BYD (Build Your Dreams) has become a prominent testament to China’s remarkable ascent within the global economy, placing the brand as a symbol of the country’s economic success story. BYD was founded in 2005, initially focusing on making rechargeable batteries for consumer electronics. However, BYD’s founder and CEO Wang Chuanfu’s had different aspirations. He envisioned BYD playing a significant role in the burgeoning electric vehicle industry beyond being a simple battery OEM. Despite early skepticism and challenges to emerging as a key player in the automotive revolution, BYD quickly scaled the manufacturing ladder to become a leading global electric vehicle (EV) manufacturer. Today the car maker holds a dominant position in the electric vehicles market in China and acts as a serious contender for global market dominance.

The early years: batteries and beyond

During the late 1990s to the early 2000s, BYD established itself as a reputable battery OEM, supplying other major consumer electronics companies. This period is generally thought to have been the groundwork for BYD’s successful entry into the automotive sector. In 2003, a strategic acquisition of a factory in Xi’an marked BYD’s first transition from battery manufacturing to producing gasoline-powered vehicles. This move, however, was not as smooth as initially planned. Initially, BYD grappled with quality issues, leading the brand to build a reputation for producing unreliable vehicles that required significant rework.

BYD’s transition in automotive manufacturing took a significant leap forward with the introduction of the F3DM, its first plug-in hybrid vehicle, in 2008, followed by the all-electric e6 in 2009. Another pivotal moment came when Warren Buffett invested USD 230 million in BYD, providing not just financial backing but also an endorsement, elevating BYD’s stature on global markets. This period was also instrumental for BYD’s advancements in R&D, increasing its patent portfolio in domains related to battery technology. The company, for instance, started adopting iron-phosphate chemistry for manufacturing its batteries, representing a cost-effective and more performant alternative to traditional materials, which eventually led to the development of the Blade battery in 2020.

Navigating the electric vehicles market in China

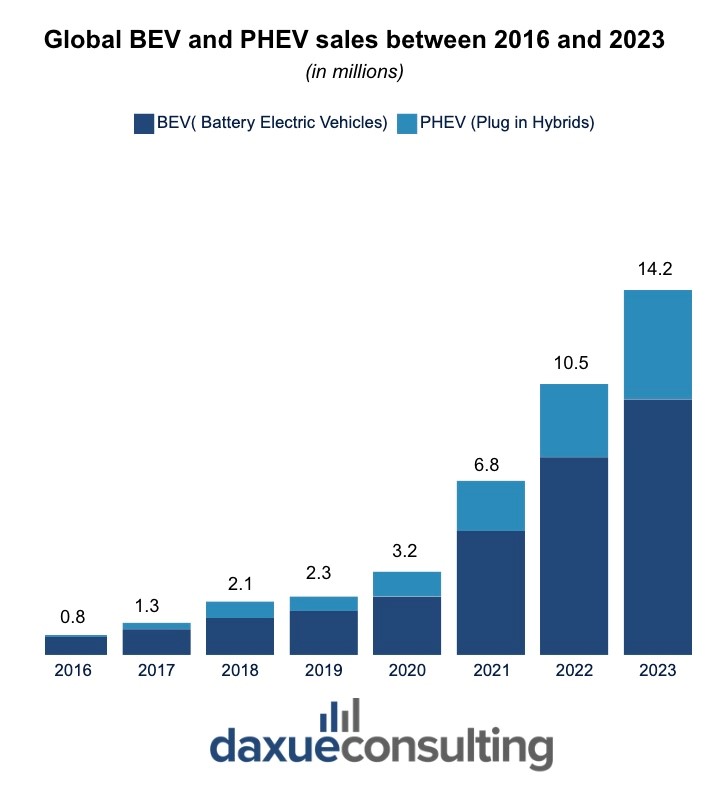

The global market for electric vehicles (EVs) has been exposing very positive signs of growth, with sales of battery electric vehicles (BEVs) soaring and plug-in hybrids (PHEVs) equally on the rise. These trends clearly indicate an accelerating shift towards electric transportation, as a larger share of light vehicles on the road are now electrified. Since 2023, for instance, BEVs have overtaken PHEVs, reflecting an increased consumer preference for all-electric models. BYD has been monitoring closely this growing market trend and has demonstrated a remarkable commitment to transitioning to fully electric vehicles, with the expansion of its all-electric model lineup, particularly with the BYD Han EV.

