How have Taobao on the Chinese internet evolved compared with its Western counterparts?

In many ways, the Great Firewall has allowed China to develop unique applications, and not equivalent versions, of the biggest online platforms the West enjoys. Just as Baidu (百度) is not China’s Google, nor is Tencent (腾讯) China’s Facebook, their similarities are limited at best, and deep complexities of these Chinese platforms offer many more services and functions. As for Alibaba Group (阿里巴巴), it is like Amazon only insofar that they are both online retail stores. While Amazon acts as B2C storefront, Alibaba’s many business arms delve into B2B with 1688.com, C2C with Taobao (淘宝), one of China’s premier consumer-to-consumer marketplaces, established in 2003, and finally B2C with Tmall (天猫), launched in 2008. With over 570 million monthly active users in 2016, Taobao allows small businesses, entrepreneurs, and customers to buy and sell a near endless variety of goods in China.

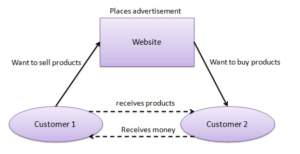

Diagram of C2C Platform (Customer-to-Customer). Source: Daxue Consulting.

In addition, Taobao provides a social element of peer selling that seldom appears on other platforms. Consumers can acquire product information, communicate with other customers, and receive real-time message from venders on Taobao. Sellers are able to post goods for sale or resale, either through a fixed price or by auction. Both buyers and sellers on Taobao are rated with system similar to Uber’s, after which the information is available to all users.

Taobao had around 467 million visitors in June 2017. Taobao is the third most visited website in China after Baidu.com (2.15 billion visitors) and QQ.com (866 million visitors) Source: SimilarWeb

According to Alibaba’s Full Fiscal Year 2017 Results, the number of annual active buyers on the company’s China retail marketplaces had experienced an 11 percent increase throughout 2016, summing up to a total of by the end of the year. Furthermore, mobile monthly active users on Alibaba’s retail marketplaces in China reached 507 million in March. To a considerable extent, the high performance of Alibaba was driven by the large number of mobile users on Taobao. As of May 2016, the Mobile Taobao App had. Evidently, more and more Chinese consumers have been transitioning from the e-commerce platform’s computer to mobile version, where users can share product knowledge, lifestyle content, as well as conduct their sales and purchases. Taobao’s app has shown strong user engagement and retention over the past few years. Daily active users open the Taobao app seven times a day on average, and also post more than 20 million comments every day on the app. The function “Ask Everyone” (问大家), launched in 2016, is becoming more popular in Taobao’s evaluation system, where consumers can raise questions, comments, and concerns about a certain product, and previous consumers of the product can respond.

Distinguishing factors of Taobao on the Chinese internet:

1) Low costs for sellers and buyers

In its infancy, Taobao successfully fended off eBay’s early expansion into China. Alibaba’s founder Jack Ma (马云) was able to do this with Taobao in part because of its competitive cost strategies. These included free listings for the first few years for sellers, and no additional charges for transactions carried out between sellers and buyers. This heightened the interest for sellers to set up online shops on Taobao, while the wide array of goods also encouraged buyers to shop there. Additionally, an online platform named “FuwuShichang” (服务市场, translated by “service marketplace”) was established by Alibaba Group and started operating in the beginning of 2015. It provided additional promotion services to Taobao stores such as website design (100RMB per month), customer service (100-200 RMB per person/month), industry analysis (300RMB per month), customer drainage (200RMB per month) and so on.

2) User-friendly website features

Taobao introduced website features designed to best appeal to local users, such as an instant messaging tool (Aliwangwang阿里旺旺) for facilitating buyer-seller communication, and a payment tool (Alipay支付宝), which offers both security and speed. Online admins on Taobao also used screen names from popular Chinese culture, which have been widely enjoyed by Taobao users. The implementation of consumer-conscious features helped Taobao become a dominant market leader on the Chinese internet within two years of opening. Its market share surged from 8% to 59% between 2003 and 2005, while eBay China plunged from 79% to 36%. By 2006, eBay was no longer able to compete, and exited China to partner with the Hong Kong firm Tom Online. With one of Taobao’s biggest competitors out of the market, they were able to seize an even greater market share.

