WeChat Mini Programs are lightweight applications that exist within the WeChat platform. Unlike traditional apps, users don’t need to download them separately. They are cost-effective, developed with HTML, JavaScript, and CSS, and designed to provide a simple, enjoyable user experience.

Understanding WeChat mini programs

WeChat MPs eliminate the need for separate app downloads, work wherever WeChat is available worldwide, and are cost-effective as developers don’t need to create different versions for various operating systems. Their limited size ensures straightforward and easy-to-use functions.

The categorization of MPs

MPs can be categorized into three types:

1. Business framework model

Consisting a main mini program serving as the core platform, and a constellation of satellite mini program supporting marketing efforts, this model is used by many well-established companies like JD, KFC, and Pop Mart.This model consists of two parts: the main mini program and the satellite mini program.

2. Touchpoint/scenario model

Companies categorize their consumers into distinct groups based on their interactions or engagement points with the brand and utilize MPs to carry out conversion and repurchase in accordance with consumption patterns. Watsons, Perfect Diary, and Winona use this type of MPs.

3. Segmented consumer model

This model involves creating mini programs tailored to specific consumer characteristics, enhancing the shopping experience. Companies that use this model include IKEA and Mixue.

Growing numbers of users are adopting WeChat mini programs

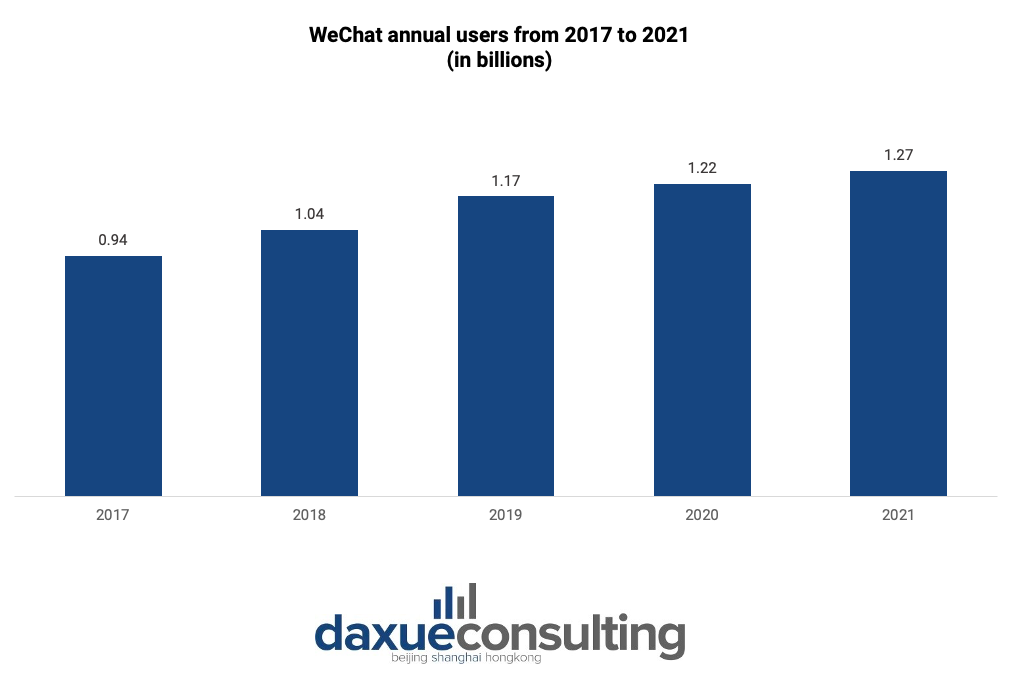

WeChat is one of the most popular social media platforms in China. As of the third quarter of 2022, there were more than 1.3 billion WeChat users globally, recording a 3.6% quarterly growth.57.9% of China’s population, or around 811 million people, are using WeChat in 2022, meaning that China is home to around two-thirds of all WeChat users.

