In recent years, the Chinese milk market has experienced continuous growth in sales. Consumers are increasingly more aware of the nutritional benefits of dairy products and are more willing to buy milk, especially healthier options with high protein, calcium, and vitamin B content.

In China’s competitive market, it can be a challenge for new brands to find their spot among the many competitors. While competition may be tough, companies that can fulfill the demand with high-quality products and effective marketing strategies have a good chance of success.

How the Chinese milk market evolved over the years

The 2008 melamine scandal and government’s efforts to pick up the pieces

In 2008, the Chinese milk market was implicated in probably the worst scandal that the food industry in China has ever seen. Traces of melamine – a toxic industrial compound generally used in plastics and fertilizers– were found in locally produced infant milk powder. Apparently, the substance was supposed to boost the milk protein content, but after four months of the discovery, around 300,000 babies fell sick and 6 babies died of kidney malfunctioning.

As a consequence, trust in local brands plummeted, leading to a 92% drop in their exports. Since then, the government has actively worked to improve the safety of locally produced milk, as well as to help domestic brands win over consumers’ trust once again.

From 2016 to today: new regulations and a fast-growing domestic milk production

The implementation of new regulations has resulted in a pass rate above 99.8% for dairy products in China in 2018, indicating a successful standardization of food safety laws. The domestic production of liquid milk experienced a year-over-year (YoY) increase of 9.6%, reaching 25.801 million tons in the third quarter of 2021, while powdered milk output amounted to 871 thousand tons in the same year, with a YoY variation of 0.4%. With these figures, China now ranks fourth among the world major diary producers.

New Zealand is China’s first milk importer

Since 2010, imports in the fluid milk sectors have seen a rapid increase. In 2020, the three major importers were New Zealand, Germany and Australia, holding 35%, 25% and 9% of the imported milk market share respectively. The reasons behind such a growth can be attributed to Chinese consumers’ increased attention towards food safety, to their new diet habits, as well as to the more favourable transportation costs and the reduced customs duties. The tariff applied to New Zealand imported milk declined from 13.5% in 2008 to zero in 2019 and a similar agreement was reached with Australia too.

The main two categories of milk: liquid milk and powdered milk

The milk market in China is mainly constituted by two categories: liquid and powdered milk.

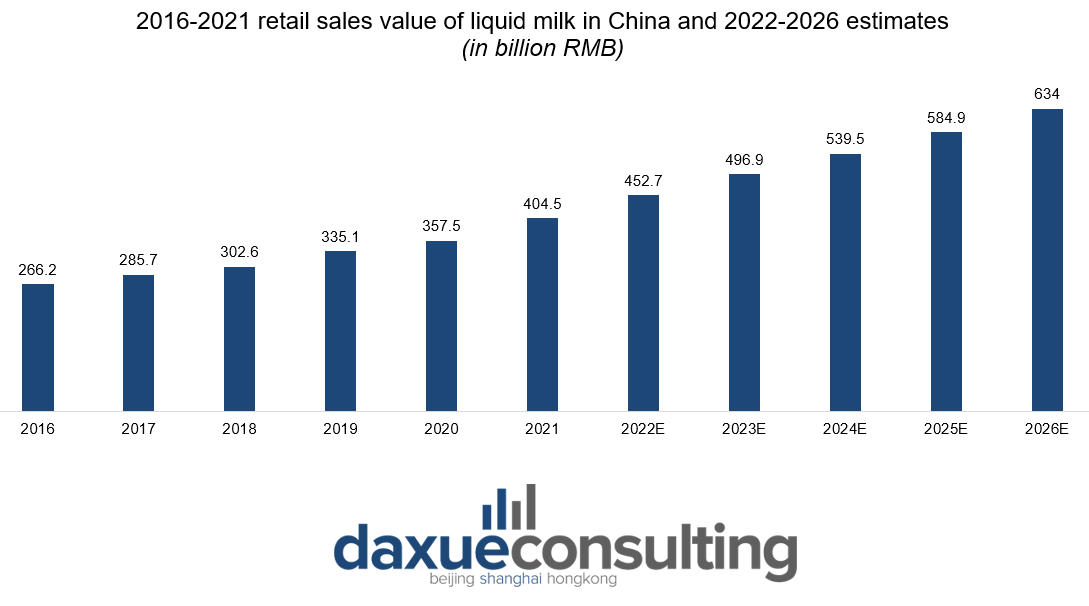

The former includes both the Ultra Heat Treatment (UHT) and the pasteurised milk, as well as other smaller sectors like flavoured milk. In response to a new interest towards milk and its nutritional intakes, the retail sales of liquid milk in China has generated more than RMB 400 billion (around USD 57 billion) in 2021 and it is forecasted to surpass RMB 600 billion (USD 86 billion) by 2026.

