China has emerged as a pivotal market for medical devices, driven by a mix of strategic policies, regulatory reforms, and a strong push toward local innovation. In 2023, the market size reached RMB 1.27 trillion, representing a nominal growth of 10.4% from the previous year. Meanwhile, 11 Chinese enterprises were listed among the world’s top 100 medical device companies, highlighting the increasing presence of Chinese companies in the global arena. From streamlined approval processes to robust post-market surveillance and reimbursement policies, China’s medical device regulations are evolving rapidly.

National Medical Products Administration’s (NMPA) central role in medical device oversight

The National Medical Products Administration (NMPA) is at the heart of China’s medical device regulations. It sets national standards, ensures safety through post-market surveillance, and manages the registration and approval process for all medical devices. The NMPA’s approach includes stringent compliance requirements and continuous monitoring of adverse events. This ensures that both domestically produced and imported devices meet the highest safety and quality standards.

Pre-market approval: The gateway to China’s market

One of the NMPA’s key responsibilities is overseeing the pre-market approval process, which serves as the gateway to China’s medical device market. The NMPA’s regulatory framework sets strict standards for medical device safety and efficacy, ensuring compliance through a structured approval process, ongoing post-market surveillance, and clinical trials when necessary.

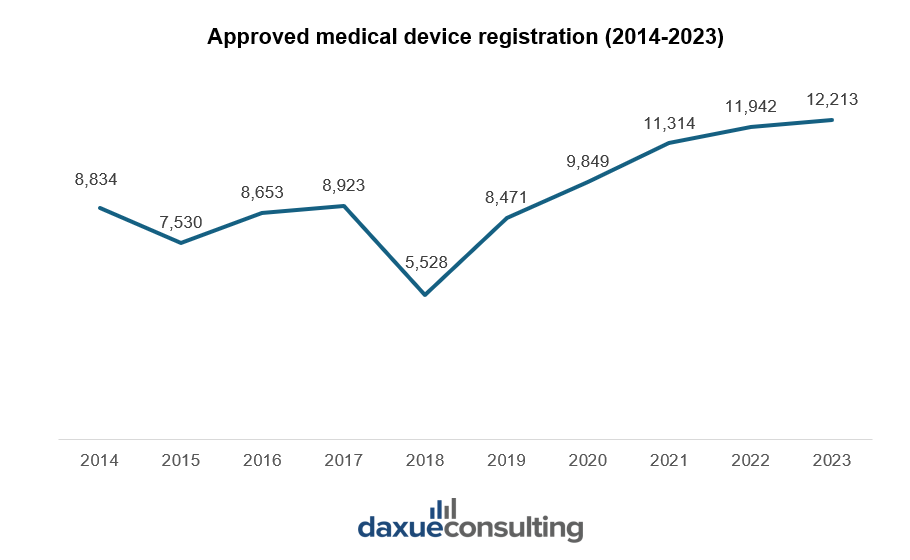

In 2018, the NMPA underwent significant reforms when China restructured the former China Food and Drug Administration (CFDA) into the NMPA. These reforms introduced stricter clinical trial requirements and other changes to the medical device approval process. As companies adjusted to these new regulations, there was likely a temporary slowdown in approvals, resulting in the dip in registration numbers observed that year.

Medical devices must undergo a registration process before entering the Chinese market. This involves submitting detailed documentation, including technical requirements, testing data, and – if applicable – clinical trial results. The Measures for the Registration and Filing of Medical Devices classify devices into three risk-based categories:

Clinical trials are often required for Class II and III devices to confirm safety and efficacy. Clinical trials must begin within three years of approval. After five years, manufacturers must apply for renewal to continue marketing the device in China. NMPA’s guidelines ensure all trials meet ethical standards and receive informed consent. Moreover, documentation must be in Chinese, with foreign language materials accompanied by original texts. Foreign manufacturers must appoint a domestic Chinese corporate legal entity to act as their agent for handling the registration and record-filing of medical devices.

Post-market surveillance: Ensuring safety every step of the way

Once approved, devices undergo post-market surveillance to maintain their safety and efficacy. The Regulations on the Supervision and Administration of Medical Devices mandate continuous performance monitoring, adverse event reporting, annual risk evaluations, recalls, and random inspections. Manufacturers bear full responsibility for ensuring their products remain safe and effective throughout their lifecycle, enforcing China’s high standards for medical device quality.

Accelerating innovation: China’s fast-track approval for medical devices

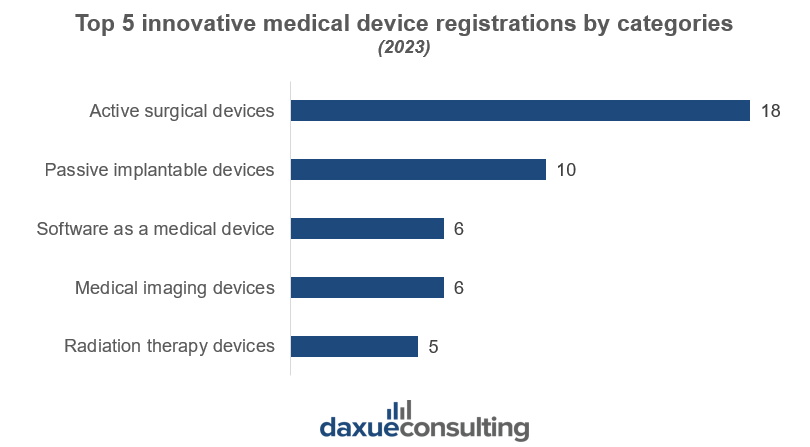

China’s medical device regulations offer fast-track approval processes for companies operating in strategic sectors, particularly for innovative and high-impact medical devices. These special pathways prioritize advancements in medical technology, focusing on areas such as rare diseases, malignant tumors, elderly and child health conditions, brain-machine interfaces, radiation therapy devices, and AI-assisted diagnostics. However, not all medical devices qualify for fast-track approvals, highlighting the selective nature of these initiatives.

Moreover, the Special Review Procedure for Innovative Medical Devices, introduced by the NMPA, accelerates the approval of groundbreaking products that meet certain international standards and possess significant clinical value. Specifically, the NMPA refers to international standards of efficacy and safety, such as the ones from the ISO and FDA – especially when reviewing imported medical devices, while ensuring those devices meet domestic regulatory criteria to address specific local health needs in China. For devices undergoing clinical trials to treat serious, life-threatening diseases without existing effective treatments, patients at clinical trial institutions may access these devices free of charge, and the safety data from the trials can contribute to the product’s registration application.

In addition, the Priority Approval Procedure for Medical Devices is also available for certain high-impact devices, including those designed for rare diseases, malignant tumors, and conditions commonly affecting the elderly and children.

Expanding access: Prioritizing high-impact medical device approvals

By 2024, the NMPA approved a total of 315 innovative medical devices (of which 250 devices were approved from 2014-2023), including the nation’s first proton therapy system and carbon ion therapy system, and domestically produced devices such as brain pacemakers, surgical robots, AI-assisted diagnostic software, and artificial hearts. The average evaluation and approval time for innovative medical devices has significantly improved by 83 days.

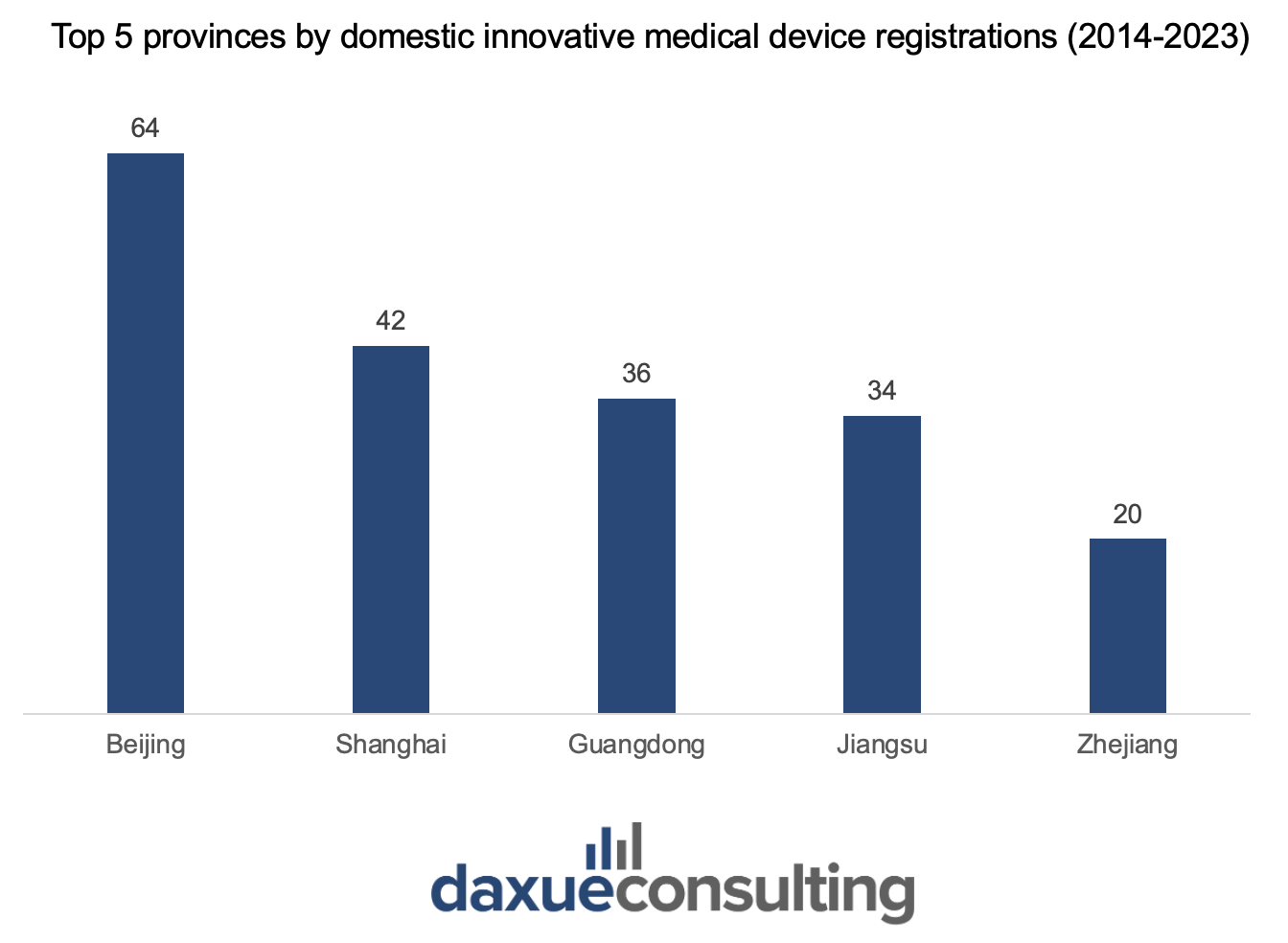

From 2014 to 2023, the largest share (78.4%) of approved innovative medical devices originated from Beijing, Shanghai, Guangdong, Jiangsu, and Zhejiang. This regional concentration can be attributed to these provinces’ dense clusters of medical manufacturers, research institutes, and favorable policies to streamline approval processes.

Additionally, the General Office of the State Council has recently declared a stronger focus on accelerating the approval and market entry of advanced medical equipment, including brain-machine interfaces, radiation therapy equipment, and novel Traditional Chinese Medicine (TCM) diagnostic and treatment tools. In some cases, clinical trial requirements may even be waived for devices targeting rare diseases to reduce time to market.

Game-changing shifts in medical device regulations

The new Medical Devices Administration Law marked a pivotal shift in the industry. The law that is expected to be enacted in second-half 2025 serves quadruple objectives. It aims to foster innovation and performance, promote localization of the medical devices industry, improve industry practices, and increase NMPA’s efficiency.

Among the key provisions is the streamlined process for Market Authorization (MA) of innovative devices, which could open new doors for manufacturers. In addition to this, Article 55 mandates that licensed medical device manufacturers commit to permanent innovation and robust risk management measures. Furthermore, the operational dynamics will undergo significant changes, as multiple articles establish joint and separate responsibilities among the MA holder, the Regulatory Agent (now referred to as the Domestic Responsible Person), and the Distributor.

The most intriguing change is the transferability of MA registration certificates between companies which allow certificates to be bought or sold between companies. This will be a game-changing move that could promote innovation through shortened R&D cycle, lower manufacturing costs, and create new possibilities in medical device innovation. These imminent shifts could reshape the competitive dynamics of the medical device market for both local and international manufacturers.

Made in China 2025: Building local champions

As part of the broader Made in China 2025 strategy, China’s medical device regulations have identified high-performance equipment as a priority industry. The initiative aims to increase the domestic production of high-performance medical equipment and reduce reliance on foreign brands, with a focus on high-performance diagnostic and therapeutic equipment. For instance, imaging devices and medical robots, high-value consumables like fully biodegradable vascular stents, and mobile medical products, including wearable devices and remote diagnostic solutions.

Furthermore, the policy also aimed to encourage breakthroughs and applications in emerging technologies, such as 3D bioprinting and induced pluripotent stem cells. Key targets include achieving a 70% market share of domestically made mid-to-high-end devices in county-level hospitals and ensuring that 80% of core components come from local manufacturers.

Bridging access through digital health coverage and reimbursement

China’s government is steadily expanding insurance coverage for digital health devices. For example, wearable health monitors and AI-assisted diagnostic and treatment tools are now more accessible under the national health insurance system.

In 2020, the National Healthcare Security Administration (NHSA) emphasized equal insurance treatment for online and offline medical services. This parity simplifies reimbursement procedures and encourages the integration of advanced technologies. For instance, Jiangsu province incorporated cutting-edge diagnostic tools and digital health technologies into its provincial reimbursement catalog.

Data protection: Trust built on security

China’s medical device regulations are tightly interwoven with its strict data protection regulations. The Personal Information Protection Law (PIPL) is a cornerstone, categorizing medical health data as sensitive and requiring processing only under specific, necessary conditions. Additionally, the Data Security Law mandates localized storage for critical data and necessitates security evaluations for cross-border transfers.

Under the Cybersecurity Law, Critical Information Infrastructure (CII) encompasses industries critical to national security and public health, including healthcare, with medical devices categorized as a key component due to their role in public services. Operators who violate the regulations governing CII may face penalties of up to RMB 1 million for entities and up to RMB 100,000 for responsible personnel. Data handlers who are not part of CII must adhere to the cross-border data transfer regulations issued by the Cyberspace Administration of China (CAC) and other governments.

Recent developments in China’s medical device regulations

- The NMPA oversees China’s medical device regulations, setting national standards, managing registration processes, ensuring compliance, and conducting rigorous post-market monitoring.

- Medical devices undergo a structured registration process, including clinical trials for higher-risk devices, to ensure safety and efficacy. Post-market measures such as adverse event reporting, random inspections, and recalls maintain long-term device quality.

- Accelerated pathways prioritize innovative devices addressing rare diseases, critical conditions, and unmet medical needs to reduce evaluation and approval times.

- The Made in China 2025 initiative promotes domestic manufacturing of high-performance medical equipment, with key focus areas such as 3D bioprinting and AI tools.

- National health insurance policies increasingly incorporate advanced medical devices, including digital health tools, to promote equitable access and reimbursement for online and offline services.

- Stringent laws like the PIPL and Data Security Law safeguard sensitive health data, enforce local data storage, and regulate cross-border data transfers to ensure trust and compliance.