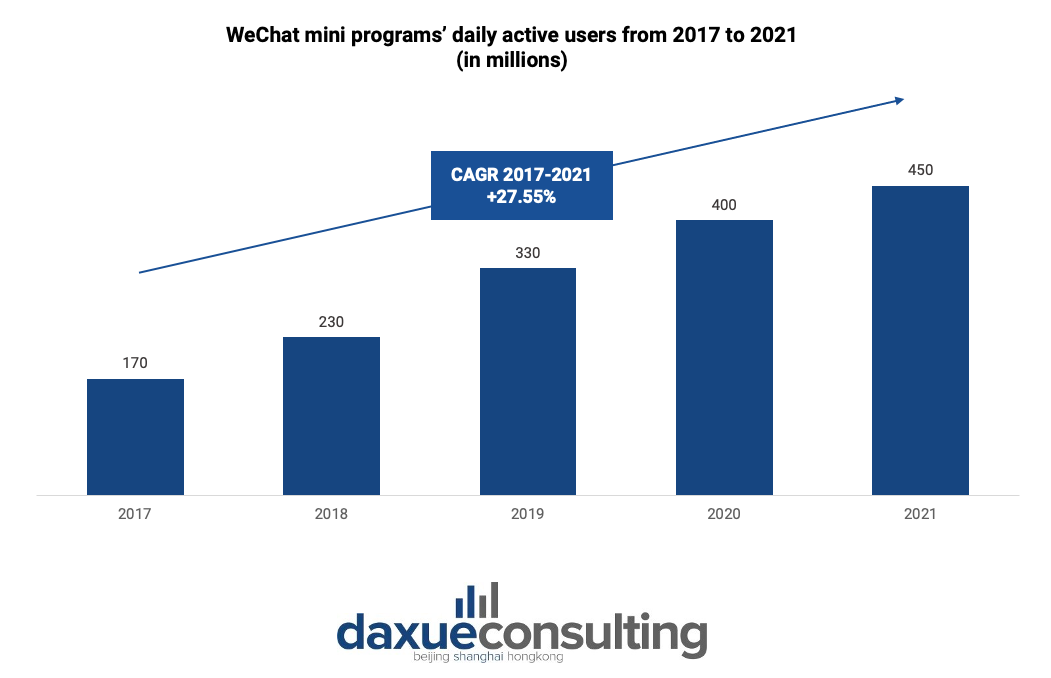

It is estimated that in 2021, WeChat MPs vaunted more than 450 million daily active users, with an average daily usage increase of 32% year-on-year. In that same year, WeChat had 3.5 million mini programs that handled 2.7 trillion RMB in transactions while the number of WeChat MP developers was approximated to surpass 3 million.

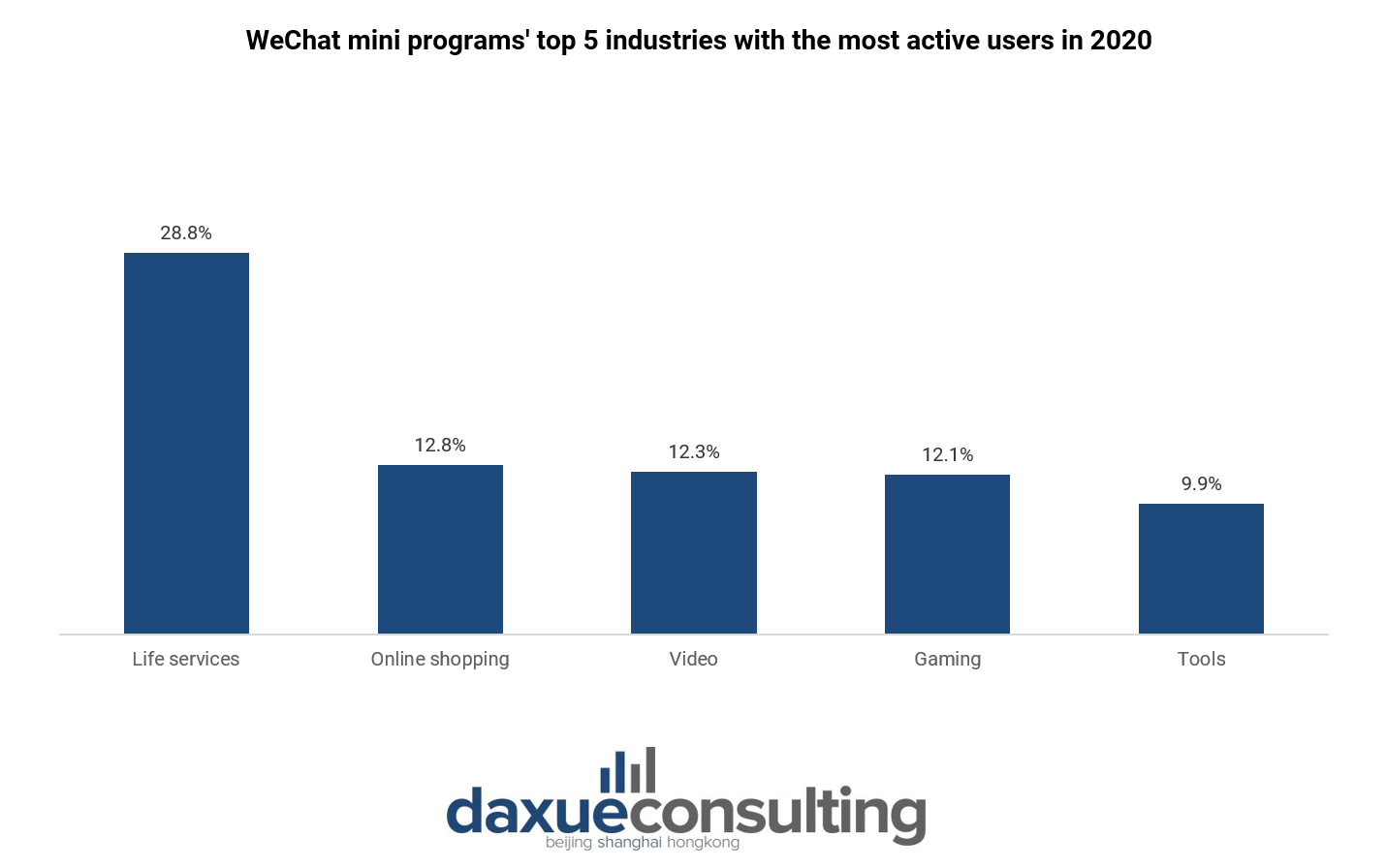

In 2020, daily life-related mini programs such as Didi, Meituan, Dianping, had the highest number of active users. Following closely behind were e-commerce MPs, with a share of 12.8%.

How to set up a WeChat mini program

Individuals, companies, governmental bodies, media, and other organizations can join WeChat MPs. Users need first to set up an account and log in to the public WeChat platform. The platform will then ask them to provide their name, logo, introduction, and service details. The functions of a mini program can be created and modified using appropriate tools. Before it can be released, the user must send the code for their mini program to the WeChat team for review and approval.

