Digital healthcare in China is rapidly transforming the healthcare landscape by integrating cutting-edge technologies such as the Internet of Things, big data, and artificial intelligence into medical services, including digitization, standardization, and intelligence of medical consultations and pharmaceutical offerings.

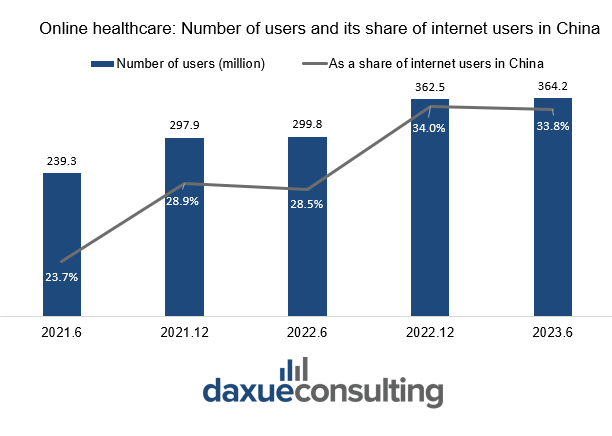

The number of online medical users in China increased from 214.8 million in December 2020 to 363 million in December 2022, making digital healthcare the fastest-growing section of the online applications business during the COVID-19 pandemic. By 2024, digital healthcare had transformed the medical landscape in China, particularly through innovations like online pharmacies, telemedicine, and AI-driven platforms.

Download our China’s samples economy report

How COVID-19 contributed to the growth of digital healthcare in China

As the 52nd Statistical Report on Internet Development in China revealed, the percentage of total online users utilizing online medical services has increased by 12.25%, from 21.75% at the end of 2020 to 34% in December 2022, at the peak of the national lockdown. By 2023, China’s digital hospitals totaled 3,000, more than six-fold the number before the pandemic.

“When Azvudine (a locally developed, repurposed small molecule) was approved as an

oral antiviral for COVID-19 in China in 2022, it became immediately available

on all digital pharmacy platforms. Patients just needed to have a quick video

conversation with one of the resident doctors, explain their symptoms, perform

a quick antigenic test, and upload the positive test result via the app. Then,

upon payment, one course of Azvudine treatment was immediately shipped to the

patient, arriving within 6 to 12 hours.”

– Irénée Robin, Managing Partner at VVR Medical

The pandemic drove a temporary surge in demand for online healthcare and catalyzed regulatory breakthroughs that laid a strong foundation for its future growth. In March 2020, the State Council supported the “Internet + Healthcare” model and, crucially, approved the inclusion of online healthcare expenses in National Health Insurance (NHI). This significantly reduces costs and expands industry potential. In 2022, the model was further emphasized in the National Development and Reform Commission’s 14th Five-Year Plan. While lockdowns ended, the regulatory progress remains firmly in place.

How does digital healthcare help with the challenge of chronic diseases in China

Currently, there are over 400 million people in China who suffer from high blood pressure, diabetes, cardio-cerebral vascular diseases, and other chronic diseases. The application of digital mobile health management systems and wearable devices is conducive to real-time tracking and collection of health data. These devices significantly strengthen the ability to monitor and control chronic diseases. China strongly encourages innovation in digital health and wearables, even facilitating the registration of such products and services via specific regulatory pathways.

Online pharmacies as a part of digital healthcare in China

Given the prevalence of chronic diseases, online pharmacies have improved access to medications, enhancing convenience for patients. Chinese pharmaceutical B2B sales accounted for more than 90% of the market. In 2023, China’s pharmaceutical e-commerce sales were RMB 248.9 billion.

According to the estimates of China Business Intelligence Network, the market is projected to reach nearly RMB 380 billion by 2025. Online pharmacies offer significant advantages: they are not limited by size, have a larger selection of drugs, and can better meet supply demands compared to offline pharmacies.

Online medical consultation platforms: Consolidating victories from growth during COVID-19

Currently, the major listed companies in the online medical industry include Ping An Good Doctor, Ali Health, and JD Health. Ping An Good Doctor, the earliest-established among the three was listed on the Hong Kong Stock Exchange in 2018 and became the first listed stock in the online medical industry.

