NITORI (宜得利), also known as “Japanese IKEA”, has maintained a remarkable 35-year streak rising sales and profits since the 1987 fiscal year. While navigating challenges like Japan’s economic bubble and industry competition, the Japanese furniture brand transformed from a workshop into a multinational giant. However, its foray into the Chinese market has seen a more tempered trajectory, diverging from the success story witnessed in its home country.

Read our report about sustainable fashion in China

Localization is key for NITORI’s strategy in China

NITORI has tactfully embraced a localization strategy in China, aligning with the online shopping habits of local consumers. To resonate with their preferences, the company kicked off by setting up a flagship store on both Taobao and Tmall. Taking a cue from successful Taobao fashion stores, NITORI has adopted a dynamic sales approach, introducing fresh products every week to engage its Chinese audience effectively.

Providing customers with a warehouse-to-door shipping service

Another innovation for the Chinese market was introducing a distinct approach in its local stores. In Japan, the company operates three primary store formats, tailored to different sizes and purposes, which includes 2,000 to 4,000 square meters shopping center home decor stores and larger 7,000 square meters home furnishing mega-stores. However, when venturing into China, the Sapporo-based furniture retailer to operate directly from shopping centers instead of replicating the Japanese model. This shift showcased agility in adapting to the local landscape, resulting in a more cost-effective logistics service compared to IKEA. Moreover, instead of maintaining inventory in Chinese stores, NITORI directly ships items from the logistics center to customers, thereby minimizing delivery costs as well as appealing consumers with the perk of free shipping.

Commitment to Chinese consumer preferences

With a focus on catering to the unique tastes and demands of the Chinese market, NITORI differentiates itself through product design and sales models. Nearly 60% of merchandise is designed based on local consumer preferences, incorporating traditional Chinese design elements. The brand’s proactive efforts in cultural blending resulted in a unique offering that resonates with contemporary aesthetics. The remaining 40%, developed collaboratively between Japanese and Chinese teams, reflects a hybrid approach leveraging both established expertise and local insights.

Despite these innovative strategies, NITORI faces a notable revenue and brand influence gap compared to its competitor IKEA in the Chinese market.

NITORI in China is targeting the middle-income demographic

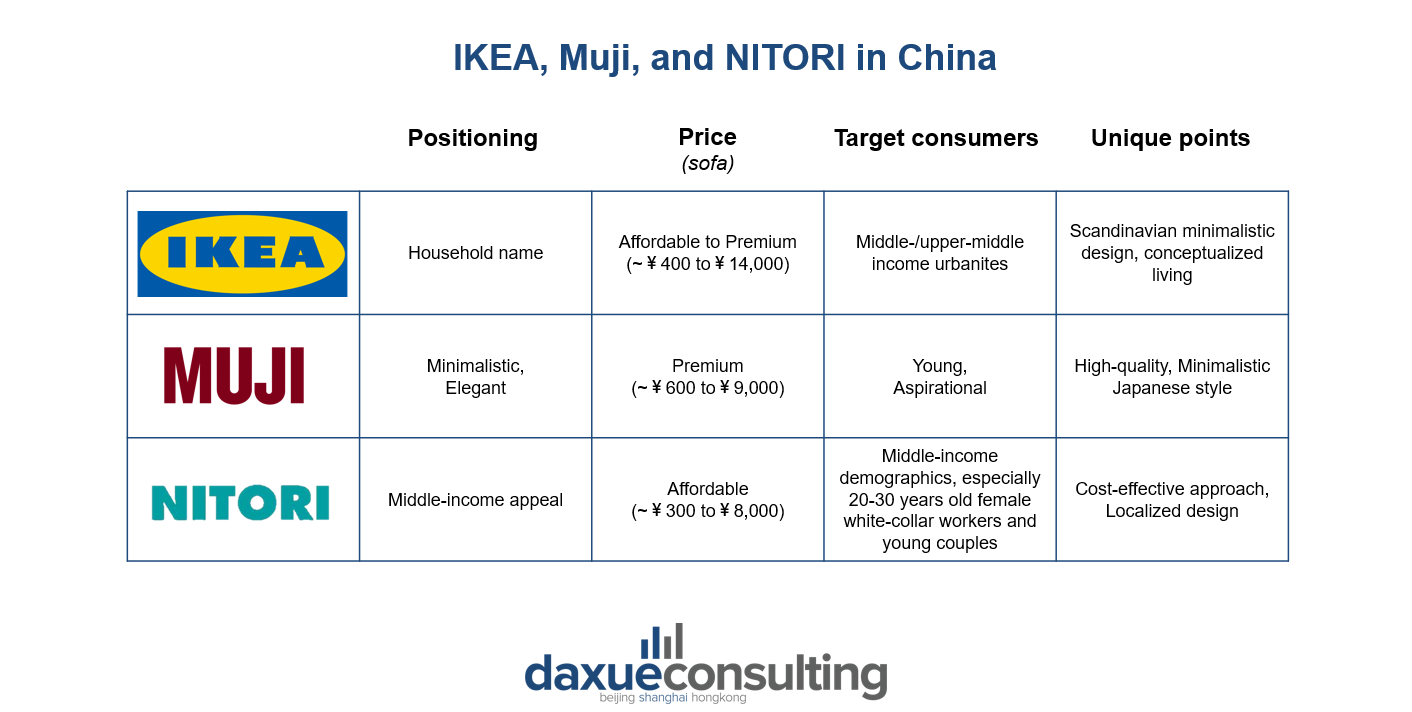

NITORI strategically targets the middle-income demographic in China, distinguishing itself from IKEA’s city-centric focus. A notable pricing difference is observed on Taobao, with NITORI’s highest-priced sofa at 8,990 RMB, nearly half the cost of IKEA’s equivalent product at 14,999 RMB.

When entering the Chinese market in 2014, the Sapporo-based company bypassed fierce competition in first-tier cities like Beijing and Shanghai. Opting for Wuhan as its first location, the company gradually expanded to over a dozen stores in surrounding areas before venturing into Shanghai in 2017. This approach aligns seamlessly with the company’s overarching brand identity of being accessible and budget-friendly, appealing to a broad consumer base. As of January 8, 2024, the brand has 93 stores in China, and plans to open 900 stores by 2032.

NITORI, Muji, and IKEA employ distinct market strategies in China

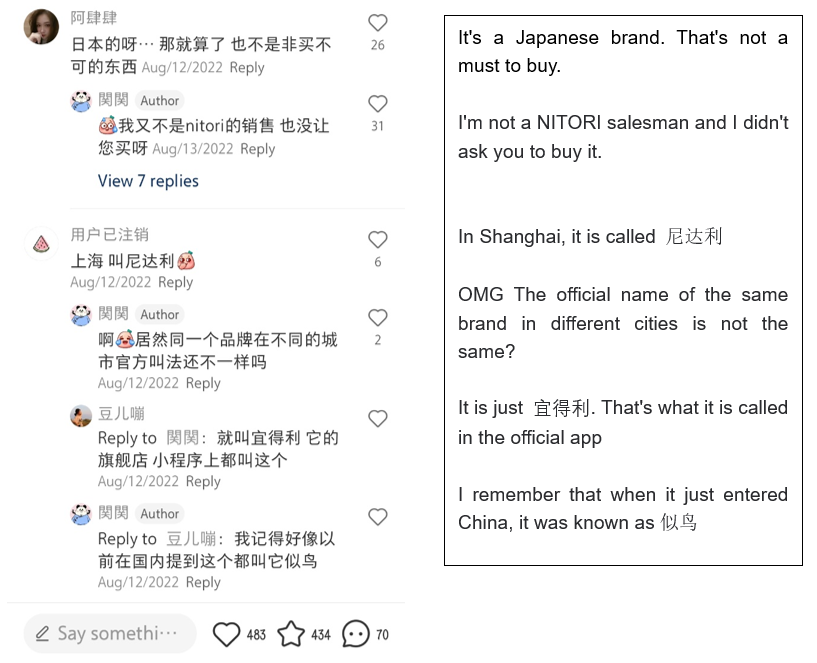

Entering the Chinese market later than rivals IKEA and Muji, NITORI encountered significant challenges in a dynamic and competitive environment. In contrast to IKEA, which solidified its status as a household name with timeless designs and a well-defined home concept, NITORI grappled with brand confusion, having various Chinese names like 似鸟、尼达利、宜得利. This lack of a distinct brand image posed a hurdle to NITORI’s recognition.

In the same landscape, Muji successfully carved its niche by embracing a minimalist Japanese style. Muji’s appeal to a younger demographic was strengthened through high-quality products and an aspirational image, further highlighting the challenges NITORI faced in establishing a unique identity in the Chinese market.

