In recent years celebrity beauty in China has moved from niche to mainstream, and the numbers tell a compelling story. Celebrity-founded beauty brands surpassed USD 1 billion in sales globally by late 2023, a staggering 57.8% year-over-year increase, far outpacing the overall beauty industry’s 11.1% growth in the same period.

This isn’t just influencer hype. It’s a structural shift in how brands are created, marketed, and scaled in the age of identity-driven commerce.

Download our report on Chinese beauty consumer pain points

From Rare Beauty (valued at over USD 2 billion) to Fenty Beauty (estimated at USD 3 billion), these brands are not just vehicles of celebrity influence, but are redefining category expectations, emphasizing inclusivity, and building brand equity well beyond their founders. Even newer entrants like Rhode, founded by Hailey Bieber, have taken off quickly, hitting a valuation of USD 1.44 billion within two years and securing a recent acquisition deal by e.l.f. Beauty.

But while this wave is reshaping the Western beauty landscape, it raises an important question: How are celebrity beauty brands doing in China?

Fenty Beauty in China: From star power to cultural relevance

A brand with values that resonate

While many Western celebrity beauty brands remain absent from China’s official retail landscape, Fenty Beauty stands out as the clear frontrunner, not simply for its founder’s fame, but for how it has transformed that fame into a culturally resonant brand identity.

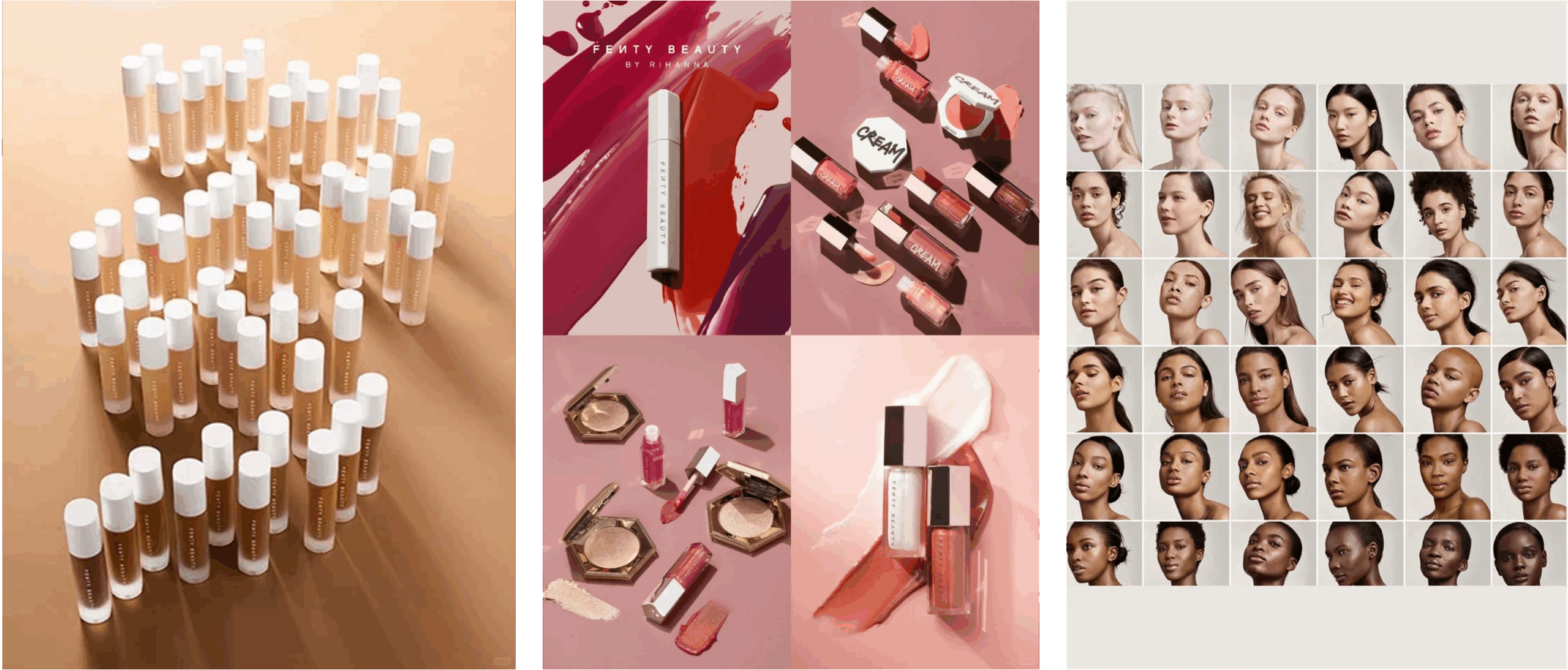

Rihanna’s brand didn’t just ride the wave of celebrity. From the start, Fenty built a compelling narrative around inclusivity, pioneering a “beauty for all” positioning that redefined industry standards and found relevance across global markets, including China. With its diverse shade ranges, high-quality formulations, and progressive brand message, Fenty has evolved beyond a celebrity label into a cultural movement.

This deeply resonates with a shift happening among Chinese consumers, especially Gen Z. Today’s young shoppers in China are less focused on what a brand sells and more on what it stands for. They’re highly individualistic, digital natives, exposed to global trends, and driven by self-expression and identity. They don’t want cookie-cutter products, but brands that represent them.

Although China may not have the same racial and skin tone diversity as Western markets, inclusivity as a brand value is still gaining traction, just in a different form. In the Chinese context, inclusivity often speaks to cultural diversity, body positivity, gender fluidity, and the celebration of individuality within a traditionally conformist society.

Take lifestyle brand Neiwai as an example: their “No Body is Nobody” campaign broke away from narrow beauty ideals by featuring women of all shapes, ages, and backgrounds, which is a bold move in a market historically dominated by homogenous, fair-skinned beauty norms. Similarly, beauty brand Into You has leaned into experimental color cosmetics and Gen Z subcultures, attracting consumers who want more than the conventional soft glam look.

For these consumers, inclusivity doesn’t have to mean offering 50 foundation shades. It means showing that a brand “sees them,” their identities, and their lifestyles. Fenty’s ethos of “beauty for all” translates meaningfully in this context, not through skin tone variety alone, but through an emotional message of being seen, heard, and accepted.

Cultural fluency as competitive edge

Fenty Beauty’s success in China isn’t just about brand values. It’s also about knowing how to engage with the culture authentically.

On May 20, 2024, China’s unofficial Valentine’s Day (520), Rihanna made an unannounced appearance at the “Fenty Beauty Alley” pop-up in Shanghai. She didn’t just show up, but rolled up her sleeves and made jianbing 煎饼 (savory Chinese pancakes) on-site, turning a long-running internet meme into reality.

Chinese fans affectionately dubbed her the “Shandong Queen,” a nickname born from humorous reinterpretations of her song titles: We Found Love became 潍坊的爱 (“Love in Weifang”) and Where Have You Been morphed into 威海油饼 (“Fried pancake in Weihai”). Her yellow cape dress at Cannes was even jokingly compared to a Chinese egg pancake.

Rather than ignoring the joke, Rihanna leaned in. She joined Douyin, went live, and played along, turning memes into meaningful moments. This shows that Fenty doesn’t just localize content; it localizes emotion and humor. It’s a masterclass in brand adaptation: transforming viral jokes into authentic brand-building moments that connect emotionally with a new market.

Retail strategy reflects long term commitment

Fenty’s localization is also evident in its channel strategy.