Ping An Good Doctor: the leader in the digital healthcare market in China

In 2020, in order to help doctors at the frontline of the fight against the epidemic, Ping An Doctor opened a free consultation hotline. During 2020, Ping An’s Internet medical platform, Ping An Doctor, received 1.1 billion user visits, making it far ahead in the number of active users compared to other platforms.

As of the second quarter of 2022, the number of registered users of the company reached 441 million, an increase of 40% since the end of 2019. Yet, it was only in the second quarter of 2024, that the company’s profit finally caught up with its growth, turning its previous net deficit into an adjusted net profit of RMB 90 million.

How does it work?

First, the AI doctor assistant matches the most suitable doctor according to the patient’s input requirements before the consultation. After that, the doctor’s team does a rapid consultation with the assistance of AI doctors’ assistants to diagnose common diseases. If needed, external doctors provide services such as non-real-time online consultations. On top of this, famous doctors can formulate expert diagnosis and treatment plans, and provide high-quality online and offline overall medical services.

Ali Health: powered by tech giant Alibaba

Alibaba Health includes online medical consultation and pharmaceutical e-commerce. Since the outbreak of the pandemic, Alibaba Health has established cooperative relationships with more than 3,000 public and private medical examination institutions to provide users with consumer-level and professional/medical-level tests and consultations.

As of March 31, 2024, Ali Health’s income was RMB 27.03 billion, a year-on-year increase of 64.6%. The increase in revenue was mainly due to the rapid growth of the pharmaceutical e-commerce platform business. There was a 28% increase in the number of service providers on the platform and a monthly average user (MAU) of nearly 300 million.

During the pandemic, Alibaba Health launched the medical and health service APP “Yilu” in September 2020. In March 2024, however, the Yilu app ceased operation. Instead, Ali Health has de-centralised its functions to Alipay and the Yilu Vaccine mini-programme on WeChat.

How it works

Users could search for “Ask Doctor” on the Alipay app, where the window of “Ali Health Online Hospital” would show up. Through the window, users can make appointments with doctors online without having to wait in long lines at the hospital. The powerful data network connects with city hospitals across the country to make it no longer difficult to see a doctor. Also, there are professional doctors and experts answering questions and providing comprehensive health advice for free.

JD Health: family doctor services

With the addition of more and more national top-level doctors, JD Health has established a plausible Internet medical service system in the industry. As early as 30th June 2021, JD Health Internet Hospital has more than 130,000 external cooperative doctors and medical experts, and the average daily online consultation volume exceeds 160,000. As of June 30th, 2021, the number of annual active users in the past 12 months reached 109 million, a year-on-year increase of more than 18.8 million active users; this figure further jumped to 172 million in 2023. In 2022, JD Health for the first time successfully achieved a net profit after three consecutive years of deficit.

How it works

JD Health uses artificial intelligence to advise patients on the right doctor to schedule appointments based on their symptoms. One of the most significant functions of this app is family doctor service. Up to eight family members can benefit from the Family Doctor package, which includes unlimited 24/7 medical advice with immediate response from a general doctor, specialist medical consultation within 48 hours, and face-to-face appointments with famous doctors. JD Health is dedicated to serving 50 million Chinese families a year. Since its launch, the average monthly growth rate of users has been 220%, which proves the demand for such services in China.

Key takeaways about digital healthcare in China:

- The digital pharma industry and consultation are becoming the new reality for Chinese citizens due to advancements in telemedicine, online pharmacies, and AI-powered platforms.

- With over 400 million people in China suffering from chronic diseases, digital health tools like wearables and mobile health systems are improving real-time monitoring. These tools help better manage conditions such as diabetes, hypertension, and cardiovascular diseases.

- Companies like Ping An Good Doctor, Ali Health, and JD Health have led digital healthcare in China, with millions of registered users. Services that are covered include online consultations, pharmacy e-commerce, and AI-driven health management.