The importance of WeChat mini programs for businesses

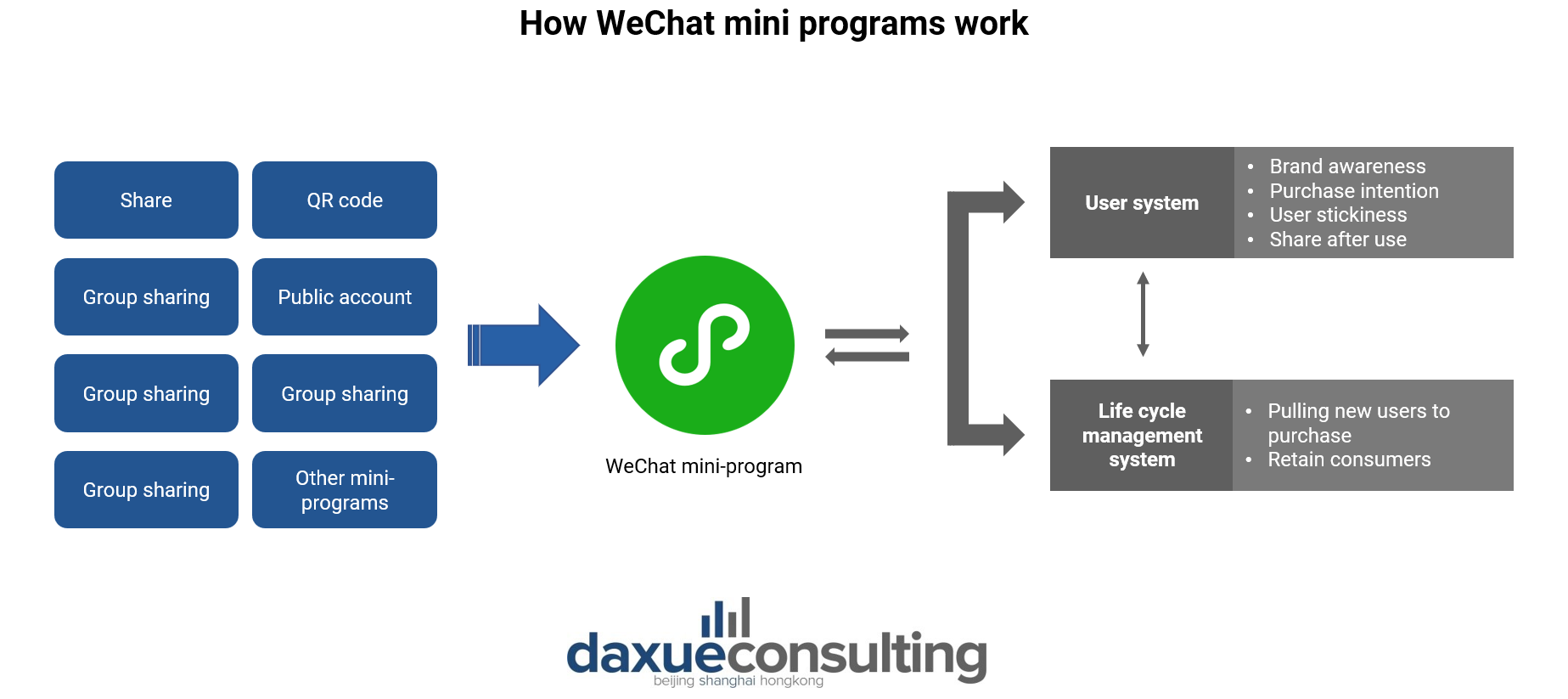

WeChat MPs offer valuable consumer data and simplify transactions through WeChat Pay. They enable businesses to track the entire consumer journey and make data-driven decisions.

Younger generations use WeChat MPs to buy essential goods

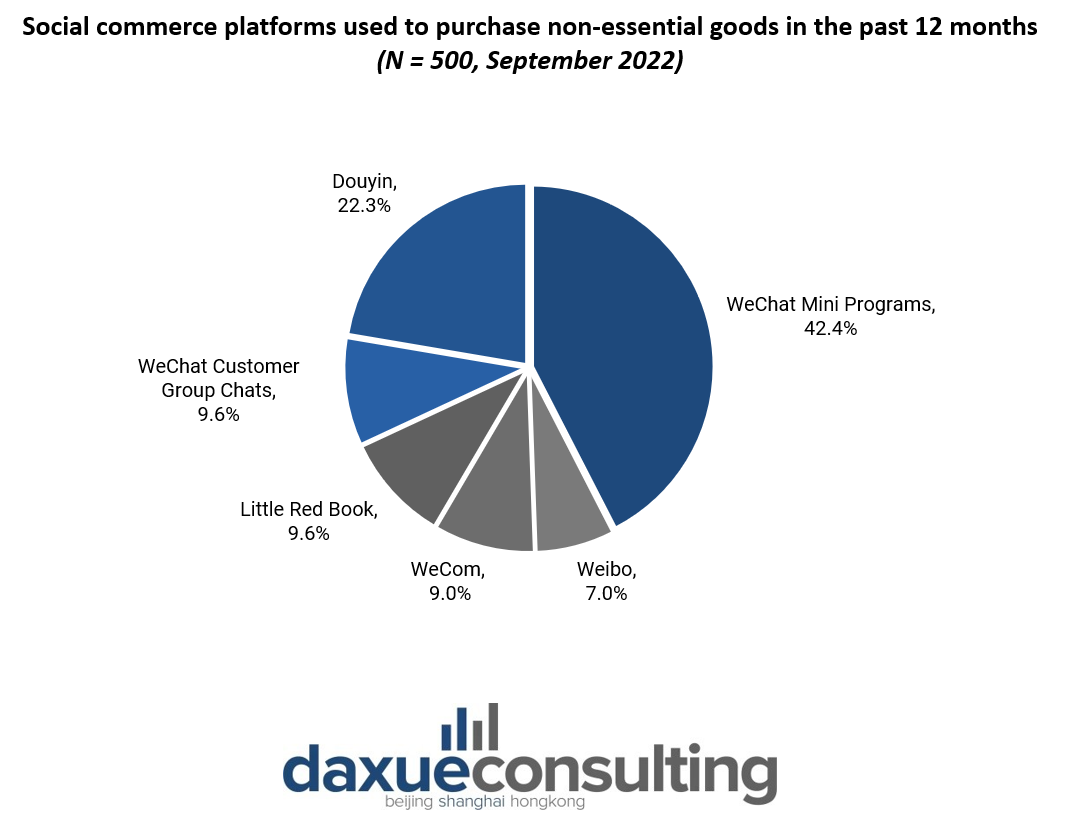

According to a survey conducted by ChatLabs, out of 500 Gen Zs surveyed, 42.4% reported purchasing non-essential goods through WeChat MP in 2022. This highlights the potential for businesses to tap into the Gen Z market by having a WeChat MP.

E-commerce and group buying in WeChat MPs

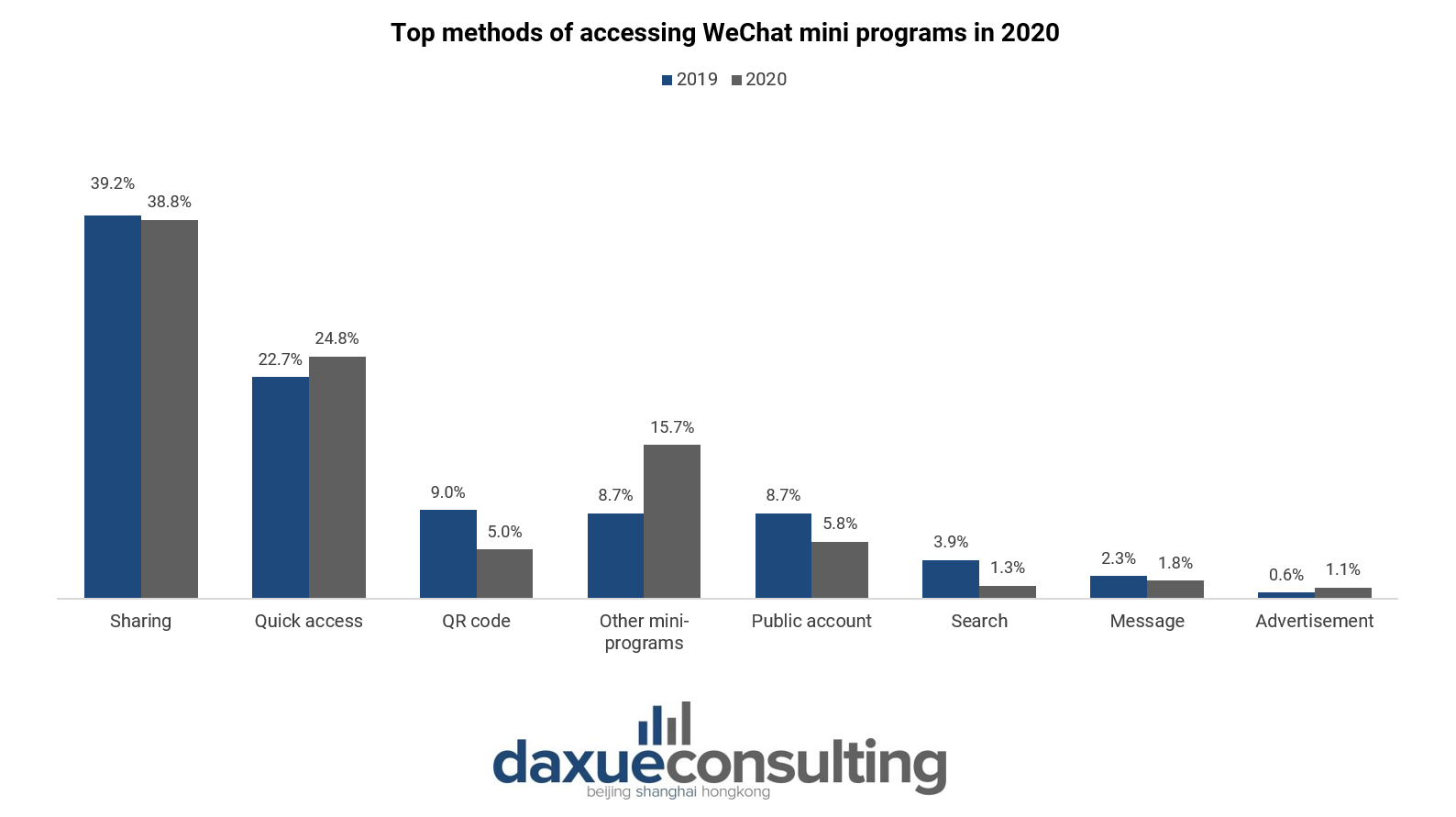

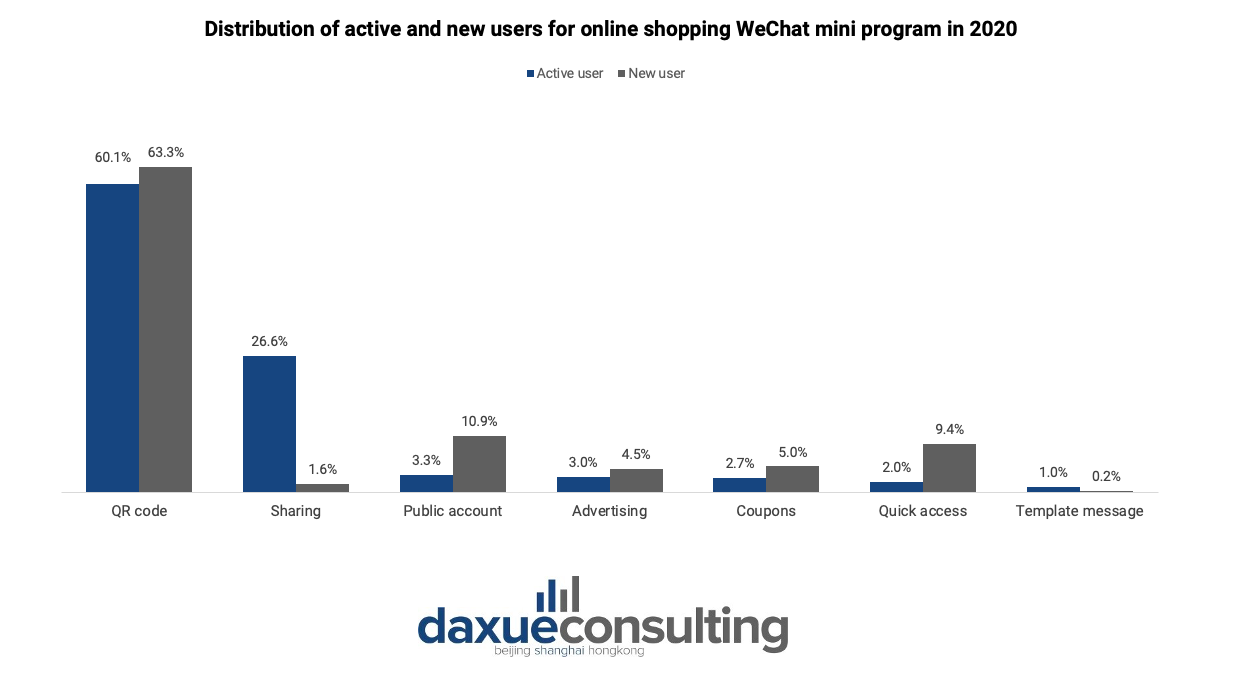

The pandemic has had a significant impact on the way people shop, and this is reflected in the increasing use of WeChat MPs for online shopping. Businesses have witnessed both heightened user retention and increased new user acquisition. To leverage this trend, companies should invest in their own WeChat MPs. It’s crucial to emphasize that QR code scanning remains the primary access method for WeChat MPs. Therefore, ensuring the easy availability of QR codes is imperative for businesses. By creating accessible WeChat MPs, enterprises can tap into this expanding market and attract more customers.

WeChat MPs have also become an important infrastructure when it comes to community group buying. Group buying refers to when clients receive discounts on goods that they buy in bulk with their network. Users can easily select the goods they want to purchase and pay through WeChat. Along with traditional e-commerce, group buying has become one of the primary methods of online purchasing in WeChat MPs in 2020.

How WeChat mini programs help brands connect with customers

As WeChat MPs provide companies the ability to track a consumer’s entire purchase journey and allows the integration of CRM platforms to track clicks and conversions, firms can accurately measure the impact of their marketing campaigns. This enables them to make data-driven business decisions, adjust their strategies, and attract more consumers.

