The online food delivery market in China is thriving, with numerous platforms providing a variety of culinary choices to meet the needs of the country’s extensive and diverse population. The market is predicted to reach a revenue of USD 395.9 billion in 2023, making China the world’s largest food delivery market. The market is also expected to maintain an annual growth rate of 10.3% from 2023 to 2027, leading to an estimated market size of USD 585.9 billion by 2027. Additionally, the COVID-19 pandemic has accelerated the penetration of online delivery apps which is projected to reach 51.6% of the population in 2023. Therefore, it is important to understand the current landscape of China’s online-to-offline (O2O) food delivery market to capitalize on the growing market.

Download our report on ASEAN x China relations

The battle for dominance in China’s food delivery industry: Ele.me and Meituan

Takeout food in China began with foreign fast-food chains like McDonald’s in the 1990s, followed by local eateries. Homegrown local restaurants, such as noodle houses and those offering regional specialties, followed suit. The real surge, though, came with the rise of online food delivery platforms, marking the rapid growth of China’s O2O delivery market.

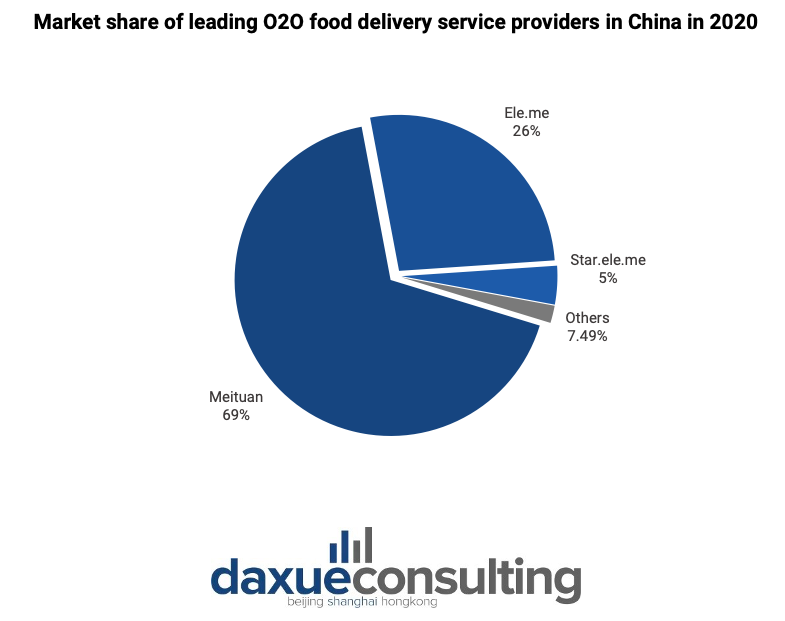

China’s food delivery market is a duopoly dominated by Chinese tech giants Alibaba and Tencent, who own 饿了么 (Ele.me) and 美团 (Meituan) respectively. Combined, these two delivery apps controlled 95% of the country’s food delivery market in 2020. Meituan offers more non-food delivery services than Ele.me, such as flowers and office supplies. Due to the significant market share, it is not a surprise that there is a high barrier to entry into the food delivery industry in China.

Who are China’s food delivery industry’s consumers?

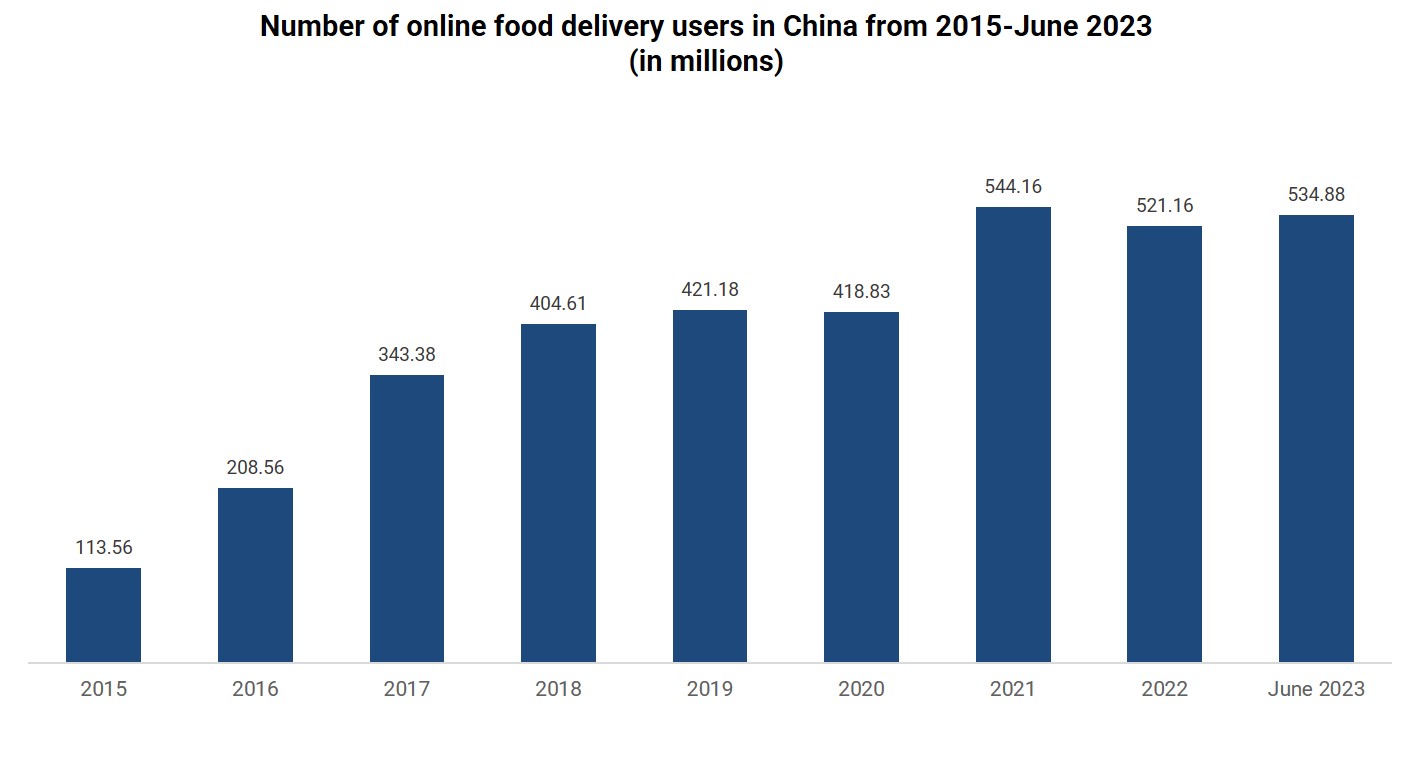

China’s food delivery services have witnessed remarkable growth, surging by approximately 371% from 2015 to June 2023. In 2015, there were just 113.6 million users of food delivery services in China. However, by June 2023, this figure had skyrocketed to an astonishing 534.88 million, showcasing the rapid adoption of delivery platforms in the country.

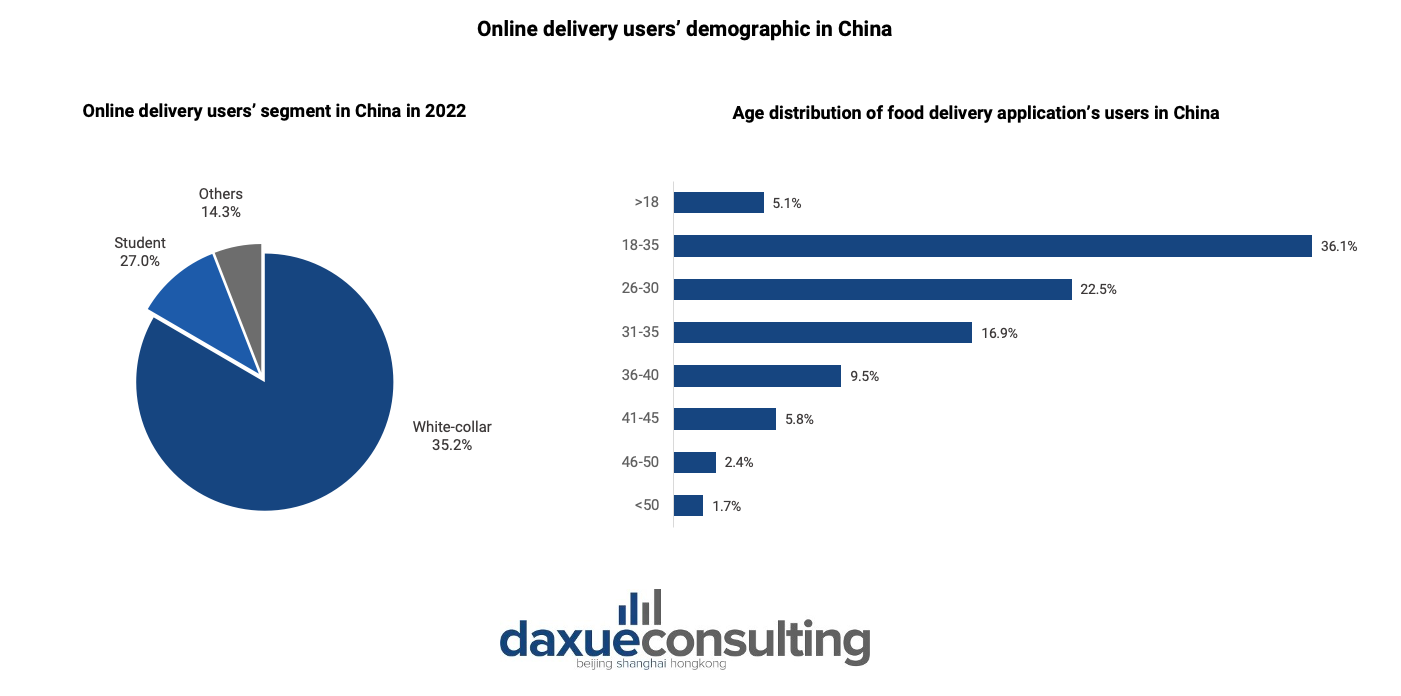

Online food delivery service users primarily consist of white-collar workers and skew toward the younger demographic

China’s online food delivery user base underwent a significant transformation. In 2015, 63% of users were white-collar workers, and 30.5% were students. By 2019, this shifted dramatically, with 83% being white-collar workers and only 10% students, illustrating a notable change in the industry’s consumer demographic. Additionally, women constitute 51% of food delivery app users, and a substantial 85% of users fall between the ages of 18 and 40, indicating a predominantly young customer base. Particularly noteworthy is the nearly 20% increase in online food delivery orders from individuals born in the 2000s in 2021, underscoring their growing importance as a customer segment.

Chinese consumers order multiple times per month and reviews frequently guide food orders

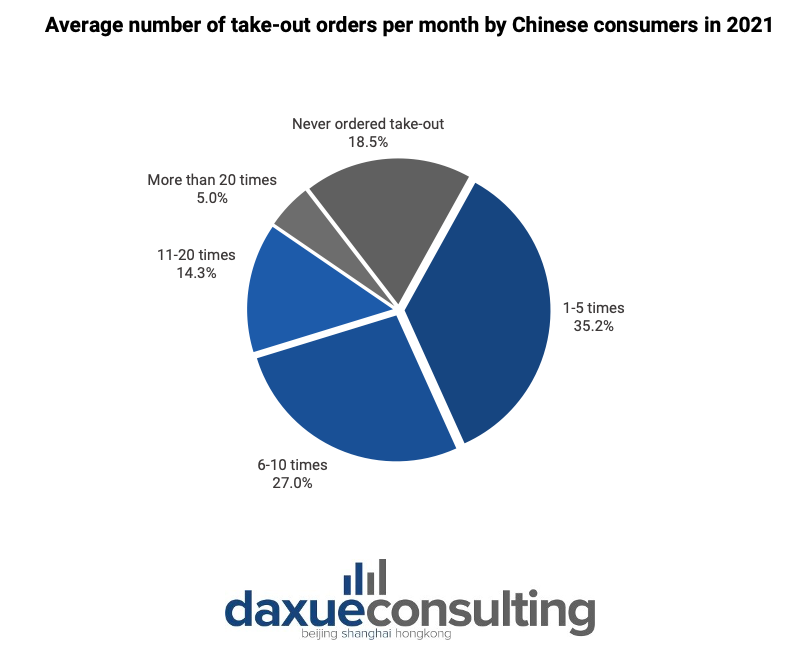

The Chinese meal delivery industry’s profitability is underlined by the consistent consumer demand. A survey revealed that 27% of Chinese consumers order food six to ten times monthly, while 14.3% make food orders 11 to 20 times a month in 2022. Impressively, only 18.5% of respondents reported never using online food delivery services, emphasizing the widespread and enduring appeal of these platforms in China. When making choices to order food delivery, Chinese consumers are also heavily influenced by customer reviews and cuisine flavors.

Top-tier cities are the main customers of China’s food delivery services

While more than half of Chinese online food delivery users, accounting for 53.9%, reside in top-tier cities (1st and 2nd tier) as of 2021, the real growth and potential are found in lower-tier cities. This is primarily due to the already high penetration of online food delivery services in top-tier cities, leaving room for smaller cities to flourish. Yet, according to Meituan’s April 2023 report, Shenzhen, Beijing, and Shanghai still stood out as cities with the highest vitality in online food delivery, considering factors like delivery volume, user activity, restaurant delivery rates, and operating hours.

Convenience meets affordability: The reasons behind the popularity of food delivery in China

Food delivery services are exceptionally popular in China, surpassing their Western counterparts. There are several reasons to explain the disparity such as the low cost and convenience of food delivery in the increasingly busy urban lifestyles in China.

Dining deals due to high competition in China’s food delivery market

Chinese consumers are highly price-sensitive. In Greater China, food delivery costs are significantly lower, equaling just 10 to 20% of US prices, thanks to intense competition among providers like Ele.me and Meituan. The fierce market competition has led to aggressive price wars, with customers frequently enjoying generous discounts and coupons. These discounts, coupled with economies of scale, have made online food orders substantially more affordable than dining out. While the coupons are not as substantial as before, this strategy has transformed the dining habits of millions, making food delivery an exceptionally attractive and budget-friendly choice for the Chinese population.

Food delivery in China is widely embraced for its time-saving convenience

China has a demanding work culture, exemplified by the pervasive “996” schedule.

Additionally, a rising phenomenon known as “lazy cancer (懒癌)” reflects a prevalent sense of laziness that has diminished the appeal of cooking meals from scratch. About 67% of the 7,220 Chinese food delivery users surveyed cited laziness as the reason for ordering instead of dining out, as per a survey in March 2020.

Digesting China’s O2O food trends: Fast food, the rise of semi-prepared dishes and group buying

The fast-food category dominates China’s O2O food consumption

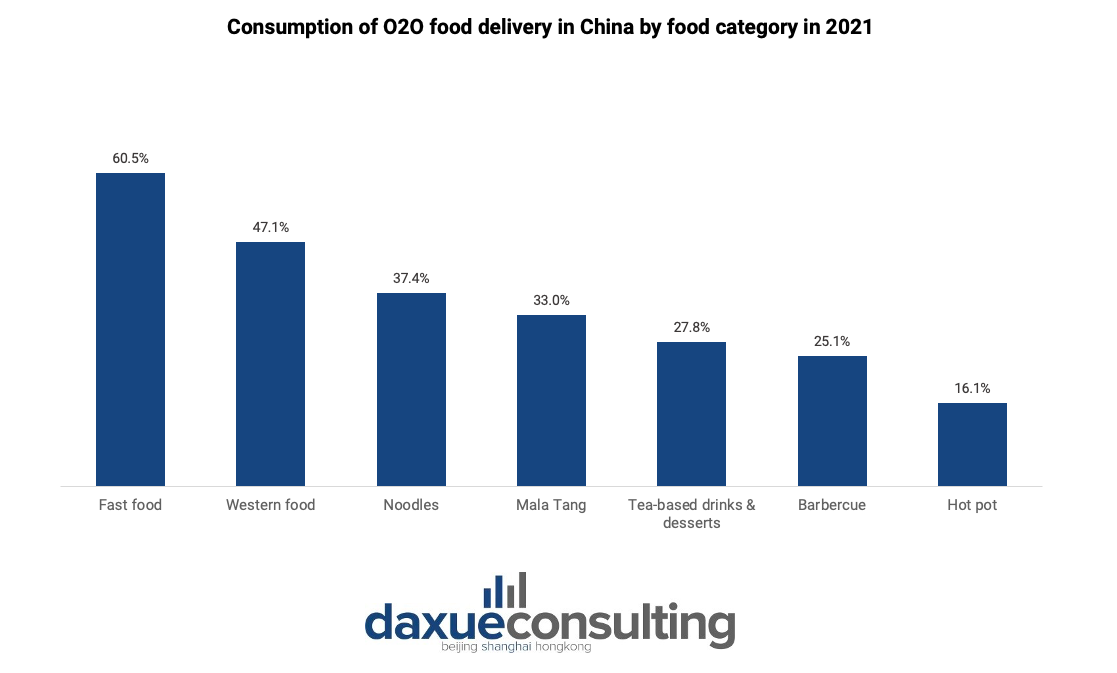

In 2021, fast food accounted for 60.5% of O2O food consumption in China, followed by Western food which made up 47.1% of the market. Other top food categories among Chinese consumers when ordering food online include noodles, Mala Tang (麻辣烫), tea-based drinks & desserts, and barbecue. Main meals dominate the industry, while dessert and beverage categories are growing rapidly. Peak demand occurs during lunch and dinner hours, with emerging trends in new periods like afternoon tea and late-night snacks.

Semi-prepared food and vegetables as a new trend in the O2O meal delivery market in China

Online shopping for semi-prepared dishes has become a new choice for young consumers, particularly in the singles economy and lazy economy in China. This new trend has led to a rapid increase in sales of semi-prepared food. The market size of the semi-prepared food market was RMB 345.9 billion, an increase of 19.8% year-on-year. According to iiMedia’s report, around 28.0% of the consumers purchased pre-made food products because they are considered healthier than food delivery which are usually high in sugar, fat, and salt.

Group buying (团购) plays a major role in cities under lockdown

Group buying has surged in popularity among residents in China’s top-tier cities, even serving as a crucial resource during Shanghai’s 2022 lockdown. Meituan Select, Meituan’s community group-buying platform, saw a 26.63% increase in downloads between March 8th and 27th 2022, coinciding with the lockdown period. Although restrictions have been lifted, group buying remains favored for its community bargaining power and product quality assurance in China’s urban centers.

New entrants to the food delivery market

Kuaishou and Douyin, which are prominent short video platforms in China, are making a foray into the food delivery sector. These services were done by integrating ordering functions into their apps. Unlike traditional delivery services, these platforms do not manage logistics directly. Instead, merchants handle deliveries while the platforms drive traffic to their pages.

Short video platforms collaborate with established logistics players in order to facilitate operations. Kuaishou has partnered with Meituan, utilizing its logistics network, whereas Douyin collaborates with SF Express and Dada. Despite entering the market later, both platforms are leveraging their vast user bases to challenge established players like Meituan and Ele.me.

Kuaishou aims to enhance local services and revenue, while Douyin is striving to meet its 2023 GMV targets, having faced difficulties in this area. For both, food delivery represents a crucial opportunity for revenue diversification and growth, positioning them as new competitors to the sector’s main players.

The future of China’s food delivery industry: A growing online grocery segment

Despite having gone from prosperity to decline in terms of its performance in the financing market in the late 10s, China’s grocery delivery industry is reaping the benefits of the stay-at-home economy the COVID-19 pandemic has stimulated in China. The pandemic has introduced older demographics into the market. For the younger demographic, online grocery platforms provide a convenient solution to their busy lives. By allowing them to order groceries online, they can save valuable time and effort, adapting to their hectic schedules. On the other hand, for the elderly, who may find it challenging to venture out for fresh products, online grocery shopping offers a lifeline.

Major players in China’s online grocery segment include Alibaba, Tencent, JD, Meituan, and Pinduoduo. These platforms bridge the accessibility gap by delivering groceries directly to their doorstep, ensuring they have access to essential items without the physical strain of traditional shopping.

Inside China’s booming online food delivery market

- China’s online food delivery market is set to reach USD 395.90 billion in 2023, making it the world’s largest, with a 10.30% annual growth rate.

- Ele.me and Meituan, owned by Alibaba and Tencent, control 95% of the market, with Ele.me amassing 68 million monthly users and Meituan reaching 75 million by July 2023.

- The majority of online food delivery users consist of young, white-collar professionals, with a significant concentration in top-tier cities.

- Laziness and busy schedules drive orders, with 67% citing laziness; customer choices are heavily influenced by reviews and flavors.

- Fast food dominates, followed by Western cuisine; semi-prepared food and group buying are rising trends.

- The stay-at-home economy boosted the online grocery segment, attracting both young professionals and the elderly population.