Despite most Chinese people’s lactose intolerance, consumption of yogurt in China is set to increase in the next years. As the demand for healthier choices continues to rise, the yogurt industry is undergoing significant innovation and transformation, presenting ample opportunities for brands to find themselves a spot in this expanding market segment.

Download the full report on the She economy in China!

China’s yogurt market produces the most revenue worldwide

The size of China’s yogurt market is expected to exceed RMB 210 billion in 2023. Most of the global revenue in yogurt is produced in China, where the market will likely grow annually at a CAGR of 9%.

Within the Chinese yogurt market, there are two distinct varieties to consider, according to their storage temperatures. Low-temperature yogurt, favored for its superior taste and nutrition, comes with a shorter shelf life and demands specialized logistics, including cold chain technology for transportation to the retail destination.

In contrast, room-temperature yogurt boasts a longer shelf life but is often perceived as nutritionally inferior. Historically, room-temperature yogurt prevailed due to limited refrigeration in retail channels. However, with rapid economic development, cold yogurt has gained popularity, valued by consumers for its taste and nutritional benefits.

Low- and room-temperature yogurts: different growth prospects

Room-temperature yogurt largely dominates the market, boasting nearly double the transaction volume of its low-temperature counterpart in 2021. Nevertheless, while the former experienced a growth rate of 6.1% from 2016 to 2021, this growth is anticipated to slow down to 3.6% between 2021 and 2026. Conversely, low-temperature yogurt has exhibited a remarkable growth rate of 14.3% and is projected to maintain a steady growth of 11.4% in the forecasted period from 2021 to 2026, thus narrowing the gap between the two varieties.

Health consciousness is the main driver of the market

As Chinese people increasingly prioritize healthy lifestyles, people prefer low-fat, zero-additives options, with little-to-no sugar and with a high protein content. Yogurts are seen as nutritious drinks that provide probiotics and vitamins. The government is also actively encouraging the consumption of milk and yogurt, as evidenced in their “Healthy China Initiative (2019–2030)”, a guideline whose purpose is to prevent diseases and promote a healthy lifestyle for all citizens.

Chinese yogurt brands dominate the scene

The main yogurt brands in China are domestic. According to the webpage Paizi Wang (牌子网), the best-ranking brands in the market for quality and price are: Yili’s Ambrosial (安慕希), specializing in Greek yogurt, Junlebao (君乐宝), Yili (伊利), Mengniu’s Chunzhen (纯甄) and Guangming’s Moslian (莫斯利安).

The only foreign brand that made it to the top 10 is Japan’s Yakult (养乐多), ranking 8th.

As Chinese yogurt brands lead, foreign companies mostly contribute to the market by exporting raw materials, like milk, and cutting-edge technology, used to process local products. In fact, Chinese people generally distrust their local diary market, because of various food scandals like the melamine incident in 2008, and believe it is safer for them to buy products from well-established big brands, which are transparent about the origin of their ingredients. Hence, it might be complex for new brands to successfully enter the market.

Ambrosial: the fresh taste of Greek yogurt

Ambrosial is a high-end room-temperature yogurt brand established by the Chinese company Yili in 2014. What sets it apart from other products in the market is the high-protein content, around 35% higher than the average drink, and its thick and creamy texture.

In addition to its exceptional taste and nutritional benefits, Yili’s brand has a history of highly effective marketing campaigns. With the support of influential brand ambassadors such as Dilraba Dilmurat, Yang Ying, Cai Xukun, and more recently, NBA player Stephen Curry, the brand has successfully captured the attention of younger generations. It has cultivated an image of being both fashionable and nutritious, resonating well with its target audience.

