Over the years, Chinese consumers have displayed a growing willingness to invest in home décor as a way to enhance their quality of life. Thus, IKEA in China has risen as a result of China’s growing furniture market.

In 2022, the Swedish furniture brand announced the successful completion of the three-year strategy and fulfillment of the investment target, which included a RMB 10 billion investment in 2020. Looking ahead, the furnishing giant has ambitious plans and intends to invest over RMB 5 billion by 2023 to further develop business digitalization, construct new stores and shopping malls as well as integrate multiple distribution channels. IKEA aims to continue its mission of reimagining offline shopping and fostering an omnichannel customer experience. Notably, IKEA’s online channels garnered over 5 billion visitors in 2021.

Download our report on the She Economy in China

A brief dive into China’s furniture market

Strong growth is expected in China’s furniture market, projecting a CAGR of 11.6% from 2022 onwards and reaching RMB 1 trillion in 2026. Also, with an annual growth of 20% the custom-made furniture market is on the rise, expecting to reach RMB 334 billion by 2024. The demand comes from the younger generation, who tends to pursue “home-style” living. Demand for children’s furniture is also rising due to the implementation of the three-child policy under the Chinese government’s 14th Five-Year Plan.

Furniture manufacturing trends in China

Domestic demand for furniture, in particular from continued urbanization, is the main driver of the Chinese furniture market. A unique characteristic common for Chinese consumers is the Guochao wave, as Chinese consumers are now increasingly demanding domestic brands, furniture, and home décor products that reflect China’s rich cultural heritage.

Chinese consumers have also become highly conscious of both the environmental impacts and materials used in the furniture they purchase. Many consumers even consider the appearance and design of their furniture to be secondary to the above factors. In terms of materials, metal furniture and wooden furniture together account for more than 90% of the furniture manufactured in China. Noting the rolling out of national environmental policies under the 14th Five-Year Plan, manufacturers must adhere to “green manufacturing”. The advent of green manufacturing is expected to be pivotal in the future of furniture production, reevaluating materials usage and pollutant emissions factors.

China is a major anchor point for manufacturing in IKEA, with suppliers manufacturing over 22% of IKEA’s entire product range. Today, the Swedish brand performs well in its sustainability practices. It actively promotes the company’s motto “Becoming People & Planet Positive”. However, the sheer scale of IKEA’s production makes fully implementing sustainable practices throughout the supply chain highly ambitious.