China’s electric vehicle (EV) market stands as the largest and fastest-growing globally. In 2024, China has constantly been leading the charge by a landslide, accounting for nearly 65% of all EV sales worldwide. BYD emerged as the primary beneficiary of this trend, significantly expanding its production capacity to meet demand. In 2022 alone, BYD sold over 911,000 battery electric vehicles (BEVs), capturing the largest share of the EV market in China.

China’s EV workforce soars past 1.5 million

Currently, the workforce in this sector is booming, exceeding 1.5 million professionals spread out across numerous EV companies and their suppliers. BYD leads recruitment in this industry, employing 570,000 workers, almost as many as the combined workforce of Detroit’s Big 3.

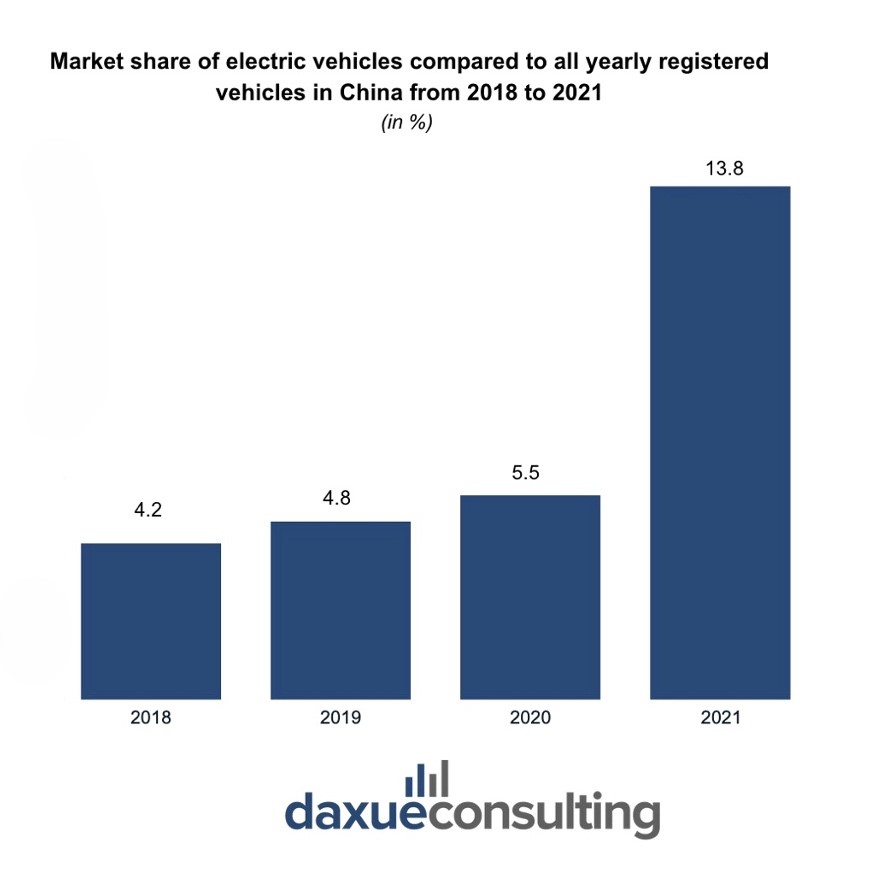

In 2023, electric plug-in vehicles accounted for a substantial 40 % share of China’s car market, which stands as the largest globally. Projections indicate that this figure is expected to exceed 50 percent by the coming year. In response to the booming market, there’s been a noticeable increase in foreign investments, with companies like Volkswagen expanding their presence in China by establishing a new research center near Nio in Hefei, staffing 3,000 engineers.

However, China has encountered a notable imbalance between its manufacturing capacity and market demand. The nation boasts enough factories to produce over twice the number of cars demanded by consumers, resulting in increased competition within the domestic market. As an example of this price competition, one of BYD’s latest models, the subcompact Seagull, is priced at less than USD 11,000.

BYD’s market dominance and emerging competitive challenges

BYD’s current performance and positioning

BYD has become a testament to the potential of Chinese carmakers in leveraging the country’s technological prowess. It was the country’s biggest car manufacturer, holding a total market share of 27%. The company also emerged as the biggest beneficiary of China’s growing appetite for new clean energy vehicles. This segment accounted for 13.5% of vehicle sales in China in 2021, a significant jump from 5.5 % in 2020.

