Throughout the country’s history, alcohol has been part of the Chinese culture, life, art, and philosophy. The spirits market in China is the leading sector in the beverage industry, boasting approximately RMB 1.1 trillion worth of revenue as of July 2023. Being such a huge part of the Chinese economy, the spirits market also represents an opportunity for foreign productors and brewers to make their own name in this sector.

Download our China’s wine and spirits industry report

Baijiu is still topping the charts as the most consumed alcoholic in China

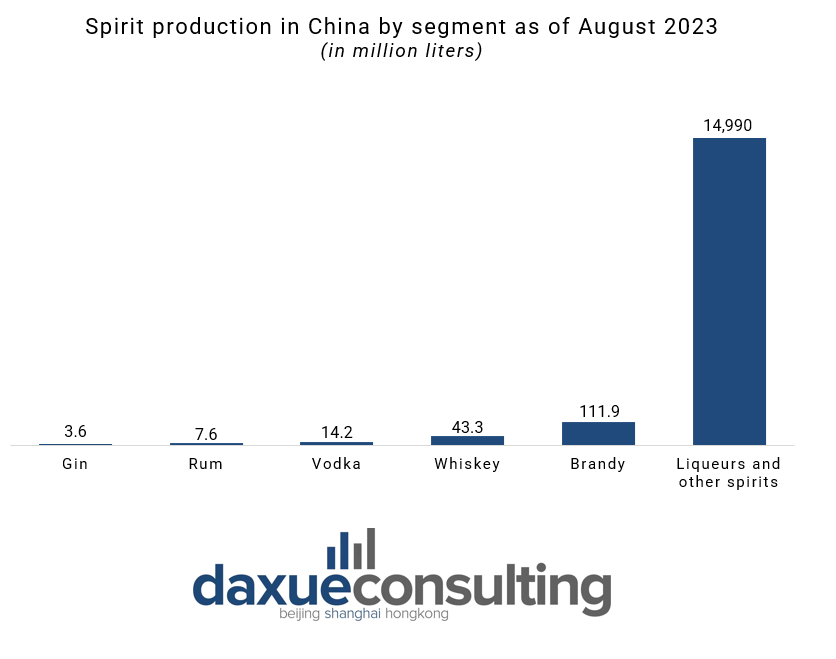

The Chinese world of alcoholic drinks is quite diverse. However, baijiu is the drink which has always been at the top in terms of both production and revenue. Meaning “white spirits”, “Baijiu (白酒)” is produced through the distillation of sorghum, but can also be produced from rice, wheat, millet, and corn. In 2022, baijiu accounted for 94% of the total sales value in the Chinese spirits market, and generated a revenue of more than RMB 662 billion in the same year. Baijiu production also is higher than any alcoholic beverage in China, with an estimated production of 15 billion litres as of August 2023.

Its market is flourishing too. As of 2023, six out of ten worldwide most valuable spirits brands are Chinese, with the baijiu producer Kweichow Moutai on the lead. In 2022, the company generated a revenue of RMB 124 billion and, as of 2023, it dominated the Chinese baijiu market. Moutai indeed, holds 17% of the spirits market share in China, followed by Wuliangye, accounting for 10%.

Kweichow Moutai relaunches its brand with Baijiu-flavored coffee, ice-cream and chocolate

To attract younger generations, Kweichow Moutai decided to go beyond the simple spirits. On September 6th 2023, the domestic coffee chain Luckin Coffee launched a baijiu-flavored latte in collaboration with Moutai. The product contained only 0.5% of alcohol and went immediately sold out. Then, on September 16th , the Guizhou-based company launched “Mao Xiaoling liquor chocolate”, the result of a collaboration with the American chocolate company Dove. The limited-edition item consisted of two chocolate bonbons filled with 2% of Moutai’s baijiu. The product was available both offline and online. The initiative was so popular that the chocolate delicacies went sold out just seconds after being launched on Tmall.

Moutai is not new to this sort of collaborations. In May 2022, the company launched its baijiu-flavored ice-cream, which was met with tremendous success.: Moutai’s flagship store sold more than 5,000 units in just 7 hours after its opening. The ice-cream was so successful that, in May 2023, Moutai opened 34 brand new flagship stores across 31 Chinese provinces. However, consumers were not particularly enthusiastic about the idea of an alcoholic ice-cream, they were concerned about children’s safety after eating a dessert filled with 59% alcohol.

Domestic products vs importations: the rise of western brands in the spirits market

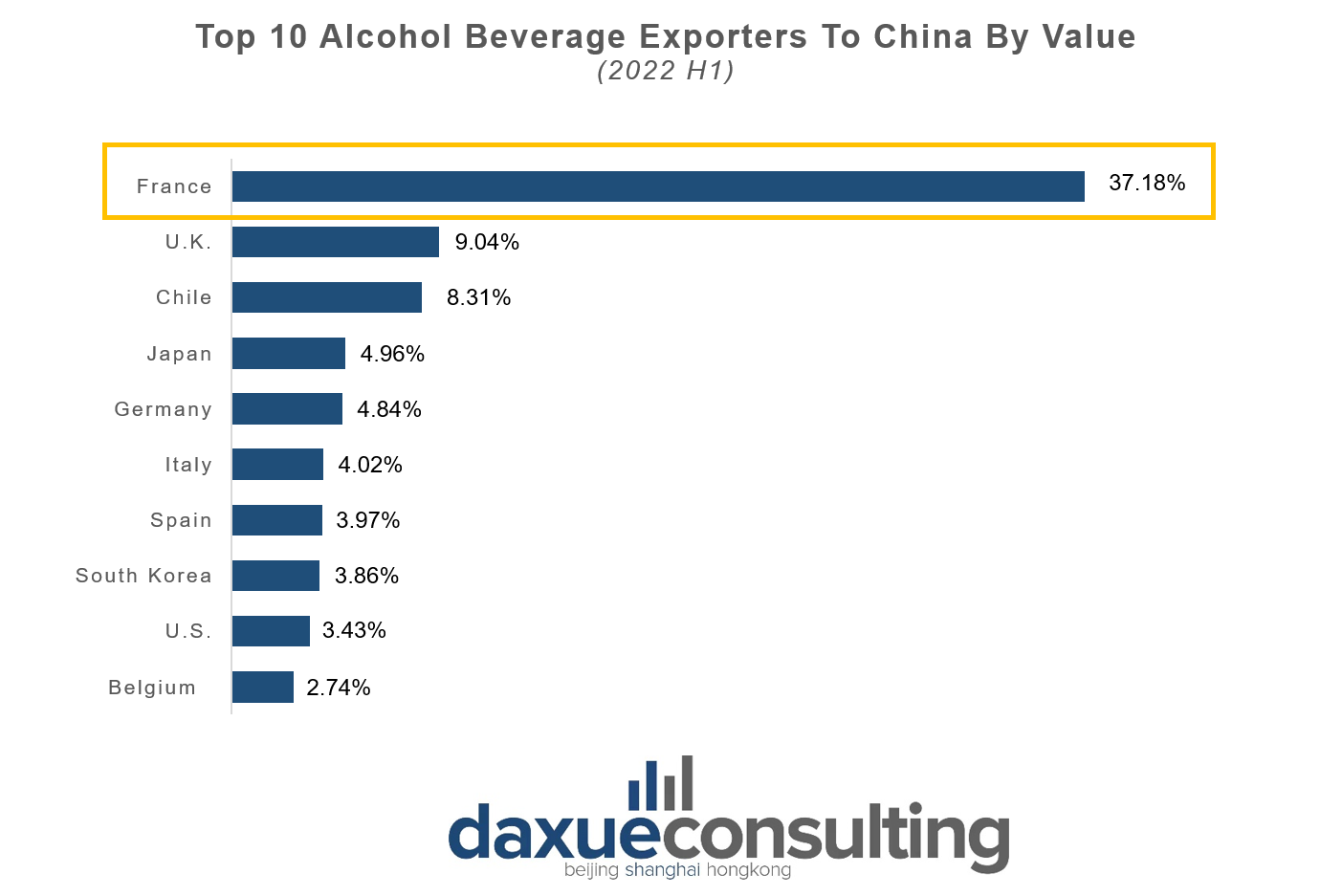

While China’s domestic spirits market continues to thrive, Chinese consumers are also showing interest in importing alcoholic beverages that are not produced locally. Such demand of foreign spirits is mainly satisfied by France, which in the first half of 2022 was the biggest alcoholic beverage exporter to China, with a total value of RMB 6 billion.

Foreign liquors are seen as a status symbol in China, for this reason, they are usually used during special dinners and social events. Brandy was the largest imported spirits in 2022, with an import volume of 37.5 million liters. France remains the dominant country in brandy imports, topping the import market with a 98.8% (RMB 12.2 billion) market share in 2021.when it comes to whiskey, England is by far the largest exporter, covering 80.1% (RMB 2.3 billion) of the 2021 Chinese whiskey import market. The silver medal is taken by Japan, whose whiskey only detained a 10.91% (RMB 365.2 million) market share in the same year.

However, the Chinese market is not just interested in whiskey and brandy. Vodka also has a big role in importations: China imports vodka from 40 countries, but Sweden is by far the largest exporter. In 2022, the most consumed vodka in China was the Swedish label “Absolut Vodka”, holding more than half the share of consumption volume by brand in China. Although these numbers may seem high, they could never outperform baijiu’s huge distribution and popularity.

The whiskey market is growing in China

Baijiu is not the only alcoholic beverage which is doing well in the spirits market in China, other drinks are starting to take a piece of the cake. Imported spirits represent a huge market for China, with almost one billion liters imported from all over the world throughout 2022. Among these imports, liquors accounted for more than 1/10 of all the spirits importations value. Whiskey is starting to grab particular attention among Chinese consumers. In 2023, China has become the 4th biggest whiskey market in the world, and its market revenue amounted for almost RMB 8.5 billion, which is still pretty far from baijiu’s figures, but it’s increasing by 2% year-on-year. Most of whiskey exported to China comes from the United Kingdom, which shipped more than RMB 2.7 billion worth of whiskey in 2021.

Despite trying to relaunch the e-commerce, offline retailers are still preferred by the majority of consumers

Beyond classic spirits retail points, Chinese consumers can also purchase alcohol using Alibaba and JD.com, which are the biggest e-commerce platforms for this type of shopping. In order to simplify the process of purchase several alcohol-delivery platforms emerged. Founded in 1998, “1919” was one of them. In 2018, Alibaba invested RMB 2.1 billion to expand 1919.cn presence in China, underlining its willing to be a competitor of JD.com and predicting to open more than 2,000 stores the following year. Its main strengths are promotions and a 19-minutes delivery, but the service only works for certain cities. However, this project underwent serious problems, particularly related to the Covid-19 pandemic. In the first half of 2020, the platform lost more than RMB 130 million, but managed to survive on the spirits market in China. In 2021, its crisis was partially stabilizing, because the app had a net profit of RMB 61 million. Despite the creation of new e-commerce platforms dedicated to selling alcoholic beverages and food delivery, offline retail stores still represent 77% of the total sales, thus the highest source of revenue. However, e-commerce platforms are starting to gain ground due to their wider choice and extremely competitive prices.

Cocktails are the new frontier of alcohol consumption among young consumers

The trend of drinking at home is also on the rise among Gen Z consumers in China. On Weibo, a growing number of young users are sharing their experiences of enjoying solo drinking, often as a personal treat or a way to unwind after work. This trend emerged during the pandemic, with hashtags like “take away cocktails” (#鸡尾酒外卖#) gaining popularity, reaching over 1.12 million views as of October 2023.

Younger consumers are now increasingly interested in cocktails, with the hashtag “cocktails” (#鸡尾酒#) accumulating over half a billion views as of October 2023. They prefer mixed drinks that incorporate juices and fruits, providing a more enjoyable and less intense drinking experience. This shift is accompanied by criticism of strong and expensive beverages like Baijiu. In response to changing preferences, Moutai is collaborating with cocktail bars in China to introduce Moutai baijiu-flavored beverages, aiming to reintroduce this traditional spirit to a younger audience. Additionally, lighter alcoholic options such as beer and cider, often imported, are gaining popularity, with a significant increase in craft beer houses in China in recent years.

China’s spirits market, a flourishing business

- The spirits market in China is extremely profitable. In July 2023, it had registered RMB 1.1 trillion worth of revenue, and 6 out of 10 of the world’s most valuable spirits producers are Chinese.

- Baijiu is the most consumed and produced drink in China. Its market is also getting bigger year-on-year. The biggest producer of this drink, Kweichow Moutai, also announced several Baijiu-flavored products such as coffee, ice-cream, and chocolate delicacies.

- Importation from other countries contribute also to the success of the spirits market in China. France is the biggest alcohol exporter, especially concerning wine, whereas the UK dominates the whiskey market.

- Despite Baijiu’s extreme popularity, other types of spirits are starting to gain popularity, whiskey is the main example. In 2022, more than one billion litres of whiskey were imported from other countries.

- Back in the pre-covid areas, some alcohol-selling e-commerce platforms have started to appear in China, such as 1919; however, the trend is slowing down.

- Pubs and bars are increasing in popularity among young consumers; the trend of drinking alone is on the rise too. Young people are starting to abandon strong spirits like Baijiu due to their harsh taste and their price.