Since establishing diplomatic relations in 1972, China and Germany have maintained a significant economic partnership. By 2016, China had become Germany’s largest trade partner in Asia, with bilateral trade reaching nearly EUR 300 billion. However, recent strains in the relationship have emerged, influenced by Russia’s actions in Ukraine, China’s deepening ties with Moscow, and heightened tensions with the United States.

Adding to the complexity, the European Union is currently investigating subsidies on Chinese electric vehicles, reflecting growing concerns about China’s expanding market share in Europe.

Download our report on Gen Z consumers

German brands in China navigating revenue diversification strategies

The implementation of China’s Dual Circulation Policy, emphasizing self-reliance and reducing dependence on foreign companies, has raised concerns among German businesses. In a 2022 survey by KPMG, 49% of 596 German companies feared their Chinese counterparts might emerge as innovation leaders in their sectors within the next five years.

Chancellor Olaf Scholz advocates a policy reset, emphasizing the diversification of Germany’s economic ties across Asia. This approach aims to address the risks associated with excessive reliance on Chinese imports while acknowledging the ongoing importance of maintaining business relations with China.

Despite the challenges, many German companies remain resilient and committed to the Chinese market. In the same survey, an impressive 96% expressed their intention to remain active in China, with 71% planning to increase investments over the next two years. This resilience is evident in their focus on establishing new production facilities and expanding research and development capabilities.

How German brands in China are redefining business in the evolving middle-class market

As China experiences a consumption upgrade and heightened sustainability awareness, German brands, celebrated for superior quality and eco-friendliness, are well-positioned to thrive in this evolving business landscape.

According to the 2023 business confidence survey conducted by the German Chamber of Commerce in China, 50% of the 593 surveyed companies express cautious optimism about increased business turnover, with 37% anticipating higher profits, mainly due to the market size and market growth opportunities in China. The Chamber welcomes China’s departure from the zero-COVID-19 policy but underscores the importance of transparency and advocates for creating a level playing field for both domestic and foreign companies.

German B2C icons in automotive, fashion, and home appliances

German B2C enterprises, spanning automotive, home appliances and fashion are exemplified by renowned brands such as BMW, Adidas, and Hugo BOSS. In the automotive sector, German car manufacturers like BMW are celebrated for their cutting-edge technology, safety features, and luxurious designs. Adidas, a leader in the sportswear industry, is recognized for its commitment to performance, innovation, and stylish athletic wear. Similarly, Hugo BOSS, a leading fashion brand, is renowned for its elegant and sophisticated clothing lines. Chinese buyers place a great value on “Made in Germany” products, whether they are premium cars, electronics, or apparel.

Strategic presence of German B2B companies: driving industrial solutions in China

German B2B companies in China span various sectors, including technology, chemicals, and the pharmaceutical industry. Renowned firms like Siemens, Bosch, and SAP have strategically expanded, offering advanced industrial solutions and cutting-edge technologies to meet the demands of China’s evolving business landscape

In particular, German B2B startups and companies recognize the Software-as-a-Service (SaaS) market as a pivotal industry. Many have forged productive synergies with local players, although competition in this arena is notably intense.

Social listening of German companies in China: high-quality products, ESG practices, and innovation

Durability and trustability

Chinese consumers value German brands because of their reputation for producing high-quality products and adhering to strict manufacturing standards. In 2022, German Chamber of Commerce in China revealed that 86% of 386 surveyed German companies operating in China consider product and service quality as their main strength compared to local competitors, influencing their business strategies. Bosch, a major engineering and electronics company, operates in China and is recognized for providing reliable and high-quality products, including automotive components, power tools, and home appliances.

ESG practices

The German government plays a leading role in promoting Environmental, Social, and Governance (ESG) practices, introducing regulations like the German Sustainability Code and the Corporate Social Responsibility (CSR) Directive. This has led to a growing number of German companies, such as BASF, Adidas, and BMW, incorporating ESG into their business strategies, including ESG reporting in China.

Innovation

German brands are widely recognized for their innovation and cutting-edge technology, particularly in the automotive and home appliance markets. Renowned for their high-tech advancements, the global conglomerate Siemens is actively involved in China, providing innovative solutions in electrification, automation, and digitalization across sectors like energy, healthcare, and manufacturing.

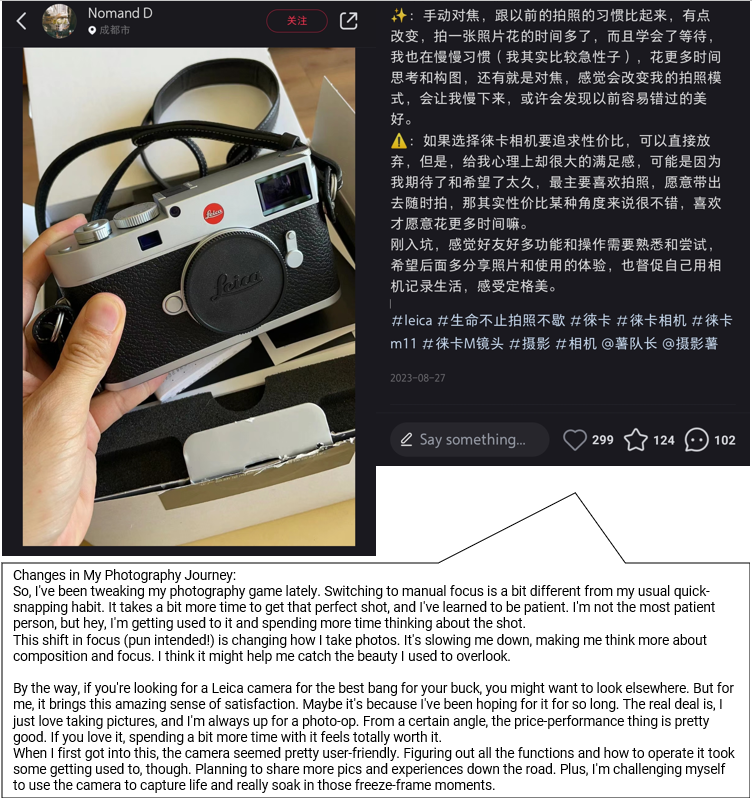

In the realm of photography, Leica’s M series cameras stand out, particularly the Leica M cameras, celebrated for their solid construction and innovative features. These cameras are celebrated for their precision, timeless design, long durability and low maintenance costs.

Opportunities and challenges for German brands in China

- As tensions rise between China, Germany, and the EU, German brands face a mix of challenges and opportunities on the global stage.

- German companies are still resilient in the face of economic shifts, with a vast majority committed to staying in China and planning increased investments.

- Effective marketing entails aligning brand messaging with prevalent Chinese consumer trends, including the consumption upgrade and sustainability awareness.

- Insights from successful German B2C brands like BMW, Adidas, and Hugo BOSS offer valuable strategies for effective branding across diverse consumer segments.

- Renowned German B2B firms like Siemens and Bosch strategically provide industrial solutions in China. Startups navigate intense competition, prioritizing the Software-as-a-Service market and forming synergies in this evolving landscape.

- Seizing opportunities in ESG practices and technological innovation aligns brands with evolving environmental standards, fostering positive perceptions and establishing market leadership.