In the first quarter of 2024, domestic tourism recorded 1.419 billion trips, a year-on-year increase of 16.7%. Domestic tourism revenue reached RMB 1.52 trillion, up 17.0% year-on-year. This marks the first time revenue of China’s traveler market has surpassed the same period in 2019. In the post-pandemic era, young Chinese travelers are seeking personalized and experiential travel. In addition to “special forces travel (特种兵旅行)”, which refers to an intense, fast-paced travel approach. Moreover, “new Chinese-style tourism (新中式旅行)” and “experience-based travel (体验式旅行)” frequently appear on social media.

Historical or niche cities are becoming popular domestically

Young people are enthusiastic about visiting historical sites within China, immersing themselves in traditional culture, and sharing these experiences with others. During 2024 National Day, topics such as “A thousand-year-old ancient town (一座有着千年历史的古镇),” “Admiring historical buildings in ancient towns (赏古镇历史建筑),” and “Exploring Shanxi’s ancient architecture (地上古建看山西)” were widely discussed on Xiaohongshu. Notable examples include Wuzhen in Zhejiang Province, Zhouzhuang in Jiangsu Province, and Fenghuang Ancient Town in Hunan Province.

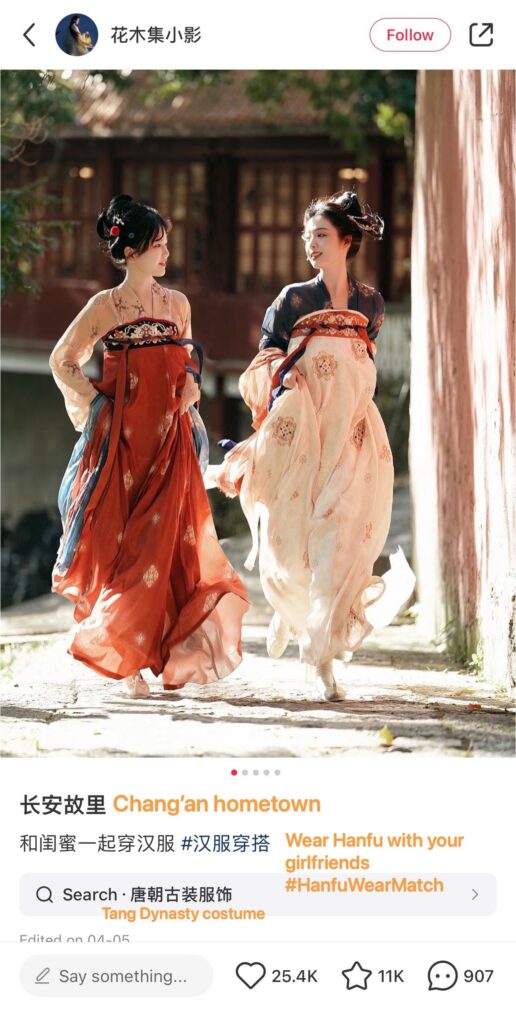

During the 2024 National Day holiday, Xiaohongshu users were excited to share their experiences of wearing traditional Chinese outfits like Hanfu (汉服), mamian skirts (马面裙), and qipaos (旗袍) while visiting historical sites. It’s a fun way to connect with the past and make their trips more memorable. Many also got into the trend of unboxing archaeological blind boxes from museums and took time to explore historical landmarks in depth, adding a creative and interactive twist to their travels.

Hidden gems: The rise of reverse tourism

As part of this trend, young travelers are not only drawn to historical cities within China but are also seeking more niche travel experiences. This growing demand is reflected in the rise of ‘reverse tourism (反向旅游),’ which has become a popular way to explore less crowded, hidden gems. On Xiaohongshu, topics such as “I want to try reverse tourism (我要反向旅游)” and “reverse tourism (反向旅游)” have collectively garnered around 300 million views. It shows a growing desire among travelers to explore ways of avoiding crowds and enhancing their travel experience.

By mid-October 2024, the “Underrated Hidden Gems” topic on Xiaohongshu had accumulated 1.23 billion views. The cities that have seen the fastest increase in attention on the platform compared to the previous year. These cities include Tianshui (天水), Yixing (宜兴), Huangshan (黄山), Yuncheng (运城), and Liuyang (浏阳). It is due to their rich cultural heritage, and unique attractions like Tianshui’s Maiji Mountain Grottoes and Yixing’s purple clay teapots.

Post-00s love outbound travel

As more Post-90s (Millennials) and Post-00s (Generation Z) enter the workforce or universities, they are becoming increasingly adventurous and financially independent. As a result, their share of the outbound travel market has surpassed that of the Post-80s. Thus, younger consumers became the dominant demographic of outbound tourism. This shift has driven a continued surge in demand for outbound travel.

According to an analysis by the China Tourism Research Institute, a significant portion of outbound tourists from China are young individuals with higher education. Middle-aged and young tourists dominate the demographic, with those aged between 22 and 41 making up 82.8% of the total. Data from Trip.com shows that the number of female tourists exceeds that of male tourists by more than 10%. The higher number of female tourists indicates a shift in travel behaviors, with more women seeking international travel experiences, possibly driven by greater financial independence, changing societal roles, and a growing emphasis on personal empowerment.

What physical goods do China’s travelers purchase while abroad?

Based on social listening research conducted on Xiaohongshu, in Europe, luxury brands like Hermes, Louis Vuitton, and Chanel dominate the conversation of Chinese travel influencers and general users. Handbags, watches, and jewelry topped the shopping lists. Hot spots include Paris’s Lafayette, Spain’s El Corte Ingles, and various European outlet malls. Beauty products are also high on the radar, particularly high-end brands like La Prairie, which are often priced lower than in China.

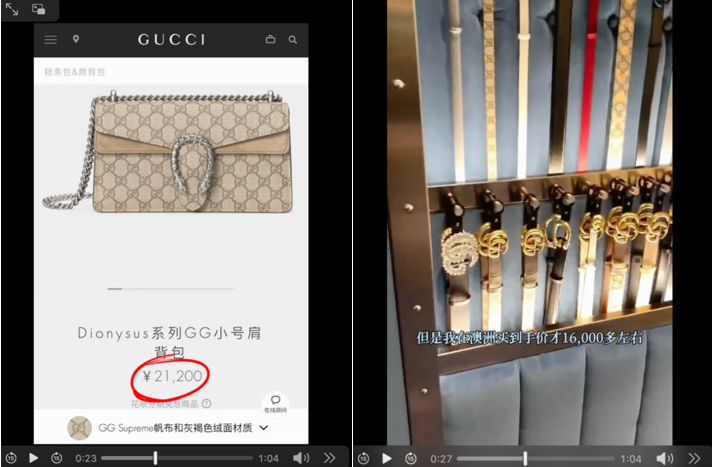

In Oceania, Australia stands out as a go-to destination for Gucci bags, which are notably more affordable than in China. Across the United States, local beauty brands such as Clinique and Estée Lauder are popular buys, along with mid-tier fashion names like Coach and Tommy Hilfiger.

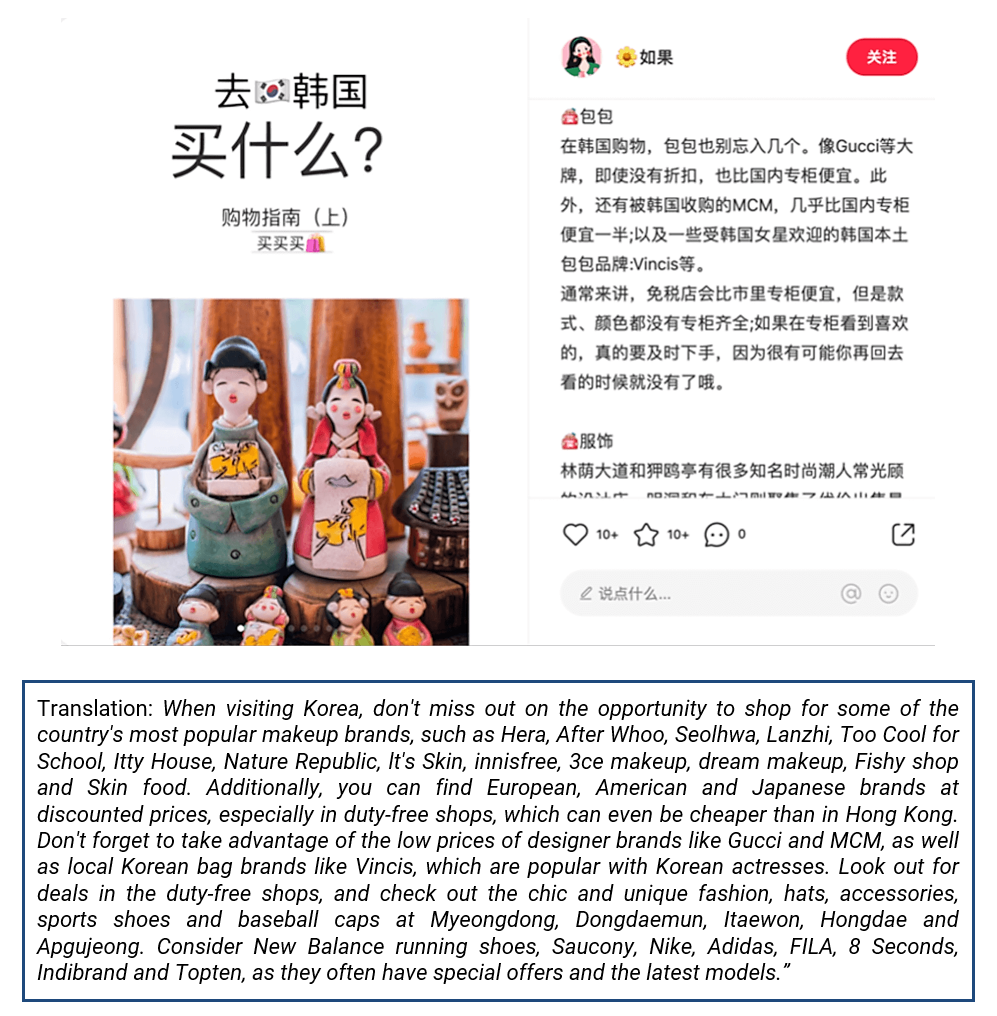

Meanwhile, Korea continues to draw Chinese shoppers for beauty products, especially in its sought-after duty-free shops. In Japan, there was a marked interest in luxury items—handbags and watches in particular for favorable exchange rates—as well as local cosmetics and snacks.

Closer to home, Hong Kong remains a shopping mecca for luxury goods like Prada and Versace. Meanwhile, Macau is known for its affordable health and skincare offerings. In Southeast Asia, Thailand is famed for its local beauty products and accessories; Singapore attracts visitors looking for distinctive local delicacies and souvenirs.

Visa restrictions and flight capacity limitations slow China’s traveler market recovery

Currently, the growth in outbound tourism is primarily focused on specific destinations, such as visa-free countries like Singapore, Thailand, and Malaysia. These countries have seen an overall increase of more than 30% compared to 2019. Other nearby outbound destinations, including Hong Kong, Macau, Japan, and South Korea, have also experienced a rise in the number of travelers compared to 2019. For instance, Japan welcomed a 65.9% increase in international visitors from China in 2024 compared to the previous year.

China’s traveler market recovery: Passport issuance surge, visa delays

The issuance of ordinary passports increased in the first half of 2024, reaching 12.34 million, a 23.2% year-on-year rise. Furthermore, the issuance of Hong Kong, Macau, and Taiwan travel permits also grew by 7.8%, but visa issuance for international travel in other countries remained a bottleneck. According to ITB China buyer surveys, many travelers faced long wait times for visa applications, particularly for Europe and the U.S., which resulted in a decrease in travel bookings.

The 2023 estimated air passenger traffic in China is expected to reach 620 million passengers, representing a 145.9% year-on-year increase compared to 2022. This figure reflects a recovery to 93.8% of the levels seen in 2019. With an accelerated recovery in the fourth quarter of 2023, outbound flight and hotel bookings on platforms like Ctrip bounced back to 80% of 2019 levels. By the first quarter of 2024, international passenger transport had already recovered to 78% of 2019 levels, and by mid-2024, transport volume is expected to increase by more than 100% compared to the same period the previous year.

In conclusion, China’s traveler market is experiencing a significant transformation, driven by a growing demand for niche, experiential travel, especially among younger generations. As these travelers seek more meaningful and immersive experiences, destinations and travel styles that cater to their desires for uniqueness and cultural exploration are seeing rapid growth. However, challenges such as visa restrictions and flight capacity limitations continue to pose obstacles to the full recovery of outbound tourism. Despite these hurdles, the increasing independence and adventurous spirit of the Post-90s and Post-00s cohorts suggest a promising future for the tourism industry, as they continue to shape the market with their evolving preferences and travel behaviors.

5 latest trends in China’s traveler market

- Young Chinese travelers increasingly seek personalized, unique travel experiences, such as “reverse tourism” and cultural immersion.

- Domestic tourism in China has surged, with young people exploring historical cities and sharing experiences on social media.

- Growth in outbound travel is concentrated in visa-free countries and nearby destinations like Singapore, Thailand, and Malaysia.

- Visa approval delays and limited flight capacity are slowing the recovery of outbound tourism, especially to Europe and the U.S.

- The Post-90s and Post-00s generations dominate outbound travel, driven by financial independence and a desire for adventure.

We offer consulting services for travel retail businesses

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with travel retail businesses. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us to discover how our expertise can drive your travel retail business’ success in China.