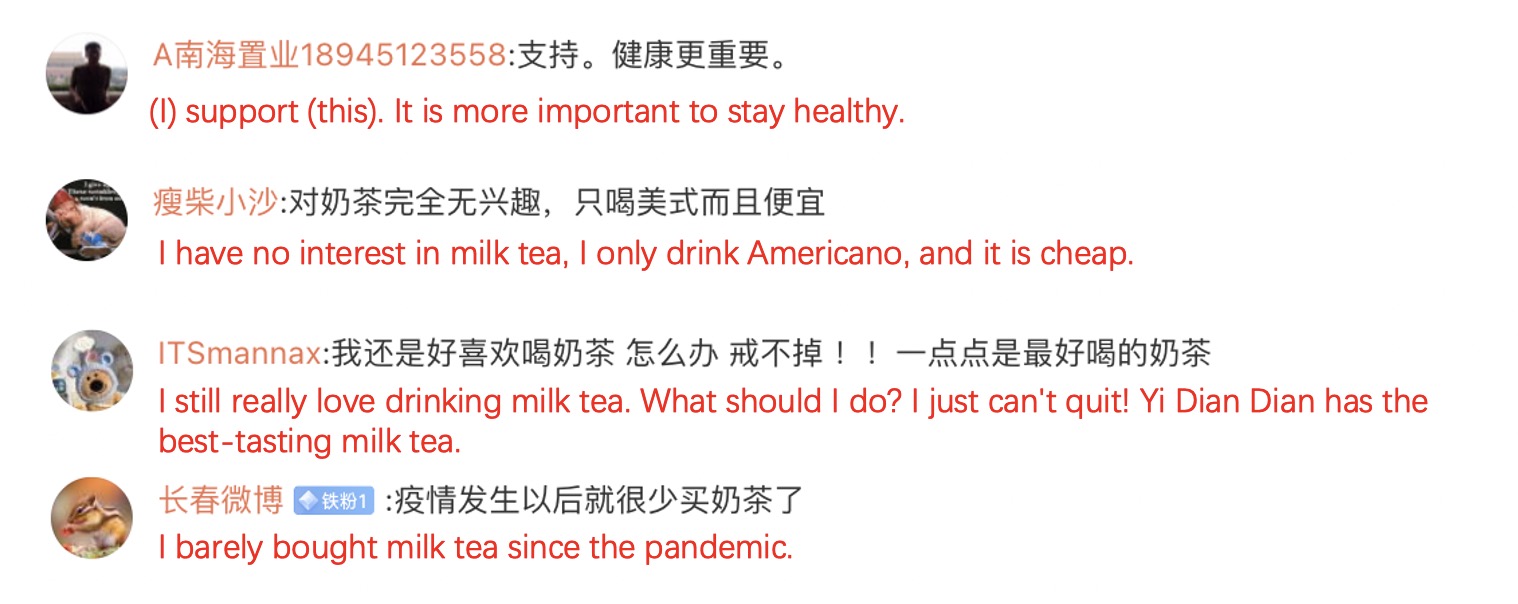

Once a national obsession among Chinese young people, traditional milk tea appears to be losing its appeal. In the 1st week of December, Weibo netizens were discussing that #first-generation internet-famous bubble tea stores are low-key shutting down# (初代网红奶茶店开始悄悄倒闭). This hashtag garnered over 180 million views within four days. One of China’s most popular milk tea brands, Yi Dian Dian (一点点), had over 4,000 outlets in February 2021, but this number decreased to 3,018 in November 2023. Its decreasing popularity could also be reflected by the number of new store openings annually, which has been showing a steady decline from 764 in 2020 to only 55 in October this year.

Download our report on Gen Z consumers

A deep dive into China’s premium milk tea brands’ struggles

Meanwhile, China’s new-style tea brands seem to be struggling as well, exemplified by higher-end brands such as Heytea and Naixue (previously known as Nayuki). Heytea specifically, announced in February 2022 that it would refrain from launching new products priced over 29 yuan for the remainder of the year, coupled with a comprehensive product adjustment, offering its most affordable option at a price as low as 9 yuan.

If the Chinese are no longer drinking milk tea, what are they drinking?

China’s freshly made yogurt and coffee markets are booming as more consumers seek diverse and healthier drink options. Junlebao, one of China’s biggest dairy manufacturers, acquired a 30% stake in More Yogurt (茉酸奶), which owns over 1,600 stores nationwide as of November 2023, displaying much confidence in the future prospect of China’s yogurt market.

The quiet exit of traditional bubble tea chains

- Weibo discussions reveal the quiet closure of first-gen internet-famous bubble tea stores, signaling a decline in the popularity of traditional milk tea.

- Yi Dian Dian, a leading milk tea brand, witnessed a significant reduction in outlets from over 4,000 in February 2021 to 3,018 in November 2023.

- Higher-end new-style tea brands like Heytea and Naixue are facing challenges, with Heytea refraining from launching high-priced products for the year and adjusting its offerings.

- Chinese consumers are moving away from traditional milk tea to seek diverse and healthier drink options.

- Booming markets include freshly made yogurt and coffee, with Junlebao’s 30% stake in More Yogurt showcasing confidence in China’s expanding yogurt market.