Since its establishment in September 2015 by Colin Huang, an entrepreneur with a successful career in software engineering at Google, Pinduoduo experienced a meteoric rise. The company rapidly ascended to become China’s most swiftly expanding e-commerce platform. It reached a Gross Merchandise Value (GMV) of USD 15 billion within a mere 2 years following its launch, when it took industry veterans Alibaba and JD.com 5 and 10 years, respectively, to hit the same benchmark.

Download our report on the She Economy in China

The e-commerce platform witnessed an instant soar after its launch. This can be explained by the consumer gap left by Taobao and JD.com when they gave up their commercialization strategy based on low-quality products and enacted a strict policy against counterfeit goods. This move pushed out thousands of sellers and left behind millions of lower-tier city shoppers in China, who were unable to afford regular products and brands. Pinduoduo saw this newly underserved segment as an opportunity and started to orientate its business strategy towards consumers with high price sensitivity.

Today Pinduoduo has solidified its dominance in the Chinese e-commerce sector, emerging as the largest social e-commerce platform in the country with a staggering user base of over 900 million, and a substantial presence in the market with 643.4 million monthly active users. By March 2020, the company had achieved over RMB 2.5 trillion in gross merchandise value (GMV).

Surpassing giants: Pinduoduo’s climb to the top

In 2023, Pinduoduo achieved an unprecedented step by surpassing the Alibaba Group and becoming China’s most valuable e-commerce firm. Alibaba’s U.S. shares saw a significant downturn, with a notable 3.2% decline on December 1, reaching a one-year low of $72.5, a reflection of the conglomerate’s ongoing struggles in the stock market with an 18% dip signaling its third consecutive year of losses.

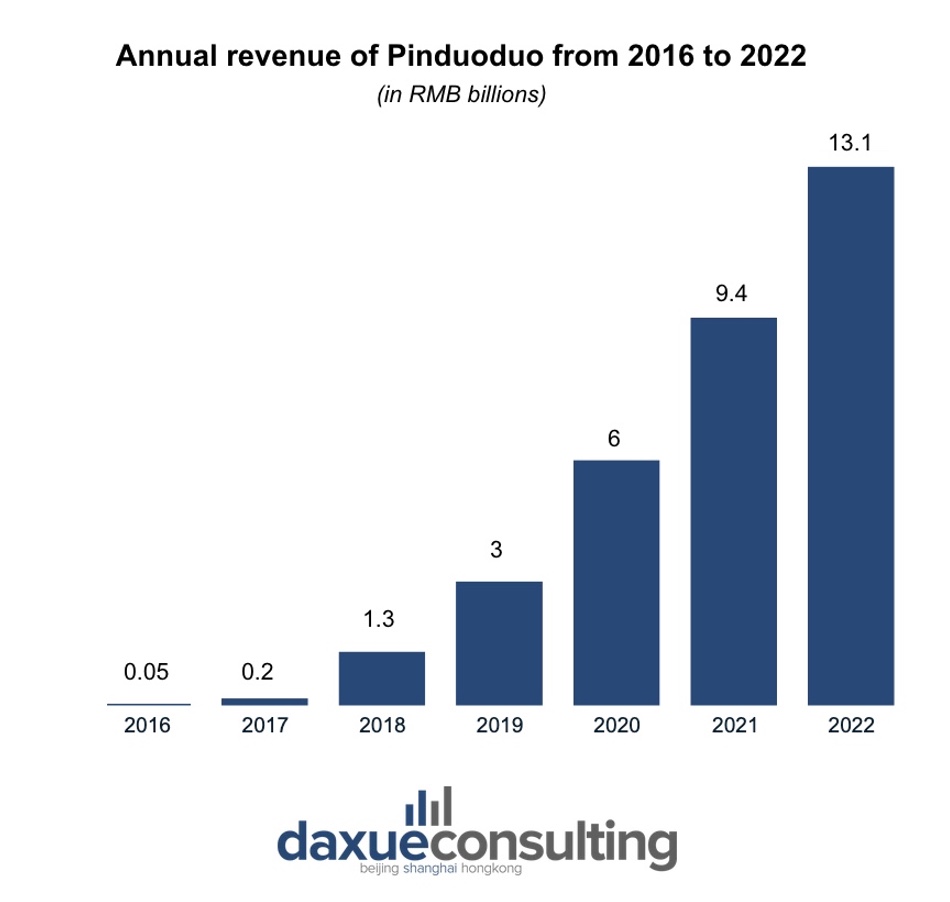

In contrast, PDD Holdings, Pinduoduo’s parent company contrastingly witnessed its market capitalization surge to approximately USD 196 billion, surpassing Alibaba’s valuation of $190 billion. This remarkable rise in PDD’s value was bolstered by its third-quarter earnings report, which showed a staggering 94% increase in revenue and a 60% hike in operating profits.

Crafting the future of online shopping

The Factory-to-Consumer (F2C) business model revolution

The first factor that has set Pinduoduo apart from its competitors is its unique business model that combines the elements of social commerce with a primary focus on consumer-to-manufacturer interaction. Consumers are encouraged to directly connect with manufacturers, bypassing traditional retail intermediaries. By constantly providing merchants with insights into consumer preferences and behaviors, the company’s platform allows them to tailor products specifically for their target audience and streamline communication between both parties. This ongoing exchange of information significantly enhances inventory and supply chain efficiency, enabling sellers to reduce production costs. These savings are then passed on to the consumers, making products more affordable and attractive.

Leveraging of social networks for a more impactful referral strategy

The Power of Social Connections has also played a pivotal role in Pinduoduo’s groundbreaking business model, as it taps into the vast potential of social networks for product promotion and user engagement. This strategy ingeniously harnesses the ubiquitous presence of social media platforms such as WeChat and QQ in daily life, transforming ordinary consumers into powerful advocates for the brand. By encouraging users to share product pages on their social media, the platform not only amplifies its reach but also incentivizes purchases through a communal shopping experience.

Group buying galore

At the heart of Pinduoduo’s strategy, there is a feature named Tuangou” (团购), which translates to “Team Purchasing” or “Group Buying”. This option ingeniously leverages the power of collective action by encouraging shoppers to band together to order the same product at an average lower price per unit. Teams of at least 5 consumers need to be formed within a 24-hour window to deblock the acquisition of the same product. If the number of customers target is reached, the platform then ensures that all participating members are rewarded with lower prices on their purchases. This model creates a win-win situation: the more people join the team, the greater the discount everyone enjoys.

E-commerce engagement through social gaming

Finally, Pinduoduo transcends the traditional “selection-decision-payment” model of online shopping by weaving in social gaming elements that transform the shopping experience into a leisure activity. This innovative approach deviates from the solitary nature of traditional e-commerce, inviting users to engage in social games that foster community and connectivity. Users are encouraged to share deals with friends and relatives, creating a virtuous cycle where participating in group buys is seen as doing a favor for others, thereby enriching personal relationships. This blend of commerce and social gaming can therefore significantly enhance user engagement and loyalty.

A dynamic marketing strategy blended with a unique consumer appeal

Pinduoduo’s external appeal works by attracting shoppers with a blend of unbeatable deals and an immersive, fun-filled buying experience, setting a new standard for value and entertainment in e-commerce. The company slogan “Together, more savings, more fun” perfectly encapsulates the essence and unique selling proposition of the company’s business model, emphasizing group buying, deep discounts, and an engaging shopping journey.

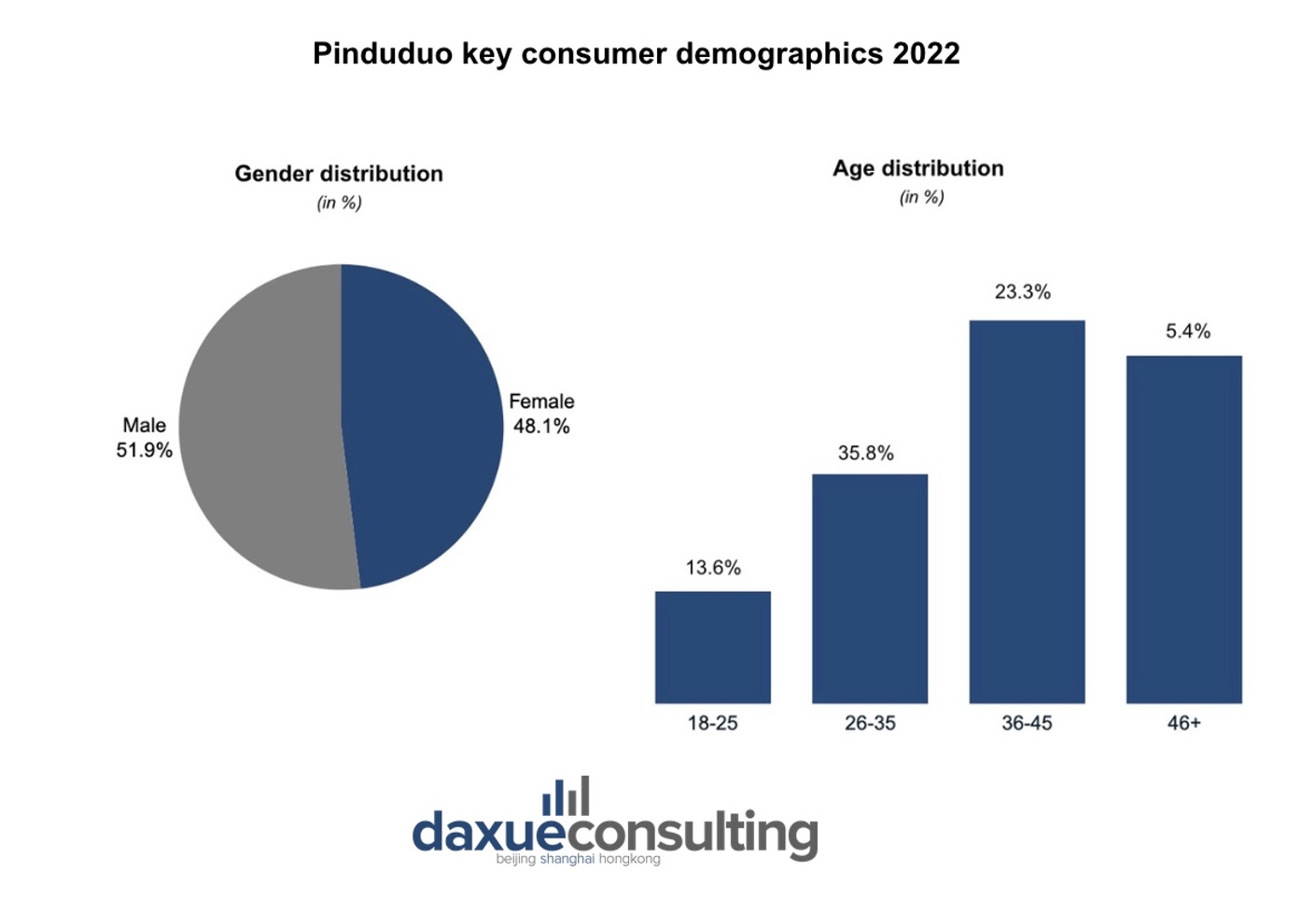

The platform’s major success in achieving widespread recognition and impact among consumers was its early and precise understanding of the needs sought by its targeted user base: The platform’s user base is predominantly composed of individuals over 30, with gender representation evening out within its users. Finally, over 36% of users in the app’s system reside in fourth and fifth tiers or below. This demographic, while having lower income and less technical skills, benefits from reduced living expenses and more leisure time, often spent in social activities.

Despite its success, the company has faced challenges with counterfeit goods. To combat this perception and embrace authenticity, Pinduoduo launched the “Branded Goods Pavilion” initiative, aimed at rejuvenating its image by fostering a direct connection between genuine brands and the vast Chinese consumer base. Over 700 brands were welcomed, encompassing a range of international names such as Bose, Nike, and Adidas, across diverse product categories. The platform judiciously differentiates between low-end and high-end product lines, ensuring a distinct space for premium offerings, thereby enhancing the shopping experience for users seeking quality and authenticity.

Stepping onto the global stage ambitions: the launch of Temu

Pinduoduo’s foray into global markets has been inaugurated through the launch of its Boston-based online marketplace named Temu. This launch marks a significant step for the company’s ambition to test its Factory-to-Consumer (F2C) model internationally and replicate its e-commerce prowess in capturing market shares beyond China.

Temu operates as an online marketplace similar to AliExpress and Wish, focusing on offering affordable goods. Its popularity rose alongside the beginning of its activity in September 2022. Its website traffic and app downloads experienced their most significant growth in May 2023, nearly doubling from the prior month.

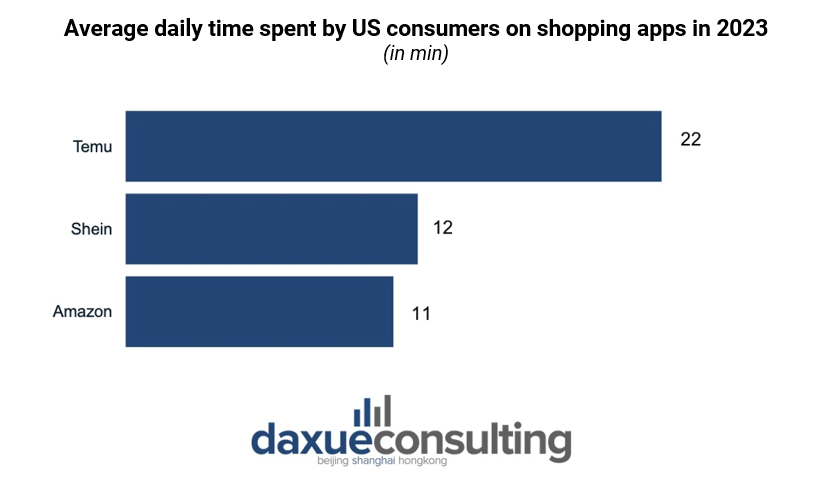

Temu has been innovating the shopping experience by integrating interaction features and bulk purchasing options, akin to Pinduoduo’s model in China. The app also combines shopping and entertainment, incorporating gamification features like minigames, keeping users engaged and potentially hooked on the dopamine rush of winning discounts. According to ECDB, a data platform for market and competitive analysis in eCommerce, covering more than 42,000 companies globally. average users are spending double the amount of time per day on Temu (22 minutes) than on Amazon (11 minutes). Social referrals are also present even though they are seen as less viable for a Western audience which puts a stronger emphasis on data protection and privacy.

The road ahead: innovations and challenges

Broadening the horizon

Pinduoduo has embarked on a strategic initiative to stabilize its revenue growth by expanding its reach beyond its initial core demographic. The company is diligently working to cultivate a more diverse consumer base, a move necessitated by the evolving preferences towards quality and cost-effectiveness that are increasingly influential in the purchasing decisions of higher-income shoppers.

To sustain its growth momentum, the platform has been broadening its range of products and enhancing the user experience to better serve the needs of consumers, with greater spending power but still seeking value for money in their purchases of daily necessities. A key example of this strategy in action is Pinduoduo’s recent partnership with leading brands to offer premium products at competitive prices. For instance, a key collaboration with Apple was established in early 2021, to offer the latest iPhone models at significantly reduced prices.

Legal and ethical considerations for international expansion

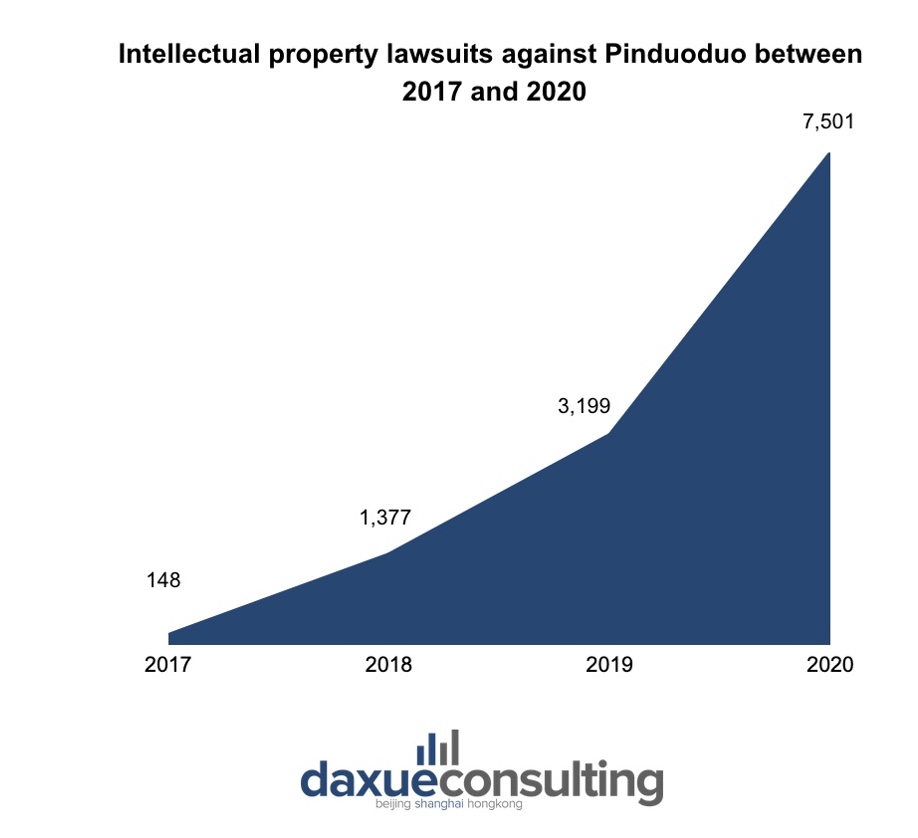

In the midst of its international expansion, Pinduoduo is confronting a complex array of legal challenges, particularly in the realm of intellectual property rights. The platform has witnessed an exponential increase in litigation since 2017, reflecting a surge in disputes over trademarks, patents, and copyright infringements. The data portrays a stark trajectory of escalating legal issues, with the number of lawsuits rising from 148 in 2017 to 1,377 in 2018, surging to 3,199 in 2019, and reaching 7,501 by 2020.

In response to this trend, it is imperative for Pinduoduo to bolster its brand protection and intellectual property enforcement strategies. Proactive management of these legal and ethical issues is not only pivotal to mitigating infringement accusations but also foundational to cultivating trust with global brands and consumers.

Addressing public perception and build consumer trust

Lastly, a significant hurdle is building consumer trust and ensuring quality assurance, especially in Western markets where skepticism about topics such as product quality, labor practices, and data security are increasingly prevalent.

The expansion of Temu internationally has sparked concerns about environmental harm and worker exploitation linked to its business practices, including the sale of fragile products and items containing toxic substances. Concerns over national security, data privacy, and the potential for data breaches through hacking and phishing activities have also been on the rise.

To combat these negative perceptions, Pinduoduo needs to implement stringent quality control measures and transparently communicate these efforts to consumers to counteract skepticism and reposition the brand with a reputation for reliability and responsibility. For instance, robust strategies that prioritize information security, protect user data and ensure fair labor practices will need to be developed.

How Pinduoduo is shaping the future of e-commerce

- Established in 2015, it rapidly became China’s largest social e-commerce platform, surpassing traditional giants with over 900 million users

- Success is attributed to an innovative Factory-to-Consumer (F2C) model, enhancing direct connections between manufacturers and consumers, making shopping interactive and cost-effective.

- It represents the most successful example of how a mobile commerce app can be designed from the ground up to engineer social sharing, viral engagement, and repeat buying as part of the user experience.

- Faced with counterfeit issues and the need to appeal to a broader audience, introduced initiatives like the “Branded Goods Pavilion” and brand partnerships to improve quality and diversify its user base.

- The launch of Temu marked its aim to replicate domestic success globally, encountering intellectual property disputes and concerns over quality, data security, and ethics.