Think grocery delivery is a COVID-19 fad? Not in China. Some Chinese consumers had been ordering grocery delivery as early as 2005, and as of 2021, grocery delivery in China is becoming a standard. Online grocery refers to the means of selling groceries through online platforms; this can be through apps but also offline shopping places like Freshippo (盒马鲜生), one of the leading players in the online grocery market. The online grocery market in China is a successful manifestation of the new retail business model.

History of Online Grocery in China

2005-2014 the budding period of online grocery in China

In 2005, Yiguo.com (易果网), the first online grocery in China was established, specialised in fresh ingredients such as vegetable, fruits, meat, etc. However, at that time, China did not possess a sound logistic system, and payment tools such as Alipay had not yet appeared, leading to low customer trust of online grocery. Although Yiguo.com managed to build its own cold chain logistic systems later, the company closed down in 2020 due to intense competition.

In 2008, the the Sanlu milk powder incident broke out. A series of food safety incidents has made Chinese people more concerned about food safety. At this time, some so-called “natural, safe and organic food” online grocery brands entered the market, such as Fruit Day (天天果园). In its slogan, Fruit Day says “Just for the ultimate freshness” in Chinese. It was also at this time that the capital market began to pay attention to the online grocery.

Source: Fruitday.com, FruitDay’s emphasis on fresh and quality food

BAT enters China’s online grocery market

In 2012, Internet giants started to enter the online grocery market in China. In the same year, Jingdong.com and SF launched their own online grocery brands, fresh.jd.com (京东生鲜) and SF’s selections (顺丰优选). As for Alibaba, it did not rush to enter the market on its own. Instead, it invested in the most established fresh e-commerce company, Yiguo.com in 2013, 2014, 2016 and 2017 to enter the market by way of investment.

In 2014, MissFresh (每日优鲜) was founded. However, the early online grocery model is just a simple imitation of the traditional E-commerce model of Taobao and Jingdong. Because the storage conditions of fresh products are more demanding than ordinary products, the application of E-commerce supply chain on online grocery business resulted in a large number of supply chain and product loss costs.

2015-2019 From prosperity to decline

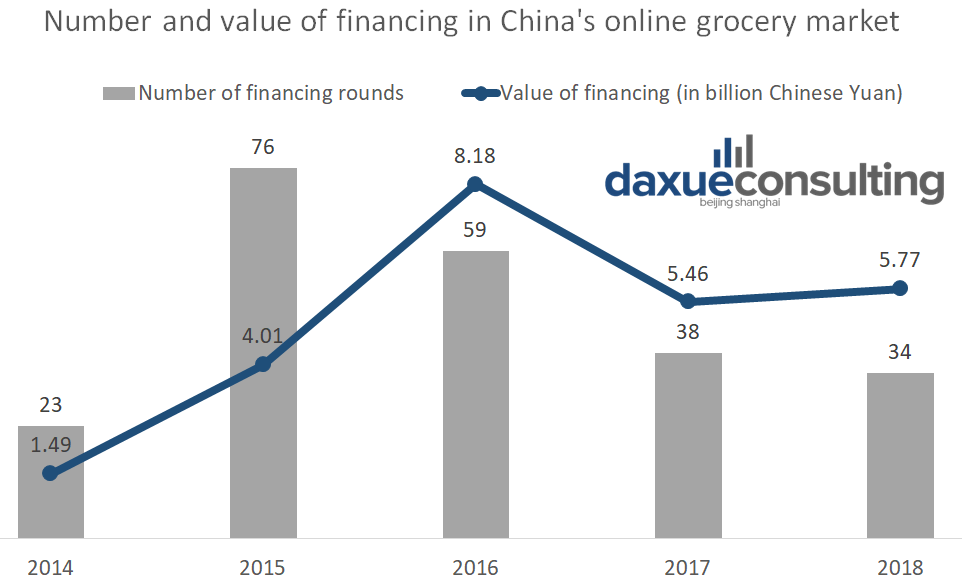

According to Founder Securities, 2015, 2016 were the 2 most prosperous years for online groceries. Within two years, brands such as Freshippo, Daojia.jingdong.com (京东到家) and Pagoda.com(百果园) have been established one after another, all backed by big capital. In 2015, China’s online grocery market reached 76 financing rounds for a total of $4.01 billion Chinese Yuan. In 2016, the total amount of financing reached even more, to 8.18 billion yuan.

Source: Founder Securities, the number and amount of financing in online grocery market

At this stage, various online grocery brands have begun to explore new business models. In the competition, two business models have proved effective. “Warehouse Store Integrated Mode (仓店一体)” led by Freshippo and “Front-end Warehouse Mode (前置仓)” led by MissFresh (每日优鲜).

