The insurance market is a critical pillar of the global economy, providing essential risk management and financial protection services to individuals and businesses alike. Hong Kong serves as a key hub at the heart of this sector, increasingly connecting China with the global insurance industry.

Despite becoming a core sector of Hong Kong’s economic framework, the insurance market isn’t exempt from its significant challenges. In 2022, the industry experienced a 7.5% decline in total gross premiums, amounting to HKD 556 billion (USD 71 billion) reflecting broader economic difficulties directly tied to the remaining backdrops of the COVID-19 pandemic. By 2023, the market saw another slight contraction, with gross premiums falling by 1.1% to HKD 549.7 billion (USD 70.2 billion). This downward trend was already affecting Hong Kong’s insurance industry before COVID-19, as market saturation and investors’ uncertainty related to the US-China trade war negatively impacted prospective sales. Since 2024 positive trends have returned, with the market projected to rebound to USD 82.3 billion in 2024, driven by a strong life insurance sector and increasing demand for health insurance by an aging population

Looking ahead, to maintain its competitive edge and sustain its legacy as a pivotal global insurance hub, Hong Kong must continuously adapt and innovate. This involves leveraging existing advantages, such as a sophisticated regulatory environment and high premium rates, while strategically aligning with key growing trends in the global and Chinese insurance markets.

Hong Kong insurance industry: A diversified and tailored range of product offerings

Hong Kong’s insurance market is distinguished by its extensive array of long-term insurance products, categorized into protection-type and investment-type offerings. This diverse range ensures comprehensive coverage and investment opportunities for a wide spectrum of consumers.

Protection-type products form a significant part of Hong Kong’s insurance offerings, providing essential coverage against various risks. Medical insurance is designed to cover healthcare expenses, offering crucial financial support for treatments, hospital stays, and other medical needs. Life and accident insurance are also key components of this industry.

The other side of the market focuses on investment-type products, which cater to individuals seeking to combine insurance coverage with investment opportunities. Savings-dividend products are a popular choice, offering a combination of insurance protection and savings, often providing policyholders with dividend payments based on the insurer’s financial performance. Investment-linked products further enhance the market’s appeal by linking the policy’s value to underlying investment funds, allowing policyholders to potentially benefit from market growth while maintaining insurance coverage.

Distinct competitive advantages of Hong Kong’s insurance market over Mainland China

1. A more mature business environment

Hong Kong’s insurance market stands out as a premier international financial hub, renowned for its mature and competitive business environment. Unlike Mainland China, which remained until recently inaccessible to foreign investments, Hong Kong offers a more favorable business environment for insurance companies, characterized by ease of doing business and stringent regulatory compliance with international standards.

A key example of Hong Kong’s alignment with international standards is the “Insurance (Amendment) Ordinance 2023,” issued on July 14, 2023. This law introduced a Risk-Based Capital (RBC) regime, replacing the previous rule-based system. The RBC approach reflects the individual risk profiles of insurers, aligning Hong Kong with global regulatory standards and enhancing the industry’s credibility and appeal to investors.

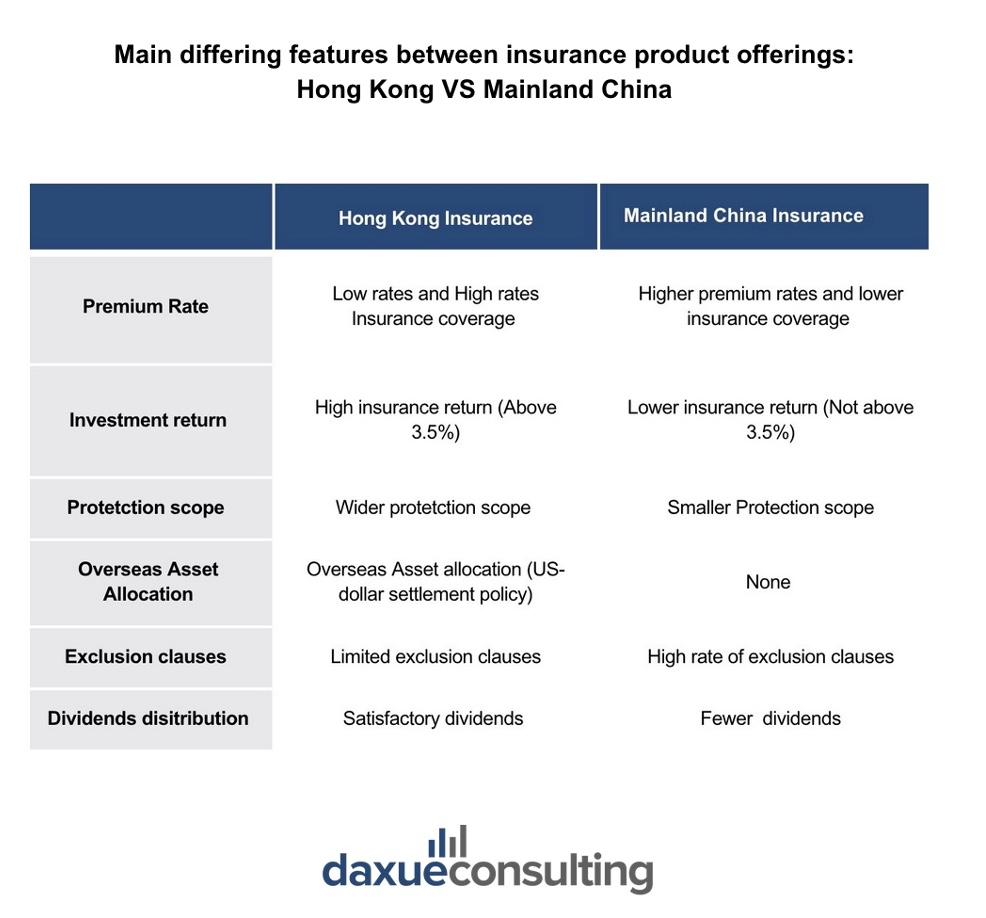

Higher average premiums and financial returns

Hong Kong’s insurance market is reputable not only for its sophistication but also for its higher expected returns compared to Mainland China. The expected returns on Hong Kong’s savings-dividend insurance products are approximately 1.5-2% higher than those available in the Mainland. This disparity is particularly pronounced following the September 2015 regulation mandated by the China Insurance Regulatory Commission (CIRC), which expects the annual returns rate for dividend-based personal insurance in the Mainland to not exceed 3.5% without additional approval. In contrast, the Hong Kong Insurance Authority imposes no such revenue-related restrictions, allowing for greater flexibility and potentially higher yields on insurance products.

Extensive protection scope

Hong Kong offers lower premium rates and broader coverage compared to Mainland China. Premiums in Hong Kong are typically one-third to one-half the cost in the Mainland for similar levels of protection. Major disease insurance policies in Hong Kong cover over 100 diseases, whereas in the Mainland, coverage usually extends to about 70 illnesses. This cost advantage is due to Hong Kong’s high GDP per capita and robust healthcare system, which help keep insurance premiums low. Additionally, fierce competition in Hong Kong’s insurance market results in competitive pricing and comprehensive protection, with policies covering nearly 100 diseases, including over 50 major diseases and more than 30 mild diseases.

Future growth opportunities for international insurers in Hong Kong

Target and engage new consumer demographics

To rejuvenate market growth, Hong Kong’s insurers have been focusing on targeting and engaging new consumer demographics, specifically tapping into the growing demand from Mainland Chinese residents. Improved living standards and higher consumption levels in Mainland China are driving residents towards purchasing insurance offerings in Hong Kong’s market. These insurance products are approximately 30% cheaper for major disease and life insurance due to competitive premium formulations based on a robust healthcare system. This cost advantage makes Hong Kong’s insurance products particularly attractive to Mainland consumers seeking superior coverage at a more competitive price.

Embrace digital integration

International insurers have gradually turned their efforts towards digitalization of their product offerings to meet consumers’ growing demand for seamless, anytime, and anywhere service access. Many insurers, like Bowtie, are accelerating digital transformation by adopting advanced technologies and enhancing online distribution. Other insurances, like MSIG Hong Kong, have widely started to leverage platforms like WeChat for simplified management of insurance plans and transactions. This digital adoption trend has further accelerated innovation with the pandemic. For instance, some Hong Kong insurers, like AIA Insurance, are developing virtual onboarding services that enable intermediaries to conduct financial needs analysis and sell selected insurance products to customers online.

Leveraging Hong Kong’s integration within Mainland China’s rapidly liberalizing insurance market

As Mainland China gradually opens its insurance market to foreign entities, this development may significantly influence Hong Kong’s insurance industry. Although Mainland China’s insurance market is in its infancy with a penetration rate of around 4%, it holds significant growth potential compared to the more mature European and American markets. This percentage is rapidly expanding. By the end of 2023, the total revenue of the Chinese insurance market had reached RMB 29.9 trillion (USD 4.1 trillion), marking a 10% increase compared to the previous year.

Indeed, insurers are already capitalizing on opportunities in the Greater Bay Area (GBA) by exploring cross-border collaborations, setting up service centers, and developing GBA-specific products. With GBA’s integration and improved transport connectivity, cross-border movement and insurance demand are poised to rise. The low penetration of life and health insurance in the nine major mainland GBA cities, averaging 3.5% of GDP compared to Hong Kong’s 18%, highlights significant growth potential.

Prudential’s strategic market turnaround and expansion efforts

The case of the British insurer Prudential exemplifies the strategic initiatives and successful expansion efforts that international insurers based in Hong Kong are pursuing to remain relevant in this evolving market environment. Prudential’s CEO, Anil Wadhwani, has committed its continued intent to leveraging the city as a central hub for its expansion across Asia and Africa. Following a robust post-Covid recovery, Prudential has restructured to prioritize life and health insurance, as well as asset management in these regions.

Wadhwani has continuously underscored Hong Kong’s strategic importance as Prudential’s flagship market, supported by a strong local presence of over 20,000 agents and a key partnership with Standard Chartered. The company’s expansion into the Greater Bay Area, including a new branch in Macau, also aligns with the overall insurance market interest in enhancing cross-border trade and capital flow with mainland China’s insurance market.

Overall, by focusing on high-growth markets and leveraging strategic partnerships, insurers like Prudential are positioning the Hong Kong insurance industry as a considerable beneficiary from the increasing demand for insurance products in Asia and globally.

Harnessing new opportunities: the future of Hong Kong’s insurance market

- Hong Kong is a pivotal hub connecting Mainland China with the global insurance market, leveraging its mature business environment and adherence to international standards.

- Despite recent challenges, such as economic downturns and regulatory changes, Hong Kong’s insurance market is rebounding strongly, with projected growth driven by robust life insurance sectors and increasing demand for health insurance.

- Hong Kong offers higher expected returns and a more diverse range of insurance products compared to Mainland China, with lower premiums and broader coverage options, appealing to both local and mainland consumers.

- Insurers in Hong Kong are embracing digital transformation to enhance customer experience and operational efficiency, leveraging technologies like online platforms and virtual services.

- The integration of Hong Kong within Mainland China’s rapidly expanding insurance market presents significant growth opportunities, particularly in the Greater Bay Area, where low insurance penetration rates suggest untapped potential.