In China, going on a honeymoon has become a common practice for newlywed couples. The honeymoon market in China has undergone significant transformations in recent years, influenced by shifting perspectives on marriage, evolving travel preferences, and the disruptive impact of COVID-19-related travel restrictions. This combination of factors has brought about a noticeable change in the dynamics of honeymoon experiences in the country.

Download our report on how young Chinese consumers

How big is the honeymoon market in China?

Shifting marriage trends in China

An estimated 6.83 million couples get married annually throughout China in 2022. This represents a 10.5% decline from the 7.63 million marriage registrations recorded in 2021 and is the lowest figure reported since 1986. This can be attributed to the COVID-19 pandemic which greatly disrupted Chinese people’s daily lives, but also to young Chinese people’s intentions to get married later or not at all. During the first quarter of 2023, there was an increase of 40,000 more couples who tied the knot compared to the same period in the previous year. However, the number of divorces surged by 127,000 during the same timeframe. This problem is taken seriously by the Chinese government, as it is associated with falling birth rates and an aging population.

Rising wedding spending per couple

In 2021, the average wedding cost per couple amounted to RMB 174,000, marking an increase of 2.7 times compared to the figures from 2015. Moreover, nearly 60% of couples express a desire for a honeymoon getaway. While the number of marriages has declined these past years, the rise in disposable income per capita has created a conducive environment for the growth of the honeymoon industry.

Young and urban Chinese drive the honeymoon travel demand

Presently, the “post-90s generation” has emerged as the primary demographic preparing for marriage. The predominant consumer base in the wedding market consists of young individuals aged 20 to 30, making up 77.9% of this market segment.

However, according to the Baidu index data, 36.14% of individuals searching for “honeymoon travel” fall into the 30-39 age group, with the 20-29 age bracket accounting for 29.33% of the searches. This could be attributed to the fact that older customers typically have greater disposable income to allocate towards their honeymoon plans.

Regarding income levels, the middle-class income bracket ranging from RMB 5,000 to 10,000 is the dominant group, comprising 29.7% of this demographic. According to the Baidu index, netizens interested in honeymoon travel mainly live in first-tier cities: Beijing, Shanghai, Nanjing, Shenzhen, and Wuhan. A quarter of honeymooners are willing to spend up to RMB 30,000 on their honeymoon.

Chinese honeymooners’ favorite destinations

While certain tourists prefer local destinations, often due to cost-effectiveness, visa requirements, or the rich variety of landscapes available within China, others are keen to allocate the money they saved during the pandemic toward international travel experiences.

Local destinations: from tropical gateways to cultural retreats

Domestically, Sanya (三亚) is a popular choice for Chinese honeymooners. Its tropical beaches and luxurious resorts provide an ideal escape from the bustling and fast-paced life of many Chinese cities, making it a sought-after destination for romantic getaways. Even foreign companies, like the Japanese wedding company GE, signed a partnership with the Sanya Tourism and Culture Investment Group. As part of this collaboration, the company aims to introduce traditional Japanese wedding ceremonies to clients seeking romantic experiences on Hainan Island (海南).

In addition to Sanya, Beihai (北海) and Xiamen (厦门), which are well-known coastal destinations, are prominently featured in trending posts on Xiaohongshu (小红书). There are also inland destinations like Xinjiang (新疆) and Yunnan (云南) provinces that have garnered considerable popularity. These non-coastal areas are famous for their cultural richness and breathtaking natural landscapes.

Overseas luxury: the quest for high-end destinations

Chinese honeymooners are showing a strong preference for island destinations like the Caribbean, the Seychelles, Bali, the Maldives, Mauritius, or Jeju Island. Moreover, certain European countries such as Switzerland, France, and Italy are popular among Chinese honeymooners. These destinations rank among the most sought-after on social media platforms.

While honeymoon trips within China generally cost up to RMB 10,000 for a week, trips outside of China can easily exceed RMB 20,000, excluding excursions. For example, two one-week round tickets to the Maldives from Shanghai start at RMB 8,300 and the cheapest accommodation for one week is over RMB 2,000. Trips to Europe can be even more expensive, especially in Switzerland and France, which are costly yet attractive destinations for Chinese honeymooners.

As the pandemic gradually subsides, Chinese wedding planners and travel agents are capturing this higher-end consumer segment by actively exploring various locations to curate the finest accommodations and activities for their clients. These clients are typically young Chinese couples seeking unique and exotic experiences. In early 2023, a delegation of Chinese travel agents had already visited the Seychelles to craft the perfect trips for their clientele.

Moreover, certain destinations, like Bali, have specialized marriage agencies for Chinese customers. The competition among these agencies has become incredibly intense, as they vie to cater to the preferences and needs of discerning and high-spending Chinese couples.

Trends in personalized and independent travel planning

The decreasing appeal of group tours

In the travel industry, a noticeable trend towards independent travel has emerged, with a decline in the number of group tours year after year. Traditional group tour products are facing challenges in satisfying the demands of modern travelers for more personalized and high-quality travel experiences. Additionally, dissatisfaction with service quality arises from issues such as forced product purchases, inadequately trained tour guides, and a general lack of attentiveness to tourists’ needs and concerns. As a result, new travel products like “independent travel,” “themed tours,” and “customized tours” are gradually gaining traction in the market.

A tendency to choose independent travel or personalized tours

Independent travel appeals particularly to the younger generation, who seek individuality and freedom, allowing them to explore picturesque landscapes and immerse themselves in local experiences. The prevalence of independent travel is notably higher in first-tier cities. The heightened expectations of residents in these urban centers require the provision of diverse and personalized travel options to cater to their specific preferences during their honeymoon trip. Moreover, access to travel and booking platforms like Fliggy (飞猪) and Trip.com (携程) makes it easier for couples to plan their own trips. These platforms provide the flexibility to tailor the journey to destinations like the Maldives and Sri Lanka, allowing the customers to select their preferred island for their stay.

Concurrently, there has been a significant surge in the number of younger travelers opting for smaller tours that offer more personalized and intimate experiences, such as a 2-6 people tour to Sanya or Yunnan. According to data from Ctrip, since March 2023, individuals aged 18-30 have accounted for nearly 35% of group tour reservations, translating to roughly 4 out of every 10 participants in these tours being young adults. Furthermore, the 18-30 age group has registered an 813% year-on-year increase in unit bookings, with a 71% boost compared to 2019 before the pandemic.

COVID-19’s lingering impact on the honeymoon market in China

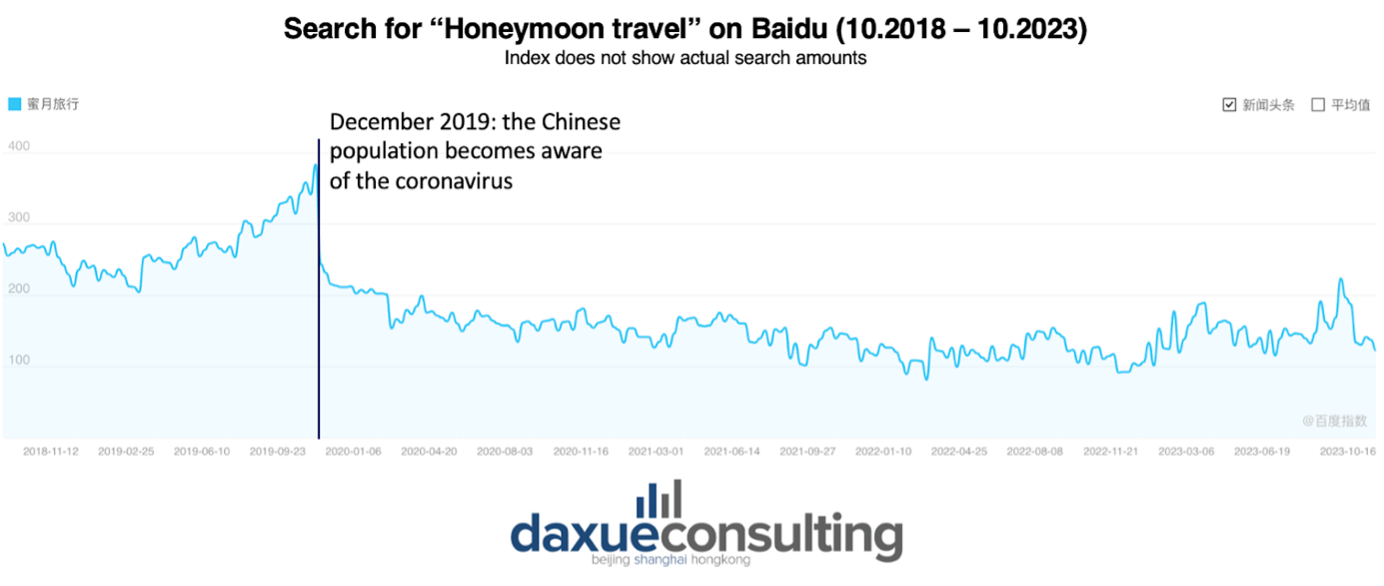

A drop in interest in “honeymoon travel”

The search interest for “honeymoon travel” (蜜月旅行) on Baidu experienced a steady rise until late 2019. However, it saw a substantial decline at the beginning of 2020 when the COVID-19 pandemic and subsequent lockdowns in China began. As depicted in the graph below, the search volume for “honeymoon travel” has not shown a significant recovery, even though the lockdowns and travel restrictions in China were lifted by the end of 2022.

“Honeymoon at your doorstep” (家门口的蜜月旅行)

The demand for “local” or “doorstep” travel has surged during the pandemic., especially in 2020, with the hashtag #家门口的蜜月旅行# (honeymoon at your doorstep) gathering 569,000 reads on Weibo. The travel restrictions on inter-provincial travel have driven more enthusiastic tourism spending in short-distance and district and county-level destinations compared to previous years. In particular, the 2020 Labor Day holiday, which is a popular date to get married, witnessed a noticeable surge in the demand for small-group tours within the province.

The honeymoon market in China: key takeaways

- China saw about 6.83 million marriages in 2022, with a recent decline attributed to the pandemic and young people delaying or opting not to marry. However, couples are spending more on weddings.

- The “post-90s generation” makes up a substantial portion of the wedding market, they are a significant driver of the honeymoon travel demand.

- A desire for more personalized travel experiences is evident among younger couples, driving a trend towards independent travel and small-group tours. Within China, beach destinations, followed by mountain areas, are the top choices. Internationally, tropical islands and European destinations are in high demand among honeymooners.

- The pandemic has impacted search interest in “honeymoon travel”, with a decline that has not fully recovered despite the easing of travel restrictions. While short-distance and local honeymoon destinations have become more popular, some couples postponed their overseas honeymoons by a few years due to travel restrictions.