Simple Love: the brand which revitalized the low-temperature yogurt segment

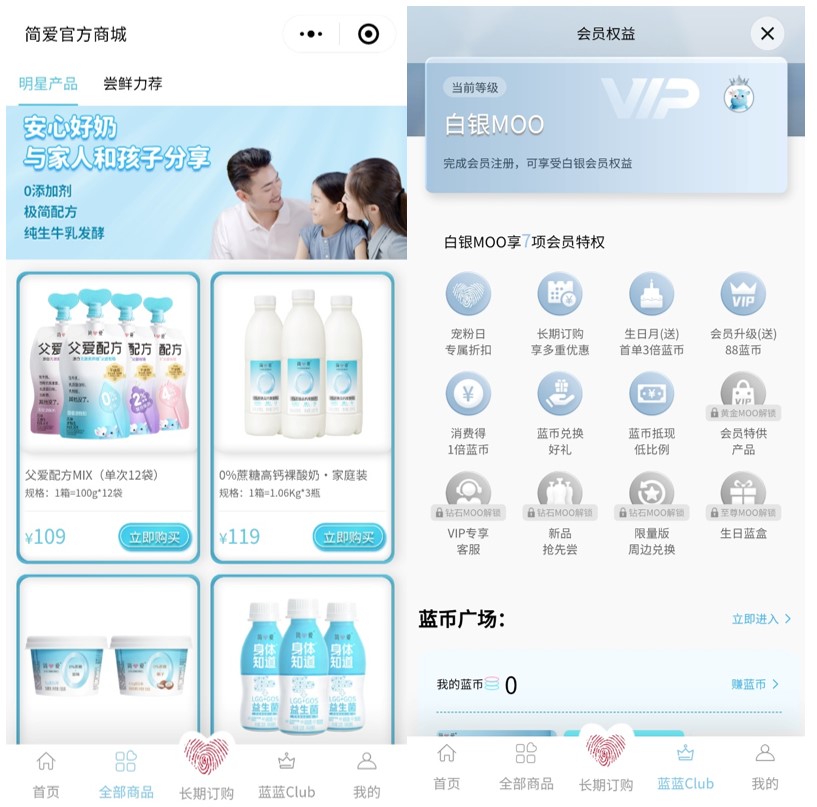

Simple Love (简爱) is a high-end brand established in June 2016 under the Pucheng Diary Group (朴诚乳业). It is renowned for its zero-additive low-temperature yogurts and its commitment to R&D, in fact it uses machines imported from France, Italy, and Denmark.

Within 5 years, the brand grew by over 160%, ranking among the top brands in the sector. The founder Xia Haitong stated that between 2018 and 2020, Simple Love’s sales surged sixfold, from 300 million to an impressive 2 billion, with annual sales surpassing RMB 3 billion.

Its unexpected popularity can be attributed to the fact that prior to them, the low-temperature yogurt market had been more or less overseen. Simple Love brought new life to the segment with its best-selling products “父爱配方” (The Love of a Father Formula) and “身体知道” (The Body Knows).

The brand is active on social media, like Douyin and Xiaohongshu, and uses celebrity endorsements to cater to the young adult audience between 22-40 years old.

Instead of the usual offline retail channels, Simple Love has opted for new retail channels, a new kind of business model encompassing both online and offline services. It can be found in Hema, Wal-Mart, Lawson, FamilyMart, 7-Eleven as well as on e-commerce platforms, specifically, JD, Tmall and WeChat.

From room-to-low-temperature and now freshly-made yogurt

While low-temperature yogurt started challenging the room-temperature counterpart’s predominance in the market, another competitor emerged in the varied Chinese landscape. Freshly-made yogurt started gaining popularity in around 2020, when the popularity wave which hit freshly-brewed tea drinks subsided and people started looking for something more refreshing and nutritious. It is then that already-existing offline stores gained momentum and won a name for themselves.

Blueglass, “the Hermès of yogurt”

Founded in 2012, Blueglass is an offline high-end yogurt store, specializing in low-temperature freshly-made yogurts. It is particularly renowned for its collagen yogurt formula, which is said to help beautify the skin. To ensure the quality of its offerings, the brand meticulously manages its entire production process, from sourcing milk through its 10,000 Holstein cows to importing fresh, high-quality ingredients from overseas. Blueglass adheres to the brand concept of “craftsmanship, responsibility, sharing, and change”. With the high unit price (around RMB 40) and the commitment to producing excellence, it has earned the title of “the Hermès of yogurt”.

More Yogurt is in rapid expansion

More Yogurt (茉酸奶) was first established in Shanghai in 2014. Ever since, it has opened more than 1,000 shops nationwide, mainly selling products following the formula “yogurt + fresh fruit + nut toppings”. It is collocated in the mid-to-high-end, with the price range varying between RMB 20 to 35.

The brand recently started a process of store expansion, and the number of stores has already tripled within half a year. The brand’s co-founder Gu Hao has announced their intention to reach between 1,300 to 1,600 offline stores by the end of 2023.

More Yogurt rises controversies for its high price and low quality products

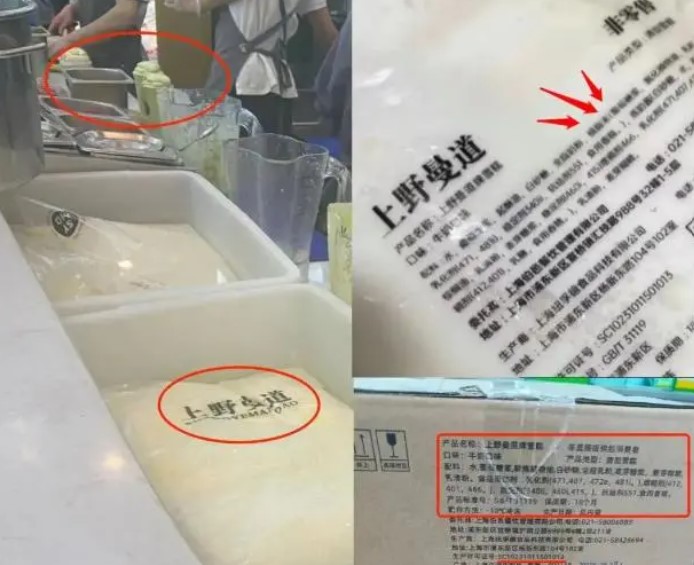

In July this year, the brand was involved in a controversy regarding the composition of its milk base, as suspicions arose that it contained non-dairy creamer rather than actual milk.

The turmoil started when the brand conducted a survey asking consumers how much they were willing to pay a cup of the soon-to-be-released Musang King Durian Milkshake, offering options of RMB 68, 88, or 108. The questionnaire sparked discussions on whether high price was justified. Soon after, a picture listing the ingredients used in their products circulated on Weibo, which included refined vegetable oil, indeed also known as non-dairy creamer.

On July 31st, the brand recalled all its products and four days later they announced they will change the base formula to use imported milk powder. This controversy has undeniably tarnished the brand’s image, and its prospects for recovery remain uncertain.

More Yogurt’s case is exemplary of how difficult it might be to maintain a good reputation in the Chinese market. Chinese consumers highly value transparency and are all ready to take down those brands they perceive to be dishonest. It is crucial to practice extra care when acting in this environment, as the greatest success might always quickly become the worst failure.

China’s thriving yogurt market: trends, brands, and challenges

- China’s yogurt market is set to surpass RMB 210 billion in 2023, with most of the global revenue generated in the country and an expected annual growth rate of 9%.

- Chinese yogurt comes in two main varieties based on storage temperature: low-temperature yogurt – favored for its taste and nutrition but with a shorter shelf life – and room-temperature yogurt, which has a longer shelf life but is seen as less nutritious.

- Health consciousness is driving consumption of yogurt in China, with a preference for low-fat, additive-free, low-sugar, high-protein options.

- Major Chinese yogurt brands include Yili’s Ambrosial, Junlebao, Yili, Mengniu’s Chunzhen, and Guangming’s Moslian.

- Ambrosial is one of the most appreciated brands in the room-temperature segment, while Simple Love is gaining traction with its zero-additive low-temperature yogurt.

- Among the freshly-made yogurt chains, Blueglass and More Yogurt are the most prominent ones.

- More Yogurt faced controversy in July due to suspicions about its milk base composition, leading to a product recall and plans to change the milk base.