Even though liquid milk accounts for over 42% of dairy consumption, powdered milk also plays an important role in the Chinese milk market.

According to Statista, skimmed milk powder consumption amounted to 446 thousand metric tons in 2021 and it is expected to reach 521.3 thousand metric tons by 2027. On the other hand, consumption of whole milk powder reached 1.8 million metric tons in the same year, corresponding to 1.25 kg per capita.

The retail sales value of the Chinese milk market as a whole was around USD 24 billion in 2020.

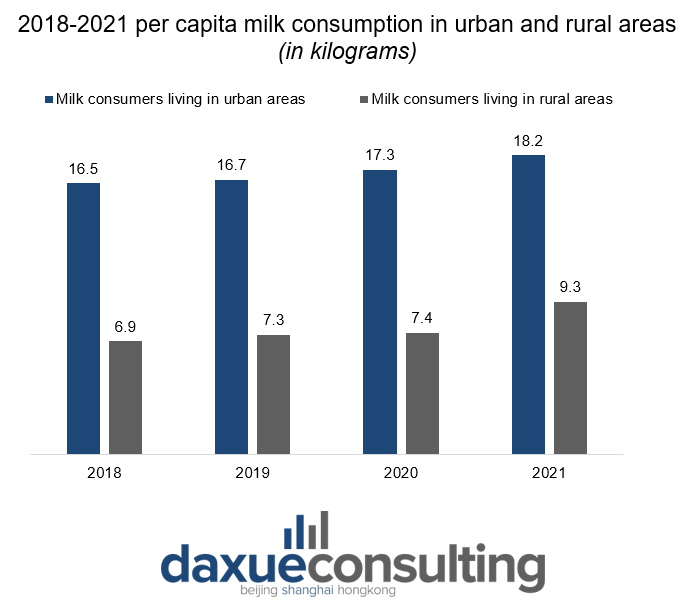

People in urban settings drink more milk

China is the second largest consumer of dairy products worldwide. It is estimated that in 2025, the Chinese dairy market will produce RMB 540 billion (almost USD 78 billion) in retail sales. However, the market has not yet reached its full potential.

People living in rural settings consume half the amount of milk of those living in cities. With China’s rapidly growing economy, it may become more efficient to transport fresh dairy products to these rural areas, potentially increasing the consumption of milk in those regions. This could have a positive impact on the Chinese milk market as a whole.

Rapid growth of dairy product consumption in China

Since 1990s, the demand for dairy products in China has witnessed an incredible growth. What most adults previously labelled as food for children is now considered to be an indispensable source of calcium and protein for all ages. In 2020, the government and several nutritional associations even released new guidelines which suggested to consume at least 300 grams a day of dairy products to have a healthier lifestyle.

Liquid milk vs powdered milk: Which category do Chinese prefer?

Liquid milk and powdered milk are similar in terms of nutrients while different in terms of taste, form, and price. Powdered milk is obtained through a process of dehydration of pasteurised milk, but its composition can vary depending on the brand. It has the advantage of being a long-lasting product, as it does not need to be refrigerated. However, its taste is considerably different from the one of liquid milk, yet it can be perfectly consumed with smoothies, tea and filtered coffee.

Although liquid milk is still leading the market, dry dairy products – which include powdered milk and condensed milk – are becoming more and more popular.

Reviving the flavoured milk market with healthy and quality ingredients

Flavoured milk is a drink made with milk, sugar, flavourings, and various other food additives. Sales in this category have declined from 2014 to 2017, likely due to growing health awareness and the perception that drinks containing food additives are unhealthy.

However, some brands have responded by offering flavoured milk containing a higher percentage of milk – 80% or more – and using quality ingredients. Despite their desire for healthy food, young consumers have not lost their taste for delicious flavours, and flavoured milk with specific nutrients – like vitamin B or probiotics – may result very appealing to Chinese consumers.

Homegrown brands lead the Chinese milk market

In 2022, the Chinese milk output amounted to around 39.32 million metric tons, 2.49 million tons more than in the previous year. The main milk producers are Yili (伊利) and Mengniu (蒙牛), who dominate the diary market in China as essentially a duopoly. According to the e-commerce big data analysis firm Jingcanmou (鲸参谋), in 2022 the two companies generated 58% of the dairy products sales on JD.com (Yili 27.9%, Mengniu 30.2%).

Mengniu: a company in continuous expansion

2022 was a great year for the Chinese company Mengniu. Its annual total sales in the milk and dairy market surpassed the 60 million units, worth more than RMB 3.9 billion (USD 562 million). The company’s best-selling product for the year was its pure milk (纯牛奶), which generated around RMB 270 million (USD 39 million) in sales.

Mengniu is among the world’s top 10 dairy brands. Over the years, it has launched other successful brands, among which Deluxe, Zhen Guo Li and Weilaixing, and has expanded its exports to over 10 countries. Starting from 2016, it has been building a supply chain overseas by acquiring companies in Australia and Indonesia, including Bellamy’s Organic, a milk powder manufacturer.

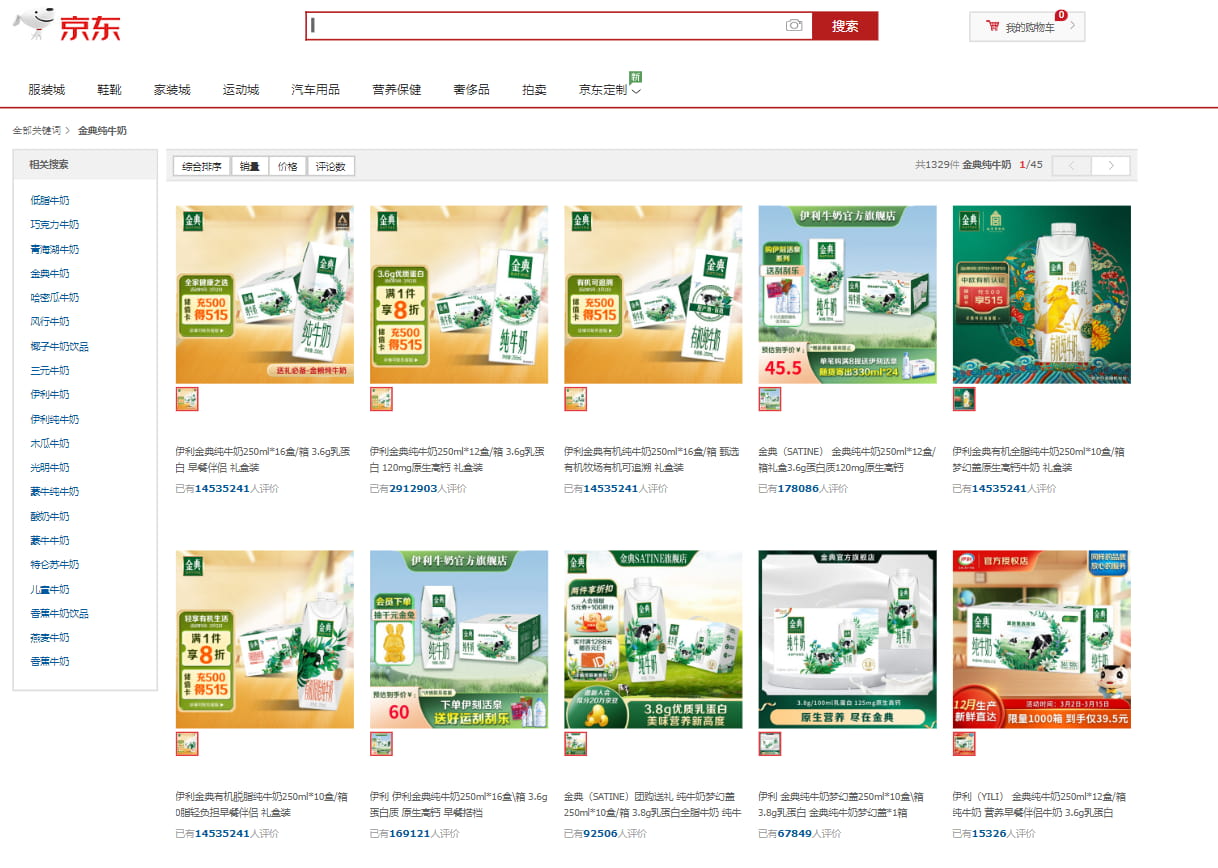

Yili: an innovative brand

In 2022, Yili’s sales performance on JD.com was slightly lower than that of its competitor Mengniu. The company produced RMB 3.6 billion (around USD 519 million) in sales, with a total volume of more than 56 million units. Its best-selling product on JD.com for that year was its Jindian Milk Protein Pure Milk (金典乳蛋白纯牛奶), with a total of 5.19 million units sold, generating RMB 350 million (USD 50 million) in sales.

The secret behind Yili’s success can be attributed to the quality of its products and its strong control over the supply chain. The company has developed a “smart farm” system to improve its cows management and it has financed “smart factories” endowed with an end-to-end traceability that gathers data and analyses it.

Yili made innovation its strong point. It developed different products depending on consumers’ needs and founded 15 innovation centres across Europe, America, Asia and Oceania. It also invested in other 20 sub-brands, like Satine, ShuHua and Wei Ke Zi. It ranks 5th among the dairy companies worldwide and it is the first company in Asia.

New opportunities for foreign brands

As of 2020, the direct-to-consumer market share of foreign brands had declined steadily from 52% in 2016 to only 23%.

However, following the introduction of new policies that lowered the customs duties and made imports from more than 50 countries easier in 2022, the foreign presence in China’s milk market is expected to grow.

Innovating for success: adapting to changing consumer demands in China’s milk industry

Chinese people prefer to purchase milk in small packages. The reason is simple: they do not drink much milk all at once, also because they tend to be lactose intolerant. More than 90% of people from the Han ethnic group have issues digesting lactose. As a consequence, if they were to buy fresh milk in big bottles, after a few days the milk would lose its freshness and taste.

Moreover, Chinese people tend to carry their drinks around, for instance to work or to school, so single serving small packs result to be more convenient for this purpose.

Creativity is the key to win consumers’ attention

Chinese people love exotic flavours, unusual products, and eye-catching packaging. To attract consumer’s curiosity, creativity must be the company’s driving force.

An example of effective creative business plan is the one developed by the brand Adopt a Cow (认养一头牛). Founded in 2016, the company only sells milk that comes from its owned-farm cows. It raises calves from the moment of their birth and checks daily their health condition and nutrition. The brand’s strength resides in the production chain transparency: Adopt a Cow livestreams the farms where the cows grow up in and it tells their backstories to the audience. In a market where consumers want to be reassured about the quality of what they eat and drink, Adopt a Cow not only sells milk, but sells certainties too.

What to keep in mind when entering the Chinese milk market

- Following the 2008 melamine scandal, Chinese consumers’ trust in local brands’ product quality dropped. The government then committed in strengthening food safety laws.

- China is the fourth world diary producer. In 2021, its output of liquid milk and powdered milk corresponded to around 25.801 million tons and 871 thousand tons respectively. However, China also needs to import milk from overseas.

- The milk market value amounted to around USD 24 billion in 2020. The most popular category is liquid milk, which holds around 42% of the dairy market, and its retail sales generated more than RMB 400 billion (around USD 57 billion) in 2021.

- People living in rural settings consume around 58% less milk than people living in urban areas.

- In response to Chinese consumers’ demand of healthier drinks, companies have revised the formula of flavoured milk. Now, flavoured milk drinks not only match consumers taste, but are nutritious too.

- The milk market in China is essentially contested by two main companies: Yili and Mengniu.

- Following China’s 2022 new policies, foreign brands might have more chances to enter the milk market in the future.

- Chinese consumers prefer to drink milk in small packages and they are fond of unique and unusual products. An effective marketing strategy should value creativity.

Author: Chiara M. Barbera

Read our China wellness market white paper

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast