China stands as the globe’s second-largest economy in terms of gross domestic product (GDP), a status it has maintained since 2010. China’s economy outweighs Japan, Germany, the UK, and India combined. Guangdong, its largest province, has a GDP larger than Canada’s, while the Yangtze River Delta, centered around Shanghai, matches Germany’s GDP. With its GDP almost reaching USD 18 trillion in 2022, exporting to China presents significant potential for businesses looking to broaden their consumer base. Yet, there are several challenges that exporters may face when entering the Chinese market such as complex regulations, intellectual property (IP) risks, and market access restrictions.

Download our report on the She Economy in China

Insights into China’s imports: Trends, challenges, and opportunities in 2024

China’s import landscape in 2023 saw both growth and decline, reflecting a complex economic environment. While total trade volume increased slightly by 0.2% to USD 5.88 trillion, imports dipped by 0.3% to USD 2.56 trillion compared to 2022. This minor dip occurred despite the country’s broader economic recovery and the robust implementation of reforms and macro-control efforts.

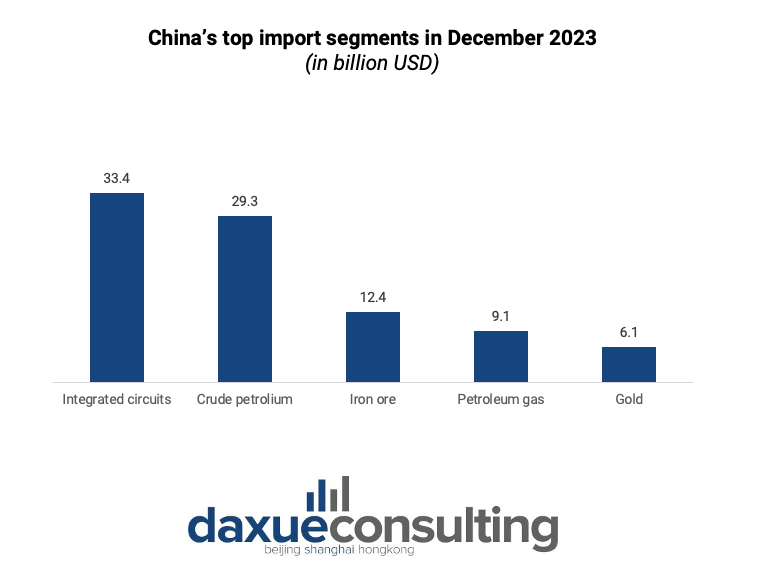

Several sectors showed noteworthy trends in import activities. There was a significant increase in the importation of bulk commodities and essential goods, reflecting a resurgence in domestic demand. Specifically, imports of energy products such as crude oil, natural gas, and coal surged by 27.2%, totaling 1.2 billion metric tons. Metal ores like iron and aluminum saw a 7.6% rise to 1.5 billion metric tons. Consumer goods imports, including textiles, clothing, shoes, hats, jewelry, and watches, also showed positive growth, with textiles and clothing increasing by 5.6%, and imports of jewelry and watches soaring by 63% and 17.2% respectively. In December 2023, integrated circuits were the top imported goods in China, reaching USD 33.4 billion, supporting its growing semiconductor industry.

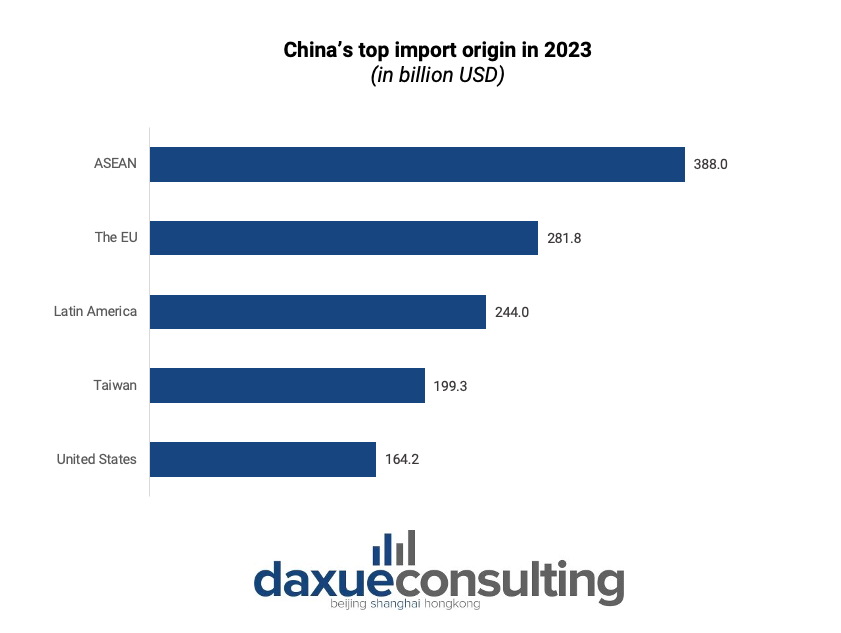

Despite a slight overall decline in imports in 2023, China’s trade landscape with its key partners remains dynamic. ASEAN and the EU are the top two economic regions for China’s imports. It is then followed by Latin America, Taiwan, and the United States. Taiwan is an important import source of machinery and electrical equipment for China. In 2023, Taiwan’s exports of machinery and electrical equipment to mainland China amounted to approximately USD 69 billion. However, tensions and trade restrictions continue to affect this relationship.

Challenges in exporting to China market: Overcoming regulatory hurdles and IP risks

China’s business landscape is characterized by intense competition, both from domestic and international players. Standing out requires differentiation through unique products, services, or marketing strategies tailored to Chinese consumers. In addition to the highly competitive market, there are some challenges that exporters need to watch out for when sending their goods to China.

Regulatory complexity

Importing goods into China can be a lengthy and complicated process. It involves dealing with multiple government agencies, each with its own rules, which can take several months. Regional differences in regulations make it even more challenging to navigate. Even within specific product categories, the regulatory landscape can shift rapidly. For instance, the “Measures for the Administration of the Registration of Imported Medical Devices,” implemented in 2021, resulted in more rigorous testing and documentation procedures for imported medical devices.

Tariffs represent another significant factor. In China, tariffs on imports can take various forms, such as ad valorem tariffs, which are calculated based on the value of the goods, specific tariffs, which are charged as a fixed fee per unit, and compound tariffs, which mix both ad valorem and specific tariffs. Moreover, other charges like VAT and consumption tax complicate the matter further. The rates of tariffs in China can also differ greatly based on the category of the imported goods and their classification under the Harmonized System (HS) codes. Changes in China’s tariff rates can occur due to shifts in trade agreements, geopolitical dynamics, and changes in domestic economic strategies.

Intellectual property

IP protection is a major concern for brands exporting to China. Intellectual property theft, including counterfeiting and trademark infringement, is prevalent in many industries.

There is an abundance of counterfeit products in China, which often undercut legitimate products and tarnish brand reputation. Various industries from luxury apparel giants like Nike and Adidas, alongside tech giants like Apple and Samsung, have all grappled with this challenge.

Trademark infringement compounds these woes, as many competitors resort to using similar names, logos, or packaging to mimic established brands, causing confusion among consumers and diluting brand identity. Enforcing patent rights in China presents further hurdles, with complex litigation procedures and protracted legal battles amplifying the challenges.

Unlike the United States which implements a “first-to-use”, China carries out a “first-to-file” system to establish trademark rights. On one hand, this system encourages people to file their trademarks quickly. However, this could pose some troubles for international companies as the system can also attract “squatters” or “bad faith” actors. These individuals may register trademarks of well-known brands, not to use them, but to later sell them at a higher price to the original owners.

For example, in 2012, Proview Technology sued Apple for trademark infringement over the “iPad” name in China. Proview claimed ownership of the “iPad” trademark in China and accused Apple of using it without permission, alleging infringement. After a prolonged legal battle, Apple settled by paying USD 60 million.

Market access restrictions

Exporters may face market access barriers or restrictions on certain products or services. Enhanced reviews and stricter conditions for foreign investments in sensitive industries could indirectly limit imports of related goods. For instance, China’s State Administration of Market Regulation (SAMR) announced new, stricter regulations for infant formula powder on July 10th, 2023, including higher scrutiny on claims related to the origin of milk sources. Terms like “imported milk source” and similar vague claims will be prohibited on labels.

To export infant formula to China, there’s a clear path outlined that companies must follow. First, only countries that have passed the national assessment detailed on the GACC website can be qualified to trade. Furthermore, manufacturers outside of China must be registered which involves backing from the exporting country’s competent authorities. The infant formula also undergoes rigorous sanitation checks to meet specific requirements under Decree 248 and 249, ensuring safety and quality. Lastly, Both the exporter and importer need to register with GACC, ensuring a well-documented trade process. This move could significantly impact international brands aiming to enter or continue their presence in China’s market, necessitating clearer labeling and potentially altering marketing strategies to comply with the new requirements.

Deeper dive: China’s F&B. cosmetics, and luxury and fashion industry

Food & Beverage

The General Administration of Customs of the People’s Republic of China imposes strict regulations to uphold food safety standards. These regulations encompass every aspect from labeling to ingredients and additives. Keeping abreast of the newest regulations is crucial.

On January 1, 2022, China introduced new regulations called the “Measures for the Administration of Imported Food (Decree 249)” or GACC Decree 249, aimed at enhancing food safety controls. This decree replaced previous regulations and imposed stricter requirements on food importers and exporters. One significant change is the introduction of pre-registration and record filing for companies and food production enterprises involved in import or export activities. Moreover, exporters are now mandated to establish a documented traceability system, enabling authorities to monitor the movement of food products from production to consumption.

Additionally, the Quality Inspection and Quarantine (AQSIQ) plays a vital role in ensuring compliance with Chinese regulations. Certain food products, such as dairy and meat, require registration for pre-market approval. Moreover, exporters should anticipate rigorous testing and inspections conducted by AQSIQ to verify adherence to Chinese quality standards.

Cosmetics

Cosmetics companies exporting to China should adhere to regulations set forth by the National Medical Products Administration (NMPA) is imperative. The NMPA mandates pre-market registration for all cosmetics imported into the country, necessitating compliance with stringent labeling, testing, and safety requirements. This registration process ensures that products meet the necessary standards before they can be distributed within the Chinese market. Furthermore, strict regulations govern the ingredients used in cosmetics destined for the Chinese market.

There is also an ongoing discussion surrounding animal testing in China. While animal testing has historically been a mandatory step for cosmetic products in China, there is a growing awareness and discussion about potentially phasing out this practice. Exporters exporting to China should remain vigilant about any future changes in regulations about animal testing, as policy shifts could impact market access and product development strategies.

Luxury and fashion

There is a great price disparity of luxury products between China and Europe and one of the main reasons for this lies in taxes and tariffs implemented. China employs the HS code system for classifying goods and determining import duty rates. All imported goods to China may be subject to three types of taxes: Customs Duty, Value Added Tax (VAT), and Consumption Tax, with rates varying based on the product’s HS code. China currently implements a high tariffs for luxury goods, between 30% to 50%. Luxury products often fall under the standard VAT, generally at a 13% import duty rate, although the rates can vary based on the item’s classification. The majority of luxury items incur a consumption tax, which ranges between 10% and 20%, depending on the item’s category. This additional tax increases the total cost of importing. Thus, while there is not a specific “luxury tariff” in place, the amalgamation of import duties, consumption taxes, and possibly different regional charges escalates the expense of importing luxury items into China compared to more common goods.

While exporting to China, some clothing materials may require China Quality Certification (CQC). CQC is a voluntary product certification offered by the China Quality Certification Centre. It serves as a mark of quality and compliance with Chinese standards, potentially facilitating smoother market entry for products. Ensuring clothing meets safety and quality standards involves rigorous testing and adherence to regulations governing flammability, fiber content, and the presence of harmful substances. Additionally, fiber content percentages must be clearly stated to inform consumers of the materials used in the garment and any potential allergens.

Staying ahead: Adapting to evolving standards in China’s import regulations

- China’s import landscape in 2023 experienced minor fluctuations despite a slight increase in total trade volume, indicating a complex economic environment.

- Taiwan remained China’s top import source in 2023, though trade tensions persisted between the two regions, particularly in machinery and electrical equipment exports.

- Exporters entering the Chinese market face challenges including regulatory complexities, intellectual property risks, and market access restrictions.

- Specific industries like Food & Beverage and Cosmetics face stringent regulations in areas such as labeling, testing, and pre-market registration.

- Recent regulations such as China’s GACC Decree 249 for imported food underscore the importance of staying updated on evolving standards and compliance requirements.

- Ongoing discussions about animal testing requirements in the cosmetics industry highlight potential policy shifts that could affect market access and product development strategies.