1. O2O e-commerce mini program

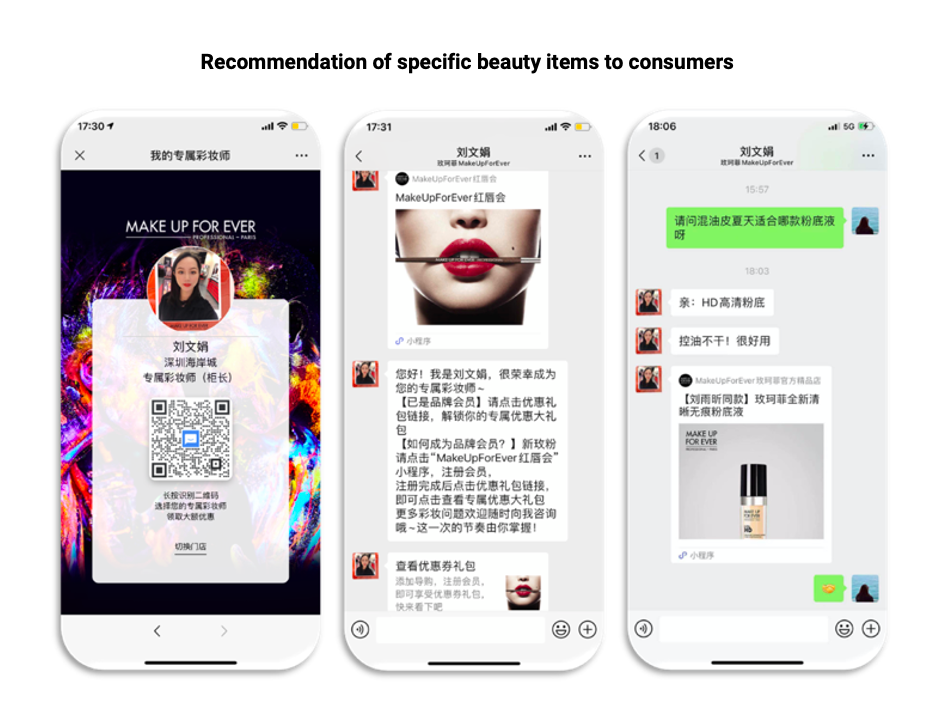

Integrating a brand’s WeChat official account with user membership accounts offers seamless access to real-time information. Brands leverage live-streaming channels to present products and engage in discussions. In this context, cosmetic brands utilize WeChat Mini Programs to facilitate product communication and connect beauty consultants with clients.

2. Membership and private cart mini program

Luxury brands in China offer a variety of tools on their WeChat MPs, such as personalized shopping carts tailored to client preferences, which can be accessed through a unique QR code. Customers have the flexibility to select either in-store pickup or home delivery options. Additionally, some Mini Programs offer exclusive benefits, cash-back gift cards, and progress tracking for reward programs.

Mini programs offer brand independence compared to the marketplaces

Although popular e-commerce sites like Tmall and JD.com provide businesses with a great deal of organic user traffic, there are some drawbacks.

These marketplace platforms host tens of thousands of merchants which means that each seller would only have a limited time and space to promote their goods and brand value. This leads to aggressive price competition as potential buyers can easily compare the cost of each product. Additionally, it is difficult for small players to compete in such platforms as merchants pay for advertisements to increase their search rank. WeChat MPs, on the other hand, can mitigate these disadvantages.

The drawbacks of utilizing WeChat MPs

WeChat Mini Programs, while valuable, have drawbacks. They lack push notification functionality, requiring users to actively open the program for updates. Sharing options are limited, hindering organic growth. Communication is restricted, as broadcast messages are unavailable. Data handling is inflexible, limited to WeChat standardized data. Notably, these limitations may not suit all businesses, as websites or native apps may be more effective for certain needs. Weighing these constraints against the platform’s benefits is essential to determine whether WeChat MPs align with specific business objectives.

Case study: Sephora

Sephora, a renowned French multinational retailer with 340 brands and its private label, expanded into Greater China with 300 premium offline stores. Sephora formally opened its WeChat MP shop in September 2018, providing Chinese customers with extensive social engagement and a seamless shopping experience.

Implementing an omnichannel strategy through WeChat’s omni-touchpoints and private domain tools, Sephora strengthened consumer connections and increased product sales. During the 2021 “618” shopping festival, Sephora’s MP store achieved a sales record more than US$100 million GMV, reflecting a growth of over 60% YoY.

WeChat MPs: a growing trend among users and brands

- WeChat MPs are different from conventional applications in that they offer a simple, affordable, and flexible solution. They are easy to develop and can be easily added or removed as needed. Moreover, the number of WeChat MP users is on the rise.

- The value of WeChat MPs lies in the ecosystem they create, the improved efficiency they offer, and the user data they can provide to the brand.

- Mini programs are becoming increasingly popular among developers and users, with 42.4% of Gen Zs buying non-essential goods through WeChat MPs.

- They are an important driver for WeChat’s growth in both user base and advertising revenues, from both Chinese and foreign brands.