China hailed as the birthplace of tea with a rich history spanning over 4,000 years, stands as the epicenter of the world’s largest tea market. There are 7 types of tea in China: green tea, yellow tea, white tea, oolong tea, black tea, dark tea, and floral tea. In 2022, the production in the tea market in China soared to approximately 3.35 million metric tons, accounting for nearly half of the world’s total tea output.

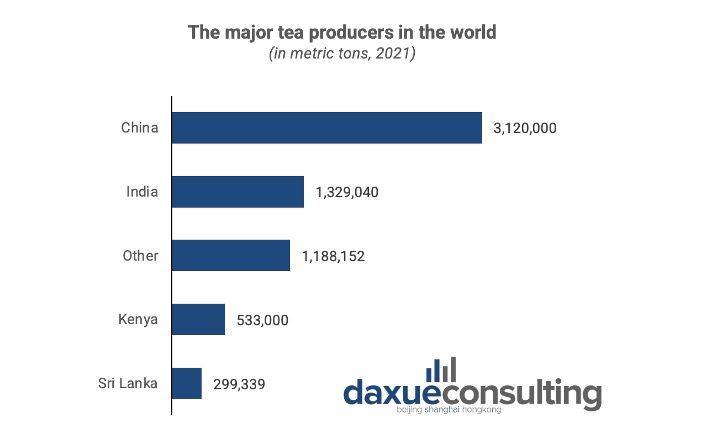

China is the largest tea producer in the world. In 2021, China’s tea production reached around 3.12 million metric tons, witnessing an increase from the 2.74 million metric tons recorded in 2020. The leading tea-exporting nations globally were identified as China, India, Sri Lanka, and Kenya.

Download our China’s F&B industry white paper

The supply chain in China’s tea market includes tea cultivation, fertilization, harvesting, processing, and packaging. Tea leaves go through a transformative journey of being skillfully rolled, dried, and oxidized based on their variants. After this, tea leaves will reach consumers through sales channels such as supermarkets, tea shops, restaurants, and e-commerce platforms in China.

China’s tea production market

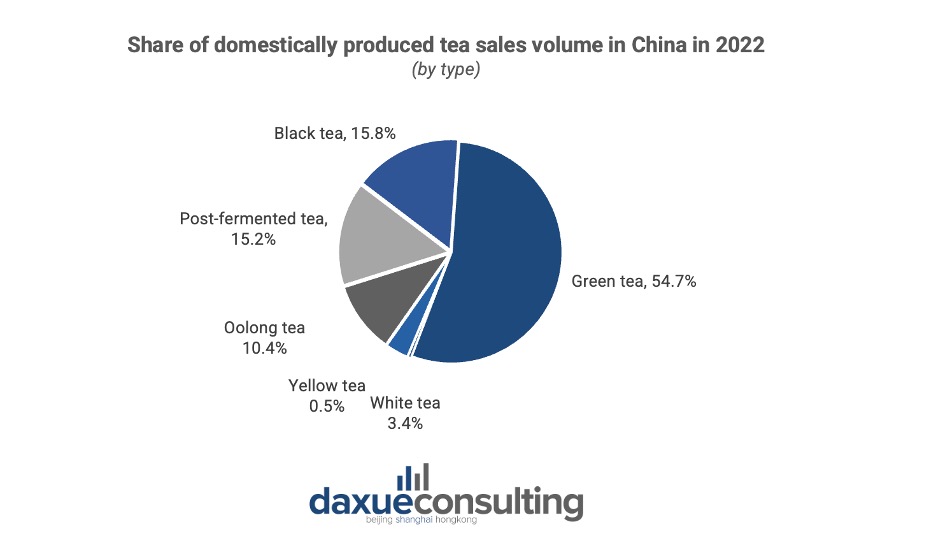

The robustness of black tea, the invigorating freshness of green tea, the harmonious equilibrium of oolong tea, and the calming infusion of herbal tea each provide a distinctive and enchanting sensory experience. The majority of the tea produced was green tea, which had approximately 55% of the total domestically grown tea sales volume in China in 2022. Considering China’s huge market demand, green tea will continue to maintain its competitive advantage for a considerable period. Besides, drinking tea is an important part of Chinese culture and traditional customs.

Moreover, China’s tea sales will maintain an upward trend. Based on a survey of 1,014 participants, approximately 95% of respondents identified as tea drinkers, with nearly one-third indulging in tea consumption on a daily basis. As the income of Chinese residents rises, quality will become an important factor in tea sales. Because of this, the profits of tea shops have experienced a notable uptick in recent years, primarily driven by the burgeoning popularity of freshly brewed concoctions.

China’s demand for tea is rising steadily

China, home to 1.4 billion people, drinks nearly 40% of the world’s tea and craves more. The report suggests that the market valuation of new-style tea beverages in China is poised to exceed RMB 200 billion (equivalent to approximately USD 27.88 billion) by the year 2025.

The new-style tea (新式茶饮)

A notable shift occurred in 2014, marking the rise of new tea varieties and premiumization within China. The new-style tea (新式茶饮) consists of fresh tea leaves and milk or cream. New-style tea represents a fusion of high-quality tea leaves, specifically tea extracts obtained through diverse methods, and the addition of fresh milk, imported cream, natural animal cream, or various fresh fruits. The prevailing variants in the current tea market in China are predominantly milk foam tea (奶盖茶) and fruit tea. The advent of new tea brands, exemplified by Heytea and Naixue Tea around 2015, marked the initiation of a robust growth phase for the new tea market in China. Tea beverages have emerged as favorites among younger Chinese consumers. In 2022, the total count of recently established tea beverage outlets surged to approximately 486,000, marking an impressive growth of over 28% from the 378,000 reported at the end of 2020.

Key characteristics of tea consumers

Increased focus on health and social

Tea consumers in China usually have decent spending power and pursue a high-quality life. Office places are a common place to consume tea. In a survey conducted with Chinese consumers in July 2022, approximately 63% of participants indicated that they consume tea for health-related reasons. Meanwhile, about one-third of the respondents mentioned that they choose to drink tea for its refreshing qualities.

Rising health awareness fuels global tea market growth

Following the onset of the COVID-19 pandemic, there is an undeniable shift towards heightened attention to personal health. While tea leaves may not serve as medicine, they are undeniably health-related products with associated benefits. The COVID-19 outbreak has amplified health awareness among Chinese consumers. A substantial number of individuals now opt for milk tea with minimal or no sugar, while fruit tea gains popularity due to its lower added sugar content and enhanced health benefits. For milk tea brands, incorporating health concepts into their promotional efforts becomes imperative in response to this heightened health consciousness.

How Gen Z influences the tea market in China

A study conducted by the media company Toluna Corporate revealed that in the emerging first-tier cities of China, the consumption of coffee and bubble milk tea is nearly equivalent.

Notably, Generation Z is anticipated to represent about 70% of the participation in new-style tea-drinking experiences, encompassing beverages like milk foam tea and fruit tea, which consistently rank high among Chinese consumers’ preferred tea varieties, besides the traditional styles. The convenience of ordering tea through apps is a common practice, with a keen focus on the brand reputation of the serving company. For instance, Heytea stands out as one of the most popular bubble tea brands in China, boasting over 21.5 million users on its WeChat mini-app and 710,000 followers on the Chinese social media platform Weibo.

Where do Chinese consumers buy tea?

Tea in China has a distinct regional association. On one hand, renowned teas are often named after their place of origin, such as West Lake Longjing (西湖龙井)and Huangshan Maofeng (黃山毛峰). Certain regions in China are particularly celebrated for their tea cultivation. On the other hand, this regional specificity implies that tea leaves from different locations possess unique characteristics. In Fujian, for instance, you can avail yourself of the chance to purchase Tieguanyin oolong tea, a distinctive variety indigenous to the region and abundantly cultivated locally. Chinese consumers still mainly rely on offline channels such as exclusive stores or large supermarkets in China. Tea businesses might explore diverse channels, integrating online and offline strategies to attract customers. Factors like quality, convenience, positive experience, and competitive pricing should be considered in channel construction.

The leading brands in China’s new-style tea market

Most of the direct-sale shops are high-end brands. They are more concentrated in the first-tier cities with higher prices but fewer offline stores. It means franchises are helpful for expansion but not for a high-end image. There is little variation in in-store menus, which means there is a trend of product homogeneity in the market.

Lipton’s (立顿) path to success in China

Lipton is the largest foreign tea brand in China. It is a black tea brand from England. In 1992, Lipton officially entered China and started to sell black tea and green tea.

Due to the high quality and clear target market, Lipton in China achieved very large sales and market share. Lipton’s owner Unilever, invested USD 50 million in Anhui (安徽) province to build one of the biggest tea factories in the world at that time. In 2008, the total annual output value of Lipton was about RMB 23 billion, which was almost 2/3 of the output value of China’s tea bag industry.

How Lipton built itself as a mainstream tea brand

Upon entering China, Lipton introduced standardized design and production for its tea products, achieving widespread market coverage and building brand awareness. Unlike other foreign tea brands that use Chinese distributors to sell products from abroad, Lipton invested in a local factory and local workforce, reducing costs and successfully localizing the brand. This strategic move allowed Lipton to promptly respond to the preferences of Chinese consumers. In 2008, Lipton was one of the first international brands advertising on the mobile Internet in China. The brand was also one of the first to use e-commerce in China.

Lipton targets Chinese white-collar workers and young adults with its tea bags

Tea is traditionally a leisure product. Therefore, many Chinese brands target middle-aged and elderly people, who have more leisure time. Most Chinese tea brands sell loose-leaf tea, which can make people enjoy the process of brewing tea. Lipton mainly targets white-collar workers in China and young adults in urban areas. The brand uses its tea bag as a competitive difference in the tea market in China because it is convenient and safer. It also greatly simplified the steps of drinking tea in China.

Lipton is facing great challenges in China

In 2019, Lipton faced a decline in profits, encountering challenges in the competitive Chinese tea market. The brand’s affordable pricing strategy necessitates high sales for revenue, but it struggles to appeal to the creativity-seeking demographic of Chinese young adults (21-30 years old). Lipton faces increased competition from Chinese brands that understand consumer preferences, offer creative packaging, and employ advanced marketing strategies (such as KOLs in China). As socializing becomes integral for young people, tea is not just a beverage but a fashion and ceremonial expression. To boost sales, traditional tea brands, including Lipton, must prioritize both quality and aesthetic appeal.

China’s tea Renaissance: navigating aesthetic trends and health consciousness

- The tea market globally is anticipated to reach USD 160 billion by 2028, with a yearly growth rate of 5.92%. China, as the leading tea producer, contributed 3.35 million metric tons in 2022, constituting almost half of the world’s production. The rise of new-style teas, exemplified by Heytea and Naixue Tea, resulted in a significant increase in tea outlets.

- Chinese consumer preferences are shifting, driven by health consciousness, with a preference for low-sugar options like milk tea and fruit tea. Gen Z plays a crucial role in influencing trends, emphasizing on-the-go purchases.

- Tea choices in China are regionally influenced, impacting consumer decisions. Traditional brands must adapt to evolving preferences and consider appearance as a vital factor alongside taste and quality.

- Lipton, the prominent foreign tea brand, faces challenges like reduced profits and changing consumer tastes, necessitating innovation to stay competitive.

- The evolving China’s tea market emphasizes the importance of aesthetics alongside traditional aspects, reflecting changing consumer dynamics and preferences.