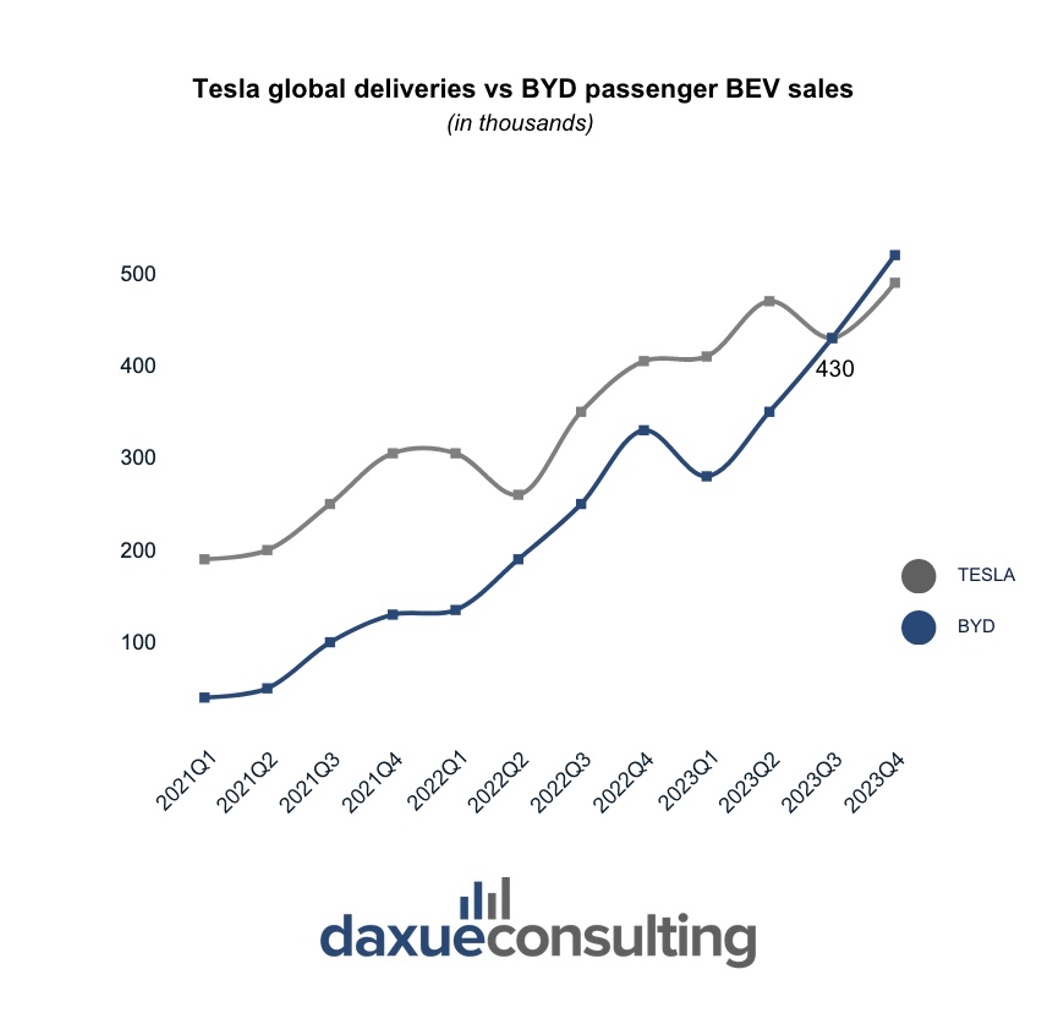

BYD’s global vehicle sales mirrored this trend, with a remarkable surge to over 3 million vehicles in 2023 from 427,302 vehicles in 2020. Overall, a seven-fold increase. Such growth has not only solidified BYD’s market share domestically, where its sales climbed over 80% in one year, but also underscored its ascendancy on the global stage. In addition, BYD’s equivalent achievement in becoming the top-selling battery electric vehicle manufacturer globally, surpassing Tesla in the fourth quarter of 2023, marks critical milestones in its global brand ascension. Notably, BYD has started exporting extensively to diverse countries such as India and Thailand, which have become pivotal markets for its vehicles and have significant international growth.

Rising threat of competition

Despite BYD’s remarkable growth and market positioning, the competitive landscape is becoming increasingly complex. Tesla’s aggressive expansion in China since 2020 has introduced a formidable competitor, known for its high-range, premium electric cars. Tesla’s adoption of lithium-iron phosphate batteries for its less expensive models represents a direct challenge to BYD’s market segment. Furthermore, the entrance of consumer electronics giants Huawei and Xiaomi into the electric vehicle space, equipped with advanced autonomous driving capabilities, signifies a broadening competitive field.

BYD has responded to these challenges proactively, with substantial investments in technology and innovation. Mr. Wang’s announcement in January of 2024 about BYD’s USD 14 billion investment in assisted driving technology and the deployment of 4,000 engineers to develop this capability reflects the company’s commitment to maintaining its competitive edge.

BYD’s supply chain financing raises concerns

In 2025, an accounting research firm, GMT Research, pointed out that BYD’s reported net debt of RMB 27.7 billion (USD 3.8 billion) vastly understates its true liabilities. According to GMT Research, BYD relied heavily on supply chain financing, a practice that sells accounts receivable or extends payment terms, sometimes beyond 275 days, to mask its debt burden. This will, in turn, affect investors’ assessments of BYD’s financial health. Whilst these practices do not violate accounting rules, risks were obscured as financial obligations are buried in other payables line items. In 2023, BYD’s other payables increased to RMB 165 billion, which caused a lack of transparency on terms and counterparties.

Moreover, according to Bloomberg, the implications towards the broader EV supply chain are stark. BYD’s supply chain financing system, Dilink platform, has issued RMB 400 billion in promissory notes. This shows how dominant players can pressure suppliers. Relying on BYD’s payment history, some suppliers treat these notes as low-risk. Yet, regulators have questioned how suppliers account for Dilink obligations.

On the other hand, global peers, like Tesla, pay suppliers within 90 days. In contrast, Chinese EV makers stretch payment terms far longer. This strains liquidity across the supply chain. As such, BYD’s reliance on working capital financing could erode trust if market conditions weaken.

Competitive advantage: How BYD keeps its innovative edge

In-house production and vertical integration

BYD distinguishes itself in the electric vehicle (EV) industry with its comprehensive approach to manufacturing and component production. The company’s hallmark is its extensive vertical integration production scheme, effectively leveraging expertise across the car manufacturing value chain. BYD manufactures the majority of its vehicle components in-house, including batteries, electric motors, and electronic controls. This commitment to vertical integration is evident across all BYD vehicles, with tires and windows being the only components outsourced. Overall, BYD takes pride in producing up to three-quarters of the components needed to assemble its car models in-house.

The strategy of reducing dependency on external suppliers not only has ensured BYD’s ability to enhance quality control and supply chain reliability but also to strictly maintain its cost competitiveness. This is in stark contrast to many other foreign car manufacturers. For instance, Volkswagen (VW), the biggest foreign competitor of BYD in China, adopts a radically different approach, based on the outsourcing of up to two-thirds of its vehicle components.

Scalability and workforce development

BYD’s scalability in its production process has been a critical factor in enhancing BYD’s position as a cost leader in the industry. The company has boasted an extensive manufacturing footprint by spreading its manufacturing facilities all across China. It made significant investments in infrastructure to support its production capabilities and ambitious production targets, in diverse localities such as Changsha (Hunan), Xi’an (Shaanxi), and Shaoguan (Guangdong).

Furthermore, the company further supports its innovative edge with research and development centers in Shenzhen and Shanghai. It recently inaugurated the Shenzhen Research and Innovation campus. The campus extension is immense, and the complex essentially acts as an independent city.

However, the cornerstone of BYD’s scalability prowess lies in its highly trained and skilled workforce. The company has never ended up forming new recruits to fit its ever-more ambitious development goals. In the last 15 months, some chief departments report having nearly increased their staff by a threefold base. This underscores the company’s extensive ability to attract and cultivate top talent.

Hybrid technology: A unique value proposition

BYD’s early focus on plug-in hybrid technology is likely the evidence highlighting the company’s most successful implementation of a differentiated cost leadership strategy. BYD has significantly increased the attractiveness of its product offerings from its competitors, offering consumers a bridge between traditional gasoline vehicles and all-electric models. This strategy has paid dividends, particularly in markets where charging infrastructure is still developing. In 2024, BYD sold 4.27 million EVs, which is an increase of about 41.3% year-on-year. More than half of it is plug-in hybrid electric vehicles (PHEVs), which reached 2.49 million units, achieving a 72.8% increase on a yearly basis.