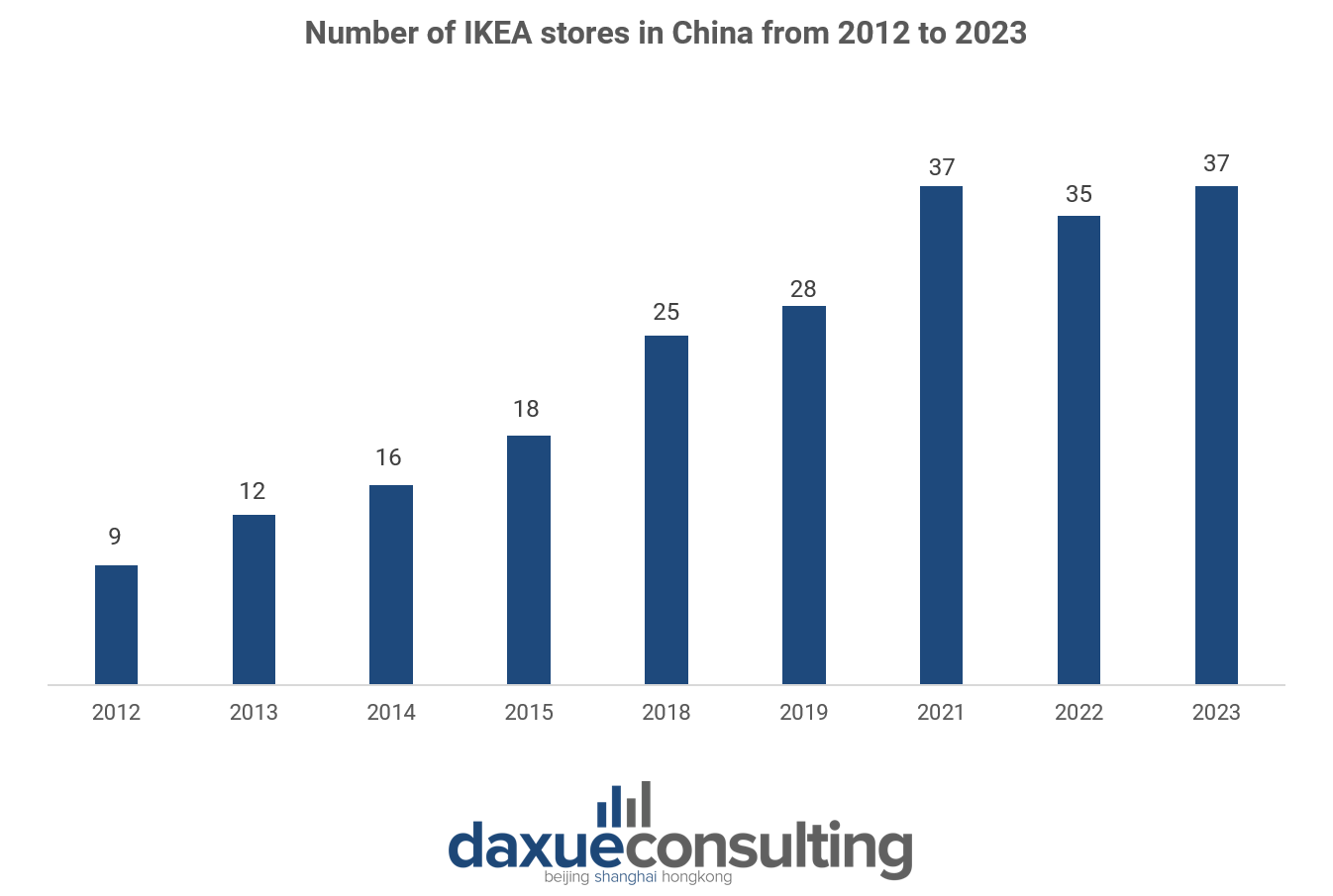

IKEA’s brick-and-mortar storefronts in China

As of October 2023, IKEA has 37 stores across China, including 34 shopping malls, one city store, and two experience shops. This is following the the closure of a Guizhou store in April 2022 the consequent closure of the Shanghai Yangpu store in early July 2022, marking the historic closure of 2 stores in China within three months.

However, IKEA remains optimistic about the Chinese market. On the contrary, based on the latest updates by Ingka Group in 2023 Swedish furniture giant was visited by 697 million people, which is 7.5% higher than the previous year. Today, IKEA in China is confident in the dynamism and resilience of the Chinese economy, enjoying the complete supply chain–from design to retail–that the Chinese market affords. Lastly, the brand aims to optimize its customer touchpoints and distribution ecosystem for consumers and market trends, elevating an omnichannel customer experience.

New, innovative storefronts

IKEA revealed plans for renewed storefronts in the 2022 kick-off meeting as part of its business development strategy for the Chinese market. IKEA believes that Chinese consumers are developing more diverse, sophisticated needs, and need ways to express their emotions and values through home décor.

To fulfill customers’ needs in the era of “new-retail”, IKEA Xuhui Shanghai will become IKEA’s first “Home Experience of Tomorrow” store. The concept store was opened in late 2021 and uses innovative visual design, interactive experiences, and social co-creation as its cornerstones.

A key paradigm shift within IKEA’s new store strategy in China is the abandoning of the typical guided path of IKEA stores. Instead, the Swedish brand aims to utilize an open layout providing customers freedom on where they would like to shop.

Another key aspect of the store experience is its “inspiration spaces”, focusing on creating curated home décor spaces that provide customers with inspiration for their own interior design needs. In addition, the new store aims to create a community hub within its walls by allocating physical spaces for workshops, knowledge-sharing, and entertainment in regard to home life.

Ultimately, IKEA in China aims to accommodate Chinese consumers’ desire for a richer, more authentic home life by offering design inspiration and social interaction, instead of only being a furniture retail store.

IKEA’s strategy in the Chinese market

In China, IKEA uses digital channels, such as Chinese social media and micro-blogging, for its marketing campaigns to gain market attractiveness and brand recognition. IKEA also adjusted its store location strategy for Chinese consumers. Chinese consumers increasingly value convenience, so IKEA has also shifted from the classic ‘blue box’ store to more convenient storefronts closer to urban centers within cities, as well as further investing in facilitating e-commerce purchases. Overall, IKEA continuously adapts its strategies to the rapidly changing environment in China.

Standardization of vision and mission

“To create a better everyday life for many people” is IKEA’s overarching vision, with the business objective being to “offer a wide range of well-designed, functional home furnishing products at prices so low that as many people as possible will be able to afford them.”

To execute this business objective, the Swedish furniture brand applies the same business model (including the store interiors, range of products and services, management style, etc.) in all of its stores globally. Furthermore, the consistently minimalist design language in all of IKEA’s products is highly popular among younger Chinese consumers, a key customer group for IKEA.

Renovative sales channels and e-commerce

With e-commerce as a key driver of the Chinese economy, IKEA kept pace by updating its sales channels. IKEA launched an online shopping service for Shanghai in 2016 and two years later, the service expanded to 149 cities in China. IKEA’s focus on e-commerce and delivery allows it to minimize costs and delivery fees to maintain and expand its customer base.

In 2020, IKEA also opened its first mini-store in China, an “IKEA City” located in Shanghai’s bustling Jing’an district. The mall has 3,500 items on display, but customers can also access an additional 6,000 items through a digital platform. As a retailer that once only operated “big-box” malls on the outskirts of cities, IKEA in China plans to increase convenience, accessibility, and flexibility for consumers living fast-paced lives in highly urbanized Chinese cities.

Now, IKEA’s omnichannel shopping experience in China is composed of brick-and-mortar stores, a mini-WeChat program, mobile applications, IKEA’s website, and a flagship online store on Tmall. These channels work in unison to provide avenues for shopping as well as ongoing customer support.

IKEA pop-up stores in China

Posting about shopping experiences on social media platforms is key consumer behavior in China that the Swedish furniture brand successfully grasped. In 2019, IKEA launched its pop-up store in Beijing focusing on contemporary attitudes and aesthetics. It was a major hit on Chinese social media, with many young consumers visiting the store and posting about their experiences. By the end of September 2019, IKEA also opened two concept stores selling modern, innovative items, aiming to utilize word-of-mouth marketing through social media.

Pop-up stores play a key role in IKEA’s strategy in China. In 2021, one opened in Kunming with a “delivery parcel” theme. In 2022, the Swedish furniture brand also opened a pop-up store in Hong Kong focusing on environmentally friendly and sustainability-produced items as well as the use of recycled and recyclable materials.

Service and product localization

Apart from the signature Swedish dishes, IKEA cafeterias in China serve localized dishes in order to fit local tastes. For example, there is dim sum in Guangdong, customers can enjoy Sichuanese hotpot in Sichuan, and spicy crayfish are the common dishes in Shandong. More recently, IKEA launched traditional Chinese New Year puddings as well as the famed “Buddha jumps over the wall” dish in 2021 for the holiday.

This strategy helps enrich customers’ experience and retain them in IKEA stores, while also the Swedish brand ensures to add to the novelty by keeping localized dishes as limited-time offerings. However, to keep an authentic brand atmosphere and distinguish their creations from traditional Chinese cuisines, IKEA incorporates a Nordic spin to their dishes.

Turning controversial customer behavior into business opportunities

In the mid-2010s, the Swedish brand was confronted with a troubling phenomenon: customers in China would sleep and relax on displayed furniture in IKEA’s stores. IKEA came under pressure to respond to these customers’ behavior, especially as IKEA prohibits this behavior in stores outside of the PRC.

However, IKEA announced that they had no intention of prohibiting customers in China from sleeping on their furniture. The rationale was that the more consumers were able to experience using IKEA’s furniture, the more they are likely to purchase. The Swedish furniture brand even established pop-up displays for customers to rest on. Although IKEA generally standardizes the store policy, they were willing to adjust it for the Chinese customer base.

IKEA’s path to be the furnishing giant in China

- Guochao and green manufacturing are key trends in the Chinese furniture industry that IKEA utilizes to capture the Chinese market.

- IKEA identified that physical storefronts must become more engaging and immersive to truly differentiate offline from online shopping.

- IKEA in China focuses on an omnichannel shopping experience that makes purchasing as easy as possible for customers.

- For the Swedish furniture brand, social media marketing and word-of-mouth are key strategies for building brand equity and recognition.

- Localization and integration as a strategic benefit: IKEA retains beloved foreign cultural aspects while also catering to local tastes and preferences.