The Daigou (代购) industry refers to individuals or agents who purchase and import goods from overseas for resale in the Chinese market. Tightened regulations and pandemic-related disruptions led to a significant reduction in the industry. While the industry is unlikely to recover to its pre-pandemic size, it experienced a rebound in 2024, with the daigou market growing by 5%.

Notably, this growth contrasts with the luxury market in China, which saw an 18–20% decline in 2024. However, a major shift in consumer behavior emerged as overseas luxury spending by Chinese tourists surged, accounting for 40% of China’s total luxury expenditure that year. This implies that domestic luxury spending declined, due to Chinese luxury consumers becoming more sophisticated and resourceful, who purchase overseas for the latest releases or a better foreign exchange rate. This also showcases the resilience of the daigou sector even as broader luxury spending trends decline.

Download our guide to Chinese gifting habits

Shift in Chinese consumers’ spending habits

Spending patterns in 2024 revealed stark regional contrasts: Chinese consumers’ overseas expenditure in Europe rebounded to 50% of 2019 levels, whereas in the Asia-Pacific region, spending surged to 120% of pre-pandemic figures. This was likely due to factors such as currency advantages in Japan and the proximity of neighboring tourist cities. Meanwhile, Hainan’s duty-free market experienced a 29% drop due to reduced tourist traffic and spending, as Chinese travelers diverted their shopping to destinations like Japan and Southeast Asia. This uneven recovery reflects shifting preferences and changes in accessibility for post-pandemic travel and purchasing behavior.

Within specific categories, the daigou sector retained its influence. In fashion and leather goods, for example, daigou sales represented 25–70% of some brands’ total mainland China revenue, illustrating the channel’s role as a bridge between global supply and domestic demand. Even as consumer preferences in the luxury market continue to shift, daigou agents maintain their dominance in these niche markets and relevance in an evolving landscape.

Daigous as gatekeepers of niche luxury in China

Daigou remains a powerful force in China’s luxury landscape, driving demand and access to both iconic and emerging brands. The most popular luxury brands among Daigou in China include Dior, Louis Vuitton, Gucci, Chanel, and Prada, consistently at the top of the list for several quarters. Chanel, in particular, is highly favored by Chinese shoppers. Other popular brands among Daigou include Hermès, Burberry, and Swatch.

Daigou also plays a crucial role in introducing new and niche brands to the Chinese market, such as Christopher Kane, which benefits from increased revenues through Daigou sales. Additionally, Daigou helps meet the high demand for iconic Hermès bags in China, where local supply is limited. They also meet the rising demand for luxury in lower-tier cities, offering international luxury products domestically and boosting sales for brands globally, while creating organic buzz on social media.

What are the luxury brands’ reactions to Daigou?

Luxury brands exhibit a nuanced stance towards the Daigou phenomenon. Daigou plays a pivotal role in elevating brand awareness, especially beneficial for newcomers in the Chinese market. Furthermore, also play a constructive role for European sales associates (SAs) by contributing to sales through parallel channels, aiding in achieving Key Performance Indicators (KPIs). However, they also pose challenges. The exclusive image of luxury brands, carefully crafted through pricing strategies and limited stocking, can be compromised by Daigou offering lower prices than China’s domestic retail prices and access to limited-edition products.

Adding to the complexity, luxury brands struggle to maintain control over the shopping experience and lack access to customer data through daigou channels of which impacts their ability to shape brand perception. Some luxury brands, exemplified by LVMH’s Bernard Arnault, view the Daigou trade negatively, vowing to address its impact on brand capital and allure.

Luxury brands crack down on daigou resellers

In response, certain luxury brands are implementing stricter regulations on cross-border e-commerce to oversee Daigou resellers. This move aims to ensure that products are sold through authorized retailers, potentially redirecting sales through official channels and mitigating the challenges posed by the Daigou market.

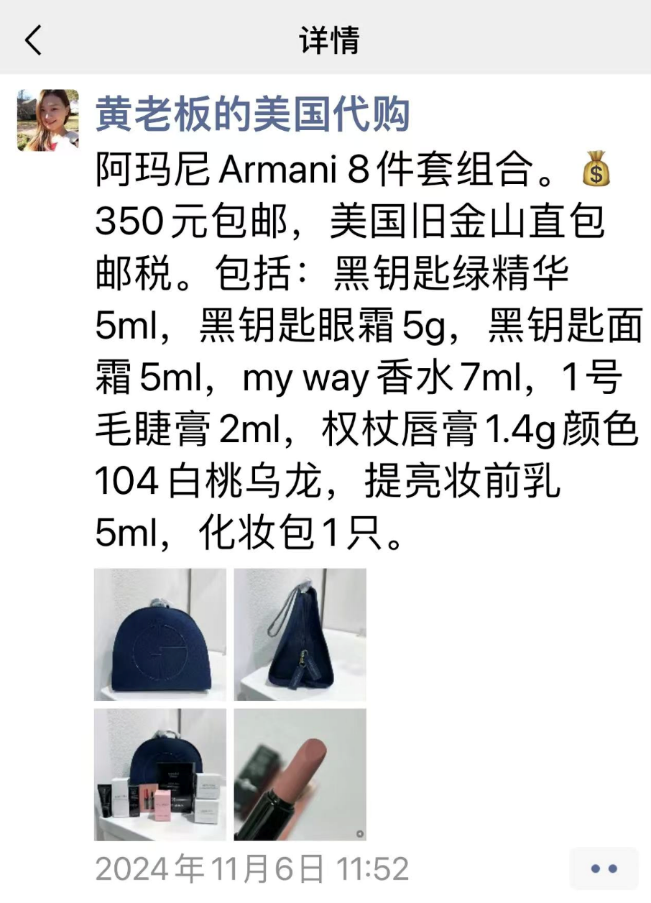

Verifying product authenticity in the Daigou gray market also remains uncertain. While platforms like Taobao showcase surging listings, these visible transactions may represent only the tip of the iceberg, as stated by Max Piero, CEO of Rehub. A significant portion of sales shifts to closed ecosystems like WeChat, where private chats and peer-to-peer transfers, resembling casual money exchanges between friends, obscure transaction volumes and product origins. The lack of visibility leaves brands and consumers navigating a murky landscape, where counterfeit risks heighten.

Simultaneously, the Chinese government has responded to the Daigou phenomenon by introducing regulations and systems to combat fraudulent activities. Measures include the verification of online buyers’ identities, reinforcing border regulations, and establishing blacklists, underscoring the commitment to addressing the complexities associated with daigou in the luxury market. A standout example is the regulation introduced in 2019 that requires AIGOU agents to register and pay taxes, a policy still effective in 2025. Violations can result in fines of up to RMB 2 million. One notable case is that of Qu Qing, a daigou merchant who was sentenced in 2023 to one year in prison and fined RMB 400,000 for evading RMB 378,000 in taxes through duty-free purchases. Despite the severity of these penalties, many unregistered daigou merchants continue to operate within the grey market.

Daigou renaissance: unveiling novel avenues in a shifting landscape

While the Chinese Daigou industry has faced significant challenges due to the COVID-19 pandemic and tighter regulations, it has shown resilience and adaptability. Focused on sourcing elusive items, especially limited-edition luxury goods, Daigou sellers adapt through livestreaming. While not fully restored to pre-pandemic levels, the Daigou industry remains a substantial contributor to China’s luxury retail, showcasing its enduring significance.

Daigou Capitalizes on Currency Weakness & Tax Incentives

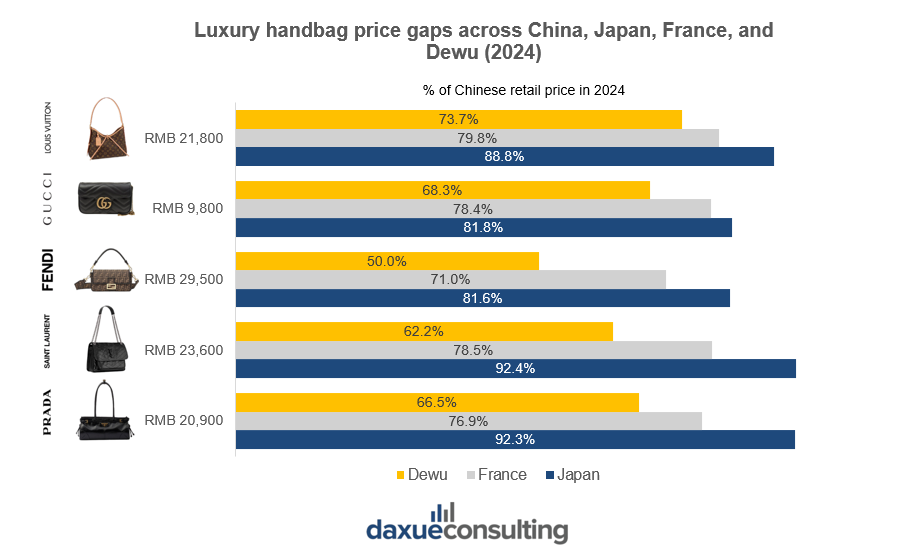

The Daigou industry is increasingly leveraging global currency fluctuations and tax policies to offer competitive pricing. In 2024, Daigou agents flocked to Japan to exploit the weaker Japanese Yen, which hit its lowest point against the Chinese Yuan in decades. Combined with Japan’s rising inflation and generous tax rebates for tourists, the price gap for certain luxury goods reached up to 30% compared to domestic prices in China. The pricing disparities between China’s domestic luxury market and overseas or resale channels reveal deeper shifts in consumer behavior and industry dynamics. Chinese shoppers are increasingly value-conscious, seeking more affordable access to the same high-end goods through alternative means such as purchasing through apps like Dewu. These savings have driven a surge in overseas shopping among price-sensitive consumers, particularly for high-margin categories like luxury, cosmetics, and designer apparel.

Livestreaming and online channels:

The Daigou industry is seizing new opportunities through innovative methods like livestreaming and online channels. Utilizing these platforms allows Daigou sellers to connect directly with customers, showcasing products in real-time. This interactive approach not only enhances the shopping experience but also opens up avenues for personalized engagement, fostering stronger relationships between sellers and consumers in the evolving landscape of e-commerce.

Daigou’s digital shift:

Daigou sellers are increasingly leveraging platforms like Taobao, where listings for brands such as Fendi surged by nearly 500% in 2024, though concerns about counterfeit goods persist. Many merchants use Taobao to attract buyers but pivot transactions to WeChat for private negotiations and client relationships, evading platform fees. Meanwhile, Dewu, a luxury-focused app, has emerged as a trusted alternative, offering authenticated products, 24-hour delivery, and a sleek interface to appeal to younger, security-conscious shoppers. This split reflects the industry’s priorities: agility on open marketplaces versus transparency on curated platforms.

Tapping into lower-tier city markets:

Daigou sellers exhibit adaptability by expanding their reach into lower-tier city markets. Capitalizing on their extensive networks, Daigou entrepreneurs excel at reaching consumers in regions where luxury products might be less accessible. This strategic move enables the Daigou industry to tap into emerging markets, catering to diverse consumer bases and establishing a foothold in areas with untapped potential for luxury goods.

Focusing on hard-to-find items:

A key avenue for Daigou sellers to thrive is by concentrating on hard-to-find items, especially limited-edition luxury products. By curating a selection that is not readily available in local boutiques, Daigou sellers can meet the demand for unique and exclusive items. This niche focus allows them to maintain relevance and attract consumers seeking distinctive products not easily found through conventional retail channels.

Reverse Daigou (逆代購 or 反向代购):

A novel trend known as “reverse Daigou” is reshaping cross-border commerce. In this emerging practice, goods are shuttled from Shenzhen into Hong Kong, facilitated by social media platforms. Leveraging this trend, Daigou sellers can explore new avenues for cross-border trade, capitalizing on the efficient movement of goods between these key regions and adapting to the evolving dynamics of international commerce.

Examples of this trend include the sale of trendy snacks from mainland China, known as “wanghong meishi” (网红美食) or “viral cuisine”, that are hard to find in Hong Kong. Popular choices for reverse Daigou include bubble tea from Yidiandian, Master Bao’s pastries, and specialty products from Alibaba’s Hema supermarkets or Walmart’s Sam’s Club stores.

On Xiaohongshu, people often use hashtags such as #reversedaigou (#反向代购), having a total of 7.1 million views (as of December 14). In a post, expressing gratitude and providing a summary of recent experiences in the context of reverse daigou. The author acknowledges the support received from understanding customers and details adjustments made in pricing and delivery methods. The author emphasizes the challenges faced, including negotiations on fees, transportation costs, and the complexities of delivery platform fees.

Collaborating with brands:

In response to demand shortages in Europe and the US during the early stages of the pandemic, some brands have turned to Daigou sellers to sell excess inventory that ended up in the Chinese market. This collaborative approach presents an opportunity for Daigou sellers to establish closer ties with brands. Such partnerships can foster mutually beneficial relationships, allowing Daigou sellers to play a pivotal role in brand distribution and sales strategies.

Revitalizing Daigou: Navigating the post-pandemic landscape through livestreaming, niche markets, and innovative commerce

- The Chinese Daigou industry, involving individuals reselling overseas products in China, has been significantly impacted by the COVID-19 pandemic and tightened regulations, leading to a reduction in market size.

- To overcome challenges, Daigou sellers have embraced online channels, particularly livestreaming on platforms like Douyin, to connect with customers. They focus on sourcing hard-to-find items, including limited-edition luxury products, and tap into lower-tier city markets where luxury goods may be less accessible.

- The emergence of “reverse Daigou” is noted, where goods shuttle from Shenzhen to Hong Kong, facilitated by social media platforms, presenting a new form of cross-border commerce.

- Collaborating with brands has become a strategy, with some brands turning to Daigou sellers to sell excess inventory in the Chinese market, opening up potential future opportunities for closer partnerships.