Infrastructure-wise, BYD has also asserted its commitment to stimulating the growth of EV technology, notably by making electric vehicles more accessible and practical for a broader range of consumers. For instance, BYD’s incoming e-Platform 3.0 is a state-of-the-art infrastructure that offers impressive electric ranges and fast charging capabilities for consumers.

BYD’s foray into international markets

Navigating international trade tariffs

Trade barriers, such as tariffs and import quotas, are currently serving as one of the most significant hurdles for Chinese companies like BYD, which aiming to expand its footprint globally. These barriers can increase the cost of exporting vehicles to foreign markets, making products less competitive compared to locally manufactured options. For BYD, navigating these barriers is crucial for its strategy to penetrate and thrive in markets outside China.

BYD has faced trade barriers head-on, notably in its attempts to enter the US market. The persistence of tariffs from the Trump era has made direct car sales challenging. At the moment, US customs authorities are currently imposing a 25% tariff on Chinese EV imports, on top of a 2.5% duty on all imported cars, with consideration at the political level to increase this further.

Despite these obstacles, BYD has strategically maneuvered by focusing on sectors less impacted by tariffs, such as electric buses, where it has established a significant presence in the US. Looking ahead, BYD’s ability to negotiate these trade barriers will be pivotal. The company is exploring manufacturing or assembly options within target markets like Mexico to circumvent tariffs, similar to what other foreign automakers have done.

The double-edged sword effect of BYD’s subsidy reliance strategy

BYD’s ascent in the electric vehicle (EV) market has been significantly bolstered by its past reliance on Chinese government subsidies, particularly notable before 2020. This financial support, peaking at approximately USD 1 million in 2016, was pivotal for BYD, enabling the development, manufacture, and marketing of plug-in hybrids and battery electric vehicles. Overall, from 2008 through 2022, BYD disclosed that it received a substantial sum of USD 2.6 billion in government assistance.

Nonetheless, this reliance on subsidies has garnered international attention, especially from the European Union, which is launching an investigation into the competitive edge these subsidies grant Chinese firms abroad. The investigation also scrutinizes other support forms, like mandates for local taxi companies to exclusively purchase BYD electric cars. This inquiry poses the risk of imposing tariffs on Chinese-made EVs, threatening BYD’s competitive stance in crucial international markets.

Labor shortages in the electric vehicles market in China

A notable issue is the acute shortage of skilled technicians and engineers, a demand far outstripping the supply. In 2021, Beijing reported a glaring discrepancy between the number of available jobs for skilled technicians and the number of qualified individuals, emphasizing the need for a significant increase in trained professionals in the industry.

Yet this concern has been hinted at as early as 2016 when the Ministry of Industry and Information Technology had already highlighted a significant gap. The ministry projected a demand for 1.2 million workers by 2025 far outstripping the current supply of skilled workforce estimated at barely 170,000. This shortage has been exacerbated by a cultural shift towards white-collar aspirations among college graduates, who prefer careers in internet companies and civil services over manufacturing roles.

There are government efforts to redirect students towards industry-relevant vocational education that have clashed with parental aspirations, leading to a 25% decline in vocational and technical high school enrollments between 2010 and 2021. Moreover, China’s factories are facing constant outflows of young talent, witnessing a 40% decrease in the population of 18-year-olds since the mid-1980s.

Shaping the future of the electric vehicles market in China

- China’s booming EV market, where BYD holds a dominant position, accounts for over 40% of the country’s new car market share, with projections indicating it will surpass 50% by next year.

- BYD’s market dominance is underscored by its remarkable surge in global vehicle sales, growing from 427,302 vehicles in 2020 to over 3 million in 2023, marking a seven-fold increase.

- BYD faces rising competition from companies like Tesla, Huawei, and Xiaomi, prompting substantial investments of $14 billion in assisted driving technology and deploying 4,000 engineers to maintain its competitive edge.

- Despite its innovative edge, BYD navigates challenges such as international trade barriers, with US tariffs imposing a 25% duty on Chinese EV imports, and labor shortages, posing obstacles to its growth trajectory.