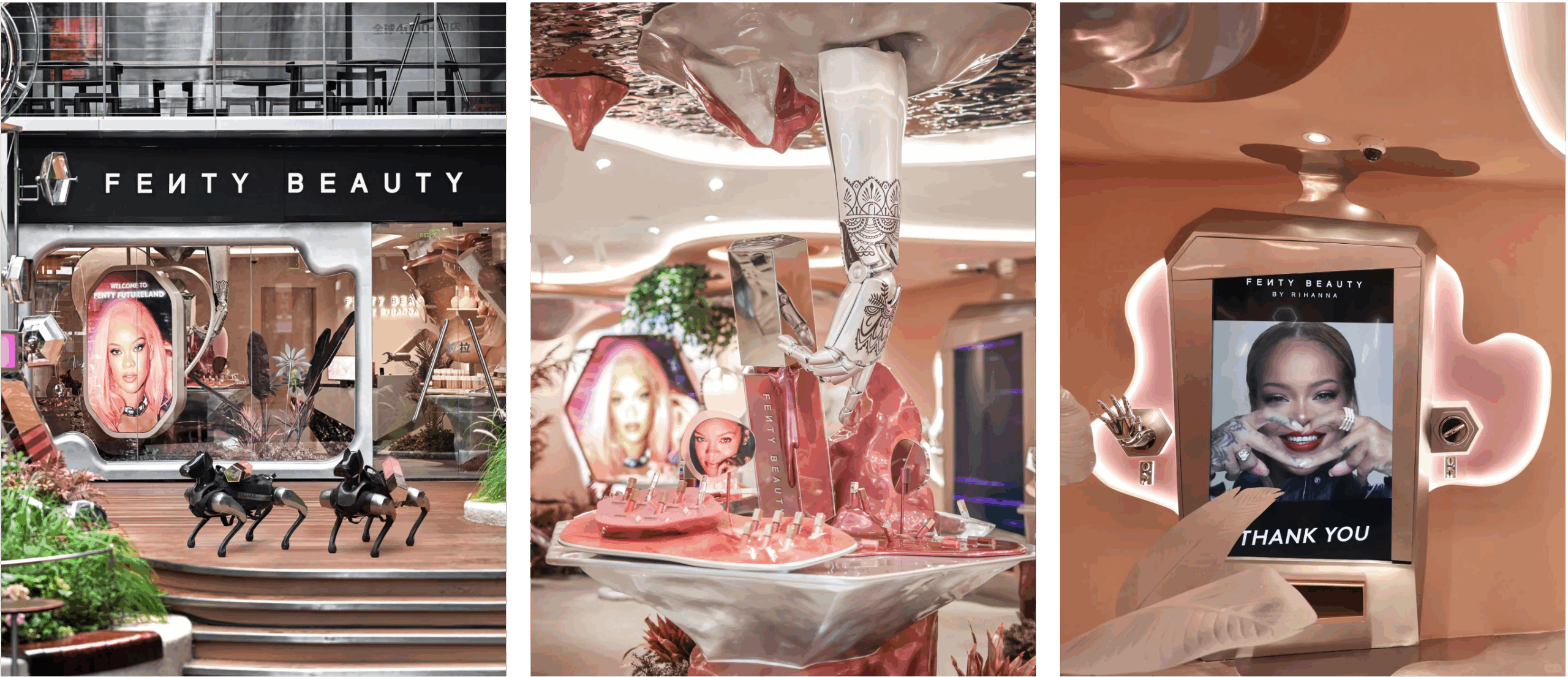

On May 27, 2025, Fenty opened its first concept store in mainland China, located in Shenzhen’s MixC World. Branded as the “Fenty Beauty Future Planet,” the immersive space features over 50 foundation shades, personalized shade-matching, interactive installations, and sensorial experiences.

This move isn’t just retail expansion. It signals Fenty’s commitment to becoming a cultural institution in China, not just a product on the shelf.

Why Chinese celebrity beauty brands struggle to scale

Meanwhile, Chinese celebrity beauty brands have yet to replicate this success, not for lack of effort, but due to fundamental structural challenges.

Over the past decade, many Chinese celebrities have launched their own beauty lines. But most focused on short-term gains, not long-term brand building. The typical formula? One hero product (usually a face mask), backed by fandom traffic, pushed through viral moments with little thought to brand architecture or identity.

Fan Beauty: A case study in limited breakthrough

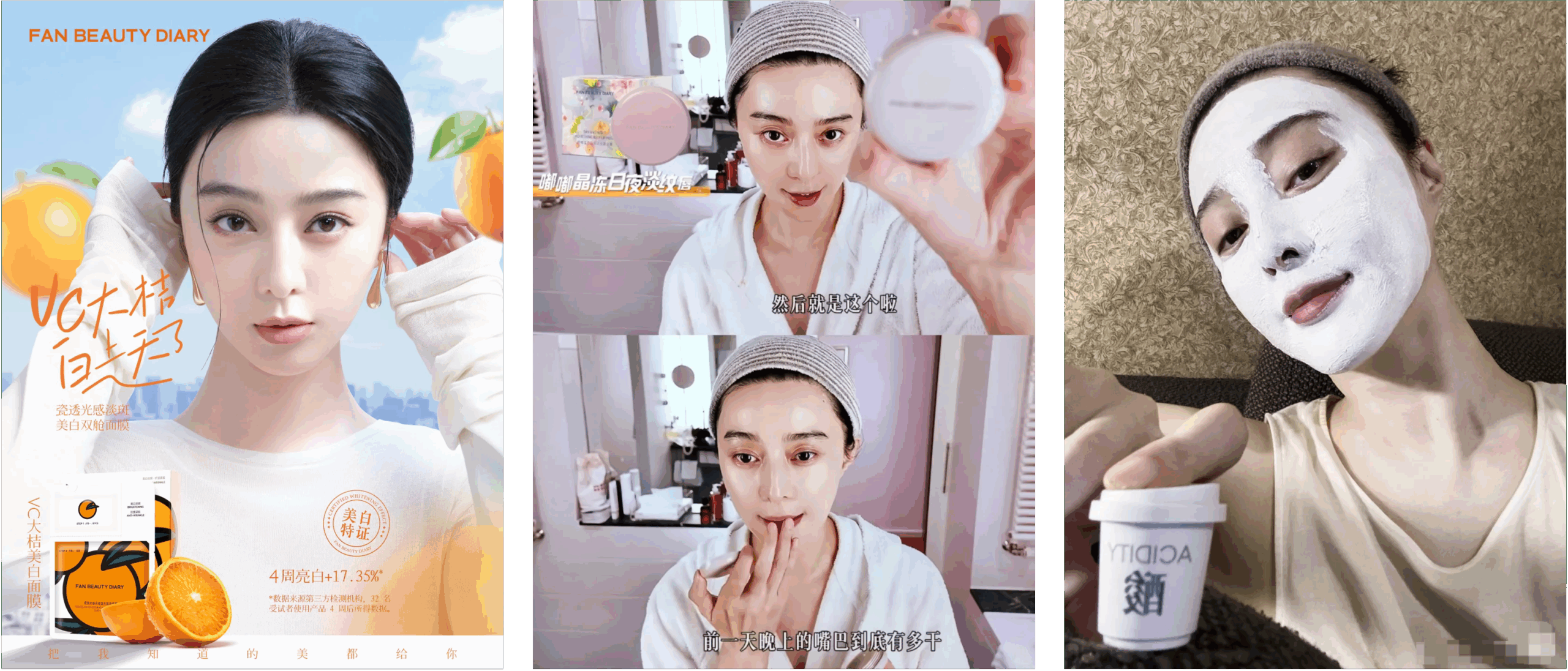

One of the few relatively successful attempts is Fan Beauty, founded by actress Fan Bingbing in 2019. The brand reportedly achieved over RMB 1.1 billion in GMV in 2023.

However, brand recognition remains weak. Most consumers still associate Fan Beauty with Fan Bingbing personally, or just with face masks, rather than seeing it as a brand with independent values or aesthetic direction.

A recent product launch, a vitamin C face mask (RMB 198 for 5 sheets), sold over 200,000 boxes in 3 days. But the spike was triggered by a viral campaign born from a chance encounter with an amateur photographer on Xiaohongshu, later turned into a co-created marketing moment.

The buzz was clever, but also highlights a dependency on Fan’s image, rather than a sustainable, standalone brand universe.

The real barrier: Lack of beauty incubators in China

So why can’t Chinese celebrity brands build lasting momentum?

One key reason: China lacks the brand incubation infrastructure that powers many Western celebrity successes.

In the U.S., brands like Kylie Cosmetics (Seed Beauty) or Fenty Beauty (LVMH’s Kendo) didn’t scale through celebrity alone. These incubators manage everything behind the scenes, from creative direction and formulation to packaging, storytelling, and omnichannel distribution.

They allow founders to focus on brand vision, while ensuring operational excellence and scalability.

Most celebrity beauty in China relies on OEM/ODM factories focused on speed and efficiency, not storytelling, brand equity, or product innovation. Without a partner to translate celebrity IP into enduring brand DNA, most efforts stay shallow.

As one insider put it:

“The celebrity is the spark. But the incubator is the engine. Without one, the flame dies fast.”

Key takeaways: What celebrity beauty in China reveals

- Fame opens the door, and brand values keep it open

Western brands like Fenty prove that while celebrity creates awareness, it’s brand vision, credibility, and cultural relevance that sustain growth.

- Chinese Gen Z doesn’t only buy fame — They buy identity

Today’s Chinese youth are looking for brands that reflect their values and worldview, not just their idols.

- China’s missing middle: Incubation & brand craftsmanship

The absence of strategic brand incubators in China leaves most celebrity beauty efforts without the infrastructure needed to scale with substance.

- The next era belongs to brands with soul

To succeed in China, beauty brands, celebrity or not, must go beyond product. They must tell stories, embrace culture, and reflect the emotional aspirations of their consumers.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.