The “Warehouse Store Integrated Mode” allows the platform to use the store as a warehouse for immediate delivery. Consumers can buy in-store or place orders online. While the “Front-end Warehouse Mode” set up shops around residential areas and do not welcome customers themselves, but act as warehousing and distribution centres.

However, starting in 2017, because of failing to do good cost control and high competition, some online grocery brands started to exit the market, or got acquired by the top players. Among over 4,000 online grocery brands, only 1% is making profits and 95% operating at a loss. As a result, the capital markets have also reduced their investment in the online grocery industry.

2020: New opportunities in online grocery in China under the COVID-19 pandemic

The pandemic spurred the stay-ay-home economy, moving daily activities online, including education, work and grocery shopping. Because of the restrictions, online groceries have become a substitute of supermarkets. This not only greatly promoted the cultivation of user habits, but also guided some middle-aged and elderly people who are accustomed to shopping at supermarkets to accept the new concept of online grocery. According to Investdata.com and Founder Securities, in June 2020, the MAU of online grocery platforms in China reached 71.76 million altogether, increased by 75.4% year-over-year when compared with the number of 40.91 million in June 2019 and the users over 40 years old have increased 237% after the pandemic.

However, the benefits brought by the epidemic may not last long. Although there was a big increase in performance in the short term, if the existing challenges are not solved, it is very likely that a part of the traffic will return to the offline. What is more, many online grocery platforms had expanded product categories and increased inventories to cope with the surge of demand during Covid-19, such inventory could incur large costs due to the inability to sell surplus products after the end of the epidemic.

The online grocery market in China

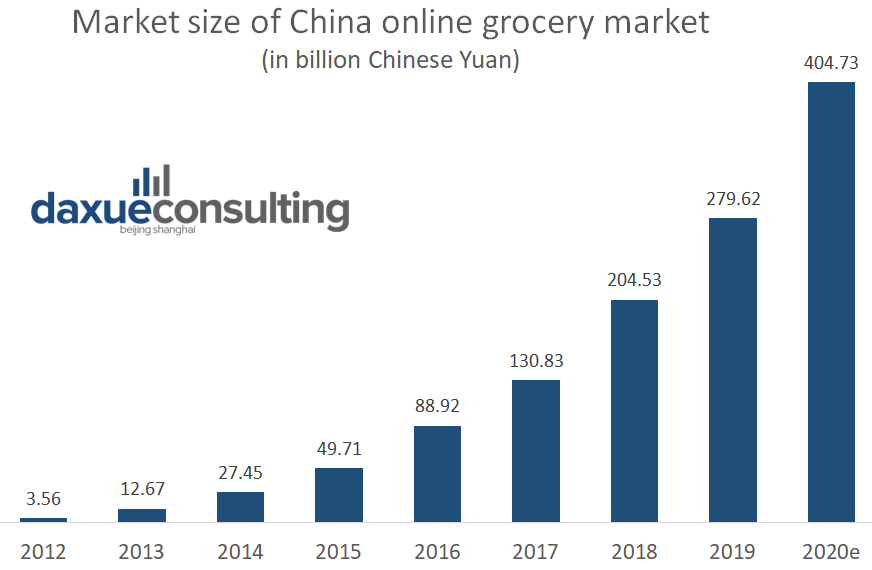

Since online grocery entered the public view in 2012, the market has grown at a steady rate. In 2019, the total market size reached 279.62 billion Chinese Yuan and still growing. In 2020, due to the COVID-19 pandemic, people’s demand for online grocery increased sharply and the market size was expected to be 404.73 in 2020. Whether 2021 brings the online grocery market in China even more wealth is yet to be seen.

Source: iResearch.com, the size of the online grocery market in China 2012-2019 (in billion Chinese Yuan)

Online grocer ditribution

Most customers of online grocery in China are from tier-1 and 2 cities such as Beijing and Shanghai, accounting for 71.4% of the total customers. This is primarily because the logistic network is more developed in Tier 1 & 2 cities than others to support the high service level of online grocery platforms. In addition, comparing to citizens of lower tier cities, those from high tier cities tend to have a faster pace of life, so they are more willing to pay for the timely online grocery services, even at a higher price. Nevertheless, online grocery giants have launched community group buying businesses in lower tier cities.

Convenience isn’t the only advantage to online grocery in China

Online grocery is seen as the grocery shopping of the next era. Comparing to traditional grocery, online grocery has several advantages:

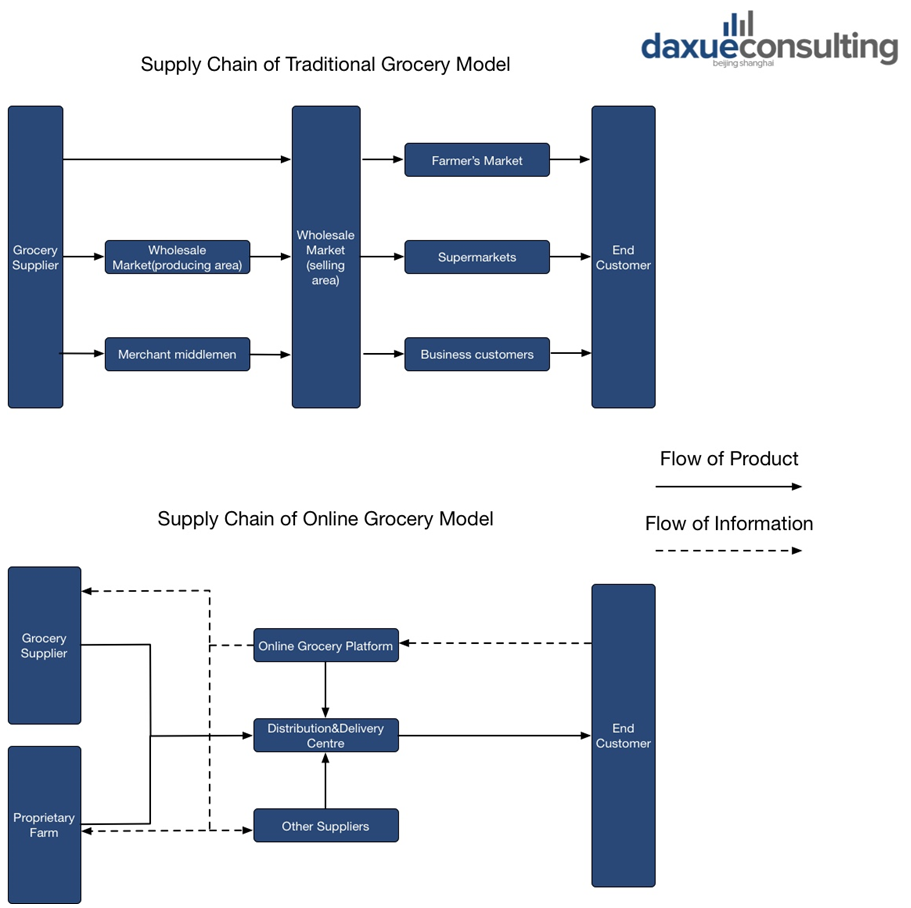

- Lower supply chain cost. Under traditional approach, the groceries requires to go through a number of distributors before reach the customer. However, online grocery platforms can directly cooperate with suppliers and only required to set up one distribution centre for packaging and delivery purposes in each area. As a result, the procurement and inventory costs decrease.

- Lower product waste during transportation. Since the supply chain is shorter, the lead time decreases as well. Groceries, especially fresh food, tend to suffer a higher wastage during the transportation process when the lead time is longer.

- More predictable demand. With the flow of information and data, online grocery platforms can procure more accurately based on the customer demand predicted by big data analysis, leading to even less inventory holding.

As product wastage and supply chain cost decreases, the total operation cost of online grocery firms tend to decrease so that the platform is able to offer a more favourable price or value-added service to its end customer than traditional retailers. For example, Alibaba’s Freshippo (Hema Xiansheng) as a high-end online grocery brand, is able to fully utilise the firm’s cloud computing system and logistic network to deal with orders. After making the order, customers can receive their groceries that deliver to the door in 30 minutes.

The supply chain of traditional and online grocery models

Challenges of online grocery in China:

Refrigeration and preservation problems. Although the supply chain of online grocery can be designed to effectively reduce the loss of food during transportation, food loss problems mainly happen in offline stores and front-end warehouses. Due to the demanding food requirements of brands such as Freshippo and Miss Fresh, fresh food is kept in shops or warehouses for a fairly short period of time. Those kept longer than the period will be disposed of due to quality concerns. According to Founder Securities, the average loss rate of online grocery’s fresh food is about 30%

Insufficient traffic. The two most successful online grocery business models are “Warehouse Store Integrated Mode” and “Lead Warehouse Mode”, both require businesses to rent space within the urban area and each site can only cover about 1-3 km radius. However, only when there is sufficient customer traffic will the advantage of scale be sufficient to cover the costs of rent, manpower and supplies. Compared to online groceries, traditional supermarkets have developed their own method of site selection only after years of accumulation of experience. If online groceries wish to compete, they need to be able to locate better than traditional supermarkets and have an estimate of local market conditions before entering a new market.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about the delivery ecosystem in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast