Semiconductors are the brains of all electronic devices, from microwaves to mobile phones and from drones to automobiles. They are essential components that allow the development of technologies crucial for economic growth, national safety, and global competitiveness. Therefore, countries are competing to win the semiconductor industry race and gain a competitive edge. However, with the tension between the US and China, the Chinese semiconductor industry is speeding up efforts to innovate and be self-reliant in semiconductors, aiming to boost their chip industry.

Inside the semiconductor supply chain: Roles and specialization

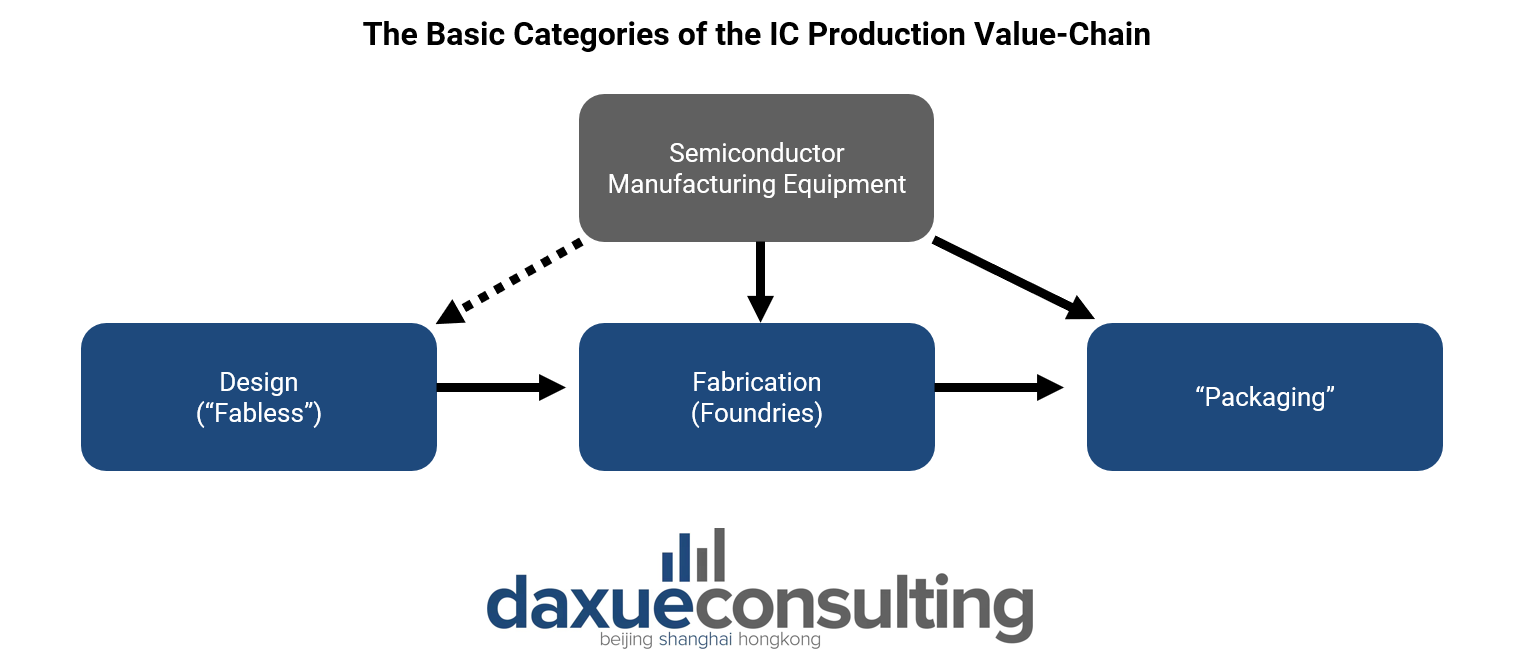

Essentially, semiconductors are created through three steps: design, manufacturing, and assembly. We can also divide the companies in the semiconductor industry into four major segments based on their role in the value chain:

- Design: design integrated circuits (ICs) for a specific purpose.

- Manufacturing: fabricate the ICs.

- Assembly/Packaging/Test (APT): assemble the ICs into a chip which is then integrated into electronic devices by product manufacturers.

- Semiconductor manufacturing equipment: Manufacture capital goods used to automate functions in other semiconductor segments.

In recent decades, semiconductor companies transitioned from the Integrated Device Manufacturers (IDM) model, which combines design, fabrication, and packaging functions, to specializing in one of the four supply chain segments:

- Pure-play design companies (Fabless) –purely focus on creating software and intellectual property.

- Pure-play manufacturing companies (Foundry) –manufacture chips for Fabless.

- OSAT (Outsourced Semiconductor Assembly and Test) companies –specialize in the APT segment of semiconductor manufacturing.

- Equipment manufacturing companies

Tracking progress: China’s semiconductor industry’s rise in 2022

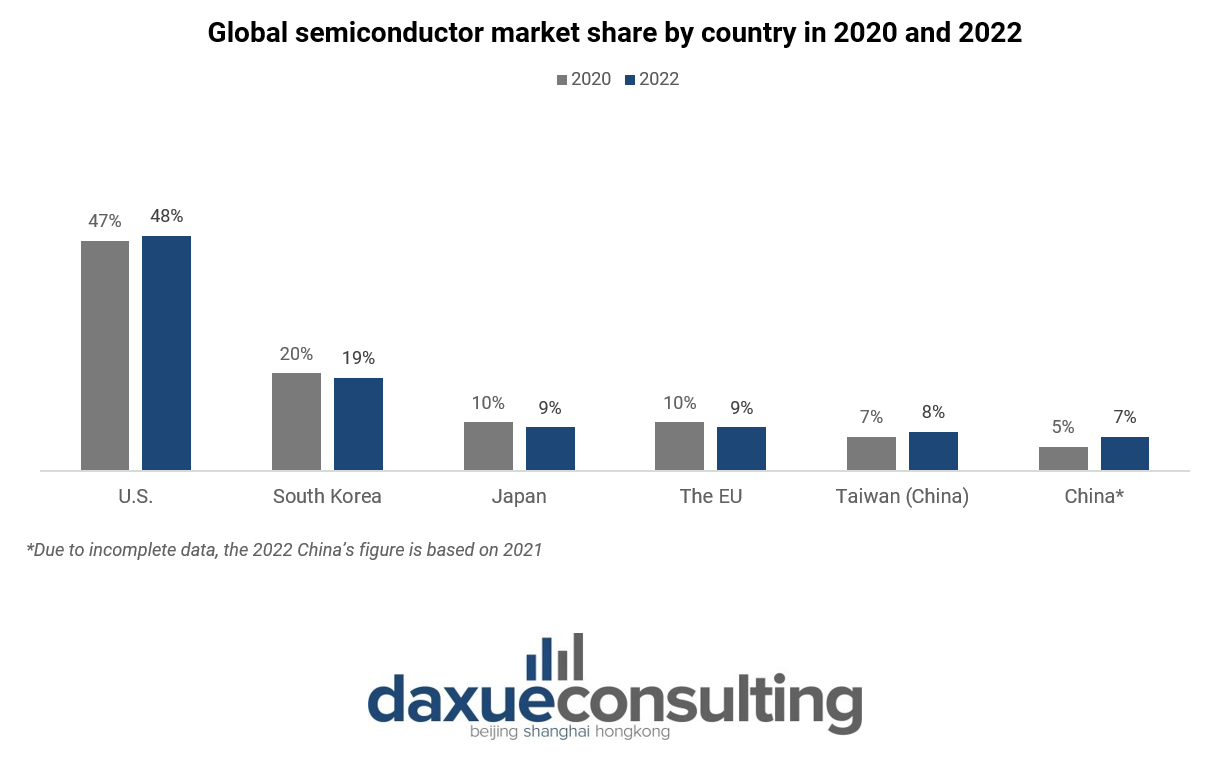

Globally, 1.15 trillion units of semiconductors were distributed in 2021, around 146 units for every person on Earth. When it comes to market share, the US semiconductor industry is at the forefront with a 48% market share in 2022. On the other hand, China’s semiconductor industry is lagging far behind with a 7% market share, after South Korea (19%), Japan (9%), Europe (9%), and Taiwan (China) (8%). However, compared to 2020, the Chinese semiconductor industry’s market share increased by 2%.

Taking a closer look at who are the frontrunners of each segment, we have the US semiconductor industry in the fabless segment, Taiwan (China) in the foundry segment, and Japan, The Netherlands, and the US are sharing the lead in the manufacturing equipment segment.

China’s semiconductor industry: A 55% contributor to APAC and 31% globally

Starting in 2001, Asia Pacific became the leading region in semiconductor sales due to the shift in electronic equipment production. The market’s remarkable growth is evident, soaring from USD39.8 billion in 2001 to over USD330.9 billion in 2022. China is the largest country market, contributing 55% to the regional APAC market and 31% globally. In 2020, China’s semiconductor industry consumed nearly a quarter, 24%, of the global semiconductor-enabled electronic devices.

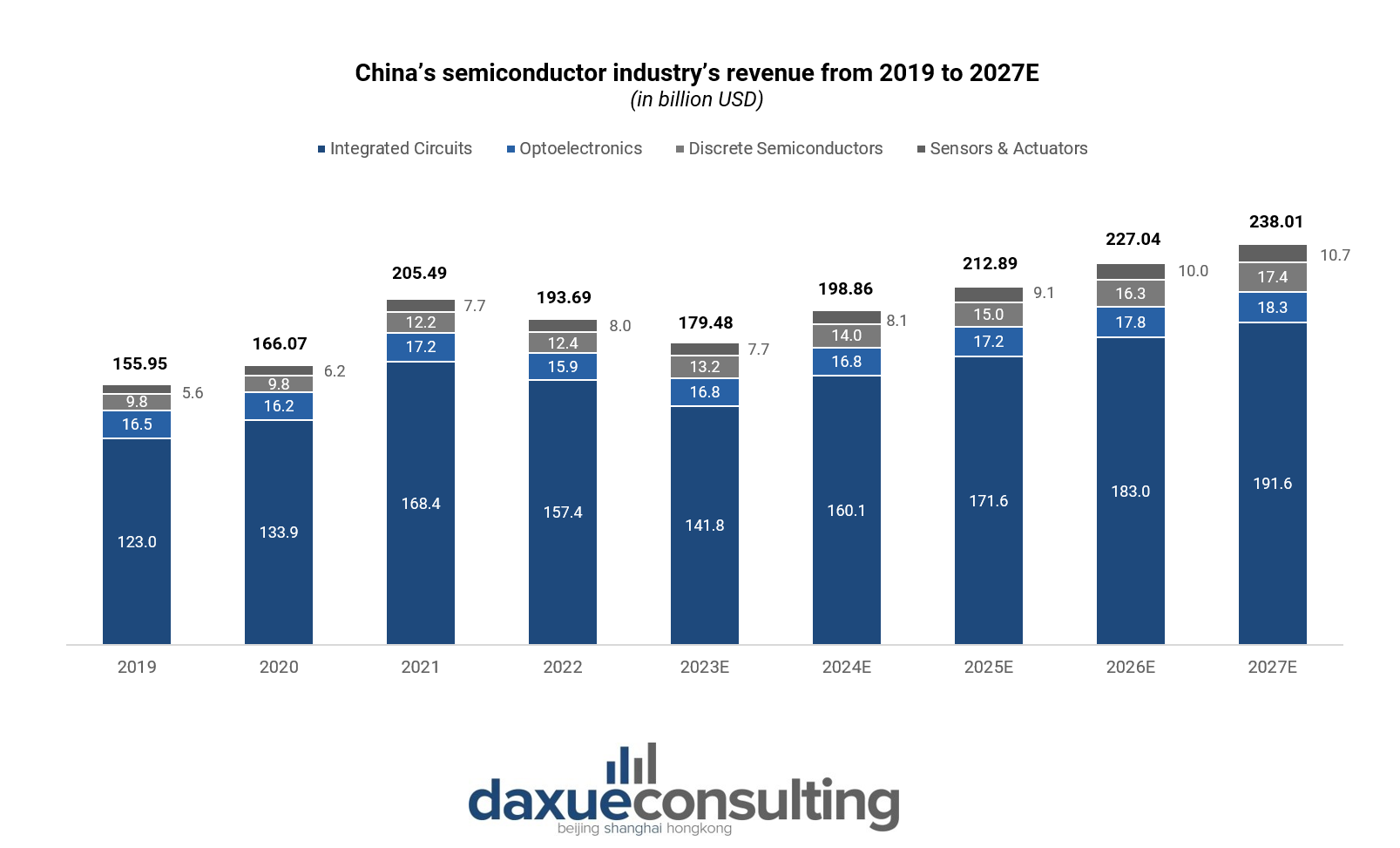

According to Statista, China is the top revenue generator on a global scale, reaching USD179.50 billion in 2023 on a global scale and is expecting a CAGR of 7.31% (2023-2027. Most of the revenue of China’s semiconductor industry is generated by integrated circuits (IC).

Escalating trade controls: US-China tension impact on China’s semiconductor industry

After the conflict between Russia and Ukraine broke out, the US government spearheaded the banning of advanced technology exports to Russia to impede its economic and military development. The country then extended the export ban to China using “to keep advanced technologies out of the wrong hands” as the motivation.

In October 2023, the Biden administration further restricted American companies from selling certain types of semiconductors to China, reinforcing controls initiated in October 2022, which banned the export of artificial intelligence (AI) computing chips to China, specifically Nvidia Corp’s and Advanced Micro Devices Inc.’s (AMD) chips. These measures aimed to prevent potential military applications in China and close regulatory loopholes. The move has escalated tensions, with Beijing accusing Washington of weaponizing trade and tech issues.

China’s AI industry heavily relies on Nvidia and AMD, making the ban on these companies the initial chokepoint in the semiconductor supply chain. This significant control over crucial links creates potential bottlenecks and disruptions, particularly impacting both China’s AI industry and the semiconductor sector.

Global restrictions tighten: Japan and the Netherlands join

Following the US, Japan implemented restrictions on semiconductor manufacturing equipment exports to China from July 2023, and the Netherlands from September 2023. These measures pose additional hurdles for China in its quest to develop independent chip manufacturing capabilities and attain self-sufficiency.

China’s other chokepoint is TSMC, the largest foundry in the world. Over 90% of highly developed nodes and 50% of global semiconductors are produced by TSMC. The Chinese semiconductor industry relies heavily on TSMC. In the first half of 2022 alone, China imported ICs from Taiwan (China), with a total value of USD 79.4 billion, accounting for almost 38% of the country’s total such imports during the period. Thus, unlike other sectors, China does not impose sanctions on chip imports from the Formosa Island even amidst the growing tension in the Strait, specifically after the visit of the Speaker of the United States House of Representatives, Nancy Pelosi, in August 2022.

Surging imports: China’s growing appetite for semiconductor equipment

China’s integrated circuit production has accounted for 16% of the world’s total IC production, ranking third in the world. Yet, China is a net semiconductor importer and it continues to increase its import. In Q3 2023, China experienced a significant 93% surge in chip-making equipment imports compared to the same period last year, reaching USD 8.75 billion (RMB 63.4 billion). Notably, lithography equipment imports, a crucial part of chip-making, increased nearly fourfold. Import data reveals a notable increase in semiconductor equipment imports from the Netherlands, even with implemented export restrictions. ASML, the Dutch market leader in lithography machines, saw a substantial rise in sales revenue from China, doubling from 24% to 46% in Q3 2023.

Regarding import origin, in Q3 2023, China’s semiconductor equipment imports from the U.S. grew by approximately 20%, but the U.S. share decreased from 17% in Q3 of 2021 to 9%. In contrast, Dutch imports surged, claiming a 30% share, up from around 15%, while Japan’s share dipped from 32% to 25% during the same period.

Driving self-sufficiency: China’s semiconductor industry journey since 2014

China has prioritized semiconductor development as a key part of its government agenda to grow its in-house IC industry. Since 2014, China has been working towards self-sufficiency in the semiconductor industry, notably through initiatives like “Made in China 2025.” Recent acceleration in this journey can be attributed to the US-China trade war from 2018 and Huawei’s blacklisting.

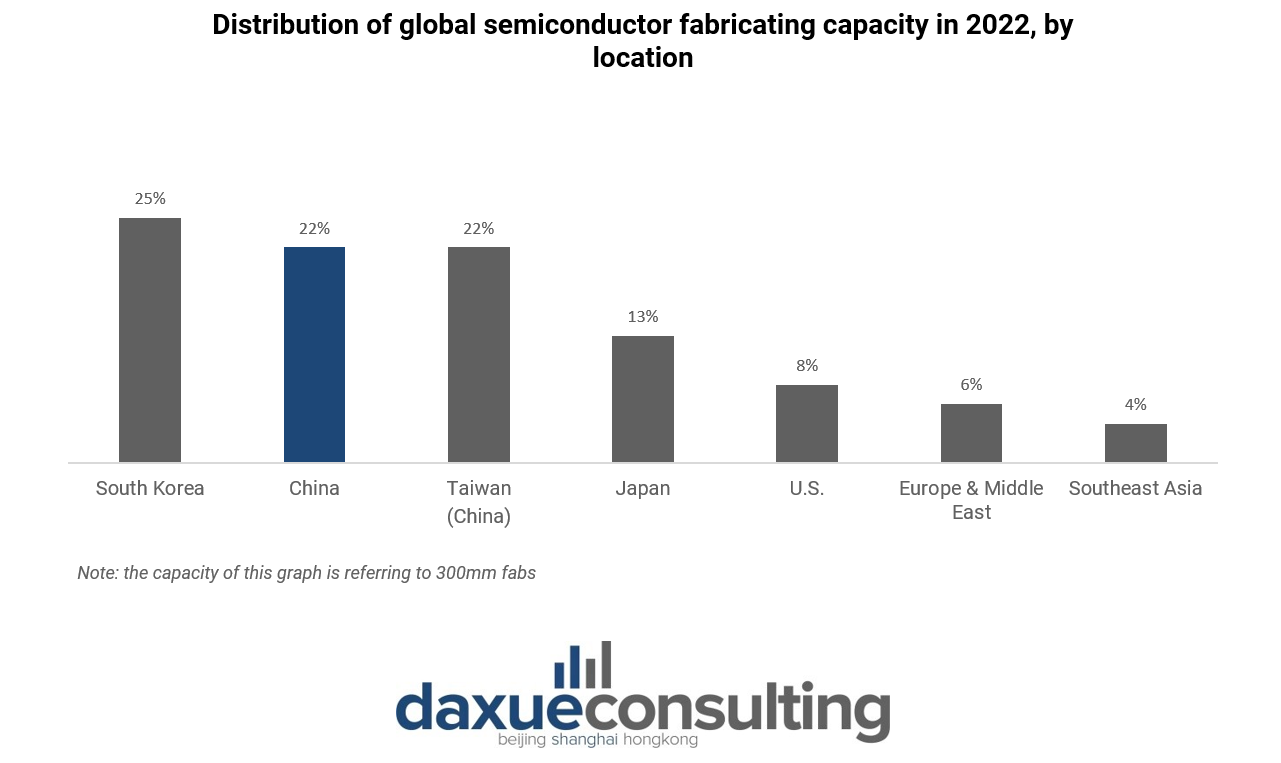

Moreover, to support these efforts, the Chinese government introduced new income tax exemptions and import duty exemptions for advanced technology nodes. The “Big Fund,” a state investment fund exceeding USD 50 billion for chips, was reinstated. Additionally, a new National Science & Technology Commission was established to coordinate industry efforts. In addition, China took the second place as the country with the highest semiconductor fabricating potential according to a press release by SEMI, a microelectronics industry association.

Chinese semiconductor industry: Challenges and opportunities

- In 2022, the US led with a 48% market share, while China lagged at 7%, though it increased by 2% from 2020, and was a major contributor to the Asia-Pacific market, accounting for 55%.

- Intensified tensions led to trade controls, export bans, and disruptions, impacting China’s AI industry and semiconductor sector.

- Following the US, Japan and the Netherlands restricted semiconductor manufacturing equipment exports to China, adding challenges to its quest for self-sufficiency.

- The PRC is a net importer of microchips, recording a notable increase in semiconductor equipment imports from the Netherlands, even with implemented export restrictions.

- Prioritizing development since 2014, China accelerated efforts with initiatives like “Made in China 2025,” tax exemptions, and substantial investments, aiming for self-sufficiency amidst global trade tensions.