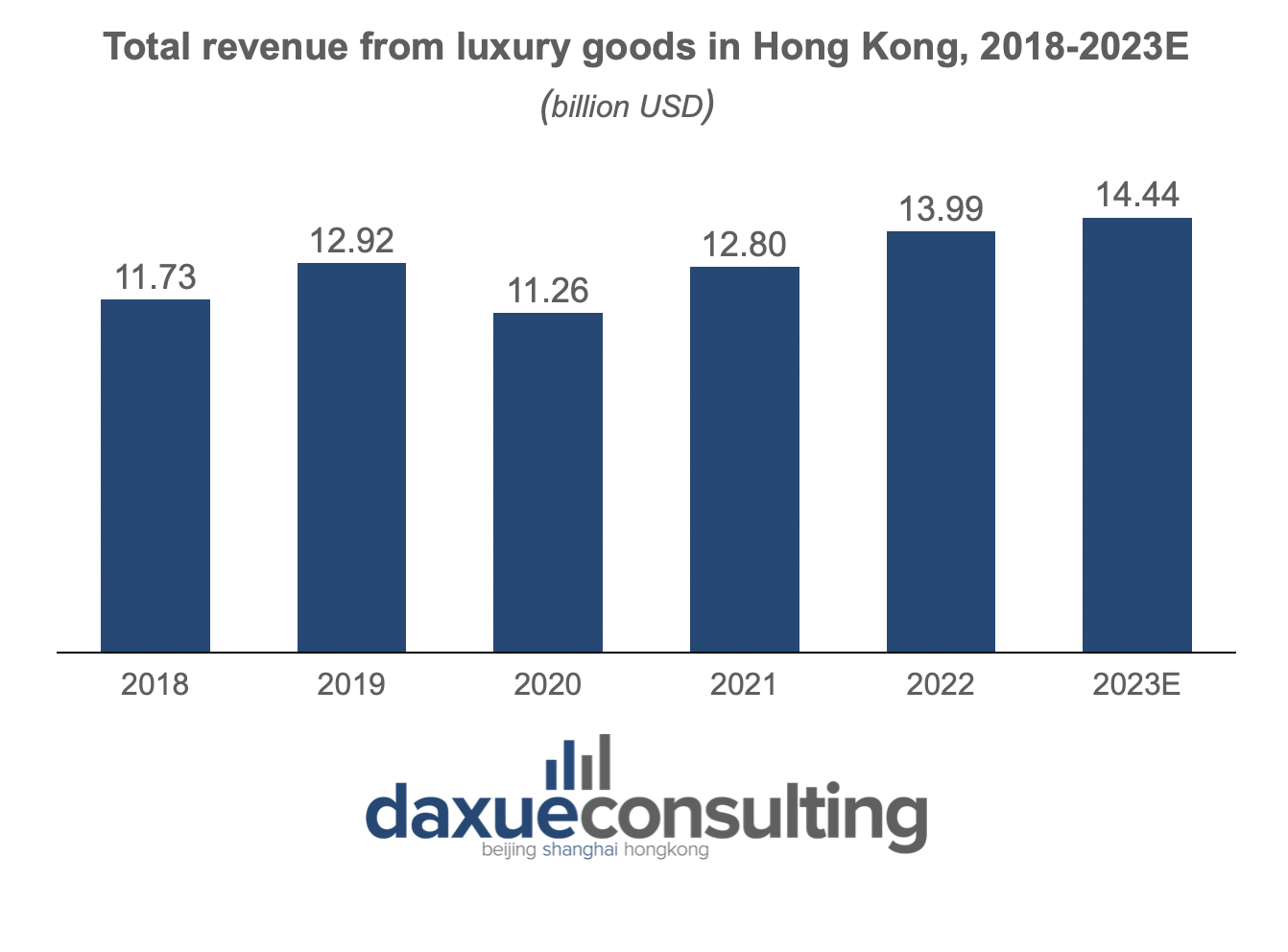

Hong Kong is well-known as a leading financial center, major travel hub and tourist destination: in 2019, Hong Kong had about a hundred million inbound visitors. Hong Kong’s luxury market has long been crucial to the city’s economy, with the total revenue for luxury goods sales reaching 12.92 billion USD before the pandemic.

Hong Kong’s luxury market: before and after the pandemic

As a popular destination for affluent Chinese tourists, Hong Kong used to be a top choice for luxury consumers before the COVID-19 pandemic. It was even preferred over Mainland China for certain products such as cosmetics and perfumes. The city also ranked as the most expensive commercial rent location until 2022 due to the significant rental space occupied by luxury retailers. However, Hong Kong has encountered obstacles in recent years that have hampered its growth.

Hong Kong’s luxury market takes a hit amid turbulent pandemic years. During the pandemic years, Hong Kong experienced turbulence and lockdowns that have affected its economic growth across all fields, with the number of inbound visitors dropping drastically and retail sales of clothing, jewelry, and cosmetics declining. Hong Kong’s luxury market particularly suffered, with a drop in luxury sales: decreasing from 12.92 billion USD in 2019 to 11.26 billion USD in 2020. In 2022, Hong Kong lost its position as home to the most expensive luxury shopping street in the world to New York. Furthermore, between 2020 and 2022, the USA and Mainland China overtook Hong Kong to become the largest export markets for Swiss watches. The relocation of companies and luxury brands from Hong Kong. Many companies started exiting Hong Kong or relocating their headquarters to Singapore, Japan, or South Korea, while many went to Mainland China. Numerous luxury stores closed in Hong Kong, rents dropped, and queues to luxury shops are now rarely seen. The spaces previously occupied by brands like Prada, Burberry or Victoria’s Secret were taken up by supermarkets and restaurants.

Recovery in the luxury sector is problematic

Foreign companies that exited Hong Kong altogether created more space for Chinese companies to grow, which gave investors reasons to be optimistic about Hong Kong’s future. However, it proved to be more problematic in the luxury sector: stores taken up by high-end brands were replaced with businesses in lower price sectors, which showed the shift of consumers’ demand in the city towards more affordable industries.

Hong Kong’s competition with Mainland China

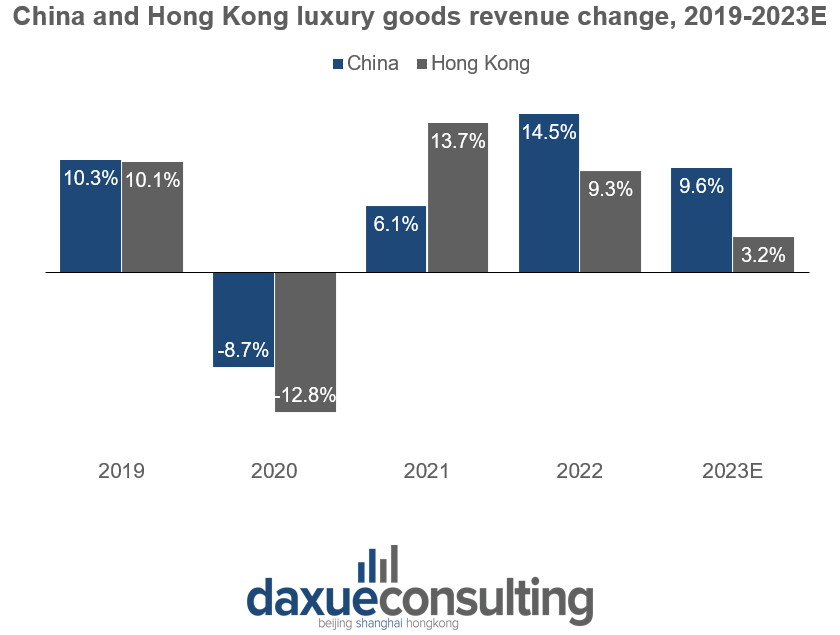

Hong Kong is facing increasing competition from Mainland China in the luxury market with the latter attracting more investments and becoming more attractive to foreign brands. This competition has been fueled by the central government’s efforts in building duty-free zones and other economic projects, as well as the growth of the luxury sector in China’s top-tier and lower-tier cities. The zero-Covid policy has played a significant role in this competition, as it has prevented many travelers from coming to Hong Kong and has thereby cut off a large part of luxury spending.

Mainland China outshining Hong Kong as top luxury stores destination

The pandemic has put Hong Kong in a position where it risks losing its edge over Mainland China. Prior to the pandemic, Hong Kong was considered a more westernized and accessible location than Mainland China, making it an attractive entry point for luxury brands. However, in 2021, luxury brands have increasingly shifted their focus to Mainland China, where they opened 55% of the world’s new luxury stores. Shanghai remains an attractive location as it is one of the world’s most expensive cities and the center of commerce in China: 16 major luxury retail projects were launched there in 2021. China’s luxury market is predicted to continue growing to become the world’s largest by 2025, further challenging Hong Kong’s position.

Hong Kong losing its price difference advantage

The price difference advantage of Hong Kong over Mainland China has reduced in the last few years, dropping from 30-40% to an average of 15%. A big role in this competition was played by the numerous economic projects unraveled in different Chinese regions. For example, the Hainan Free Trade Port Law passed in 2021, directed at increasing foreign investment in the area and transforming Hainan into a major trading hub. An important feature of the new zone is its duty-free policy, which supported luxury consumption in Hainan.

The rising influence of lower-tier cities in Mainland China

It’s not just the high-profile economic projects and top-tier cities that are competing with Hong Kong in the luxury market. In recent years, lower-tier cities in China have started to garner attention from luxury brands as well. The growing number of consumers there who are willing to spend on luxury products as a status symbol is driving this trend. In 2021, Tier 3 and Tier 4 cities have seen luxury market penetration rate grow by 22% and 15%, respectively.

Can Hong Kong regain its position in the luxury industry?

E-commerce as a potential key to unlocking growth

Hong Kong has the potential to develop in the direction of e-commerce since it is not as widespread yet. One of the reasons China could also be seeing higher growth in the luxury sector is its high involvement in e-commerce in contrast to Hong Kong. In 2022, China had a 27% penetration of e-commerce compared to 10% in Hong Kong. However, the last few years saw slow growth of revenues from luxury goods from the pandemic level, which still gives hope for Hong Kong’s rebound. Outside the luxury sector, many Hong Kong brands continue to successfully attract more consumers.

E-commerce is crucial for the luxury sector: more than half of the wealthiest Chinese customers with net worth over 10 million RMB purchase luxury goods online, and more than 200 luxury brands have already entered the Tmall Luxury Pavilion due to its large traffic. Although e-commerce is less developed in Hong Kong, its growth can be expected: in 2021, 63% of rich consumers started using online channels more often to buy luxury goods, which was largely a result of long lockdowns. Furthermore, Hong Kong also boasts a high internet penetration, with 93% of its population having access to the internet. This is expected to further fuel the growth of e-commerce in the country in the coming years.

Rise of tourism and the recovery of Hong Kong’s luxury market

the luxury sector in Hong Kong relied heavily on tourism, both inbound and outbound, with over half of tourists coming from Mainland China prior to the pandemic. The reopening of Mainland China could lead to the resurgence of tourism in Hong Kong, which could provide a boost to the luxury industry. However, for Hong Kong to reclaim its position as a leader in luxury, it must identify and capitalize on unique opportunities that set it apart from Mainland China.

Collaborating with other cities

One way for Hong Kong to maintain its economic advantage is through collaboration with nearby cities, such as those in the Greater Bay Area and Hainan. For example, cities in the Greater Bay Area – Shenzhen, Guangzhou and part of the Guangdong Province – are underserved in terms of shopping malls and points of sales. In the past, shoppers from these areas have visited Hong Kong for its wider range of stores, with high-income travelers visiting the city an average of 3 times a year.

How has Hong Kong’s luxury market changed since the pandemic?

- The luxury market in Hong Kong has been on the decline in recent years, including during the pandemic, and slow growth is expected to continue. Many companies have exited Hong Kong or relocated their headquarters to other cities within China or other countries due to the political unrest and drop in tourism.

- Hong Kong is facing competition from China’s duty-free zones that are attracting more foreign direct investment.

- The city, although seeing negative trends at the moment, could still rebound if it manages to exploit new opportunities.

Author: Sofia Tishchenko

Download our report on the emergence of Chinese luxury brands