Amid the Chinese Contraceptives Market’s bad reputation, opportunities abound

Due to changing cultural norms, the Chinese contraceptives market harbors high excess potential. Fierce competition and a broken reputation, however, present major challenges to the industry.

While it is often held that the Chinese people have a conservative view towards sex, this belief is chiefly applicable only to elderly Chinese citizens who have been strongly influenced by traditional culture. China’s younger generations have tended to approach the topic more openly.

In fact, according to a 2011 investigation conducted across several major Chinese cities, 79 percent of 21-year-olds surveyed have had premarital sex. Additionally, multiple other studies pointed out that their beliefs regarding sex did not vary significantly from those of western counterparts.

As a result, Chinese youth have begun to pay increasing attention to sex-related issues such as contraception. Data show, for instance, that the majority of young people want to have their first child no earlier than the age of 25.

According to an article by Reuters reporter Adam Jourdan, this “sex savvy” generation of Chinese youth are a major source of the country’s condom market potential.Recognizing this trend, Chinese investors have proceeded to buy a top-selling condom brand from the Australian company Ansell Ltd. (安思尔) at $600 million, Jourdan added.

While the condom was met with much popularity in China, oral contraceptives, however, were not quite as well-received. Additionally, Chinese consumers have developed doubts against the country’s contraceptives market due to widespread reports of “fake” and low-quality products.

Nevertheless, as “safe sex” practices continue to garner support from both civilians and authorities, business optimism regarding condoms and oral contraceptives remain undampened.

Thus, in response to the rising popularity of contraceptives in China, a number of enterprises have sought to enter the market. Daxue Consulting has constructed a comprehensive view of this market and sized its potential based on demographic data and consumers’ feedback from multiple Chinese cities and provinces.

The following article presents a sketch of the market’s current ecosystem and challenges according to our research.

Support from the Chinese government

Since China’s official participation in the 2009 World Contraception Day events, the Chinese government has been a vocal advocate for contraceptives.

The China Press Conference for World Contraception Day 2012 (2012年世界避孕日·中国新闻发布会). Source: China Population Communication Centre (中国人口宣传教育中心)

According to a 2014 report published on the magazine Modern Advertising (现代广告), the Chinese government purchases 1.2 billion condoms each year, distributing them via health institutions. This figure has been increasing year-on-year, and the government has since entered into contracts with at least 30 condom producers.

Condoms are easily accessible in China’s convenience stores; vendors often display these products right before the counter in an effort to increase their exposure. Photo credit: Daxue Consulting

These events signified a great shift from the 1989 “Ban on the advertisement of sex-related products” (关于严禁刊播有关性生活产品广告的规定). Despite the increasingly common presence of condoms in the everyday lives of Chinese people, the product had — due to its direct link to sexual intercourse — held a taboo status prior to the government’s public endorsement of condoms.

In 1999, for instance, a China Central Television (中国中央电视台) public announcement on AIDS prevention through condoms was allowed to be broadcasted for only one day. Furthermore, in 2001, the Australian condom brand Jissbon’s (杰士邦) poster commercial on the exterior of buildings was dismantled by government departments.

However, the Chinese government gradually recognized the importance of contraceptives in national health and demographic issues such as birth control and AIDS prevention. Notably, the CIA World Factbook reported as recently as 2012 that, with 780,000 AIDS-infected patients, China had the 11th largest number of people living with AIDS among all countries in the world.

Thus, in response to these problems, the People’s Republic of China’s National Health Commission (卫生部), alongside the National Population and Family Planning Commission (计生委) and six other commissions eventually held a meeting in October 2006. As a result of this conference, the Chinese government issued an “Advice on Strongly Promoting the Use of Condoms” (关于大力推广安全套使用意见). This event marked the Chinese government’s official acceptance of contraceptives in public advertisements.

Even so, it was clearly ruled in this statement that the public promotion of condoms was allowed only on specific media, and could be used solely for public welfare purposes. Only in more recent years did the Chinese government gradually relax regulations regarding the advertisement of condoms.

Demand for contraceptives in China yet immature

Condoms and other oral contraceptives are the main contraceptive products used in China. Nonetheless, only 49.5 percent of respondents to a poll in China thought that oral contraceptives are effective. Moreover, Chinese females have a low acceptance rate of oral contraceptives, often due to the belief that oral contraceptives are harmful to health.

Headline of an article reading: “Be careful when consuming oral contraceptives; do not let contraception become infertility.” Source: NetEase (网易)

According to research conducted by Daxue Consulting in 2014, Chinese people ranked the effectiveness of contraceptive products in the following order:

- Male condoms

- Short-term contraceptives

- Emergency contraceptives

- Rhythm method

Additionally, the research showed that 80 percent of Chinese respondents thought that both males and females need to take the responsibility of using contraception.

Overall, the contraceptive market in China has great potential –– in part due to changing cultural beliefs surrounding sex, increasing demand for sexual health products, as well as increased support from the government.

It is also notable, however, that a sizable portion of China’s sexually active population has yet to develop habits of regularly using contraceptives.

Furthermore, figures released on the World Contraception Day website revealed that 45 percent of women in China used abortion to terminate unplanned pregnancies. This said, it is little surprise that the number of babies aborted in China is in fact comparable in magnitude to the number of babies actually born in the country.

In 2014, Hong Kong China News Agency (香港新聞網) reported that some 16 million babies were born in China each year. During the same time period, approximately another 13 million babies were also aborted annually, according to China Monitor Health (中康研究院).

The condom market: fighting it out for atomized shares

As of 2014, the use of condoms had already become common among the Chinese population. In 19 major cities including Beijing (北京), Shanghai (上海), Tianjin (天津), Chengdu (成都), and Guangzhou (广州), the average Chinese person aged between 20 and 30 years used 6.5 condoms per month, the Chinese business information website Chinabgao.com (中国报告大厅) wrote in an article.

Additionally, those living in Wuhan city (武汉) used the most condoms on average, at 8.2 condoms per person per month.

In the past, only 10 percent of China’s sexually active population used condoms regularly –– now, the same figure sits at 50 percent. According to a global market research firm, China’s market for condoms has been set to increase by around 60 percent over the five years since 2015, and foreign manufacturers will benefit significantly from this opportunity.

The Chinese market for condoms, however, has already become very competitive by 2014, with aleast onene thousand condom brands vying for business, chinabgao.com reported. Up until 2017, the market’s situation has continued to remain competitive.

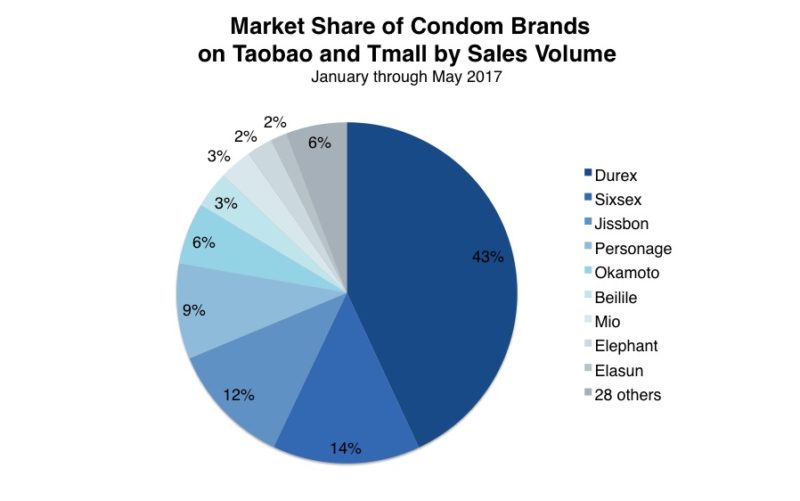

Market share of condom brands on Taobao and Tmall by sales volume between January and May 2017.Source: Maijia (卖家)

Between January and May 2017, a total of 8,114,455condom packages were sold on onTaobao (淘宝) and Tmall (天猫), two of the most popular online retailers in China.

Among all brands present on these websites, Durex (杜蕾斯) was the unequivocal leader during this time period. The brand topped the industry with a sales volume of 3,499,021 — roughly three to four times larger than those of Sixsex (第六感) and Jissbon (杰士邦), its two closest runner-ups.

On the contrary, Taobao and Tmall’s 28 least popular condom brands had to fight over a meagre six percent share of these two online retailers’ markets.

While market shares of brands on Taobao and Tmall may not be able to represent the entirety of the industry’s circumstances in China, these two outlets are nonetheless major sources of retail transactions in the country. Thus, it may be reasonably estimated that, based on these two websites, the Chinese condom market exists in a crowded state wherein smaller market shares are atomized by a large number of brands.

Market share of domestic and foreign condom brands in China by sales volume on Taobao and Tmall between January and May 2017. Source: Maijia

Furthermore, the number of imported condoms has been increasing, with shipments coming from the UK, US, Japan, Sweden, Malaysia, Korea, and 12 other countries.

Local businesses too produced condoms on a smaller scale, but have not been very well known. Although the product qualities of these firms are comparable to those of products imported from developed countries, they are of inferior packaging in terms of texture and design, chinabgao.com stated in a report.

Most of these domestic condom producers were originally established on government investment during China’s plan era, and responded very slowly to the formation of the market, the report added. This situation is evidenced by the fact that, throughout the first five months of 2017, the online market share of domestic Chinese condom producers on Taobao and Tmall remained low at 23 percent.

The Chinese condom market, however, is still expanding. According to the National Population and Family Planning Commission, the country’s annual consumption of condoms has reached 4.7 billion since the notion of family planning became widely accepted in China.

The oral contraceptives market: surmounting misconceptions

Oral contraceptives, on the other hand, have been much less popularized in comparison to condoms. On Taobao and Tmall, for instance, this category displayed a sales volume much lower than that of condoms. Between January and May 2017, oral contraceptives on the two websites had a total sales volume of 68,394, which is approximately just 0.8 percent of condom sales on the same platforms and over the same time period.

This phenomenon may be explained by observations made in the White Book of Chinese Female Health 2015 (2015中国女性健康白皮书). The book reported that among 80 million respondents, 53.08 percent of Chinese females did not take any effective contraceptive pills. Only 3.09 percent of the female population took emergency contraceptive products. Furthermore, as few as 0.67 percent of the Chinese female population used short-term contraceptives.

Knowledge regarding the safety and variety of contraceptive pills generally remains low among women. China Monitor Health reported that, according to information released by the World Contraception Day website as of 2016, 30.4 percent of women have never heard of short-term contraceptive pills, and yet more women maintain misunderstandings that the use of contraceptive pills may lead to disease, affect fertility, and harm future fetus health.

In the same year, 58.8 percent of women interviewed thought of emergency contraceptive pills first when they think of oral contraceptives, and were less familiar with the other options.

Thus, within the unpopular market of oral contraceptives, emergency contraceptive pills occupy the largest share in contraceptive pills market, according to China Monitor Health. Considering the low level of saturation in China’s emergency contraceptive potential, as well as the population’s unfamiliarity with other oral contraceptives, however, there evidently remains great room for growth in the market for these pills.

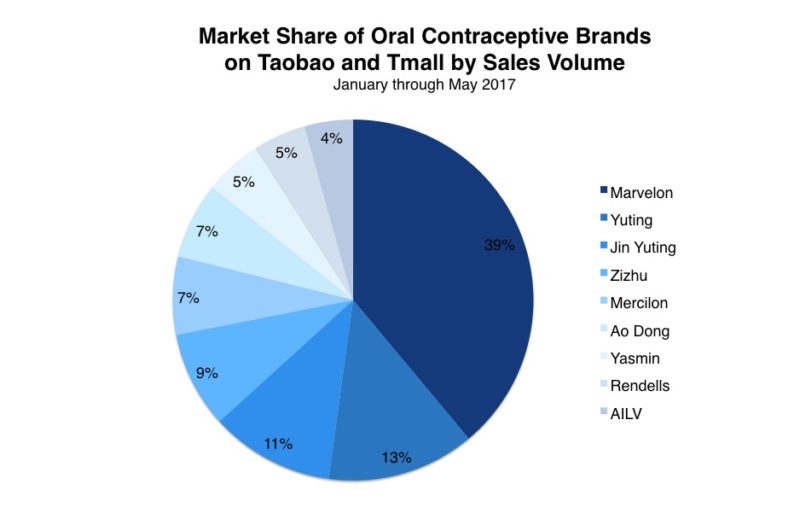

Throughout January to May 2017, the leading oral contraceptives brand on Taobao and Tmall was Marvelon (妈富隆) , comprising 39 percent of the market with a sales volume of 26,622. Aside from this brand, the eight other players on these two online outlets were much smaller. Nonetheless, it may be noted that the oral contraceptives market was significantly less atomized than that of condoms, which sustained a total of 37 brands.

Market share of oral contraceptive brands on Taobao and Tmall by Sales Volume between January and May 2017. Source: Maijia

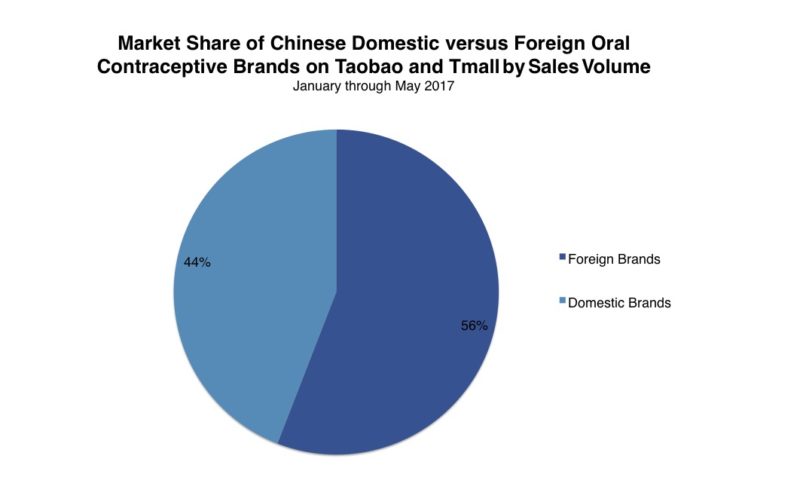

Furthermore, the market share of China’s domestic oral contraceptive brands lagged behind that of its foreign counterparts by a mere 12 percent. Thus, Chinese domestic producers have been much more competitive in the oral contraceptives market than in the condom market.

Market share of Chinese domestic versus foreign oral contraceptive brands on Taobao and Tmall by sales volume between January and May 2017. Source: Maijia

According to China Monitor Health, the Chinese market for contraceptive pills amounted to 2.98 billion yuan in 2015, and had grown 4.5 percent compared to 2014. It was estimated to grow to 3.39 billion yuan in 2016.

Particularly, markets for non-emergency contraceptive pills are expected to experience continued growth. Short-term contraceptives, for instance, had a sale of 780 million yuan in 2015, and was estimated to surpass one billion in 2016, experiencing more than a 20 percent growth, China Monitor Health reported.

The Internet diversifies means of purchasing contraceptives

In 2016, China Monitor Health observed that 70 percent of oral contraceptives sales came from the retail shops.Otherwise, consumers also bought pills from online pharmacies.

As online sales had also just begun to emerge at the time, however, some consumers also chose to buy contraceptives on the web, according to Modern Advertising.

The web is favorable to consumers in that it permits them unlimited time to assess a wide variety of contraceptive products without bearing the embarrassing pressure of being judged and observed, as is commonly the case in physical stores, Modern Advertising reported.

According to a 2014 study, there existed a saying in China that customers seeking condoms in physical stores often adhered to the “3-second rule,” which dictates that one must hastily choose a product in order to decrease the embarrassment of having to buy condoms in public.

According to the study, this phenomenon suggests that consumers are usually unable to rationally analyze their options in physical stores, due to both social pressure and time constraint.

On the contrary, the advent of online shopping behaviour may allow the consumer to avoid the judgment of other people and subsequently make choices based on their real needs. As a result, online sales channels have contributed to an increase in the use of condoms in sexual intercourse, the study wrote.

Picture extracted from a humorous video clip, showing a customer at a retail store. The subtitles read: “Mister, are you buying condoms?” Source: rkanr.com (人看人视频网)

Customers distrust quality of contraceptives

The Chinese contraceptives market––especially the condom market––however, has generally been unable to gain the trust of consumers.

As of 2014, there had been 538,443 different condoms available for sale on Taobao. For product packages sold in packs of tens or dozens, prices online varied from as high as 60 yuan to low as less than 10 yuan per box, chinabgao.com reported.

Regarding this vast range of products of very uneven pricing, however, information was often scant. Thus, consumers were unable to differentiate products from one another amid a market rife with low-quality and fake goods.

Quality management of condoms too has been inadequate. At present, although condom-producing enterprises have obtained certifications from quality control systems, not all of them adhered to ethical business practices.

To pursue profits, individual enterprises have even sold unqualified products to other manufacturers at a low price, creating an uneven quality across products on the market.

Alarmed by the health hazards associated to low-quality condoms, the China Food and Drug Administration (国家食品药品监督管理总局) issued an announcement on March 23, 2015, calling for all of its provincial bureaus to enhance safety measures concerning condom production.

In 2017, the same administration issued a surprising report which revealed the extent of the condom industry’s quality deficiency. According to the report, even samples of condoms produced by Durex –– a major condom brand –– failed to meet quality standards.

Baidu search recommendations and results for the keywords “buy condoms online” (网上买避孕套), as of June 5, 2017. Source: Baidu (百度)

As of June 5, 2017, the keywords “buy condoms online” (网上买避孕套) and “buy contraceptive pills online” (网上买避孕药) yielded several search recommendations and results that either questioned or placed emphasis on the safety of these products. This occurrence suggests that Chinese consumers may be highly wary and distrustful contraceptive products due to their inconsistent quality.

The keywords “buy condoms online”, for instance, turned up search recommendations that ask, “Is it safe to buy condoms online?Is buying condoms online reliable?” Furthermore, the first result for the same keyword search read: “Buy condoms online on Durex, buy through the Durex Website, authentic products guaranteed.”

Thus, it remains to be seen whether or not the Chinese contraceptives market can eventually gain trust among consumers and establish credible leading brands by observing better business practices and promoting consumer knowledge.

To identify key strategies for tackling these challenges, Daxue Consulting has conducted a comprehensive survey of respondents involved in the market, including China’s pharmacies, young women, and over one thousand teenagers nationwide.

Through our contact with these groups, we access and update information on consumer willingness to pay, purchase habits, product acceptance and more. Subscribe to our newsletter or contact us for more information on your industry in China.

LEARN MORE ABOUT THE CHINESE MARKET