considering China’s status as the biggest tobacco market, it has enormous potential to continue the current rapid growth rate. In 2018, vaping in China generated about 5.52 billion RMB, and it is predicted to grow more than double to 11.28 billion RMB by 2022.

Source: Statista, designed by Daxue Consulting, Chinese e-cigarettes and auxiliary products market size

Perceptions of vaping in China

Perceptions of vaping and smoking in China are somewhat different from those in the West, especially compared to the U.S. However, the perceptions differ depending on the demographic groups. People in certain groups, such as less educated, low-income, and rural populations, are more likely to have smoking habits due to the relatively low tobacco price and smoking culture within their circles. Tobacco offerings (递烟) are a common phenomenon, and it is usually viewed as a polite gesture among Chinese men and will cause even those who don’t consider themselves smokers to light up. For the less educated populations, the switch to vaping is less common because the stigma about vaping is usually more prevalent than the stigma about smoking.

The smoking culture is also prevalent in business settings. Offering tobacco in business settings is a standard practice, in fact, smoking is considered an important socializing event in some business settings. However, because business people typically have more resources and pay more attention to health, a small number of e-cigarette products, like once-famous, Ru Yan, and “healthier” cigarettes, such as those with herbs, target those customers.

Chinese netizens question whether vaping is healthier

Nonetheless, vaping is still mainly considered a phenomenon among the younger generations, and its health benefits compared to smoking are often dismissed by the older generations as scams. On Zhihu, there exist questions that reflect some people’s perceptions of vaping in China. For example, a user asked, “smoking e-cigarettes are more likely to cause lung disease than traditional cigarettes, is it true?” Another asked, “between cigarette and e-cigarette, which one is more harmful?” with the elaboration, “a lot of people said this [e-cigarette] is more harmful, is that true?”

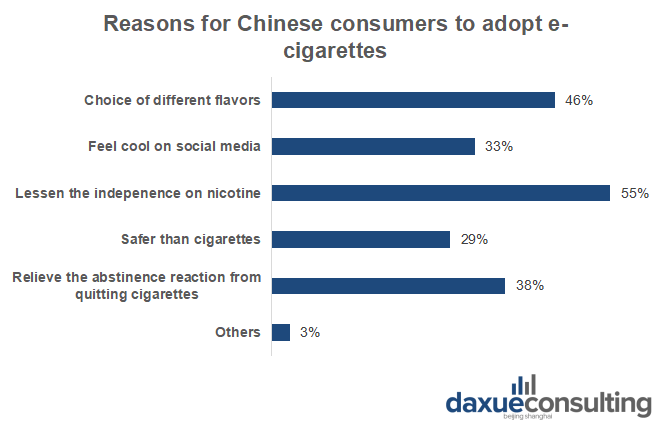

The popularity among the younger generations is also the result of the relatively more positive perceptions among them. Like Juul in the U.S., the industry’s marketing effort has played a large role in creating and spreading this perception. Most companies offer a wide selection of colours, designs, and flavours to attract younger generations. The vaping subculture has also emerged in society. Vaping-related posts like videos of vaping performance can be seen across social media. When one browses through WeChat moments or Xiaohongshu, e-cigarettes often are displayed casually when users share their special moments of life.

Three phases of the electronic cigarette and vape market in China

The electronic cigarette market in China has gone through three phases. Other than the change of perceptions of vaping in China, the market’s lows and highs have also been defined by the change of regulations.

2003-2009: Rise and Fall of the father of e-cigarette

The electronic cigarette industry in China started in 2003 when the first e-cigarette was patented in China. The patent owner Han Li introduced the brand Ru Yan and became the world-renowned father of e-cigarette. At the time, his products started with a price tag of 599 RMB and even went up to 16,800 RMB. However, the marketing strategy made Ru Yan a considerable success; the company claimed to sell more than 300 thousand e-cigarettes at its peak in 2008. At this stage, the electronic cigarette industry in China primarily targeted the products as an aid for quitting smoking. However, in 2009 media questioned the effectiveness of its products and products in the market with similar nature. The electronic cigarette and vape market in China suddenly deteriorated, and most of the companies turned to foreign markets.

2009-2018: Becoming a global manufacturing hub and Juul’s global trend

Between 2009 and 2018, Shenzhen relied on its well-developed electronic industry supply chain, and the cross-border business environment became the global e-cigarette manufacturing hub; the Chinese market started to revive gradually. The recent rapid development of the vape market in China should be attributed to the worldwide trend led by a specific Shenzhen-manufactured product, Juul, in the mid-2010s.

Since the emergence of American company Juul Labs (previously Pax Labs) and the launch of its product Juul in 2015, the small pod vape (pod system, pod mod) with nicotine-salt (much higher nicotine concentration than traditional vape juice) has rapidly become mainstream. The chemical structure of nicotine salt can better simulate nicotine hit provided by tobaccos, compared to the liquid used for traditional vape tanks. It had revolutionized the e-cigarette industry in the last five years, and its innovations have driven the industrial transformation.

Although Juul only entered the Chinese market in 2019 and was quickly removed amid the U.S. vaping crackdown, Juul inspired many of China’s mainstream brands. For example, China’s most prominent brand Relx provides products with similar concepts and technologies as Juul, and its products are in a similar price range as Juul. However, many prefer Relx because of the better user experience and the more comprehensive range of flavours it provides. Its international expansion saw huge success, even in countries where Juul has set foot in.

2018-now: Fierce competition and regulations

Since 2018, new technologies and the global trend have stimulated the domestic market. Many companies started to focus on the domestic market and new companies have been created every day to ride the wave. The competition has become tough in the vape market in China, and only a few companies have maintained their reputations and market shares.

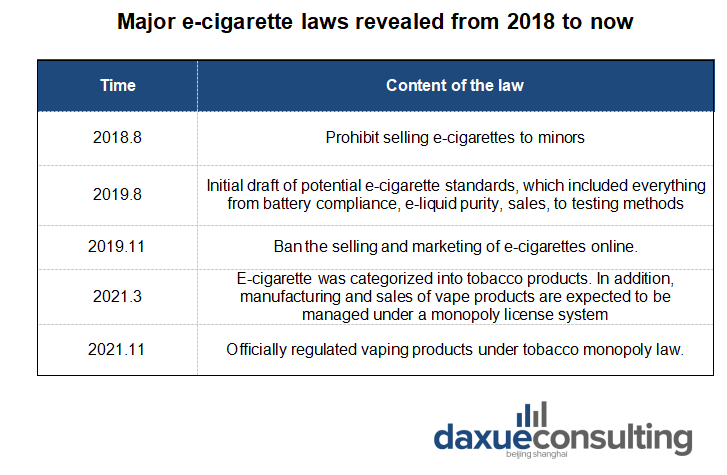

Regulations are the most critical factor for the e-cigarette market. Just as in the U.S., the electronic cigarette industry in China also experienced an exceptionally rough year in 2020. The regulations in 2019 that impose stricter standards on the sector reshaped the Chinese market’s dynamic. Law changes are specified in the following.

The E-cigarette market in China is at the pivot point under stricter regulations

As glamourous as China’s e-cigarette market look along with its astonishing expansion rate, a wide range of problems of the products have been recorded, such as e-liquid leak, battery short circuit, spontaneous combustion, as well as hazardous ingredients, which cause safety and health concerns to users. According to the research about vaping by The Economist, the nicotine content within e-cigarettes can potentially cause lung disease, craving, and addiction to a varying extent. Among this list of problems, the most concerning one are that e-cigarette products have way departed from their initial purpose. Intended as a substitute for regular cigarettes to help people quit smoking, e-cigarette is now enticing many teenagers and young adults who have never smoked to vape, said professor Yang Tingzhong, a smoke control expert from Fudan University. According to Tingzhong’s survey conducted by China’s Center for Disease Control and Prevention, among 2,400 middle school students, many aged between 12 to 18, 4.5% of them have tried vaping once, and 1.6% reported vaping in the last 30 days. He also found that many of them who have vaped before could easily purchase e-cigarettes from convenience stores, despite the mandatory age check required by the government.

Government issues stricter laws to put the e-cigarette market under control

Lack of scrutiny is the key factor that leads to China’s current disorganized e-cigarette market. Since 2018, the Chinese government has been seeking to snuff out the aforementioned problems and clamp down on this industry.

Vaping in China: Impacts on China’s e-cigarette market and potential future trends

E-cigarette producers are losing profitability under this sweeping trend of increasingly stricter regulations and market volatility. For instance, shares in China’s biggest e-cigarette maker RLX Technology plunged by more than 40% when the regulators announced the draft laws that would classify e-cigarettes as tobacco products. Similarly, Smoore, another China’s e-cigarette giant, found their share slashing by 27.1% after Beijing announced the standardized rules of selling e-cigarettes and tobacco products. However, despite the grim outlooks, there are still market opportunities and room for profit lying ahead, which producers should set eyes on.

1. Synthetic nicotine

In the future, synthetic nicotine is likely to be used to eliminate the restrictions imposed by traditional nicotine. Synthetic nicotine has the same molecular formula as natural nicotine. As an additive, it may not be included in the e-cigarette regulations of the Food and Drug Administration.

2. Restore the initial strategy

China’s E-cigarette industry has gone too far to hook adolescences on nicotine, which has given vaping a negative reputation. After the regulations come into full effect, it’s expected that e-cigarette producers will go back to their old angle of converting smokers to vapes and adjust market strategies accordingly. However, this also means producers will face the challenge of changing consumer habits in a market that’s largely old men.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast