Meituan’s market strategy continues to evolve as the company sets its sights on integrating AI and expanding into new markets. With its foundation as the world’s largest on-demand food delivery service, processing over 60 million orders daily through a network of more than five million active couriers, Meituan has established itself as a critical delivery infrastructure provider in China.

Download our report on the She Economy in China

As of June 2024, Meituan has achieved revenue of RMB 82.25 billion in the third quarter, an increase of 21% year-on-year. How did Meituan stand out in the fierce competition and become the top 3 listed Internet companies in China by market value? This case study will explore Meituan’s market strategy and analyze how it applies private traffic and AI innovations to reach consumers and facilitate brand growth.

Strategy 1: Applying the platform business model to create a leading Chinese Super APP

The platform business model has become a more popular strategy for Internet companies due to pipeline businesses’ competitiveness and information technology advancements. The platform business model brings producers and consumers together to create values in exchanges. For platform businesses, the sources of competitive advantages are to facilitate more external interactions and to create “network effects”.

As a local life platform offering over 200 services, Meituan regards its operating system as a bridge to connect merchants, riders, and end consumers. Participants can instantly connect and complete transactions on this platform.

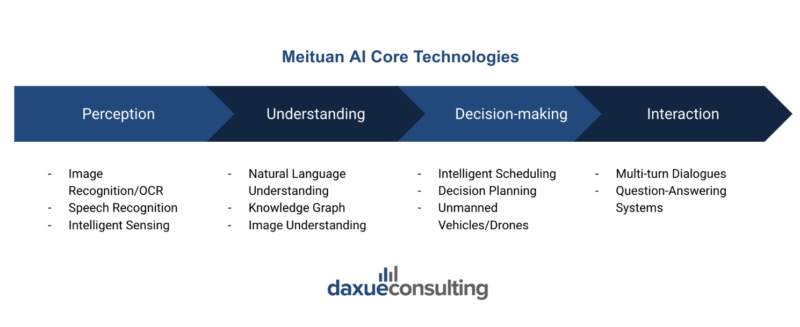

To enhance network effects, Meituan also adheres to the principle of technologies, allowing big data, cloud computing, AI, and other technologies to serve the evolution of the entire instant delivery network. As of 2024, the number of monthly active users on the Meituan platform has reached 81 million. As the number of users grew, the value assets of the platform increased accordingly. By maximizing the total value, the platform can continuously provide more valuable services for users, thereby building a circular ecosystem.

As a local life platform that offers over 200 services, Meituan regards its operating system as a bridge to connect merchants, riders, and end consumers. Participants can instantly connect and complete transactions on this platform.

To enhance network effects, Meituan also adheres to the principle of technologies, allowing big data, cloud computing, AI, and other technologies to serve the evolution of the entire instant delivery network. As of 2024, the number of monthly active users on the Meituan platform has reached 81 million. As the number of users grew, the value assets of the platform increased accordingly. By maximizing the total value, the platform can continuously provide more valuable services for users, thereby building a circular ecosystem.

Food + Platform model

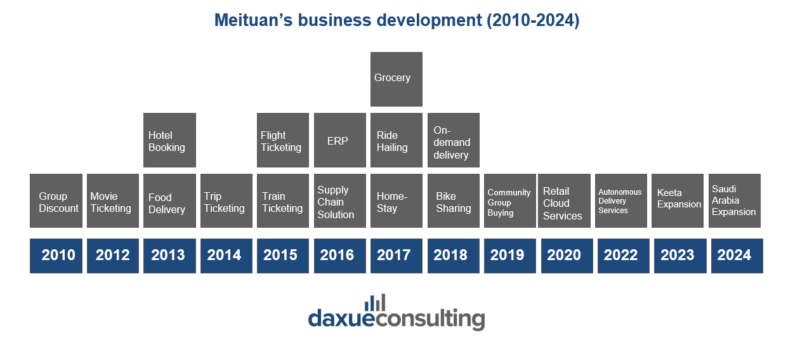

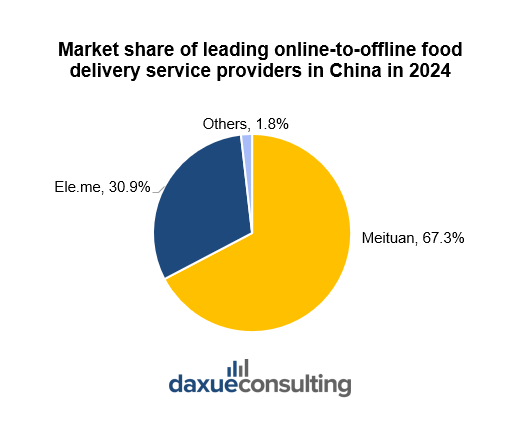

Meituan originally launched its business as the “Groupon of China” in 2010. After eight years of development, Meituan’s market strategy upgraded to “Food + Platform”. Meituan considers food-related services its core business, with food delivery accounting for 30% of its revenue. To support this core offering, Meituan has built a super-platform that also encompasses additional services, which contribute 28.2% of its revenue. This approach strengthens its competitive edge by creating a moat around its food delivery business while diversifying its revenue streams. By expanding into these additional categories, Meituan not only reduces competitive pressure from other companies but also enhances user stickiness, increasing customer loyalty and engagement across its ecosystem. As of 2024, Meituan has obtained an overwhelming advantage in the food delivery industry in China, with a market share of 69%, nearly twice that of its close competitor Ele.me.

Strategy 2: “Customer-centric” is the company’s most important value

Meituan’s recent introduction of Pin Hao Fan exemplifies its ability to cater to evolving consumption trends, particularly within the low-price domain. Pin Hao Fan has successfully captured demand for value-for-money offerings, achieving a peak daily order volume of 8 million and significantly improving user retention and order frequency. The platform collaborates with branded restaurants to deliver high-quality, affordable products, appealing to younger consumers while supporting small and medium-sized merchants.

For B2B merchants, Meituan provides a suite of comprehensive solutions, including precision online marketing tools, real-time distribution infrastructure, cloud-based enterprise resource planning (ERP) systems, aggregate payment systems, and supply chain management support. These technical capabilities enable merchants to improve operational efficiency, enhance traffic exposure, and innovate their supply formats. By integrating initiatives like Pin Hao Fan with its broader support systems, Meituan demonstrates a strong commitment to its customer-centric philosophy, driving growth for both consumers and businesses.

Strategy 3: Creating private traffic to build a sustainable ecosystem

Private traffic was one of the most popular China marketing trends where brands funnel traffic to their own platforms (in contrast to third-party platforms) where they can control data and increase repeat purchases.

How does private traffic work in Meituan?

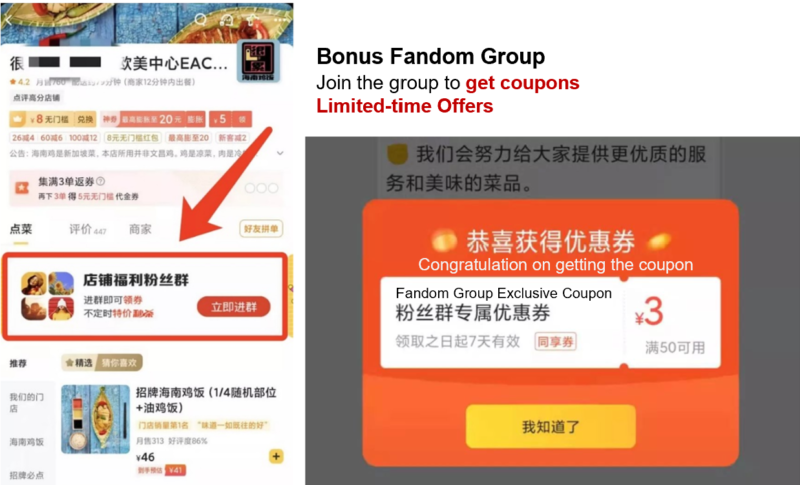

Bonus Fandom Group

The Bonus Fandom Group allows Meituan Waimai merchants to efficiently connect with end customers. The entrance of Meituan’s fandom groups is currently only available on the merchant’s homepage. Consumers can enter the group chat by clicking on the banner with “Shop Bonus Fandom Group”. The banner also includes advertisements such as “You can get coupons when you enter the group” and “limited-time offers” to attract users, which positioned the “bonus” function of the fandom groups.

On the one hand, businesses can intuitively reach consumers and combine fun gameplay and fan service to interact with users, thereby improving consumer satisfaction. Moreover, private traffic helps Meituan and merchants better capture consumer needs, thereby increasing the likelihood of higher conversion rates. On the other hand, consumers can also establish real-time online communication scenarios with the merchants to create a more convenient shopping experience.

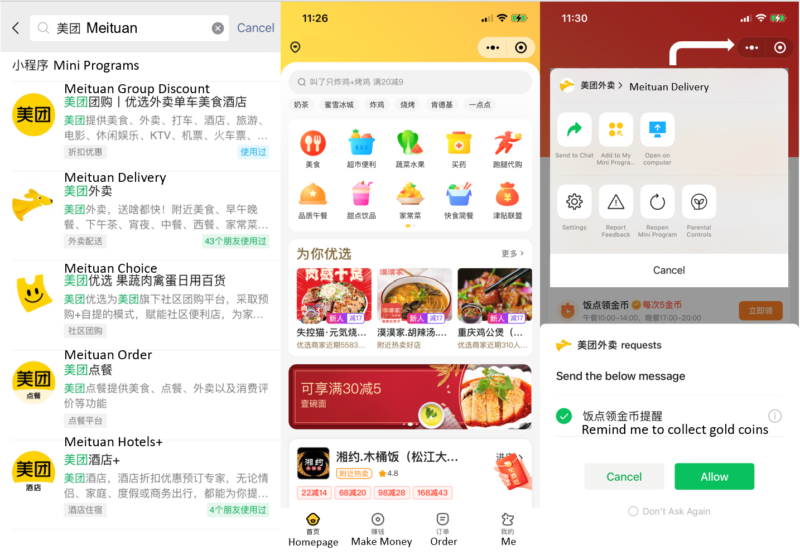

Mini Programs increased private traffic

In response to the potential threat, instead of falling into the public traffic, Meituan Dianping entered the field of Mini Programs to make better use of the private traffic in the WeChat ecosystem. WeChat, as China’s most popular multi-purpose app with over 1.2 billion monthly active users, can drive huge traffic for the brands and help to fully own and engage consumers. Additionally, the launch of Meituan Mini Programs will be more cost-effective than investing in advertisements on other platforms and billboards.

Most of the functions in the Meituan Mini Program are the same as the Meituan APP, such as homepage, order, and profile. Users can use the Meituan Mini Program to set up a clock to remind them to collect coupons. This feature can boost user retention and ordering rates.

Strategy 4: What’s next for Meituan? AI and market expansion

AI-Driven delivery optimization

To enhance service and courier experience, Meituan developed a real-time intelligent dispatch system using operations research and machine learning to optimize order assignment in a dynamic environment. Since its 2019 implementation, the system has reduced average delivery time by 20.96%, courier travel distance by 23.77%, and saved approximately USD 0.23 billion annually. It also supported the growth of new digital businesses like Meituan Instashopping and Meituan Grocery.

Building on this foundation, Meituan has incorporated vision AI to further enhance its operations. Vision AI is critical for driving business model innovation, delivering personalized services, and improving competitive advantages. However, challenges persist, including high infrastructure costs, the need for flexible resource scheduling, and computing power limitations. To tackle these challenges, Meituan adopted 4th Gen Intel® Xeon® Scalable processors with built-in Intel® Advanced Matrix Extensions (Intel® AMX) to accelerate AI inference.

By converting models from FP32 to BF16, Meituan achieved inference performance improvements of 3.38–4.13x. This optimization has increased the overall efficiency of online resources by over 3x and saved 70% on service costs. Meituan applies vision AI across multiple business operations, including QR code bike locks, pharmaceutical package scanning, merchant registration identification, and cosmetology performance monitoring. These AI applications improve work efficiency, reduce costs, and enhance customer satisfaction.

Acquisition of Lightyear and AI expansion

Meituan strengthened its AI capabilities by acquiring Lightyear, an AI startup specializing in machine learning and autonomous systems. This acquisition enhances Meituan’s ability to develop cutting-edge AI technologies, particularly in autonomous delivery systems and predictive analytics. The integration of Lightyear’s expertise allows Meituan to accelerate the deployment of autonomous delivery robots and AI-driven logistics platforms, improving operational efficiency and reducing reliance on human couriers. It also positions Meituan to leverage AI for personalized customer recommendations, further enhancing user experience and increasing engagement.

The acquisition reflects Meituan’s long-term strategy of investing in AI to solidify its leadership in the O2O market and support future expansions into smart logistics and intelligent commerce platforms. Looking ahead, Meituan plans to further develop autonomous delivery robots and drone technology to scale its delivery network and sustain operational efficiency, positioning itself at the forefront of China’s smart logistics ecosystem.

Expansion plans beyond the Mainland China market

While Meituan has dominated China’s domestic market, the company is now expanding beyond the mainland to capture new growth opportunities. In May 2023, Meituan launched Keeta in Hong Kong, which quickly became the second-largest food service provider in the region by the first quarter of 2024, measured by the number of orders. Additionally, in 2024, Meituan announced its entry into Saudi Arabia, leveraging the country’s booming e-commerce market and growing demand for delivery services. To succeed, Meituan has partnered with local logistics providers and implemented culturally tailored marketing campaigns. These expansions demonstrate Meituan’s strategic focus on international growth, tapping into markets with high potential for mobile commerce and delivery services.

A glance at Meituan’s market strategy

- Meituan has evolved into a “Super App” by integrating over 200 services, using AI and big data to enhance user engagement and network effects.

- With 81 million monthly active users in 2024, it connects consumers, merchants, and couriers through its platform, solidifying its dominance in China’s on-demand delivery market.

- Meituan focuses on catering to consumer needs, exemplified by its Pin Hao Fan service, which provides affordable, high-quality food options.

- For future growth, Meituan leverages AI for optimization, reducing delivery times and costs, while expanding into new markets like Hong Kong and Saudi Arabia.