The beverage industry in China is booming, thanks to the recovery of social events like parties and wedding banquets after the pandemic. The market grew to 1.25 trillion RMB (182 billion USD) in 2022 and produced 183.3 million tons in 2021.

The most popular beverages in China in 2022 were packaged drinking water, carbonated beverages, dairy products, and sparkling water, with consumption rates of 63%, 55%, 54% and 42%, respectively. Moreover, health-awareness is reshaping consumer preferences, leading to the rise of healthy nutrition products.

Healthy trends in the Chinese beverage market

Product safety, natural ingredients, and nutrition are key factors for Chinese consumers when choosing beverages. They also seek beverages that enhance their lifestyle. These preferences have boosted the popularity of milk and protein beverages.

Convenience and freshness are also important to Chinese consumers; however, product quality outweighs all the other factors. This shift in consumption preferences has reduced the demand for traditional carbonated drinks. Meanwhile, health-awareness is growing and influencing the beverage industries.

The Chinese bottled water brands bet on functional water

With an increasingly health-aware consumer base and rising concerns about its water supply, China has seen a rise in demand for bottled water. According to the China Industrial Development Institute, the market size of bottled water in China has exceeded 200 billion RMB (29 billion USD) in 2021 and is expected to continue growing at a rate of 8%-9% in the next few years, breaking through 300 billion RMB (44 billion USD) in 2025. In terms of product types, purified water represents 35.2% of the Chinese bottled water market, followed by natural water at 28% and mineral water at 18.5%.

Moreover, Chinese bottled water brands attach greater importance to health benefits to attract customers. For instance, in February 2023, Genki Forest launched its “Vitality water (元气自在水)” products, such as red bean pearl barley water and red dates wolfberry water. These products contain traditional Chinese medicine ingredients, meeting consumers’ expectations for healthier bottled water.

The carbonated drinks industry must adapt to the growing demand for healthier products

In 2020, China’s carbonated drinks market increased from 78.8 billion RMB (11.4 billion USD) in 2014 to 88.5 billion RMB (12.8 billion USD), with an annual compound growth rate of only 1.9%, much lower than that of other kinds of beverage. This slow growth is due to the rising health awareness of Chinese consumers, who tend to substitute sugar-free sodas for carbonated drinks. Consequently, Chinese carbonated drinks companies have started to launch healthier products, such as sugar-free sodas and sparkling water. Among them, Genki Forest’s sparkling water has successfully appealed to young Chinese consumers.

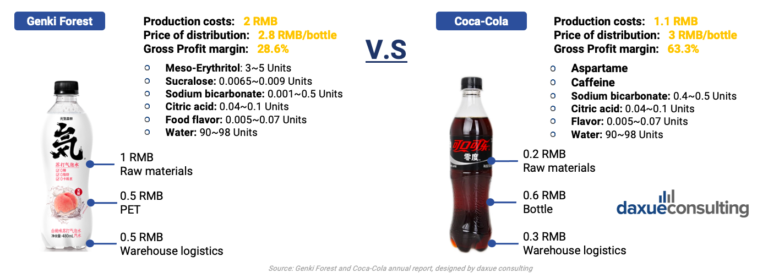

Some carbonated drinks brands have chosen cheaper ingredients to increase their profits. For example, Coca-Cola uses aspartame instead of the healthier but costlier alternative meso-Erythritol. In contrast, Genki Forest stands out from competitors by investing in healthier and tastier ingredients. It replaces sucrose with meso-Erythritol and sucralose because these two ingredients contain 60-80% sweetness as sucrose does. Additionally, meso-Erythritol contains almost zero calories.

Therefore, the healthy beverage industry is likely to gain more market share from the carbonated drinks industry in China in the future. According to 2021 China Sugar-free Beverage Market Trends Insight Report, the market size of sugar-free drinks reached 11.78 billion RMB (1.71 billion USD) in 2020, a seven-fold increase from 2014, and is expected to grow to 22.74 billion RMB (3.31 billion USD) by 2025.

The fruit and vegetable juice industry in China benefits from the healthy living trend

As a major agricultural power, China is the first fruit and vegetables producer in the world. In 2021, the output of fruit and vegetable juice drinks in China reached 16.9 million tons, up 11.42% year on year. According to China Big-data, from 2016 to 2020, the growth of Chinese fruit and vegetable juice market was relatively stable, increasing from 1.2 trillion RMB (175 billion USD) in 2016 to 1.3 trillion (189 billion USD) RMB, with an average annual compound growth rate of 2.5%. In 2022, the market size of China’s fruit juice industry reached 1.4 trillion RMB (204 billion USD).

According to Chinapp, the brands with the highest brand power index in the Chinese juice industry are Huiyuan (汇源), Coconutpalm (椰树), and Minute Maid (美汁源). However, although China’s fruit juice market is dominated by low-concentration fruit juice drinks, accounting for 74.3% of the sales volume, high-concentration fruit juice is expected to have a broader development prospect in the coming years, with the enhancement of consumers’ health awareness.

The Chinese energy drinks market is booming

Nowadays, many people use energy drinks to help them study and work. Additionally, sports and fitness have become a popular lifestyle choice among a growing number of Chinese people. According to the 2021 China Sports and Fitness Crowd Insight Report released by Mob Research Institute, the number of people exercising is expected to rise to 560 million by 2030. As more and more people do sports in China, energy drinks have gained popularity among local consumers. According to Euromonitor, the consumption of energy drinks in China showed a growing trend from 2017 to 2022, reaching 2.95 billion liters in 2022.

China’s energy drink segment is dominated by Dongpeng holding 31.7% of the market share in 2022 but leaves plenty of room for competition. Among the competitors, Red Bull and Hi-Tiger stand out as strongly established in the local market. Due to the shift in modern consumer preferences, the Chinese energy drinks market has exhibited significant growth potential.

China’s young but flourishing drinkable dairy market

The Chinese milk industry is showing rapid growth

Milk consumption is not as common in Chinese culture as it is in the West, and lactose intolerance is prevalent. However, due to the rise of consumption upgrading and increasing awareness of national health, consumer demand for milk and dairy products is growing rapidly, providing a boost to the development of the dairy industry in China. Especially after the pandemic, which rekindled the need for more nutrition, the intake of dairy products in China has increased to 13kg per year in 2021. From 2018 to 2021, China’s milk production reached 36.83 million tons, up 7.1% year on year. The milk industry in China is dominated by two domestic giants, Yili and Mengniu, who held 26.4% and 21.6% of the total market share in 2020, respectively.

Mostly sold in boxes, milk in China has slowly become more and more affordable as domestic brands have slowly taken over the market, ousting the more expensive competition. The Chinese milk industry is expected to continue to grow as it benefits from lower price and fresh product perception.

Yogurt sales in China are growing steadily

The yogurt market in China overtook for the first time the Chinese milk market in 2017. According to Euromonitor, the sales volume of yogurt products in China grew from 45.6 billion RMB (6.6 billion USD) in 2012 to 220 billion RMB (32 billion USD) in 2022, with a compound annual growth rate of 9.2%. Similarly to the Chinese milk industry, China’s yogurt industry is dominated by dairy giants Yili and Mengniu, whose market share is 28.8% and 24.5% respectively in 2022. As healthy living becomes increasingly popular, Chinese ready-to-drink yogurt brands like Momchilovtsi and Ambrosia have gained significant popularity among consumers.

Tea sales in China are going strong

For a long period of time, China has been acting as a great tea consumption country. With the progress of technology and the further increase of tea demand in China, the production and sales volume of tea in China continued to grow. According to Intelligence Research Group, the output of tea in China reached 3.18 million tons in 2021, with a year-on-year increase of 248,200 tons, and the sales volume of tea was 2.3 million tons, with a year-on-year increase of 100,300 tons. Moreover, healthier, lower-calory, tea-based drinks are on the rise as Chinese consumers are looking for healthier products. When it comes to distribution, retail stores and supermarkets represent the bulk of tea sales in China, followed by tea and coffee shops.

Another driver of the tea market in China is new style tea. Milk tea is the signature drink of new style tea, a sweet drink that is brewed in milk, or mixed with milk powder, whose main consumers are female Gen Z consumers. The Chinese brand HEYTEA, (in Chinese: 喜茶 xi cha), was a pioneer in new style tea, which has managed to create buzz around the product by leveraging social media and improving customer experience.

China’s coffee market is young but growing at an incredible speed

The Chinese coffee industry is relatively young compared to the tea industry. Nestlé entered the market in 1989, introducing instant coffee to Chinese consumers. In 1999, Starbucks opened its first store and popularized the coffee shop trend. However, nowadays, China has become the world’s biggest coffee consumption market, with coffee consumption growing at 15-20 % per year, well above the global average of 2 %. In 2021, the scale of China’s coffee market reached 381.7 billion RMB (55.5 billion USD). According to iiMedia Research, China’s coffee market is expected to maintain a growth rate of 27.2%, reaching 1 trillion RMB (145.5 billion USD) in 2025. Thanks to their early entry in the market and weak domestic competition, foreign brands dominate the Chinese coffee industry as Chinese consumers prefer to buy their coffee in franchise shops rather than retailers’. Starbucks is the leading brand of fresh ground coffee in China, holding 36.4% of the market in 2020. However, some domestic brands like Luckin Coffee are also showing strong momentum.

Alcohol consumption in China is changing while Baijiu still is by far the most popular

Craft beer is becoming more and more popular in China

As China’s economy and population evolve, so do the preferences and behaviors of its consumers. Drinking craft beer is becoming a new trend among young generations. Because of this trend, the size of the domestic craft beer market increased from 3.3 billion RMB (480 million USD) to about 42.8 billion RMB (6.2 billion USD) in 10 years from 2011 to 2021. In 2021, craft beer consumption in China is growing much faster than the overall beer market, but there is still a large gap with other countries like the United States.

The development of Chinese wine industry is not stable

Although wine consumption is not traditionally significant in Chinese culture, the adoption of westernized lifestyles in major urban areas has sparked an interest in wine among Chinese consumers. Wine has a premium beverage image in China and the market is maturing. As a result, wine sales in China have increased steadily over the years, driven by a surge in health awareness. The perception of wine as a healthy beverage was especially prevalent among respondents in the middle-aged groups, who stated that “drinking wine is good for health”. More than half of the respondents aged 36-45 and 46-55 shared this view.

Overall, there is still a lack of strong wine consumption culture in China, and most consumers do not consume wine regularly. This weakens the industry’s ability to face risks and uncertainties. In the past two years, due to the impact of the pandemic, the demand for wine in China has dropped significantly, and the apparent demand for wine from January to July 2022 was only. The pandemic has affected the wine demand in China greatly in the last two years. From January to July 2022, the apparent wine demand was only 325,000 tons.

Baijiu still is by far the most popular strong alcohol in China

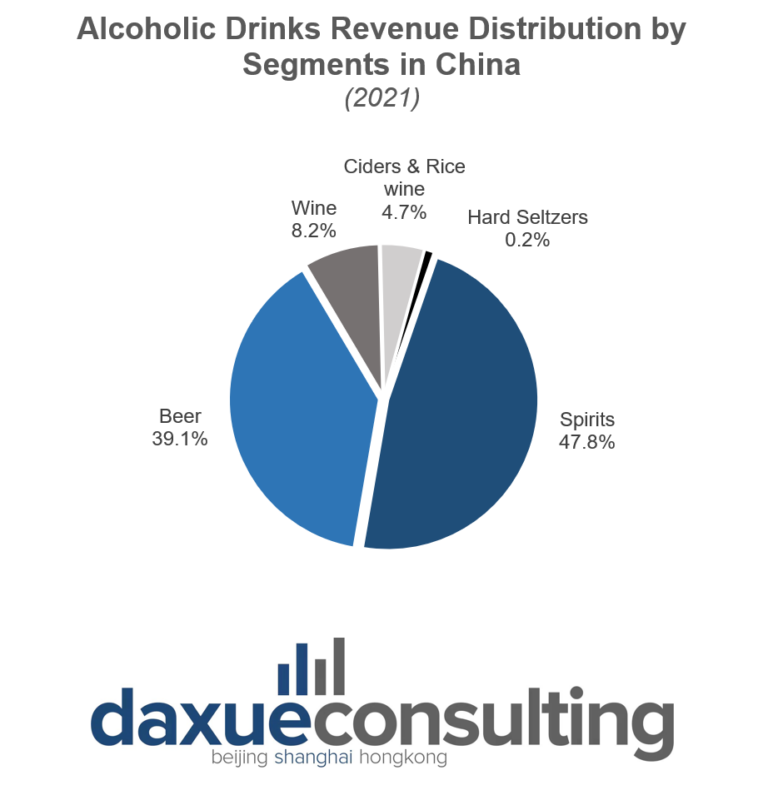

In China, the world of alcoholic drinks is quite diverse, however, in 2021 the most consumed beverages were spirits and beer, holding respectively 47.8% and 39.1% of the market revenue.

As far as spirits are concerned, Baijiu outperforms all the other competitors. “Baijiu (白酒)” is a Chinese spirit usually produced through the distillation of sorghum, but can also be produced from rice, wheat, millet, and corn. It is the most common alcoholic beverage in China, in 2021 its sales generated 603 billion RMB (86.5 billion USD). According to the National Bureau of Statistics, Baijiu’s cumulative value of production was 2.02 billion liters in March 2022, with a growth of 60% compared to February.

In addition, among the top 10 most valuable spirits brands in China, six are domestic brands. All of these local brands produce baijiu, with Moutai on the lead, valued at 43 billion USD. For Chinese consumers, Moutai is a symbol of status. During some special days such as the Spring Festival, Feitian Moutai will cost around 3,300 to 2,400 RMB per bottle.

Health trends shape preferences in the Chinese beverage market

- The growing trend of healthy living in China has had significant implications for the Chinese beverage market. The soft drinks sector has faced challenges from the healthy living trend and must innovate to maintain its growth.

- As health-awareness spread among Chinese consumers, energy drinks and drinkable dairy products are gaining great popularity.

- The Chinese functional water industry has a strong development potential, as it meets the growing health awareness and expectations of consumers. Chinese people are great tea consumers. However, China’s coffee market is growing at an incredible speed and should not be overlooked.

- Baijiu is still the most popular alcoholic drink in China, with Moutai as the leading brand. However, the alcohol consumption trend in China is changing, as younger generations show more interest in craft beer and wine.

Author: Camille Gaujacq

Updated by: Lyu Ai

Learn about China’s wine and spirits industry