Pet Lovers Spending Billions in China

The Chinese pet market (dog and cat) or companion animal market is considered to be lucrative based on sheer volume alone yet the current status is quite small compared to the U.S.A. or other pet-lover countries. In 2016, the total U.S. market expenditure equaled USD 66.75 billion compared to China’s market of USD 17.70 billion. A leading pet owner discussion platform, YC.cn (有宠网) estimated that the volume will reach USD29 billion in the near future with a growth rate of 20.5%.

There are at least four factors to ensure Chinese pet market high growth rates:

(1) Many Chinese now treat pets like family members and are willing to spend more on pets.

(2) Elderly population: old parents see pets as their companions.

(3) Chinese now become more and more scientific in raising pets.

(4) E-commerce provides more convenient channels.

The first factor says people are willing to spend more on pets and in part is due to more discretionary income and higher living standards. According to research conducted by Daxue Consulting, 8% of families in China’s tier-1 and tier-2 cities now own pets.

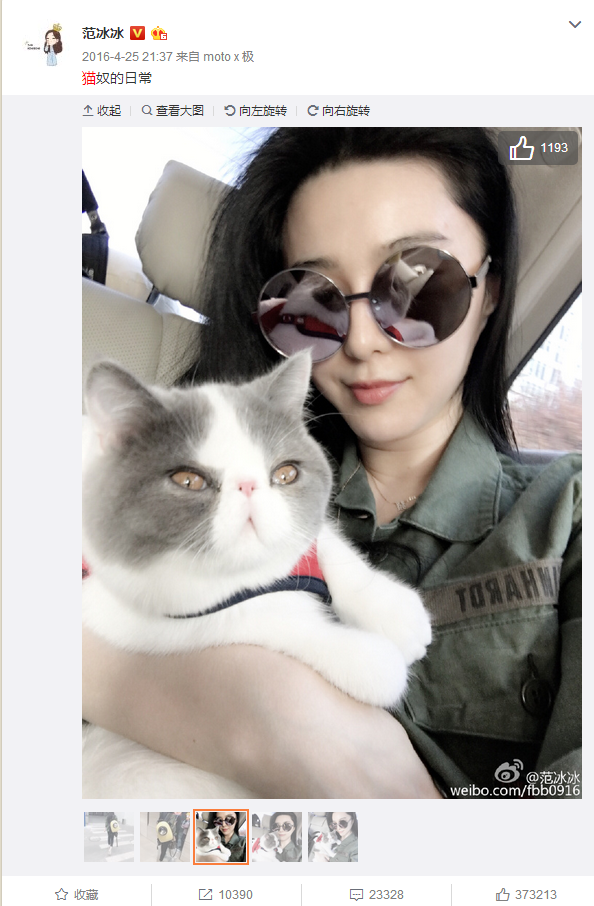

This enthusiasm for companion animals can be partly attributed to celebrities. Popular movie stars like Angelababy (81.35 million followers on Weibo微博), Fan Bingbing (范冰冰, 56.87 million followers), Hugo (胡歌, 55.58 million followers) and Liu Yifei (刘亦菲, 51.04 million followers) are all raising cats. Raising pets allow celebrities to connect closer with their fans and netizens always show huge fondness when a KOL posts his or her pets on Weibo.

The Chinese movie star, Fanbingbing (范冰冰) is regularly posting photos of her cats on her official Weibo account. On this post, she wrote: “The daily life of a cat slave (猫奴, means a person who is fond of cats).”

The growing fondness of dogs and cats can be seen from the prosperity of public accounts on pets. On April 24th, the Newrank Index (新榜指数, showing the popularity of WeChat accounts) showed that a WeChat account named ‘大爱狗狗控’ (big dog lovers) ranked 6thamong all accounts on the list of LOHAS (乐活日榜).

The growing affection of companion animals will lead to a prosperous future for all the sub-segments in the pet industry. For example, sub-segment market share in 2016 showed food at 37%, accessories 26%, medicine 24% and services 12%. Among them, pet food is an already dominated market, while the sub-segments of medicine and services are still small with opportunities of growth.

Read the analysis below to see how prosperous these segments will be and what the good opportunities are, both in mass and niche markets.

Pet Food In China’s Booming Pet Market

Among pet lover expenditures, owners spent most on pet food, which accounts for 35% of the total industry. Dogs definitely eat more than cats and on average, owners spend RMB 500 per month, while cat food cost owners approximately RMB 177 per month.

Mintel, a leading market intelligence agency, reported a 2011 – 2016 compounded annual growth rate (CAGR) of 28.1 % in rising incomes that has contributed to the number of single child families now raising companion pets.

Evelyn, a project manager at Daxue Consulting, estimates the Chinese pet market industry to reach RMB 200 billion (USD 29 billion) in 2016. This market has been growing rapidly despite the overall weak fast moving consumer goods (FMCG) industry. Bain demonstrated this dwarfing growth in a 2015 report, in which the FMCG sales growth hovered around 3.5 % in China. This has been the lowest in a 5-year period, while sales of pet food experienced 11.7 % growth.

[ctt template=”2″ link=”wb87u” via=”yes” ]The Chinese pet market industry reached RMB 200 billion (USD 29 billion) in 2016. [/ctt]

The medium and high-end markets are obviously dominated by foreign brands, with Mars Foods (玛氏公司) from the U.S., Nestlé (雀巢) from Switzerland and Royal Canin (皇家狗粮) from France accounting for more than 70% of the share. Daxue’s 2014 article on the pet food market analyzed that Mars Foods and Royal Canin are ahead of their competitors because they have the advantage of an early entry into the Chinese pet market. While local brands such as Care (好主人) and Sanpo (珍宝) is occupying low-end markets. However, the dominated market from early entries does not mean there are no opportunities for new brands. A survey from Mintel showed that only 20% of pet food consumers said they won’t change food brands. Indeed, two big players in the high-end market have already planned to penetrate into rural areas. In June 2016, Mars and Nestlé made cooperative contracts with Alibaba (阿里巴巴), to open their official flagship stores on Tmall (天猫), while Alibaba will help these two brands to develop the supply chains into smaller cities and rural areas.

No matter for high-end or low-end products, consumers now place more emphasis on natural food. Sixty-eight percent of consumers selected, “being organic” as an important factor that will affect their choices. Although some pet food products with new dietary functions have been launched one after another, consumers are suspicious about these products, worrying that these have harmful addictives that are unhealthy for their pets.

Although some pet food products with new dietary functions have been launched one after another, consumers are suspicious about these products, worrying that these have harmful addictives that are unhealthy for their pets.

In 2014, shocking news reported that a company in Jiangmen (江门) had smuggled pet food worth USD 24 million into China. After importing the food, they sold it to the sellers on e-commerce platforms. Two American brands, Fromm (福摩) and Hill’s (希尔斯) had been smuggled into China primarily because they are viewed as having an excellent reputation and good quality. The Administration of Quality Supervision (质检总局) however has not included these brands clearance to be imported into China.

Medical Treatment & Foreign Dominated Vaccines

According to a report from Goumin.com (狗民网, a leading online discussion website for pet owners), pet owners on average spent RMB 321 in 2016 for their pets on medical treatments. The products related to medical treatment are vaccines, medicine, and services related to medical treatments in a veterinary clinic.

Among particular medicine, vaccination growth is considered very promising. Vaccination market share has big potential for both dogs and cats, for example, a cat should have 3 rounds of vaccination during its lifetime, and each round contains 1 or 2 vaccines shots. Chinese consumers trust imported brands despite the relatively higher prices. However, in order to save money from going to a veterinary clinic, some owners buy vaccines on Taobao (淘宝) and inject their pets themselves. Not only can this can be potentially very unsafe for both pet and pet owners but the vaccine may also not have the intended effect. A vaccine from Pfizer (辉瑞卫佳), sold for RMB 23 on Taobao, and the sales volume equaled 8,868 bottles a month between April 3rd to March 3rd. In Yinchuan (银川), a journalist from People’s Daily (人民日报) visited 20 pet stores in April and found that more than 80% of these stores were providing vaccination services for pets without qualifications. Moreover, some commercial stores also provide medical treatment for pets and is a clear indication that veterinary clinics are not being used as they should be.

The price of imported vaccines are higher than domestic products and despite the higher prices, imported vaccine brands still dominate the market with 70% market share. However, there are only 14 imported products having been legally registered in China, thus supply cannot meet domestic demand. Famous imported brands are Nobivac (英特威, RMB 80) from Netherlands, Pfizer (辉瑞卫佳, RMB 80-120) from the U.S., Merial (梅里亚, RMB 80 ), and Virbac (维克, RMB 70 ) from France.

The shortage of imported pet vaccine supply had thus led to consumers procuring vaccinations from unofficial channels. Unofficial channels even gave rise to a wild spread of pirated products. Considering anxious consumers’ longing for high quality imported vaccines, the current shortage is a good opportunity for other foreign vaccine brands to enter the Chinese pet market.

Apart from vaccines, flea &tick control, probiotics and supplements will also be promising because Chinese pet owners have become more scientific in raising pets.

As for veterinary clinics, Liulang (刘朗), the president of Beijing Small Animal Veterinary Association (北京小动物协会), described the present situation, “Now in China, there are about 11,000 veterinary clinics. But more than 70% of them are very small.” The remaining 30% of large veterinary clinics have already received special attention and large investment.

In 2016, Chinese veterinary clinic, Puppy Town Animal Hospital (芭比堂), had received investment from a subsidiary of Hillhouse Capital (高瓴资本). Earlier in 2016, its counterpart, Ruipeng Pet Hospital (瑞鹏宠物医院) went further to become the first publicly listed company among Chinese pet hospitals. Ruipeng provides services including medical care, grooming, foster and even SPA treatments for pets (function: to kill fleas and to deodorize). Ruipeng’s success in becoming listed should be attributed to its strong performance in 2015. According to its prospectus, it opened 18 new stores in Shenzhen (深圳), Guangzhou (广州), and Shanghai (上海) in 2015. This led to its revenue increasing by 49%, among which the revenue from pet medical treatments increased by 61%.

A dog is enjoying a SPA for him/her

Accessories – Smart Product Innovation

Pet accessories include dog leashes, tools for eating and bathing, kennels, toys, clothes and so on. According to a report from Goumin.com, 30% of pet owners spend more than RMB 1,000 per year on accessories for their pets.

Higher discretionary income has allowed pet owners to spend more on the high-quality accessories; however they are also attracted by discounted goods.

Among the accessory segments, pet toys account for 10% of pet owner expenditure and is increasingly demonstrating the humanization of pets in the mind of owners.

Smart pet toys are always experiencing innovation and newly emerging, in which approximately 28 % of owners said they have bought smart toys. Similar to smart toys, some other traditional accessories are becoming smart as well, such as dog collars with built-in GPS, equipment to supervise the health and mood of pets, automatic pet feeders, and etc.

A collar with GPS on Taobao, price: RMB 399

Chinese Pet Market Primed For Growth:

Chinese pet market booming is so hot that everything in the pet industry seems to be full of opportunities. Many owners now become interested in some new services such as pet training, pet photos, pet funerals, pet cemeteries and so on. In January 2016, Boqii (波奇网), the popular online e-commerce for pet products, had obtained a USD 120 million investment, in its series C round II. The Chinese pet market is still far from a red ocean. There are still large opportunities for foreign brands to enter and build their fame.

Photo credit: Daxue Consulting

To know more about the Chinese pet market, contact our dedicated project managers by email at dx@daxueconsulting.com