Worldwide Top Websites Traffic Ranking ( June 01, 2017) for the category “Shopping > general merchandise”: Taobao ranks fourth behind Amazon, Ebay and Aliexpress. Source: SimilarWeb

In the first quarter of 2017, China’s online retail market totaled 1350,13 billion yuan, dominated by Tmall and Taobao (80.5%). Taobao utilized the weaknesses of its competitors, as well as its own strengths, to seize the opportunities of the market and become a premier e-commerce site in China. As a platform of Chinese origin, Taobao also has the distinct advantage of being more attractive to Chinese netizens. Perhaps one of Taobao’s greatest strengths, however, is its well-established connectivity with Alibaba’s other platforms. “Their products are so well diversified, people can almost find anything they are looking for,” says Shawn Lou, a Daxue project manager. “From a market seller’s perspective: I think the biggest strength is their enormous amount of online traffic, Taobao means Taobao market, the Tmall domestic market, and the Tmall international market combined. Sellers on Taobao can enjoy the traffic from all these three channels, which I think no other major e-commerce platforms can offer”.

[ctt template=”2″ link=”4cdOs” via=”yes” ] China dominates worldwide e-commerce: in the first quarter of 2017, China’s online retail market totaled 1350,13 billion yuan.[/ctt]

Even at first glance, the Taobao site is full of information, but also intuitive to access. Indeed, Chinese netizens like websites that are packed with a lot of information and aesthetically pleasing.

“Sellers on Taobao can enjoy the traffic from three channels, which I think no other major e-commerce platforms can offer” says Shawn Lou, project manager at Daxue Consulting.

China Top Websites Traffic Ranking ( June 01, 2017) for all categories: Three shopping sites are in the Top 5: Taobao, Tmall and Jingdong. Amazon is placed 38th in the list. Source: SimilarWeb

3) Diversification of marketing models

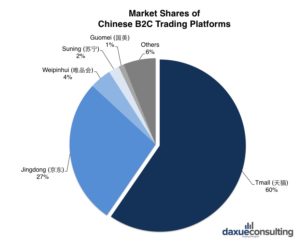

In April 2008, Taobao introduced a new B2C platform called Taobao Mall (淘宝商城) to complement its C2C marketplace. Since then, Taobao has established itself as the destination for quality, attractive goods for Chinese consumers. Taobao Mall launched an independent web domain, Tmall.com, which enhanced its focus on product variety and improvements in shopping experiences. In June 2011, it became an independent business, and then changed its Chinese name to Tian Mao天猫 (Tmall) in January 2012. In 2016, Tmall has grown into China’s largest B2C trading platform, with a market share of 57.5%, followed by Jingdong (京东, 26.2%) and Weipinhui (唯品会, 3.6%). The market share of Chinese B2C trading platform is showed as follows:

Tmall dominates market share among other Chinese B2C platforms. Reproduced by Daxue Consulting from Analysys易观

In May 2013, Alibaba Group began cooperated with several Chinese logistics companies to establish Cainiao Network (菜鸟网络). It aimed to form a shared logistics platform that rents facilities to logistics companies and sellers so they can distribute products better. As for consumer promises, Taobao aims to uphold its delivery window of up to 24 hours anywhere in China, and 72 hours for international destinations in the future. According to a company disclosure, 90% of businesses on Taobao have contract with Cainiao network in regards to their delivery management. According to Alibaba Group’s annual report, Cainiao network enabled 42 million packages per day in June 2016, and there is a total of 1.7 million delivery personnel and 180,000 delivery stations for the platform. Over 70% of Chinese delivery packages operate through the Cainiao network. It provides both the online data management services and offline warehouse and delivery service to consumers and sellers. Consumers can search their delivery information from different logistics company included in Cainiao Network from Cainiao Guoguo (菜鸟裹裹), the mobile app of Cainiao Network. Taobao shop keepers can manage these packages through their different logistics companies in the Cainiao Network as well.

Easy options to track packages and view customer profiles appear in full view on the mobile app Cainiao Guoguo. Photo source: Baidu

As one of Alibaba’s chief online e-commerce platforms, Taobao mainly focuses on the Chinese C2C business where Chinese customers interact with each other directly. In 2017, Alibaba Group expanded the business to incorporate wider B2B, B2C and C2C trading platform functions, facing both the international and Chinese markets. They are identified as follows:

| Name | Seller | Buyer | Business Model |

| Taobao | Chinese small businesses | Chinese consumers | Retail: C2C |

| Tmall | Top-quality brands merchandise | Chinese consumers | Retail: B2C |

| AliExpress | Chinese seller | Global consumers | Retail: C2C |

| Alibaba (global trade) | Trade agents, wholesalers, retailers, manufacturers, and SMEs from all over the world | Wholesale: B2B | |

| Alibaba(1688) | Trade agents, wholesalers, retailers, manufacturers and SMEs from China | Wholesale: B2B | |

Different type of e-commerce platform under Alibaba Group. Source: Daxue Consulting

4) Powerful Promotional efforts

Taobao’s strategic alliances with Chinese Internet portals such as 21 CN, Sohu (搜狐), and MSN enabled the establishment of long-term cooperation and mutually beneficial partnerships. In recent years, Taobao is also depending on advertisements through commercial movies and famous TV programs to promote itself.

On April 29, 2013, Alibaba announced an investment of USD 586 million in Sina Weibo (新浪微博), the leading Chinese microblogging website. According to Reuters, the deal “should drive more web traffic to Alibaba’s Taobao Marketplace, China’s largest e-commerce website with a consumer focus.” On August 1, 2013, Alibaba launched Weibo for Taobao, which allows users to link Sina Weibo accounts with Taobao accounts. This liking of e-commerce platforms with social networking sites will be sustainable as long as Sina Weibo remains widely in use.

Taobao also makes use of special sales promotions to boost sales throughout the year. is celebrated on November 11th, and is the biggest promotion day for Chinese online trading platforms. Often referred to as Global Online Shopping Festival, it was originally celebrated by young and single Chinese as Single’s Day. In 2009, Alibaba began holding promotional events on Tmall during that day. Total turnover from the promotions exceeded expectations, and Taobao continues to host the promotions. Since then, November 11th became the fixed date for large-scale promotion activity on Tmall and it gradually expanded to the whole e-commerce industry, including Taobao, Jingdong, Yihaodian and so on. On November 11th, 2016, the total GMV of Alibaba reached 1211.8 billion Yuan.

5) Corporate cooperation with banks

In an effort to increase user trust and security, Taobao is pursuing economic cooperation with the various major banks in China such as ICBC (中国工商银行) and Bank Of China (中国银行). This cooperation will enable the banking transactions carried out on its website to be much more secure against fraudulent activity and scams.

From 2012 onwards, Taobao began to accept international Visa and MasterCard credit cards while AliPay supported domestic bank cards. The plan to support international credit cards was announced in late 2011, and correctly anticipated the high demand from the international e-commerce market. As of 2017, almost all international credit cards, including Visa/MasterCard/JCB, are now supported by Taobao and its payment services. For example, Hong Kong users can now make payments through credit cards, Alipay HK, PPS, Octopus and certain bank cards. Taiwan consumers can make payments through credit cards, convenience stores (Family Mart and Seven Eleven) and ATM transfers.

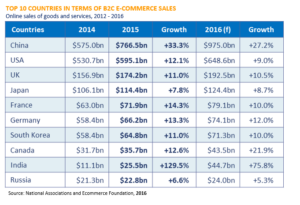

In the 2015 Global Retail E-commerce Index, China maintains a sizeable lead in e-commerce activity internationally. Source: Ecommerce Foundation

Since its founding, Taobao has evolved from an unassuming online C2C storefront, to a massive platform that hosts millions of consumer transactions. Features created with Chinese users in mind have helped Taobao attract Chinese netizens and outcompete international opponents like eBay and Amazon. By expanding operations through strategic partnerships and regular promotions, Taobao has grown to become one of, if not the most important C2C platform in China. For any enterprising firm looking to breach China’s markets and capitalize on its e-commerce infrastructure, Taobao should be an essential part of that entry strategy.

Daxue Consulting expertise: China E-Commerce Market Entry Strategy

We have helped many clients in the past to define their entry strategy, and in a variety of industries. Recently, a European trading company sought to expand its operations into China through e-commerce. The client approached us looking to build a bespoke market penetration strategy, so that they could sell their goods on China’s top e-commerce platforms. Daxue worked with their management team to help them develop the most effective entry strategy.

The initial steps of our work entailed rigorous research and analysis of the client’s position, the competitors, distribution channels, and the market. Our use of advanced analytics and fieldwork helped us identify the key competitors, the most effective distribution channels, and newly effective marketing tactics and promotions unique to the Chinese market. Ultimately, we delivered a comprehensive report that allowed the client to successfully enter the Chinese e-commerce market.

For more on our insights and services, contact us at dx@daxueconsulting.com or follow us on Twitter:

What is driving the explosive #growth of e-pharmacies in #China? Discover it here: https://t.co/dgGEeQyqvT @PharmacyPodcast #ecommerce pic.twitter.com/J4G6ScdqCG

— Daxue Consulting (@DaxueConsulting) 19 octobre 2017