Chinese mini dramas (also known as micro dramas) first appeared in China in 2018, shortly after Tiktok’s debut, and have since exploded in popularity, especially among younger viewers. These bite sized stories are filmed vertically and somewhere between 1 to 3 minute per episode. Initially, these stories gained traction for their compact narratives, fast pacing, short production cycle and low cost.

The production rate of these dramas is rapid, China produced more than 8,000 new mini dramas in 2024, ten times more than the rest of the world combined. The market for these videos has grown to RMB 50.4 billion (USD 6.9 billion) in 2024 and is consumed on social media platforms such as Douyin (Chinese version of Tiktok), Kuaishou, and Xiaohongshu.

Why Chinese mini dramas work: Addictive, accessible and engaging

Mini dramas are easily consumable and accessible on mobile devices, hence consumers can share their opinions directly in the comment section of a video. What draws viewers to these short dramas are the dramatic characters and plot twists. What was once low quality and low effort content that’s popular on social media has been replaced by these high production competitive short dramas that dominate the landscape and became a baseline expectation from the viewers.

For some series, users are able to watch the first few episodes for free. However, the subsequent episodes can cost RMB 140 (USD 20) or more depending on the number of episodes. This “freemium” model, paired with bingeable storytelling, has fueled both viewership and monetization.

Lucrative market: Low production cost and high revenue

While a traditional TV series takes about four to five months to film and costs at least tens of millions of RMB, mini dramas are often produced in just three to four days at a cost of RMB 400,000 – 800,000. Outside of the low production cost, mini dramas are also extremely lucrative, with most of the revenue generated from viewer payment and advertising income. With the market valued at RMB 38.4 billion in 2024, RMB 20.7 billion came from audience payments, RMB 15.8 billion came from advertising revenue, and RMB 800 million came from revenue sharing.

The surge in mini drama production also fueled a need for filming locations, and abandoned spaces in the countryside of China have all turned into filming base with different setting and background. For example, a village in Xi’an transformed an abandoned 15,000 square meter textile plant into a facility with sets such as palaces, villages, jail cells, hospitals and libraries.

Brands jump in: Product placement through storytelling

According to the latest Statistical Report on China’s Internet Development released in August 2024, 52.4% of internet users are now mini drama viewers. Brands have leveraged this surplus of views as a marketing strategy.

The Chinese skincare brand Kans has emerged as a market leader in the mini drama space, partnering with influencers to create mini drama episodes that feature their products. The drama uses popular tropes such as “CEO falls in love” and embedding the product naturally in each episode. In 2023 Kans produced a total of 5 mini dramas with Douyin influencer @Jiang17 with an investment of RMB 50 million, and generated RMB 3.34 billion (USD 464 million) in sales and over 50 billion views as a result. These dramas can emotionally connect with its viewers, and making Kan’s skincare products a part of the character’s daily lives has helped the brand increase awareness. This shows that mini dramas can be used as a marketing strategy without being overly promotional.

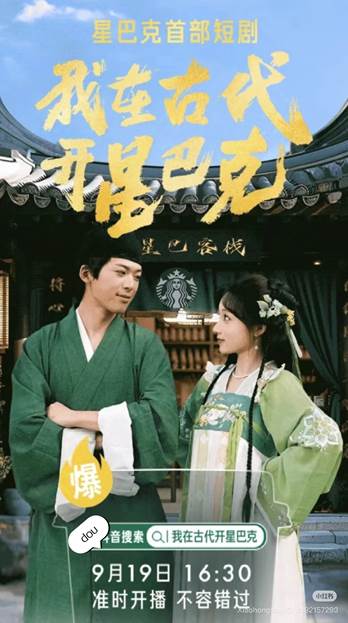

Starbucks also caught onto the trend and created their own mini drama series in 2024 called “I Opened a Starbucks in Ancient Times”, and the storyline follows a modern barista transported to ancient China, where they introduce coffee culture to the local community. This ties in Starbucks as a brand to Chinese culture, and along with the drama Starbucks also launched promotions and coupons for viewers. The blend of storytelling and product placement generated over 2 million views in the first day, with strong social media engagement from consumers.

Government tightens restrictions on Chinese mini dramas

China has mandated a licensing requirement for broadcasting micro dramas and enable tighter control on what content gets published online. All Chinese mini dramas must hold an online film distribution permit. In a recent campaign, the National Radio and Television Administration removed 25,300 mini dramas, totaling close to 1.4 million episodes, for non-compliance.

China is also monitoring the relationship of the character in the shows, and censors have deleted more than 700 videos of dramas that depicted fighting between in-laws. Many of the drama are known to exaggerate conflict between family members such as husband and wife and intergenerational conflicts, which is seen against by the government. They deleted shows that promotes “unhealthy and non-mainstream views on family, marriage and love”, mainly due to the declining marriage rate in China.

What does this mean for marketing in the future?

As mini drama continues to grow, consumers are drawn to brands that they can build an emotional connection with. Product placement in these dramas can keep the product at the top of mind for viewers as they associate the narrative and characters with the brand. The high level of attention that is going towards this content opens opportunities for brands to create their own show and stories where it’s not just pure marketing but also entertainment.

Chinese mini drama as a form of advertisement

- Mini dramas first appeared in China in 2018; each episode is 1-3 minutes long and are filmed vertically. They are known for their dramatic plot twists and intense narratives.

- Compared to traditional TV series, mini dramas are low production and highly lucrative, with the market valued at RMB 38.4 billion in 2024.

- Kans (a Chinese skincare company) partnered with a Douyin influencer to create 5 series of dramas that had over 50 billion views and generated RMB 3.34 billion.

- Starbucks launched a fantasy drama connecting its brand to Chinese culture, gaining 2 million views on day one.

- The Chinese government is tightening their restrictions on mini dramas and banning stories that have conflicting relationships between the characters, such as a fight between husband and wife.