NITORI’s pursuit of affordability and aesthetics in China

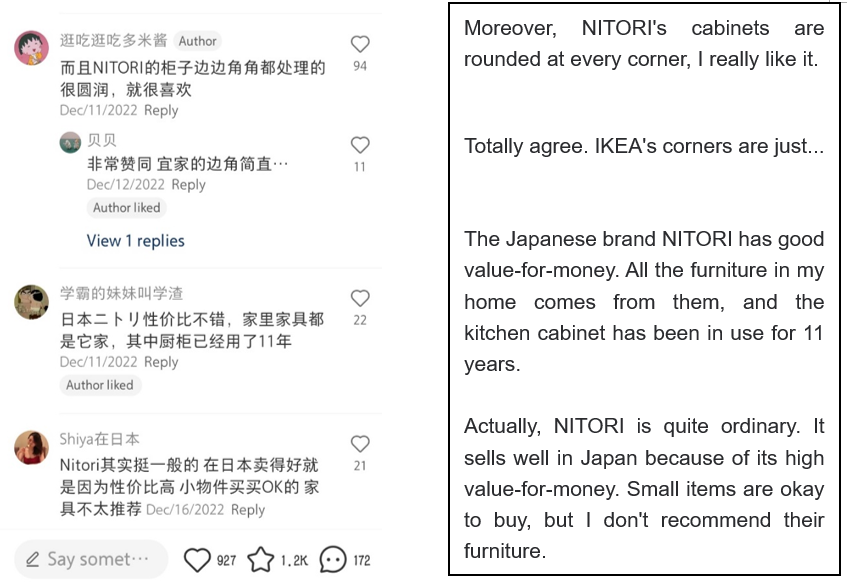

The Japanese furnishing chain NITORI places a strong emphasis on extreme cost efficiency, drawing inspiration from successful models employed by fashion giants like Zara and Gap. However, this cost-cutting focus has, in some cases, led to criticism from Chinese netizens who find its furniture pieces lacking a distinct design style and appearing outdated.

In light of these critiques, the belief that success hinges solely on offering low prices faces a challenge in the Chinese market. While NITORI’s founder, Shosuke Yonezawa, sees “low prices” as a global principle, the Chinese market now prioritizes factors beyond affordability, including materials, style, design, and the conveyed lifestyle. This shift challenges the assumption that providing low prices alone resonates with consumers. Recognizing this change, NITORI is increasingly placing importance on high quality alongside affordability. With discussions on Xiaohongshu exceeding 13 thousand notes, conversations about the brand extend beyond affordability to explore diverse factors such as aesthetic appeal.

The brand successfully gains attention in Hong Kong

As of September 22, 2023, the brand has opened its first store in Hong Kong, with a more favorable reception compared to its mainland China performance. The company plans to expand further, with aspirations to reach a total of 20 stores in Hong Kong by the year 2032.

The brand has successfully generated buzz and fostered engagement online by leveraging the power of social media and prominent video platforms such as YouTube, resulting in a substantial increase in brand awareness.

This success story in Hong Kong is underpinned by a combination of factors. The city’s diverse and cosmopolitan consumer base aligns seamlessly with NITORI’s versatile product offerings. Furthermore, the brand’s commitment to maintaining a delicate balance between cost-effectiveness and unwavering quality strongly resonates with the discerning preferences of Hong Kong residents who prioritize both affordability and enduring value.

NITORI in China: evolving beyond low-cost strategies

- NITORI adapted to the Chinese market by establishing an online presence on Taobao and Tmall, introducing weekly product releases, and diverging from its Japanese store formats to initiate operations directly from shopping centers in China.

- Targeting the middle-income demographic as well as prioritizing second-tier cities, the Sapporo-based brand avoided direct competition with well-established players while maintaining an accessible and budget-friendly brand identity.

- Despite its emphasis on affordability, the Japanese furniture retailer faces challenges in creating a compelling brand identity and engaging younger consumers, contrasting with IKEA and Muji’s success in building emotional connections through design, storytelling, and quality focus.

- The rise of consumer upgrading in China challenges NITORI to shift from solely offering low prices to emphasizing high quality alongside affordability, acknowledging the evolving preferences of consumers regarding materials, style, and lifestyle conveyed by products.

- NITORI’s first store received a favorable reception in Hong Kong, resonating with the city’s diverse consumer base and underscores the brand’s commitment to cost-effectiveness and quality.